Plus500US Review

This review is specifically for Plus500 US users. For those outside the U.S., please refer to the general Plus500 review.

Tradable Assets: Futures

Minimum Deposit: as low as $100

Fees & Commissions:

- Standard & E-Mini contract = $0.89

- Micro contract = $0.49

- No data fees, platform fees, or deposit and withdrawal fees (except for wire withdrawals)

Ideal For: Futures traders seeking a user-friendly platform for trade execution.

Table of Contents

- What is Plus500US?

- Pros & Cons

- What Features and Tools Does the Plus500US Platform Offer?

- What are the Tradable Futures Markets on Plus500US?

- What Kind of Education & Research Does Plus500US Offer?

- Company Information & Regulation

- Is Plus500US Trustworthy?

- What are Plus500US' Fees & Charges?

- Deposits & Withdrawals

- Does Plus500US Have Good Customer Service?

- How Do You Open a Plus500US Trading Account?

- The Bottom Line on Plus500US

- FAQs

What is Plus500US?

Founded in 2008, Plus500 has evolved into a global multi-asset fintech group, operating trading platforms built on its own technology. The company is trusted by more than 30 million customers worldwide and its shares are traded on the London Stock Exchange (LSE: PLUS), and it is included in the FTSE 250 index. In addition, Plus500 is an official partner of the Chicago Bulls.

Plus500 recently expanded its operations into the United States, providing futures trading via its advanced platform available on most desktop and mobile devices. Plus500US empowers millions of investors to access futures trading across various asset classes, including equity indices, forex, interest rates, commodities, and cryptocurrencies.

Plus500US aims to lower the barrier to entry for active futures trading by offering:

- A first deposit bonus of up to $200 (enabling commission-free trading until the bonus is depleted)

- Minimum deposits as low as $100

- Competitive commissions

- Low intraday margin requirements

In addition, Plus500US does not charge data fees, platform fees, or deposit and withdrawal fees (except for wire withdrawals). There are also no routing fees. However, traders may incur guaranteed stop order fees and inactivity fees.

Plus500US Pros and Cons

Pros

- ✔ Dozens of assets are available for trading across several different asset classes

- ✔ Full regulation in the United States

- ✔ No data fees, platform fees, or deposit and withdrawal fees (except for wire withdrawals)

- ✔ Lightning-fast execution speeds

- ✔ Vast video and article educational resources for all experience levels

- ✔ Low trading fees

- ✔ 24/7 customer support via online chat and email

- ✔ Risk-free demo accounts

- ✔ Low intraday margin requirements

Cons

- ✖ No SIPC protection for U.S. investors

- ✖ Doesn’t offer one-click trading

- ✖ Some assets have a high bid-ask spread

What Features and Tools Does the Plus500US Platform Offer?

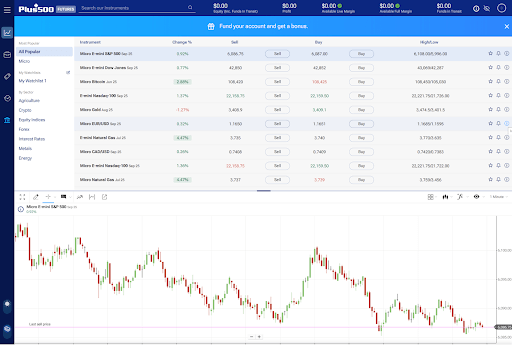

Plus500 WebTrader Platform

Plus500's WebTrader is a browser-based platform designed for ease of use, with no need for a separate desktop download.

It allows traders to effortlessly create watchlists, execute trades directly from charts, and access live chat support within the interface. Key features include:

- Seamless Trading: Easy creation of watchlists, chart analysis, trade entry, and position monitoring.

- Demo & Live Trading: Provides a free, unlimited demo trading account that mirrors live conditions with real-time quotes, allowing users to practice strategies and reset virtual funds as needed. A one-click toggle allows users to switch instantly between a demo account and live trading.

- Enhanced Visibility: Offers a dark mode for comfortable viewing during extended trading sessions.

- Efficient Navigation: A prominent search tool at the top of the screen enables quick retrieval of any asset.

- Comprehensive Order Types: Supports standard market, limit, and stop-loss orders. A convenient feature allows users to set initial, take-profit, and stop-loss orders simultaneously for a "set and forget" approach.

- Robust Charting: Provides multiple chart types (e.g., Candles, Renko, Range Bars), over 100 technical indicators, classic drawing tools like Fibonacci retracement levels, and eleven time frames (from one minute to one week).

