With the run-up in prices for many precious metals this year, the metals and mining sector is expected to have a good 2025. Exchange-traded funds that track the sector, such as the State Street SPDR S&P Metals & Mining ETF (XME), are up 83% year-to-date (YTD).

Jefferies analyst Christopher LeFemina is among those betting that the run will continue in 2026. He wrote in the firm’s Mining Minutes note that “the sector should outperform again as a result.”

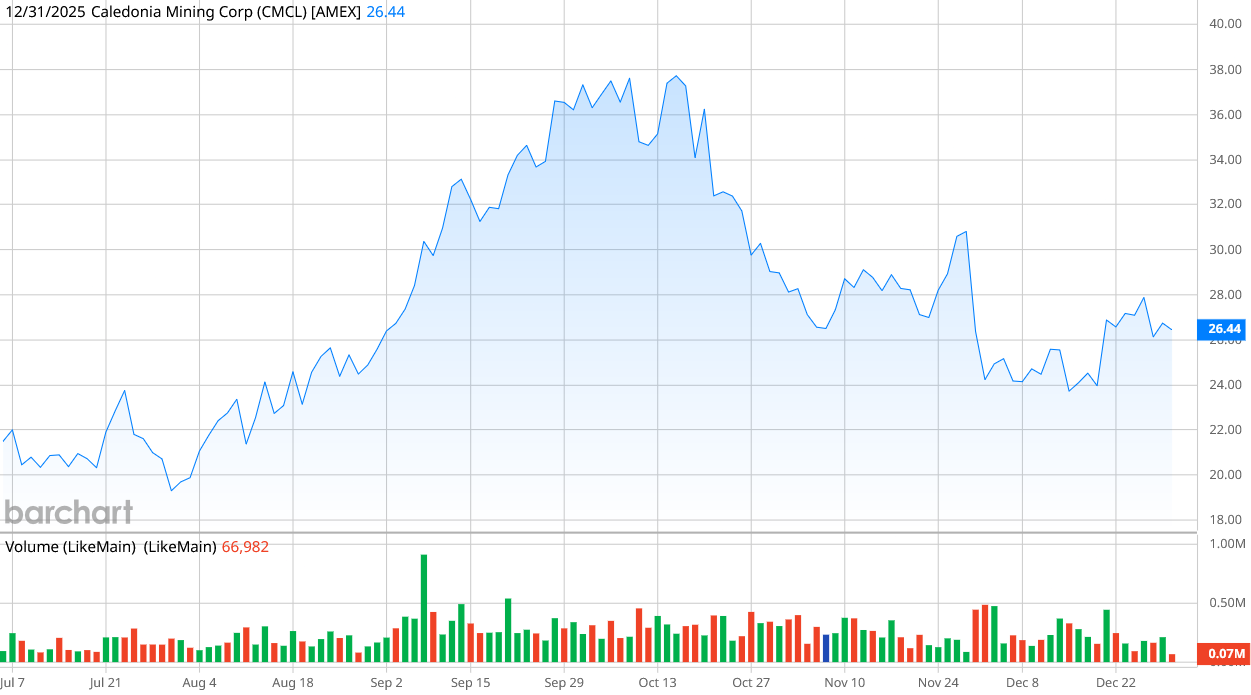

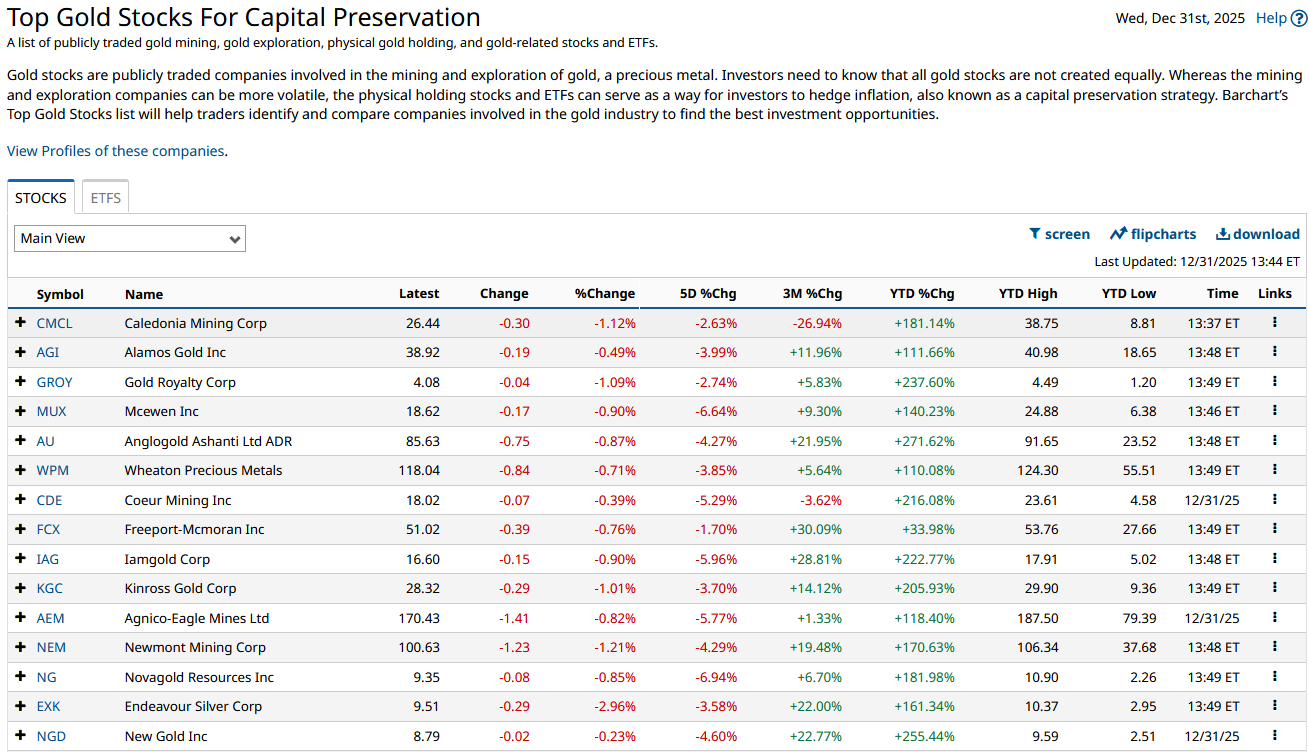

Barchart’s top-rated gold stock is currently Caledonia Mining (CMCL), which is up 181% so far this year, far outpacing the 66% gain in gold prices during the year. Let’s take a closer look at Caledonia and its prospects for the new year.

About Caledonia Mining Stock

Based in South Africa, Caledonia Mining is an exploration, development, and mining company that is focused on Zimbabwe, where it operates the Blanket Gold Mine. The company estimates that the mine includes reserves that will allow it to continue operations at least until 2034.

Shares, as mentioned before, are up 181% this year and 37% in the past six months, outperforming the S&P 500’s ($SPX) year-to-date (YTD) gain of 17%. Shares are currently trading at a price-to-earnings (P/E) ratio of 10, which at first blush seems low. But the P/E ratio is higher than the stock’s five-year mean P/E of 7.3.

Caledonia Mining also pays a dividend of $0.56 per share, which equates to a yield of 2.1%. The size of the dividend, which is $0.14 per quarter, is unchanged since 2021.

Caledonia Mining Beats on Earnings

Earnings for the third quarter were solid for the gold mining company, as Caledonia reported revenue of $71.4 million, up 52% from a year ago. Net profits were $18.7 million versus $3.3 million in the same quarter a year ago, and earnings per share of $0.77 beat analysts’ expectations by 2 cents per share.

