Senior Market Strategist John Rowland, CMT, explains the implications of a dollar collapse below key support at 98 on metals, stocks, and the rest of your portfolio.

This gold miner stock's strong fundamentals put it at the top of the list.

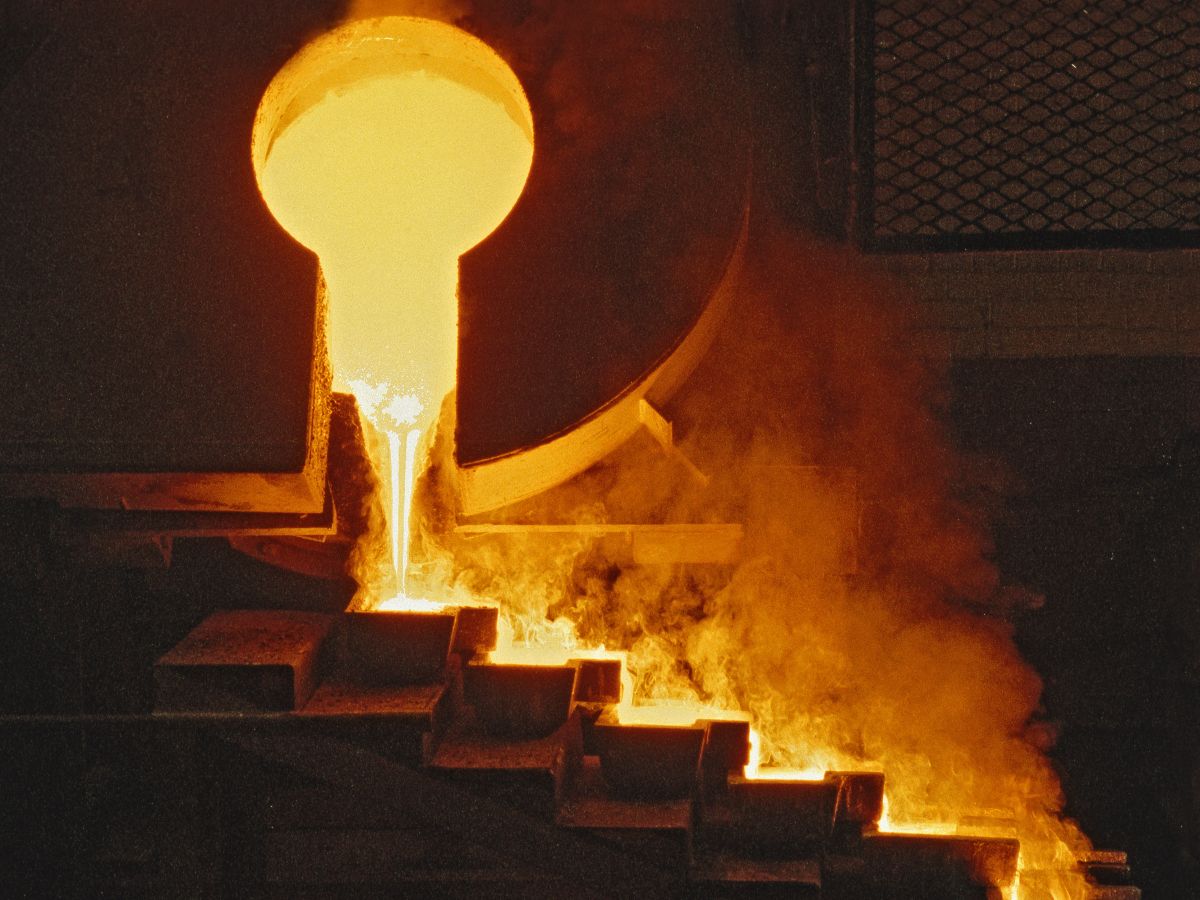

The SPDR S&P Metals & Mining ETF is up nearly 75% in 2025, outperforming the S&P 500 and tech giants like Nvidia as investors rotate into real assets; tariffs, industrial demand, and rising metal prices...

After a brutal last week on Trump tariff concerns, Wall Street attempted to bounce back on April 7. Invesco QQQ Trust QQQ added 0.24% in the key trading session and advanced 1.2% after hours. SPDR S&P...

Gold bulls should be aware of some of the market shifts happening right now, as a potential pullback could be in the works for them.

Put option buyers might have just bet the wrong way about the energy and basic materials sectors, where investors can profit.

The prospect of new trade restrictions has heightened concerns about inflation and potential trade wars, fueling demand for gold, traditionally seen as a hedge against economic and geopolitical instability....

Cleveland-Cliffs’ stock surge follows optimism around U.S. President Trump’s protectionist trade policies that could shield U.S. steelmakers from foreign competition.

On an adjusted basis, the company reported $53.7 million, or $3.20 per share, for the three months ended Dec. 31, compared with the average analysts’ expectation of $1.64 per share.

Saudi Arabia's Energy Minister, Abdulaziz bin Salman, has declared that oil is no longer the primary focus of energy security. Speaking at the annual Future Minerals Forum in Riyadh, he emphasized a shift...