1-Month SOFR Apr '21 (SLJ21)

Seasonal Chart

Price Performance

See More| Period | Period Low | Period High | Performance | |

|---|---|---|---|---|

| 1-Month | 99.9825 +0.01% on 04/15/21 | | 99.9925 unch on 04/28/21 | +0.0050 (unch) since 03/30/21 |

| 3-Month | 99.9450 +0.05% on 02/25/21 | | 99.9925 unch on 04/28/21 | +0.0300 (+0.03%) since 01/29/21 |

| 52-Week | 99.9150 +0.08% on 11/11/20 | | 100.0100 -0.02% on 05/07/20 | +0.0450 (+0.05%) since 04/30/20 |

Most Recent Stories

More News

The S&P 500 Index ($SPX ) (SPY ) today is down by -0.32%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is down by -0.293%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is down by -0.14%. December E-mini...

The S&P 500 Index ($SPX ) (SPY ) today is down by -0.14%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is down by -0.13%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is up by +0.03%. December E-mini S&P...

December S&P 500 E-Mini futures (ESZ25) are down -0.06%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.14% this morning as investors exercise caution ahead of the release of the key U.S. jobs...

The S&P 500 Index ($SPX ) (SPY ) on Monday closed down by -0.16%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed down by -0.09%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed down by -0.51%....

It’s past time that stock market participants started paying attention to bonds.

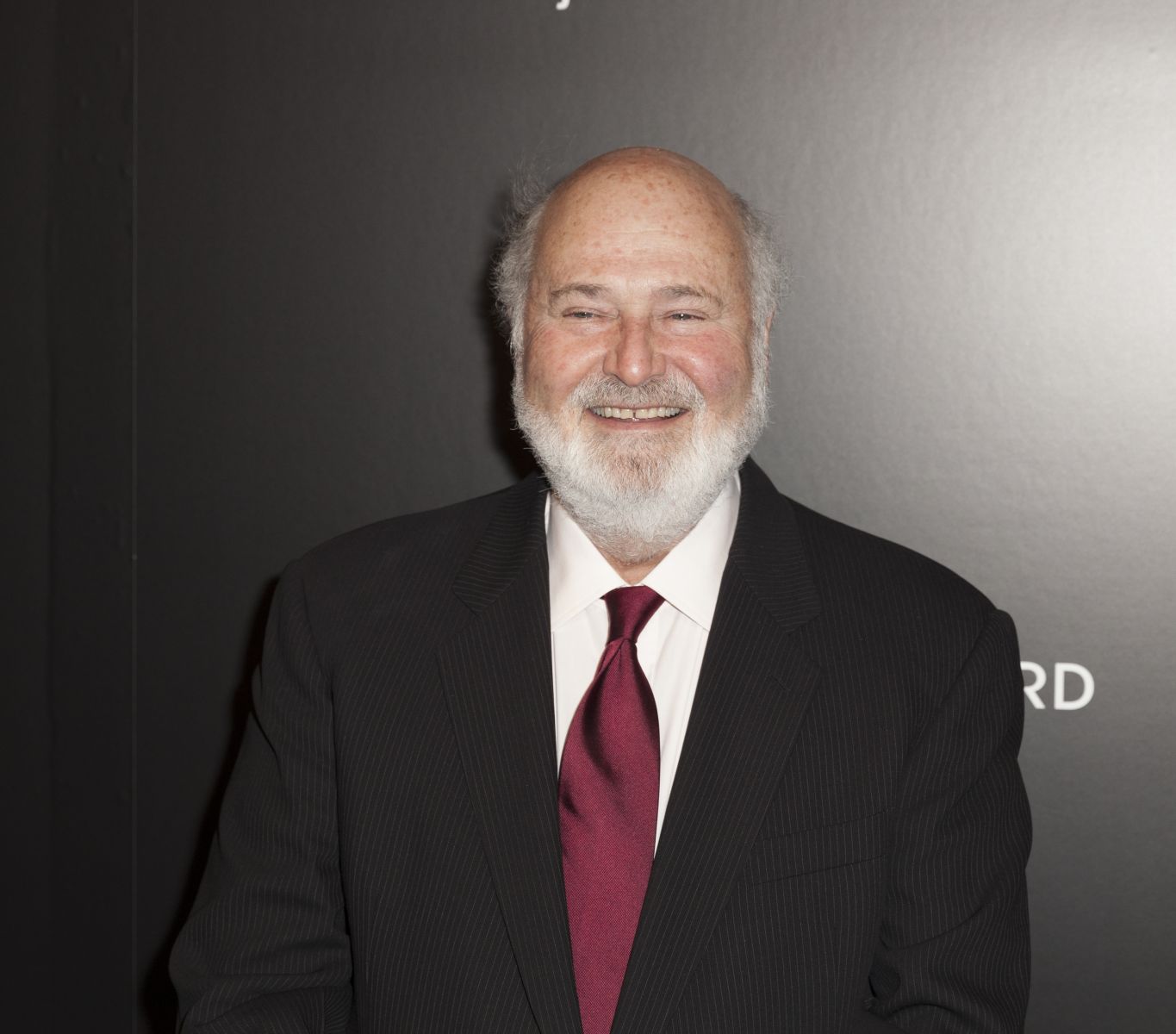

These four famous quotes from Reiner’s legacy can help investors become smarter and more successful in today’s market.

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

The S&P 500 Index ($SPX ) (SPY ) today is down by -0.15%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is down by -0.24%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is down by -0.26%. December E-mini...

March Treasury note futures present a selling opportunity on more price weakness.

The S&P 500 Index ($SPX ) (SPY ) today is up by +0.39%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is up by +0.27%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is up by +0.50%. December E-mini S&P futures...

December S&P 500 E-Mini futures (ESZ25) are up +0.48%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.49% this morning, signaling a partial rebound from Friday’s tech-led selloff on Wall Street...