- Customizable Layouts: The "multiple charts view" allows traders to arrange various charts on the same screen, ideal for monitoring multiple markets and time frames. Trading directly from the chart is also supported.

- Real-time Alerts: Offers customizable real-time market alerts via email, SMS, or push notifications. Traders can set alerts for specific price levels, percentage price changes (daily/hourly), and shifts in Traders' Sentiment (percentage of buyers/sellers).

- Multilingual Support: The platform is available in 30 different languages.

- Security: Two-factor authentication is available for enhanced account security.

The WebTrader platform is designed intuitively and provides an excellent user experience. However, it lacks advanced features like automated trading, backtesting, and one-click trading.

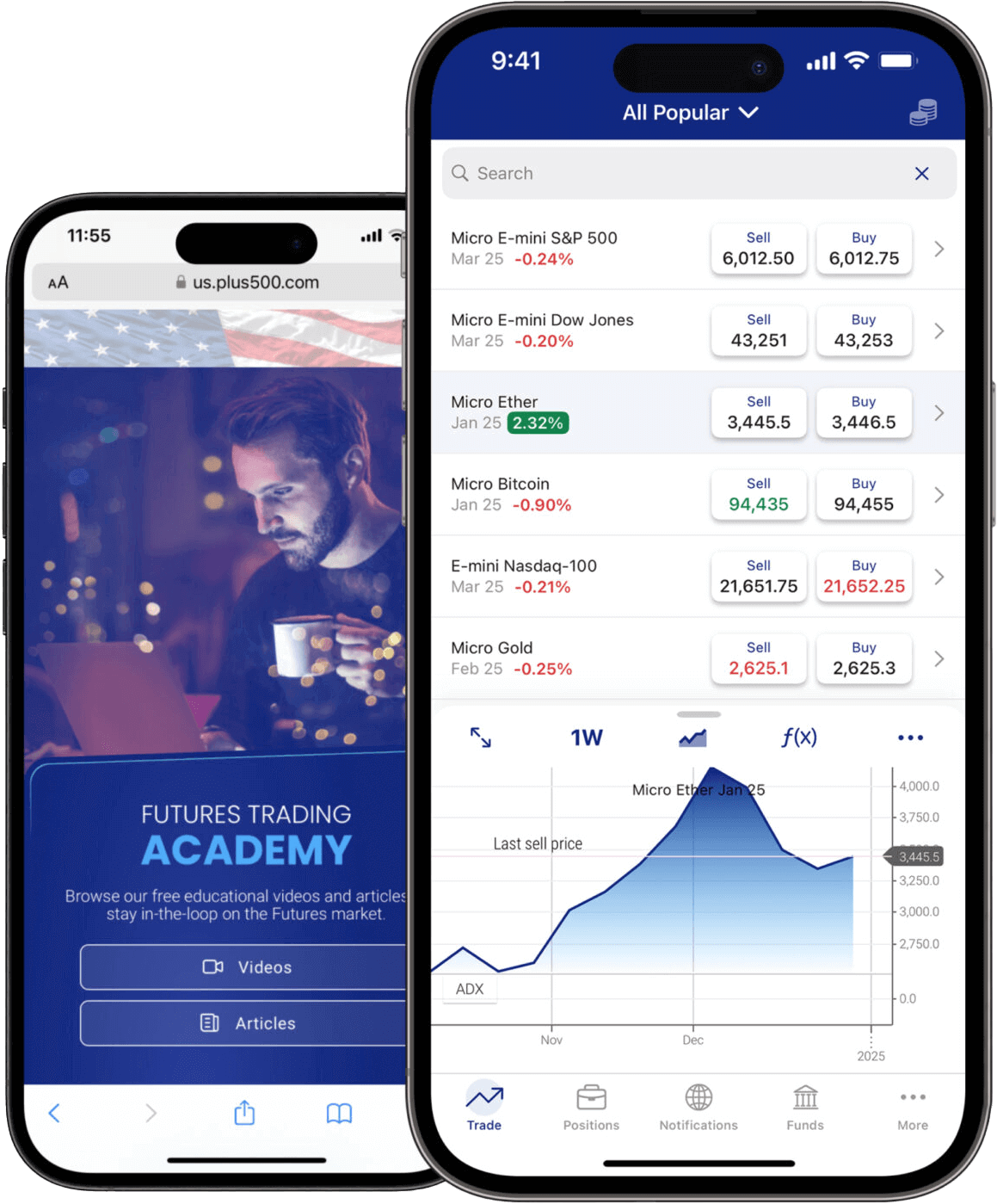

Plus500 Mobile App

The Plus500 mobile app, available for iOS and Android devices, mirrors the intuitive interface and advanced functionality of its WebTrader counterpart, providing a powerful trading experience on the go. Notable features include:

- Strong Security: Offers two-factor authentication, including SMS verification for new device logins.

