/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies Inc. (PLTR) stock may have hit a bottom after several tranches of large and unusual volume in out-of-the-money PLTR put options have traded today. Palantir's strong free cash flow and FCF margins imply a higher price target.

PLTR is up today to $139.66 per share, after hitting a recent trough of $129.13 on Feb. 12. That was after the company released its Q4 and 2025 results on Feb. 2.

So, has the post-earnings sell-off been overdone? That may be the case given the huge amount of put options traded in out-of-the-money (OTM) strike prices today.

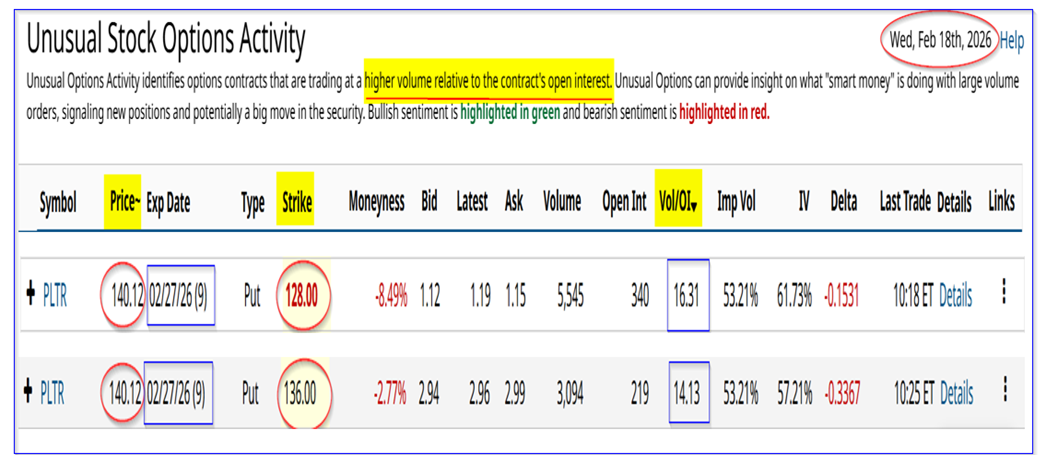

That can be seen in today's Barchart Unusual Stock Options Activity Report.

It shows that over 5,500 put option contracts have traded at the $128.00 strike price and almost 3,100 puts at the $136.00 strike price, both expiring in 9 days on Feb. 27.

These volumes are highly unusual. For example, the $128 put contracts have traded at over 16x the prior number of contracts outstanding, and 14x for the $136.00 strike.\

PLTR Put Activity Overdone?

What is going on here? The premiums are very high. The midpoint for the $18 is $1.14, representing a breakeven for the buyer of $$126.86 (i.e., $128-$1.14), or 9.5% below the PLTR trading price.

That implies investors are super bearish, maybe too much so. Is PLTR really going to fall another 9.5% in the next 9 days before expiry?

In fact, short-sellers of this put option are making a very attractive 9-day yield of 0.89% (i.e., $1.14/$128.00). That works out to a monthly rate of over 2.67% (i.e., 3x 0.89%), assuming it could be repeated.

Similarly, the midpoint of the $136 put tranche is $2.96, offering a short-seller a 9-day 2.177% yield (i.e., $2.96/$136.00). That equals a 6.5%+ monthly yield, if it can be repeated.

The bottom line is that put option buyers are giving up a huge amount of premium to put sellers here. It looks overdone.

After all, Palantir's earnings and more specifically, its free cash flow (FCF) and FCF margins were stellar, again.

