/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

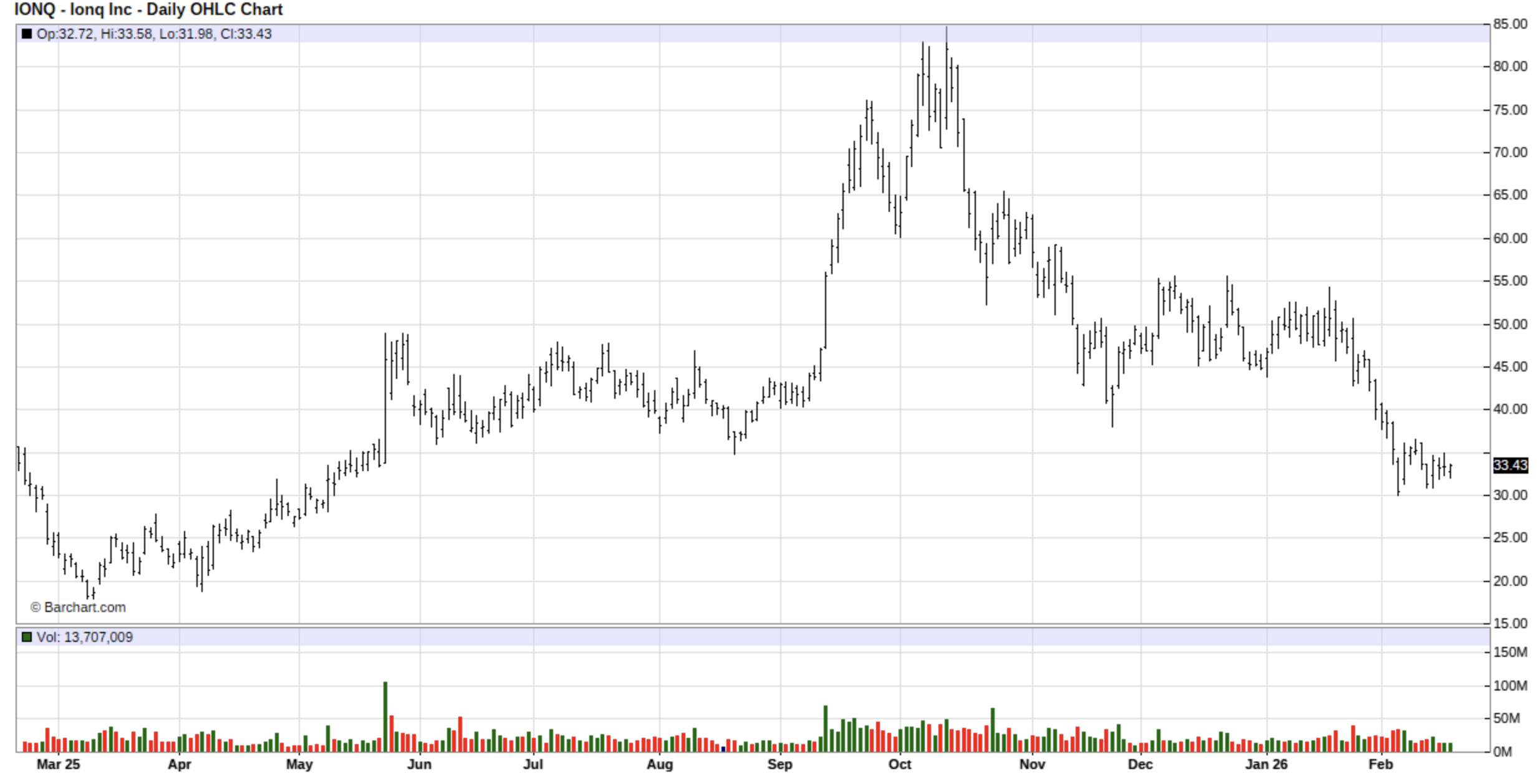

Weakness may be a buy opportunity in quantum computing company IonQ (IONQ), which will post fourth quarter and full-year 2025 financial results on Feb. 25.

Fear Has Already Been Priced Into IONQ Stock

Since peaking in October, IONQ stock is now down about 61%. But that’ll happen when the company posts a massive net loss of $1.05 billion, despite a 221.5% jump in revenue, and creates fears of dilution through stock issuances to fund acquisitions. Worse, there were short-seller allegations from Wolfpack Research. In fact, according to the short seller firm, IonQ did not disclose that reported revenues had been dependent on Pentagon budget earmarks or that those contracts had been canceled in 2025.

Short Seller Concerns Are Overblown

IonQ responded with a note that the allegations are false, adding, “We have a clear path to shareholder value creation, and our recent agreement to acquire SkyWater Technology is evidence that IonQ is a trusted ecosystem partner to the U.S. government, allied nations, and industry collaborators,” as quoted by Fortune.

We also have to consider that this isn’t the first time that short sellers have attacked IONQ. In May 2022, Scorpion Capital said IonQ’s technology was a hoax. The report sent the stock from about $7.80 to a low of $4.82 before it rebounded. By 2025, a U.S. Court of Appeals for the Fifth Circuit Court ruled that the short-seller report was not reliable. In March 2025, short sellers at Kerrisdale Capital said IonQ was hype. Shortly after, the IONQ stock would fall from about $25.60 to a low of $17.88. Following the short report pullback, the quantum computing stock rallied from its $17.88 low to about $49.