- Flexible Trading: Users can easily switch between demo and live trading modes within the app.

- Advanced Charting: The mobile app boasts robust charting capabilities, including 12 chart types, 11 time frames (from 1 Minute to 1 Week), 119 indicators (surpassing MetaTrader's offering), and 21 drawing tools (including Fibonacci, Gartley, and Pitchfork).

- Standard Order Types: All standard order types, such as market, limit, and stop-loss orders, are readily available.

The Plus500 mobile app is an impressive tool that combines ease of use with comprehensive features, satisfying the needs of most traders. A minor point to note is that charts created on the web platform do not sync automatically with the mobile app.

What are the Tradable Futures Markets on Plus500US?

With Plus500US, you can trade futures on a wide variety of markets, offering access to both traditional and emerging asset classes. These include:

- ✔ Equity Indexes

- ✔ Interest Rates

- ✔ Agriculture

- ✔ Metals

- ✔ Forex

- ✔ Energies

- ✔ Cryptocurrencies

What Kind of Education & Research Does Plus500US Offer?

Plus500US offers educational resources through its Trading Academy to help traders learn about futures trading. The Trading Academy provides a range of materials designed to enhance traders' understanding of the futures market, from basic principles to more advanced topics. These resources can be valuable for individuals new to futures trading or those seeking to broaden their knowledge.

The educational content includes articles and videos. These resources can cover subjects such as the fundamentals of futures contracts, market analysis, trading strategies, and risk management. By providing these materials, Plus500US aims to equip its users with the knowledge and skills necessary to make informed trading decisions.

Company Information & Regulation

Established in 2008, Plus500 has grown to serve more than 30 million clients and operates under the regulation of authorities in several countries. These include Australia, Cyprus, Dubai, the UK, Singapore, and Israel. The company is publicly traded on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Plus500 expanded into the US market in 2021 with the acquisition of Cunningham Trading Systems (CTS). CTS provides an advanced platform that supports trading in options and futures. Subsequently, in 2022, Plus500 began offering futures trading to US clients through the TradeSniper platform, which utilizes CTS's technology. US operations are conducted through the subsidiary Plus500US Financial Services LLC, which is registered with several regulatory bodies and organizations, including:

- Regulated by Commodity Futures Trading Commission (CFTC)

- Registered as a Futures Commission Merchant (FCM)

- Member of National Futures Association (NFA)

Is Plus500US Trustworthy?

Plus500 demonstrates a commitment to transparency by making key information readily accessible to users. Details regarding their regulatory status are prominently displayed, such as at the footer of each page on their website. Furthermore, the company provides clear breakdowns of all applicable costs on its "Fees and Charges" page, and the complete terms of service are outlined in a User Agreement document found within the "Terms & Agreements" section.

This commitment to openness is reinforced by several factors that contribute to Plus500's trustworthiness. These include regulation by major financial authorities, a substantial history of operation, and its status as a publicly traded company with a market capitalization exceeding one billion dollars.

What are Plus500US' Fees & Charges?

Plus500US's services are competitively positioned within the futures industry:

- Standard contract commission = $0.89

- Micro contract commission = $0.49

Plus500US operates as a member of the National Futures Association (NFA). As a self-regulatory organization, the NFA mandates certain nominal assessment fees, which are passed on to traders. Beyond these NFA fees, clients can expect to encounter a few other charges. Specifically, the NFA imposes a fee of $0.02 per side for each futures contract (amounting to $0.04 for a round-turn transaction). Additionally, a $10 liquidation fee is applied in situations where a client fails to meet the required minimum margin.

It's important to note that Plus500US does not charge fees for inactivity, account opening, routing, or platform usage.

It is also crucial to understand that futures trading is conducted through centralized exchanges, such as the Chicago Mercantile Exchange (CME). Consequently, traders will be subject to exchange commissions. These are separate from, and in addition to, any fees charged by Plus500US. Plus500US holds full membership in the CME Group.

Deposits & Withdrawals

Plus500US provides US-based traders with several secure and commonly used methods for funding their accounts and withdrawing funds, and the broker does not impose any fees for these transactions. Deposits are accepted through debit cards (specifically Visa and Mastercard), bank wire, ACH bank transfers, Google Pay, and Apple Pay. These same methods are also available for withdrawing funds from a trader's account. Currently, Plus500US does not support the use of credit cards or prepaid cards.