Strong FCF and FCF Margin Results

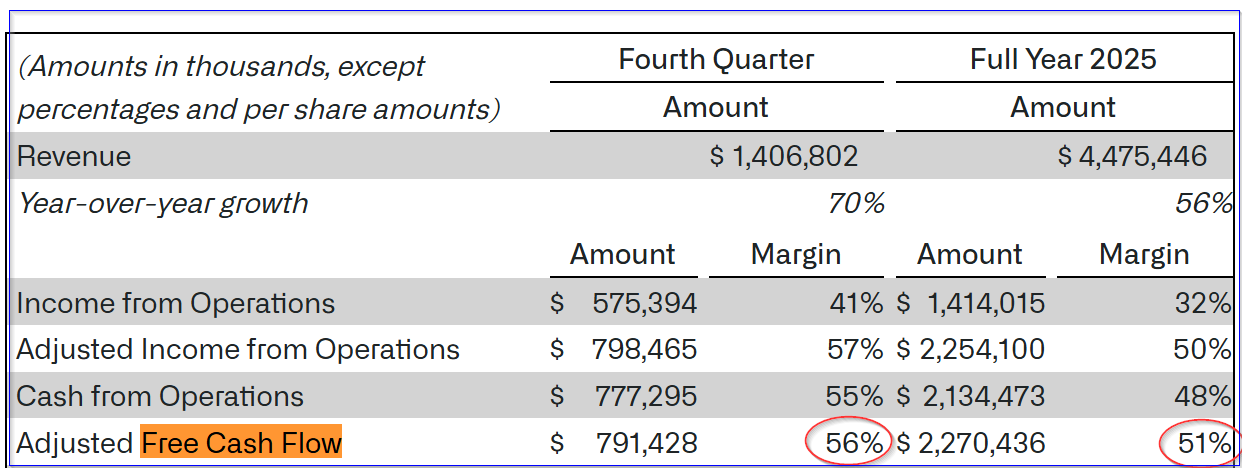

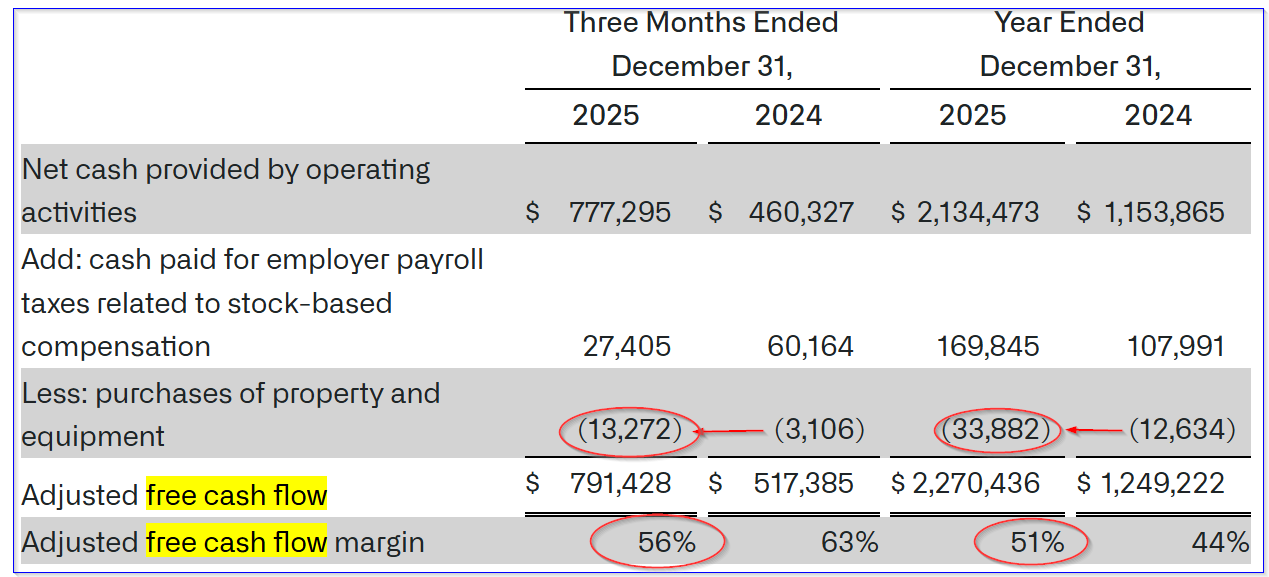

Palantir is one of the very few companies that emphasizes its FCF margins. The company reported that its free cash flow, on an adjusted basis, represented 56% of its Q4 revenue. And for 2025, it was 51%.

This can be seen in Palantir's table above, taken from its Q4 shareholder letter. Last year, the adj. FCF margin was 63% for Q4, but that was for $517 million on $828 million in revenue. Since then, adj. FCF has risen 53% to $791.4 million, and revenue is up +70% at $1.4 billion.

However, for the full year, 2025 had a major increase in its FCF margin from 44% in 2024 to 51% in 2025. That can be seen in a table Palantir provided, showing that capex spending, which lowers FCF, had tripled over both periods:

Strong Outlook

Even more importantly, the company's outlook for 2026 shows that it expects a similar FCF margin:

Revenue forecast: $7.182b - $7.198 billion (midpoint = $7.19 billion) (+60.6% over 2025)

Adj. FCF forecast: $3.925b - $4.125 billion (midpoint = $4.025 billion) (+77% higher than 2025)

Implied adj. FCF margin for 2026: $4.025b/$7.19b = 56.7%

This is unique in several ways. First, very few companies can reliably project their adjusted FCF margins. That shows a huge degree of confidence in its revenue and operations.

Second, this 56.7% adj. FCF margin is 11% over than the 51% adj. FCF margin in 2025. In other words, even as revenue is expected to rise over 60% in 2025, it will squeeze out even more cash from operations, as the adj. FCF is expected to rise 77%.

That's a huge sign of operating leverage, a very desirable financial trait. It should increase the value of PLTR stock.

Higher Price Targets

As a result, the market is now valuing PLTR with a 0.69% FCF yield:

$2.27b adj. FCF 2025 / $331.29 billion mkt cap today = 0.00686 = 0.686% adj. FCF yield

This means that if Palantir were to pay out 100% of its last year's FCF to shareholders, the stock would have a 0.686% dividend yield.

So, applying that to the midpoint 2026 FCF forecast:

$4.025b adj. FCF / 0.069 = $583.3 billion mkt cap

That is 76% over today's mkt cap. In other words, PLTR stock is worth 76% more:

$139.66 x 1.76 = $245.80 target price (TP)

That is higher than other analysts' PTs. Yahoo! Finance reports that 27 analysts have an average PT of $189.92. But that PT is still 35% higher than today's price.

Summary and Conclusion

No wonder short-sellers are selling out-of-the-money put options in PLTR stock today. They see a potential rebound in PLTR stock.

However, investors should be careful about copying this play. PLTR is very volatile. It could result in an unrealized capital loss, if PLTR falls below 128.00.

Nevertheless, at least for the $128 strike price put, the delta ratio is below 0.16, implying less than a 20% chance that PLTR will fall to $128 over the next 10 days. That looks like a low possibility, especially given PLTR's huge upside.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)