Gold (GCG26) prices overnight climbed to a fresh record high of $4,530.80 an ounce, basis February Comex futures. March Comex silver (SIH26) futures also hit a record high of $70.155 an ounce overnight. Gold marked its 50th record-breaking session this year, as both metals are being driven higher by safe-haven demand amid escalating U.S.-Venezuela tensions, as well as expectations of more U.S. interest rate cuts later next year. So far this year, gold has soared 70%, on track for its strongest annual gain since 1979. Silver is up by over 130% this year.

Where Are Gold and Silver Prices Headed in 2026? The Bull and Bear Cases.

Let’s break down, in bullet points, the bullish and bearish elements that will be impacting gold and silver prices in the new year.

The Bullish Case:

- Technical factors remain firmly bullish overall, as near-term and longer-term price uptrends remain in place on the daily, weekly, and monthly charts.

- U.S. Federal Reserve monetary policy is likely to lean overall dovish in 2026, especially as President Donald Trump will hand-pick his Fed chair, who will come on board in late spring. Easier Fed monetary policy would likely put pressure on other major global central banks to also keep their monetary policies easier. That would mean better global demand for gold and silver, and possibly a weaker U.S. dollar.

- Global central banks are still stocking up on gold, with China leading the way. More of the same is likely in 2026.

- Major countries continue hoarding rare earths. The artificial intelligence, electric vehicles, and increasing solar power around the globe mean more demand for minerals and metals, like silver. Major countries are stocking up on “rare earths” for their own needs now, and needs in the future.

- Geopolitics. The current U.S.-Venezuelan tensions are the latest upset to the general marketplace that is driving better safe-haven demand for gold and silver. That situation will de-escalate at some point but will very likely be followed shortly thereafter by some new political stress somewhere in the world. And then something after that. Such is the way the world works, as history shows.

The Bearish Case:

- The gold and silver markets are in very mature runs — likely in the eighth or ninth inning, in baseball terms. Raw commodity markets, including metals, are highly cyclical. History proves they go through periods of boom and bust, only to start the cycle over again. There is no doubt gold and silver, as well as platinum and palladium, are in boom cycles at present. So bust will follow. We just don’t know precisely when.

- The Federal Reserve may not be able to lean as easy on U.S. monetary policy as many doves hope. A stronger U.S. GDP reading on Tuesday and persistently elevated U.S. inflation levels may keep the Fed’s hands tied on further reducing U.S. interest rates —no matter what President Donald Trump may want.

- A booming U.S. stock market. While the major U.S. stock indexes have turned choppy and sideways recently, they are still not that far below their recent record highs. A bullish U.S. stock market is bearish for metals, from a competing asset class perspective.

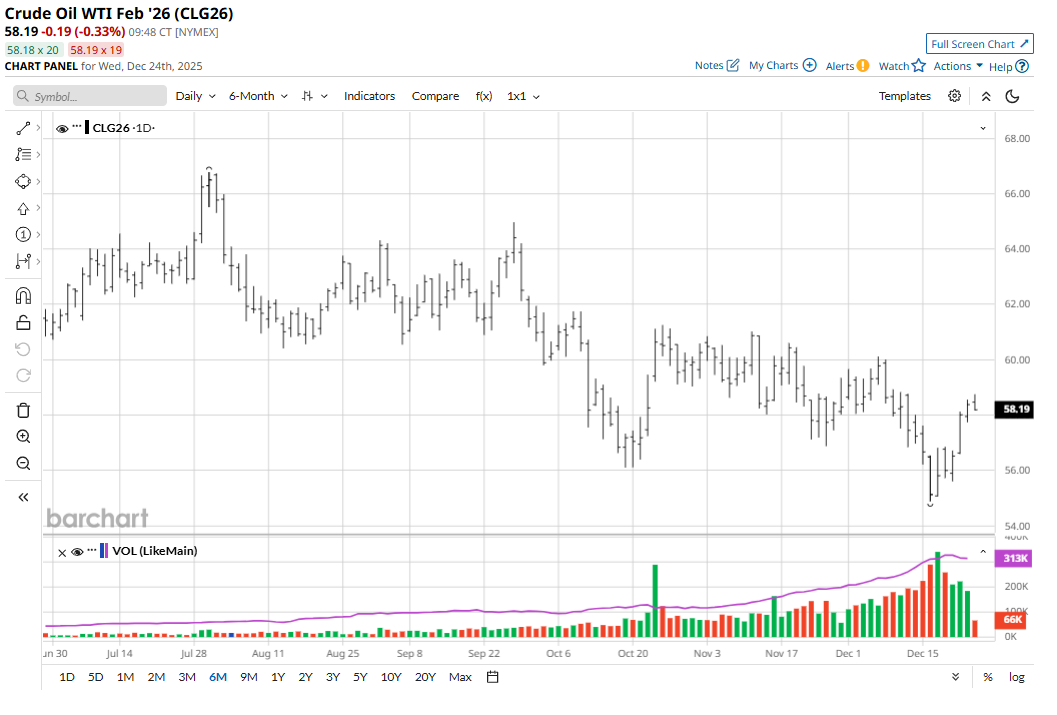

Forecasts for a global crude oil (CLG26) glut in 2026. Such would likely mean crude oil prices trending lower. Crude oil is arguably the leader of the raw commodity sector. If oil prices are trending lower, most commodities, including gold and silver, would find it more difficult to buck that downtrend in oil prices for very long.

There’s an old market adage that says when the general public catches wind of an existing bullish market price move, that’s a sure sign that market’s bullish move has pretty much already run its course. On Monday, I got inquiries from ABC News and National Public Radio, regarding the record highs scored in gold and silver. That suggests time is running out on their bull runs.

The Bottom Line: What I Expect for Gold and Silver

I’m still bullish, longer-term, on gold and silver markets. That’s based on the bullish longer-term technicals that are presently in place and will likely remain in place for at least a few more months.

Silver is the key market, in my opinion. The silver market is very overextended and is overdue for some consolidation and a pause from the recent extreme upside daily price moves. If silver prices pull back significantly, gold will do the same. If silver continues to power higher, it will pull gold along for the ride. Stay tuned and Happy Holidays!

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)