Plus500US generally processes withdrawals back to the same method that a customer initially used for depositing funds. Withdrawal processing typically takes between one and three business days. A minimum withdrawal amount of $100 is in place. The minimum deposit amounts are $200 for bank transfers, and $100 for all other accepted deposit methods.

Does Plus500US Have Good Customer Service?

Plus500US focuses on providing accessible customer support to assist traders with any inquiries or issues. Their primary channel is the 24/7 live chat service, which offers timely assistance. Plus500US customers can also utilize 24-hour phone support and reach out via email. The Plus500US website is supported in both English and Spanish.

The broker's customer support services, including live chat, phone, and email options, are designed to help users navigate the platform, understand trading processes, and resolve technical difficulties.

How Do You Open a Plus500US Trading Account?

Plus500US offers a straightforward account opening process, typically completed within 15 minutes, and provides only one account type. New clients are eligible for a bonus of up to $200, which can be used to trade without incurring commissions until the bonus funds are exhausted. The minimum deposit required to open an account is $100.

To open an individual account with Plus500US, prospective clients must provide essential personal and financial details. This includes information such as their name, date of birth, country of residence, residential address, Social Security number, phone number, employment status, financial details (annual income, net worth, and source of funds), and level of trading experience.

Funding the account can be done via bank transfer, debit card (Visa and Mastercard), and Apple Pay. The minimum deposit is $100 for debit cards and $200 for wire transfers.

The Bottom Line on Plus500US

Plus500US presents a compelling option for futures traders. The platform's user-friendly interface, accessible through WebTrader and mobile apps, simplifies the trading process. This ease of use, combined with a relatively low minimum deposit, makes futures trading more approachable for individuals who may be hesitant to enter the market with larger capital outlays.

The availability of educational resources within the Trading Academy further supports novice traders in developing their understanding of futures markets. While Plus500US offers essential tools, its strength lies in its streamlined approach. For those prioritizing simplicity and accessibility, Plus500US is a strong contender.

FAQs

Is Plus500 a CFD or Futures Platform?

Plus500 operates both CFD and futures platforms, depending on the region. In the U.S., Plus500US offers direct futures trading, regulated by the CFTC and NFA. Outside the U.S., the platform primarily offers CFD trading across various instruments like stocks, forex, commodities, and indices.

What Is the Plus500US Demo Account?

Plus500 offers an unlimited free demo account that replicates real market conditions with virtual funds. This allows users — especially beginners — to practice trading strategies without risking real capital.

Is Plus500 Available in the U.S.?

Yes, Plus500 is available in the U.S. through its dedicated platform which offers direct access to futures markets.

How Does Plus500US Protect Client Funds?

Plus500US holds client funds in segregated accounts, separating them from the company’s operational funds. This is a critical safety measure that helps protect traders’ deposits and is enforced under the regulation of the Commodity Futures Trading Commission (CFTC).

What Is the Minimum Deposit to Start Trading on Plus500US?

The minimum deposit to open a live trading account with Plus500US is just $100, making it accessible to a wide range of traders.

Can You Trade Crypto on Plus500US?

Yes, cryptocurrency futures are available on the Plus500US platform.

Does Plus500US Support Copy Trading or Algo-Trading?

No, Plus500US does not currently support copy trading or algorithmic trading. The platform is designed for manual trading and emphasizes simplicity and user control rather than automation.

Where is Plus500US based?

Plus500US Financial Services, LLC; 2 Pierce Pl, Itasca, IL 60143, USA.

Is Plus500US safe?

Due to its regulatory oversight, Plus500 is generally considered a trustworthy platform. Clients of Plus500US can also be assured that their funds are held separately in segregated bank accounts.

How does Plus500US make money?

Plus500US primarily generates revenue through commissions, charging a fee for each futures contract traded on its platform. The company does not charge overnight funding fees or currency conversion fees, as it only supports trading in U.S. dollars for U.S.-based clients.

How long does it take to withdraw money from an account at Plus500US?

Withdrawals from Plus500US accounts typically take between 1 and 3 business days to process.

What are the withdrawal fees at Plus500US?

There are no fees for withdrawals at Plus500US.

Is Plus500US good for beginners?

Plus500US is often seen as a solid choice for those new to futures trading. The platform's design emphasizes ease of use, making it relatively straightforward for novice traders to navigate.

Trading in futures and options involves the risk of loss and is not suitable for everyone.