(KCH26) (CCH26) (SBH26) (CANE) (ZCZ25) (ZWZ25) (ZSF26) (CORN) (WEAT) (SOYB) (TAGS) (DBA) (RMF26)

"La Niña: Soft Commodities & Have grain markets finally bottomed?"

By Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- Mid-Afternoon Report - October 30, 2025

Image Source: The Met Office

Grain markets are finally showing some life that could significantly boost demand for U.S. soybeans and other grains. However, worries about a developing La Niña have also caused some angst among grain traders. La Niña can be bullish toward grains in the longer term, disrupting both Argentinian and US grain production, and yet generate bearish pressure on soft commodities such as sugar and coffee. Presently, the weather situation is ideal in South America, but this will not be a major factor for corn and soybean prices until after December.

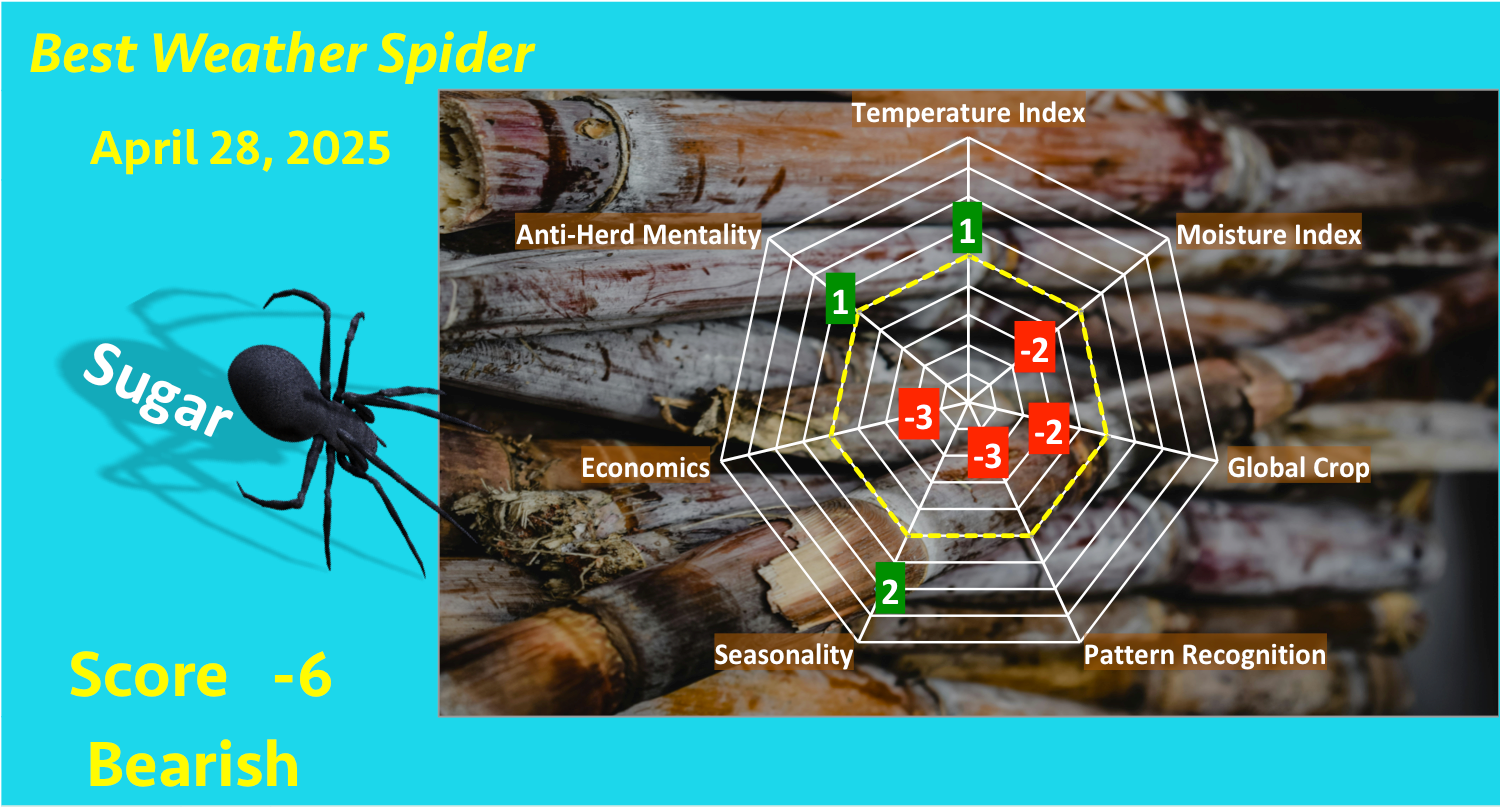

Indeed, consistent with my forecast back in April, I have been mostly bearish toward sugar prices, based on a lower crude oil market. More importantly, there was my prediction of a stellar Indian Monsoon and a big Thailand sugar crop (for the world’s 2nd and 3rd largest producers, respectively). My “Weather Spider” (like the one shown below) covers many commodity markets for our WeatherWealth subscribers on six continents.

