/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

Micron (MU) stock has rallied significantly, rising about 242% over the past six months. Despite this steep run, Micron’s valuation still looks attractive and remains low relative to its earnings trajectory, suggesting further upside potential in the stock.

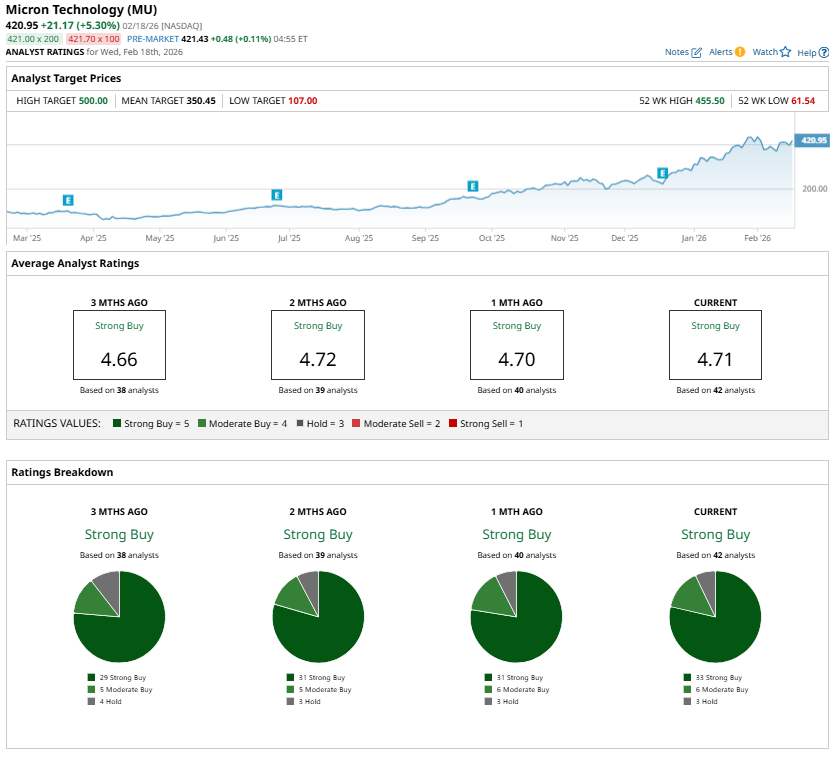

Notably, Wall Street’s highest 12-month price target for MU stock is $500. With the shares recently closing at $420.95 and up more than 47% year-to-date (YTD), reaching that target would represent an additional gain of about 16%. Given the company’s earnings momentum, low valuation, and the current strength of the memory cycle, that level of upside appears attainable.

MU Stock’s Rally to Sustain in 2026

The strong underlying demand and pricing suggest that the rally in MU stock will sustain in 2026 and beyond. The rapid expansion of AI data centers is significantly increasing the need for high-performance, high-capacity memory and storage solutions. At the same time, Micron’s products are being adopted across a growing range of applications, from autonomous vehicles to advanced medical diagnostics, which is further supporting demand. This secular demand backdrop and tight industry supply are translating into stronger pricing and operating leverage for Micron.

In its fiscal first quarter, Micron delivered record revenue in both DRAM and NAND, alongside substantial improvements in profitability. DRAM revenue reached $10.8 billion, up 69% year-over-year (YoY). Sequential growth was also robust, supported by a roughly 20% increase in pricing amid tight industry supply. Higher shipments, pricing strength, and improved product mix drove the segment’s earnings.

NAND followed a similar trajectory. Revenue climbed to $2.7 billion, up 22% YoY, driven by higher shipments, improved pricing, and a favorable mix.

The company’s consolidated gross margin rose to 56.8%, up 11 percentage points sequentially. Further adjusted EPS (earnings per share) surged to $4.78, marking 58% sequential growth and a 167% increase from the year-ago period. This significant growth reflects high demand and pricing, cost efficiency, and product mix.

In the data center end market, management expects server demand to stay strong throughout 2026, as both memory and storage content per server continue to increase to support AI training and inference workloads. Micron’s differentiated portfolio, including high-bandwidth memory (HBM), high-capacity server DRAM modules, and data center solid-state drives, positions the company well to capture a growing share of this higher-value opportunity.

Notably, Micron has already secured pricing and volume agreements covering its entire calendar 2026 HBM supply, including its next-generation HBM4 products. Management projects the total addressable market (TAM) for HBM to continue to expand at a solid pace, supporting its growth.

Micron’s customized HBM4E solutions could further accelerate its growth. The tailored, high-value products support both pricing resilience and margin expansion.

Looking ahead, industry supply for both DRAM and NAND remains tight, and management anticipates these conditions will persist through calendar 2026 and potentially beyond.

In sum, constrained supply and rising AI-driven demand position Micron to expand earnings at a solid pace, supporting its share price rally.

Micron’s Valuation Is Still Attractive

MU stock is trading at roughly 12.5 times forward earnings, which is still significantly low given the company’s strong growth trajectory in 2026 and beyond.

Wall Street analysts expect Micron to generate EPS of $33.05 in fiscal 2026, representing a more than 330% YoY increase. Moreover, fiscal 2027 EPS is projected to climb another 38%, even against a tough YoY comparison.

Micron’s modest valuation and robust forward earnings outlook create a compelling risk-reward profile, indicating further upside in its stock price. Wall Street is optimistic about MU stock, with the majority of analysts endorsing a “Strong Buy” rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)