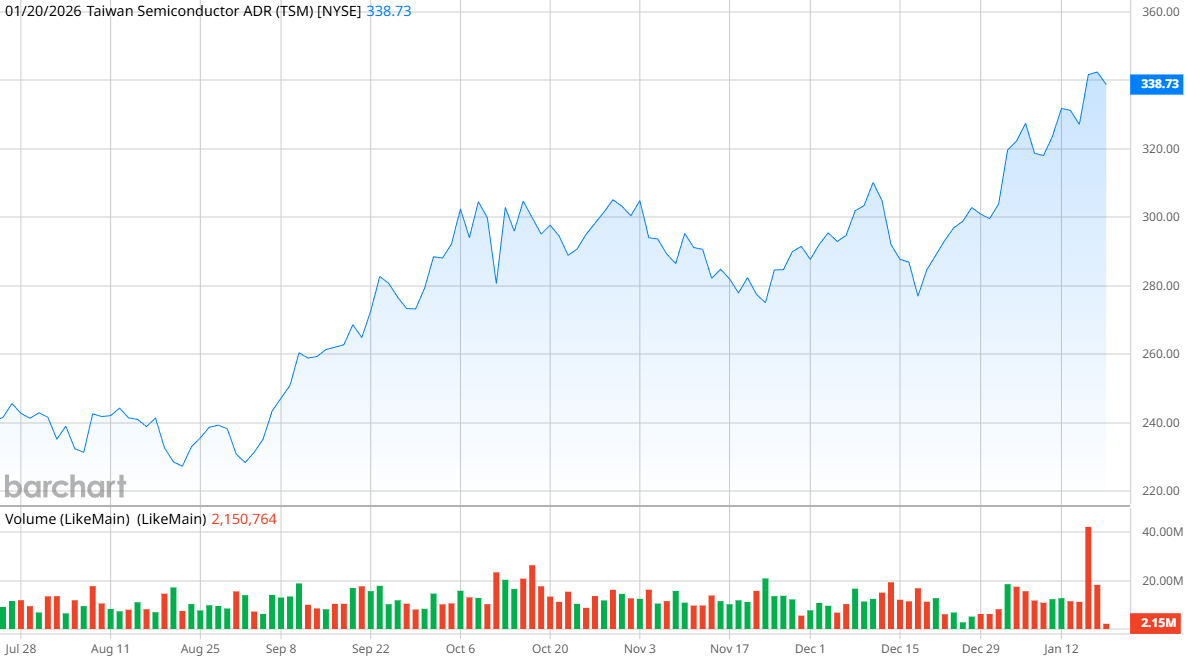

Taiwan Semiconductor (TSM) has been a hot stock in recent months. As the world’s largest chipmaker, TSMC serves as a foundry for some of the biggest semiconductor companies in the world, including Nvidia (NVDA), Advanced Micro Devices (AMD), Qualcomm (QCOM), and Broadcom (AVGO). Shares are off to a great start in 2026, up about 9% since the beginning of the year.

But one thing that may be overlooked about TSMC is it’s burgeoning status as a dependable dividend stock. Taiwan Semiconductor just announced a 20% dividend hike, from $0.16 to $0.19. The dividend will be payable on April 9 for shareholders of record on March 23.

Although the dividend yield of 1% may not excite investors, it's notable that TSMC’s payout has now grown 120% in the last five years. Combined with Taiwan Semiconductor’s impressive stock performance, TSMC is an interesting name for both growth and yield.

About Taiwan Semiconductor Stock

Based in Taiwan, TSMC is best known for creating the semiconductor industry’s Dedicated IC Foundry business model that manufactures chips for other companies, rather than selling and branding their own products.

In 2024, the company said that it produced 11,878 different products for hundreds of customers, using 288 separate technologies. It gets the majority of its money from making 3 nanometer and 5 nanometer chips for high-performance computing, but it also makes products for smartphones, automobiles, and Internet of Things products.

TSMC has a market capitalization of $1.7 trillion, making it the sixth-largest publicly traded company in the world.

Shares are up 51% in the last year, soundly outperforming the S&P 500. Its one-year performance reflects the strength of the foundry market today — Intel (INTC) is up a whopping 118%.

However, when you consider the valuations, TSMC looks much more appealing. Intel has a current forward price-to-earnings (P/E) ratio of 78.2, while TSMC is a much more reasonable 23.9.

TSMC Beats on Earnings

Taiwan Semiconductor reported a strong fourth quarter, with revenue of $33.7 billion, up 20.5% from the same period a year ago. Net income of $16.3 billion was up 35%, and TSMC reported earnings per share of $3.14, beating analysts' expectations for $2.82.