Earnings are Expected to Remain Strong

For Q4 2025, analysts are looking for another quarter of solid revenue. Current estimates point to revenue of around $40 million for the quarter, reflecting further solid growth. EPS is expected to be negative with a loss of about 51 cents per share, which is an improvement. For full-year 2025, IONQ already guided revenue in a range of $106 million to $110 million, with analysts expecting results near the high end of that range. In its Q3 2025 earnings report, the company crushed estimates on the top and bottom lines. Its 17-cent-per-share loss was a beat by three cents. Revenue of $39.87 million, up 221.5% year-over-year (YoY), beat by $12.88 million. Granted, it also posted a net loss of about $1.05 billion, but most of that was from large, non-cash charges and rising costs.

IonQ Could Dominate a Potential $198 Billion Market

Moving forward, we do expect to see far better results from the company—especially as it attempts to dominate a potential $198 billion market by 2040. Here’s why.

In October, IonQ became the first and only quantum computing company to demonstrate two-qubit gate fidelities of 99.99%. That means IonQ’s platform makes just one error out of every 10,000 tries, which gives it a massive lead over its competition. According to IonQ, “This is a landmark technical milestone that underpins IonQ’s accelerated roadmap to millions of qubits by 2030—unlocking more complex applications for customers sooner and a thousands of time reduction in logical error rates.”

As noted by CEO Niccolo de Masi, “Our technical achievements continue to solidify IonQ’s quantum platform as the most complete and powerful in the world, with a correspondingly larger addressable global market. With $3.5 billion of pro-forma net cash, we are continuing to reap the compounding benefits of our scale and momentum advantages, entrenching our position as the dominant force in quantum and the only complete platform solution.”

Again, moving forward, as IonQ improves its technology to become even more accurate, it could dominate the quantum computing sector, which, according to McKinsey & Co., could be worth between $28 billion and $72 billion by 2035. By 2040, it could be worth $198 billion.

What Other Analysts Are Saying About IONQ Stock

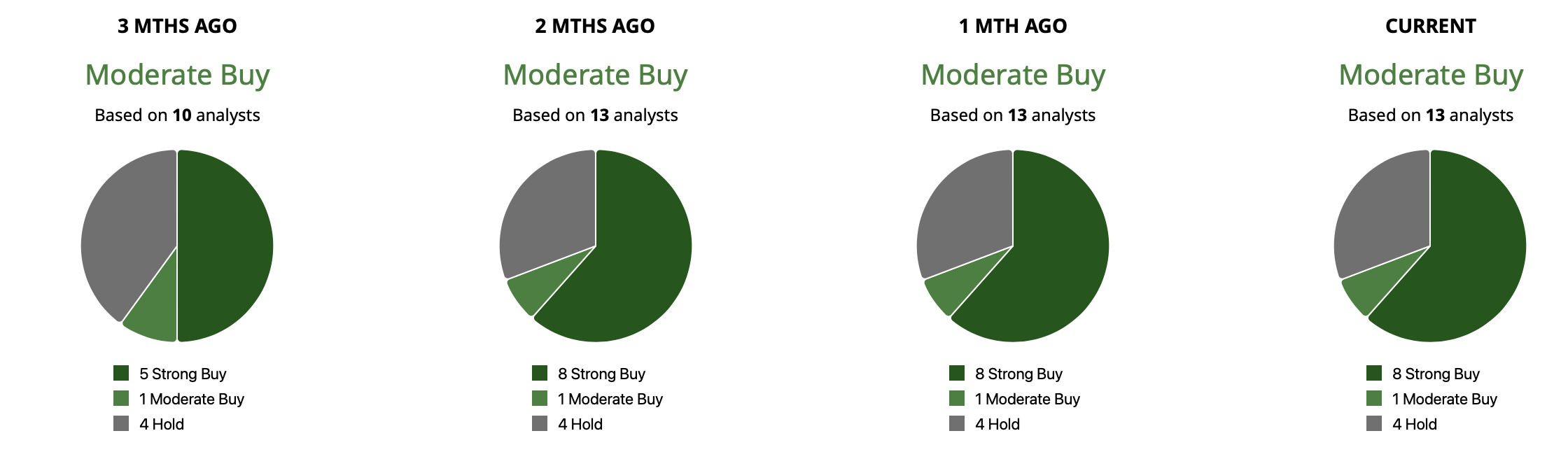

Of the 13 analysts covering the IONQ stock, eight have it rated as a “Strong Buy,” one rates it as a “Moderate Buy,” and four rate it as a “Hold.” Presently, the mean target price among analysts is $75.50, implying 126% upside. The high-end target is $100, implying 199% upside.

With revenue growth accelerating, technical milestones stacking up, billions in cash on the balance sheet, and a legitimate shot at leading what could become a $100+ billion industry, the long-term story remains firmly intact. Add in a stock that’s already been punished, improving earnings trends, and broad analyst support, and the current pullback looks far more like an opportunity. For investors who can tolerate near-term noise and focus on where quantum computing is headed over the next decade, IONQ's weakness is a buy opportunity.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)