Source: Weather Spider by BestWeather Inc.; royalty-free photo of sugarcane by pexels.com

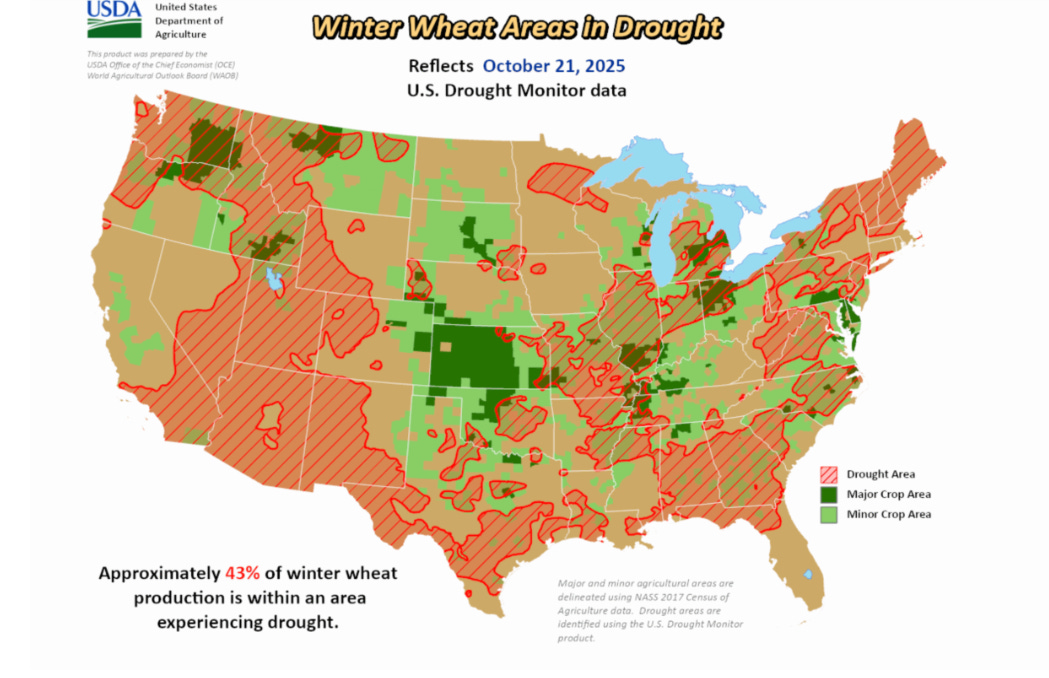

Moving right along, take notice in the image below, showing the developing drought in some of the soft-red wheat areas in the eastern corn belt (43% of US wheat areas are in drought). While this is not yet a major problem, it could very well be a background factor in the wheat market rallying, though it will not really be until March-June that the weather becomes more of an influence on wheat futures action. The hard-red wheat areas in Kansas, Nebraska, and into northern Texas are in good shape. La Niña could change that later.

Map Source: USDA

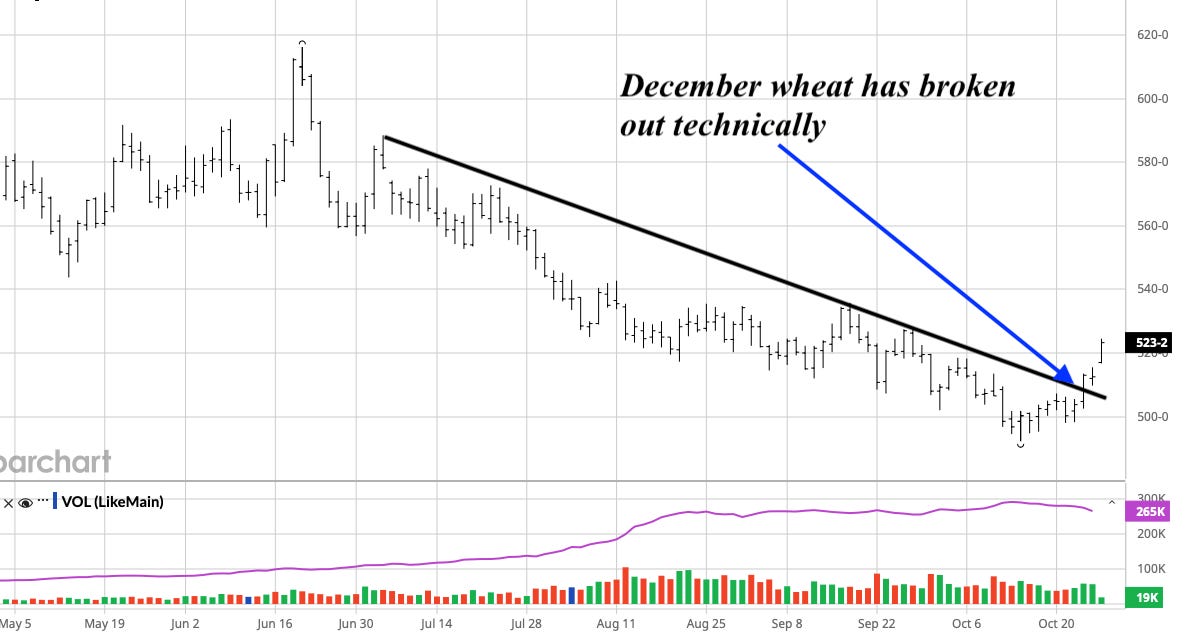

For the first time in months, the chart pattern shown below for wheat futures became more bullish over the last week. Will La Niña strengthen or weaken by the spring? If it maintains its muscle, a bull market will finally ensue for many grain markets with weather problems, not just in the US Plains wheat areas, but also in the South American grain-producing regions.

Source: Barchart.com with superimposed arrows and commentary by WeatherWealth Newsletter

Would you like to see one of our latest WeatherWealth reports from several weeks ago with trading ideas for multiple markets?

Please feel free to download a complimentary issue by clicking HERE

Or, feel free to request a 2-week free trial subscription to our WeatherWealth newsletter, then please click the link below:

https://www.bestweatherinc.com/new-membership-options/

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)