/Women%20sitting%20on%20roling%20chair%20in%20front%20of%20computer%20monitors%20by%20ThisisEngineering%20via%20Unsplash.jpg)

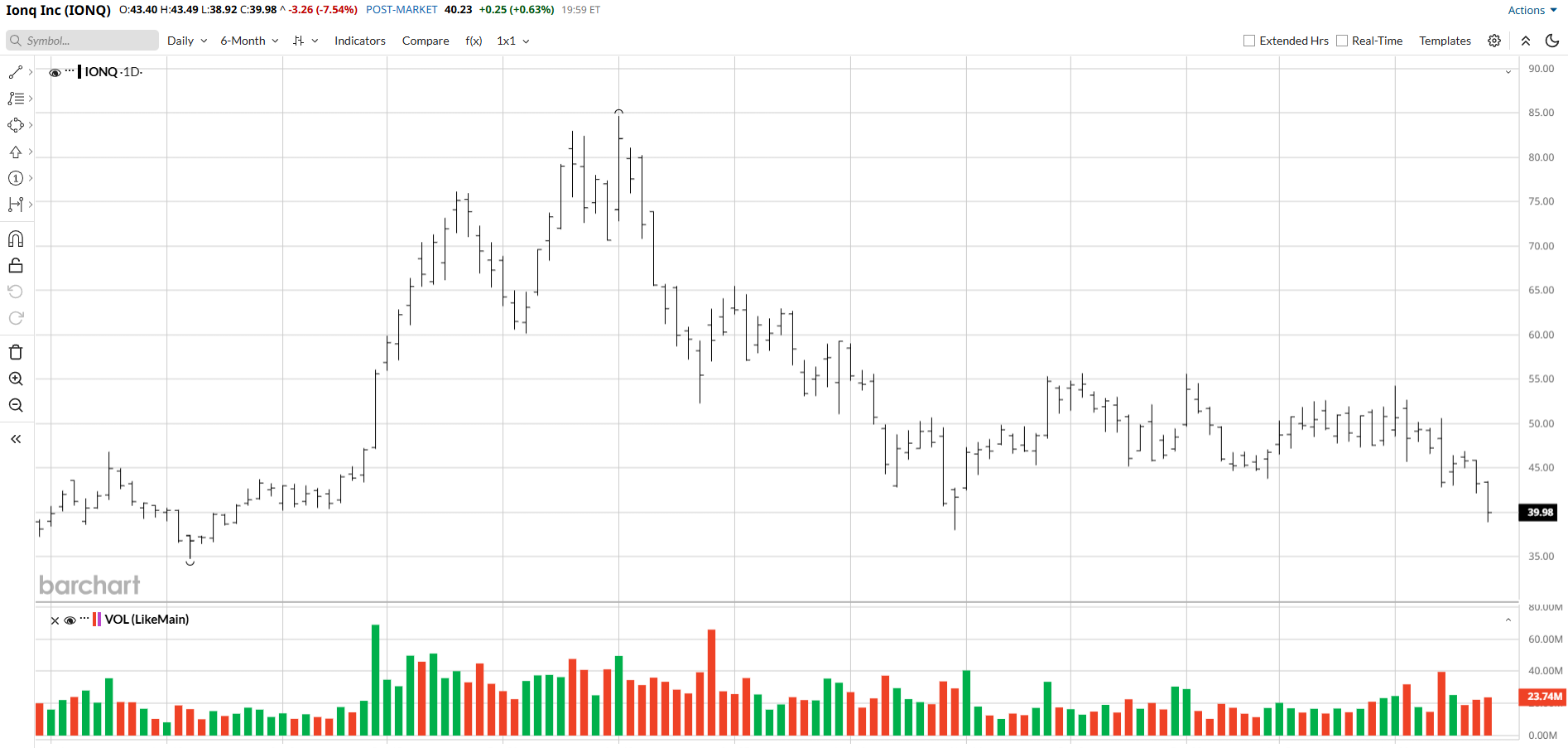

Quantum stocks, including IonQ (IONQ), have sunk sharply in recent days as a number of factors, including disappointment in Microsoft's (MSFT) quarterly results, have made the Street averse to high-risk stocks in general and high-risk tech names in particular.

IONQ has a great deal of potential. But because the decline of high-risk tech names looks poised to continue in the short term and quantum computing is still in its early stages, I would not advise investors to buy IONQ stock at this point.

Also making me cautious about IONQ is the fact that its valuation remains quite stratospheric despite the recent downturn of its shares.

About IONQ

IonQ produces and markets quantum technologies, including quantum computers and related software. In the last several months, it has made multiple acquisitions, including Seed Innovation, which has “expertise in machine learning (ML), advanced software architecture, and cloud migration,” according to IonQ. In November, the quantum-computing firm disclosed that it had agreed to purchase Skywater Technology for about $1.8 billion in cash and stock. SkyWater, which has multiple chip factories and customers in the aerospace and industrial sectors, is expected to enable IonQ to launch its upcoming products more quickly. Additionally, the quantum firm hopes to sell its offerings to SkyWater's customers.

Among IonQ's current customers are Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Airbus, Hyundai, the National Quantum Computing Centre, and the Los Alamos National Laboratory.

In the third quarter of 2025, the company's revenue jumped to $39.87 million, up 92.7% versus the same period a year earlier. However, its net loss soared to $1.05 billion from $52.5 million in Q3 of 2024.

Analysts' average estimate calls for the company's per-share loss to narrow to -$1.74 this year from -$5.08 in 2025. IONQ stock has a market capitalization of $13.9 billion and a price-to-sales (P/S) ratio of 124x.

High Potential and High Risk

Many huge tech companies, including Microsoft, Alphabet, and IBM (IBM), are investing significant amounts of time and money in quantum technology, while the well-regarded consulting firm McKinsey has estimated that the quantum market may balloon to $72 billion in 2035 from just $4 billion in 2024.

IonQ's customer list is quite impressive, as it has won deals with the U.S. Air Force, the country's Defense Advanced Research Projects Agency (DARPA), and pharma giant AstraZeneca (AZN). Also boding well for IONQ, the company expects to have generated $106 million to $110 million of revenue for all of 2025.

Still, as shown by the fact that the quantum-computing sector generated just $4 billion of revenue in 2024, the space is still in its early stages. And the Street has a history of excitedly and rapidly buying the stocks of emerging technologies, only to later quickly unload those same equities as their novelty wore off. Of course, the most famous example is the internet bubble of the early 2000s. But multiple other sectors, including electric vehicle (EV) stocks and solar stocks, have experienced the same thing, reaching gigantic valuations only to subsequently collapse.

Because quantum is in its early stages and IONQ has an extremely high valuation, history indicates that it and all of its peers are vulnerable to very large pullbacks. Providing more evidence for that assertion, its shares tumbled 31% in the three months that ended on Jan. 30.

The Bottom Line on IONQ

Ultimately, investors should wait for the stock to reach a more reasonable valuation before buying shares.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)