(ZWH26) (ZWK26) (ZWN26) (ZWU26) (KEN26) (MWH26) (MWN26)

“Dust Storms Hit Plains Wheat: Signs For a New Bull Market?”

February 22, 2026

by Jim Roemer

Meteorologist

Commodity Trading Advisor

Principal, Best Weather Inc.

Co-Founder, Climate Predict LLC

Publisher, Weather Wealth Newsletter

Scott Mathews, Editor-in-Chief

Image Source: BestWeather Inc. creation via ChatGPT

First of all, to get the answer to this question, we invite you to sign up for FREE abbreviated Weather Wealth newsletters on Substack, here:

Visit us at Substack via This Link

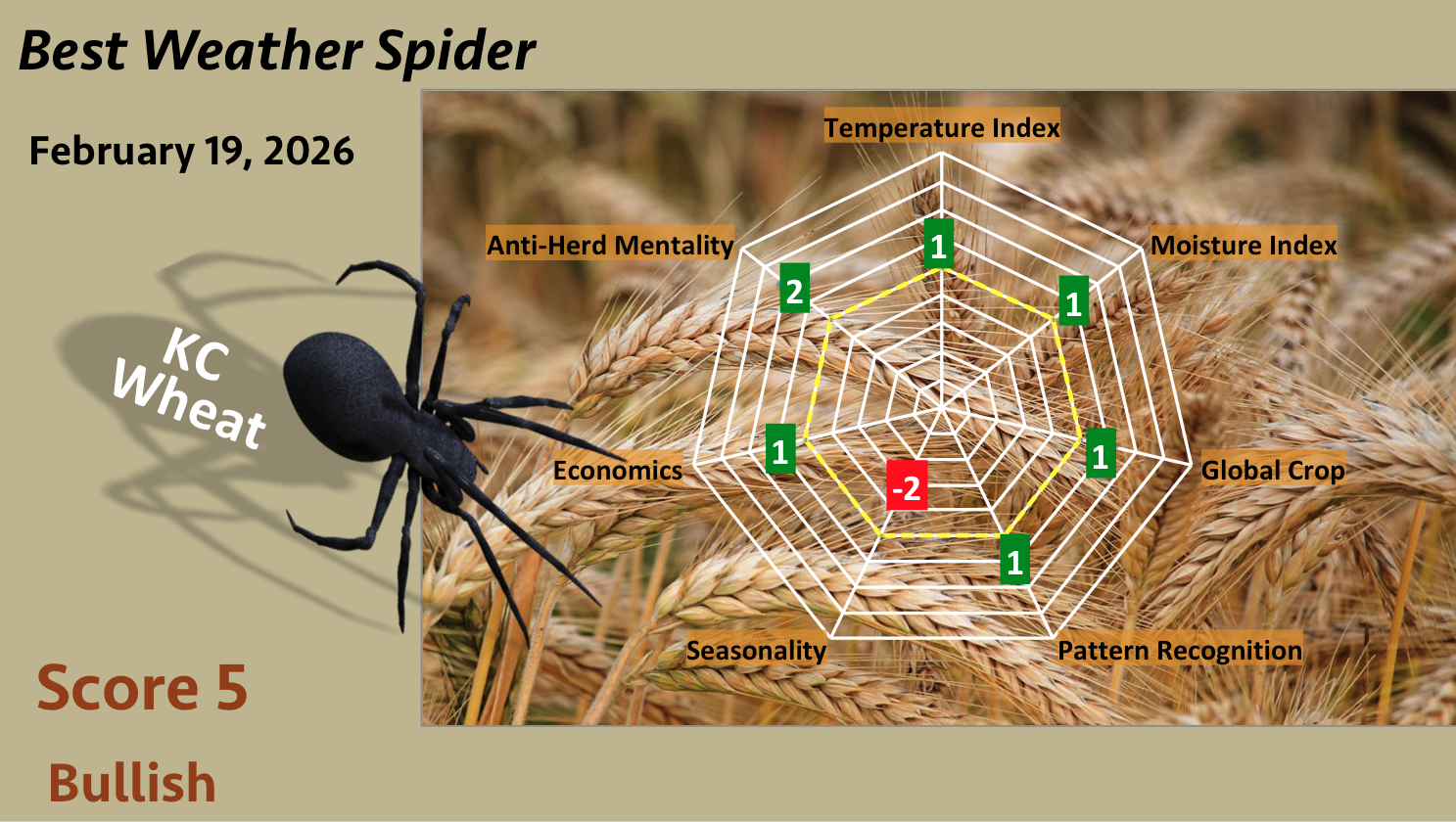

Below, one can see that our BestWeather Spider score turned bullish last week, for the first time in years. Notice that the technical chart pattern has become slightly bullish (+1), and that climatic variables such as temperature, rainfall, and current global crop conditions are also all (+1). These scores go from -4 to +4 (very bearish to very bullish). Then, they are all added together to determine the overall score.

Image Source: BestWeather Inc.