Caledonia reported free cash flow of $5.9 million, versus a loss of $2.4 million in the third quarter of 2024. “The strong gold price environment, which increased 40% to average $3,434 per ounce, combined with higher production, has resulted in a 52% increase in quarterly revenue and a significant uplift in free cash flow,” CEO Mark Learmonth said.

Management said the cash surplus will be used to modernize the Blanket mine and for a feasibility study for its Bilboes mine in the Matabeleland North province of Zimbabwe. The company purchased the mine in 2023.

What Do Analysts Expect for CMCL Stock?

To be fair, only a single analyst is covering CMCL stock, giving it a “Strong Buy” rating and a price target of $45, which is 69% higher than Caledonia Mining’s current stock price. But it’s more telling that Caledonia is Barchart’s top gold stock for capital preservation—indicating that the company is generating plenty of free cash flow, is avoiding risky debt, and isn’t killing its balance sheet by aggressively expanding.

That means that Caledonia is in a solid position should gold prices suddenly retreat, and it shouldn’t have to dilute shareholders to maintain operations.

Does that make Caledonia a buy? Perhaps, depending on your risk profile. Gold mining stocks can be a risky proposition. Mining is very capital-intensive, and margins can get squeezed even in the best of markets.

If you are looking for a single gold mining stock, then Caledonia is a reasonable option, particularly when you consider the bullish Jefferies note on mining stocks and Caledonia’s strong rating in Barchart’s screen. However, if you wanted to hedge your bets, another option would be to look at a gold mining ETF. Such as the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) or the VanEck Junior Gold Miners ETF (GDXJ), both of which include CMCL in their holdings.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)