For the full year, TSMC reported $122.42 billion in revenue, representing a 35.9% increase from the previous year. Management issued guidance for first-quarter revenue to be between $34.6 billion and $35.8 billion, which would be a 38% year-over-year gain at the midpoint.

TSMC is in the midst of a $165 billion project to build foundry capacity in Arizona, where it’s already making Nvidia Blackwell chips. The company plans to spend between $52 billion and $56 billion on capex this year, up from $40.9 billion in 2025 and $29.8 billion in 2024.

CEO C.C. Wei said TSMC continues to see strong growth thanks to the expansion of AI and the demand for more semiconductors.

“Looking ahead, we observe increasing AI model adoption across consumer, enterprise and sovereign AI segment. This is driving need for more and more computation, which supports the robust demand for leading edge silicon,” he said. “Our customers continue to provide us with their positive outlook. In addition, our customers' customer, who are mainly the cloud service providers, are also providing strong signals and reaching out directly to request the capacity to support their business. Thus, our conviction in the multi-year AI megatrend remains strong, and we believe the demand for semiconductors will continue to be very fundamental.”

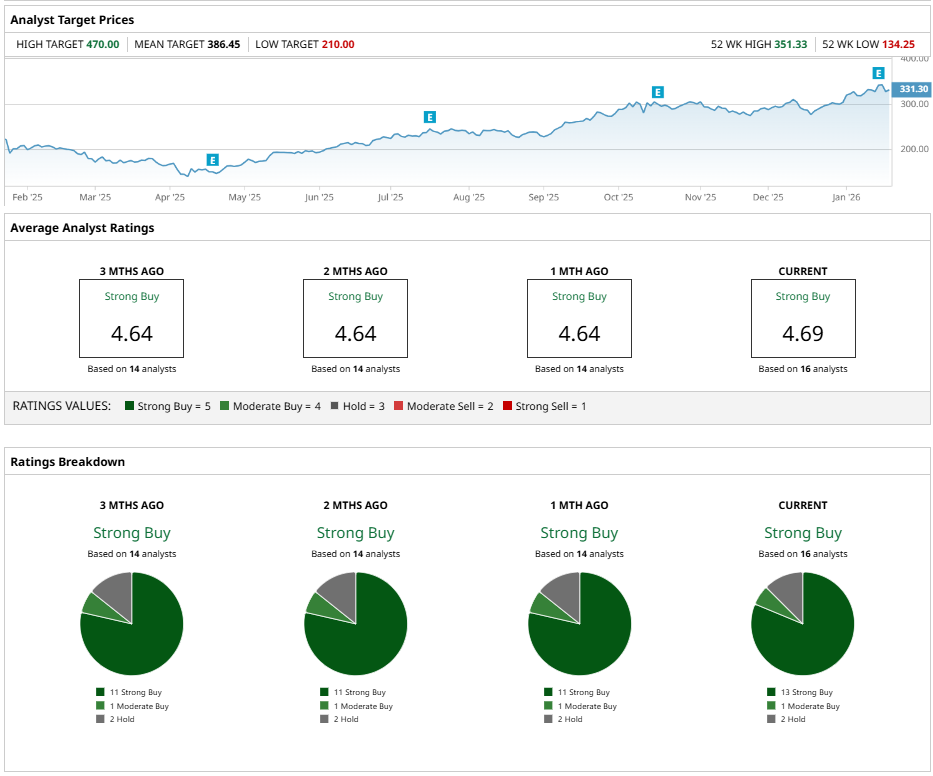

What Do Analysts Expect for TSMC Stock?

TSMC has a key advantage in that it’s the primary foundry for many of the top semiconductor companies. That means no matter which company wins the race to design the best AI chips, TSMC will likely be the foundry to actually build them. That’s one key reason why analysts are overwhelmingly bullish about the stock.

Of 16 analysts who cover TSMC stock, 13 of them have “Strong Buy” ratings and one has a “Moderate Buy” rating. The remaining two suggest holding. None of them recommend selling, and that sentiment has been consistent for the last several months. Analysts have a consensus price target of $386.45 on TSM stock.

TSMC has a lot going for it. The growth in revenue and earnings should continue to delight investors, and the dividend looks very secure considering TSMC’s payout ratio is only 23%. I expect this dividend and stock price to continue to grow over the next few quarters, making TSMC a no-brainer stock to buy right now.

On the date of publication, Patrick Sanders had a position in: NVDA. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)