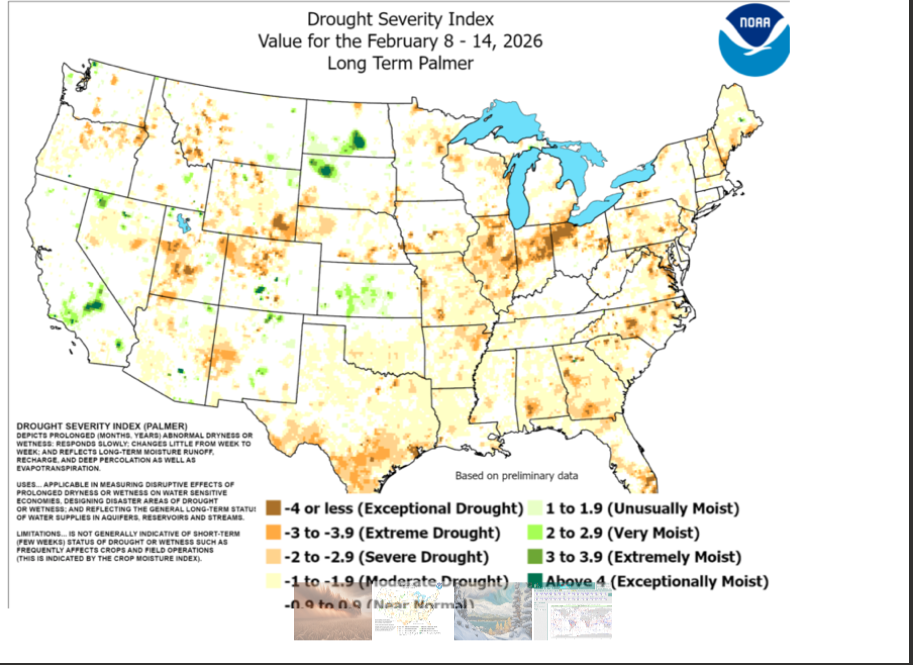

Given record wheat production (or nearly record production) in several countries over the last three years (The US, Canada, Russia, Europe, and/or Australia), we have been in a long-term bear market. Presently, while there were some great rains in parts of Kansas and Oklahoma two weeks ago, parts of the southern Plains “biscuit belt” are having light-to-moderate drought conditions. The same holds true for some soft-red wheat areas in the Ohio Valley.

Source: NOAA

Recent massive snow and avalanches in areas like Lake Tahoe (many skiers still stranded) helped whip up 40-50 MPH winds in the Plains this last week that resulted in major dust storms. This is beginning to hurt some wheat from Oklahoma to eastern Colorado.

Meanwhile, the Black Sea region, particularly Ukraine and southern Russia, was experiencing potential frost damage

to winter crops, prompting market anxiety.

Here are the key regional weather problems for wheat:

United States: Severe, expanding dryness is impacting the Southern Plains and Eastern regions, raising concerns for winter wheat development. Above-average temperatures in the eastern half of the U.S. and erratic, shifting temperatures in the Plains are causing concern over winter crop protection.

Black Sea (Russia/Ukraine): Concerns regarding frost damage to winter crops have recently increased, as shifting, warmer temperatures have melted protective snow cover, leaving crops exposed.

China: Persistent dry conditions and high temperatures in the Northern Plains have affected about 25% of the wheat area, causing concerns about potential yield losses.

Argentina: Some key growing areas remain under dry conditions, which have reduced production capacity

BOTTOM LINE:

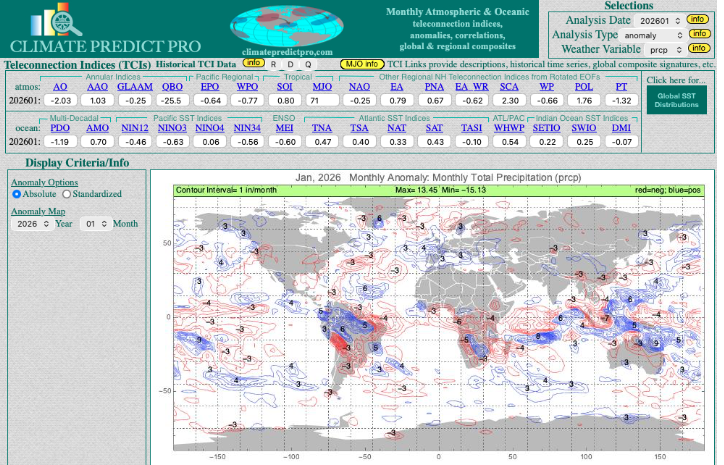

We may be entering the first bull market in wheat in years. However, weak La Niña conditions probably need to hold on into the early

spring to garner more potential global problems. This is still questionable and something I will be discussing in my WeatherWealth newsletter in the weeks and months ahead.

I use teleconnections such as La Niña, El Niño, Arctic Sea Ice, the Northern Atlantic Oscillation Index and many more to predict weather and commodity prices for farmers and traders around the world.

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)