/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

Few partnerships in tech have been as transformative, or as complicated, as the one between Microsoft Corporation (MSFT) and OpenAI. Microsoft has invested billions into OpenAI, embedding its models across Azure and integrating them into products like enterprise artificial intelligence (AI) tools and developer platforms. In return, Microsoft reportedly secured a 20% share of OpenAI’s revenue through 2030, effectively tying its financial upside to OpenAI’s meteoric growth. The relationship has had its tensions, especially as OpenAI restructured. But commercially, the two remain tightly linked across cloud infrastructure, APIs, and consumer AI deployments.

Now that arrangement goes even further. Under a revised agreement, Microsoft is set to receive 20% of OpenAI’s total revenue through 2032, extending the original arrangement by two years. The update also adjusts control dynamics, giving OpenAI greater flexibility to work with additional compute providers while easing certain exclusivity clauses. At the same time, OpenAI committed to massive long-term Azure spending, strengthening Microsoft’s cloud backlog and visibility into future AI-driven demand.

Microsoft remains financially and operationally tied to one of the fastest-growing AI platforms. So, with this extended revenue runway, does the long-term bull case for MSFT look even more compelling?

About Microsoft Stock

Microsoft hardly needs an introduction. A core member of the Magnificent Seven, it has grown from a scrappy software pioneer into a technology titan, boasting a market capitalization of $3 trillion. Windows still commands more than 70% of the global PC operating system market, but that is just the starting point.

Today, Microsoft’s influence stretches across Azure cloud computing, Microsoft 365 productivity tools, developer platforms, enterprise solutions, and gaming. What truly defines the company is its evolution – from boxed software to subscription ecosystems, from on-premise servers to AI-powered cloud platforms. Whether in corporate boardrooms, university classrooms, or everyday households, Microsoft has woven itself into the digital fabric of modern life – steady, scalable, and constantly reinventing itself.

When it comes to MSFT stock’s price performance, the long-term chart is impressive. Over the past two decades, shares have transformed loyal holders into market royalty. Even across the last 10 years, the stock’s roughly 685% surge cemented its status as a mega-cap leader riding the cloud and AI revolution.

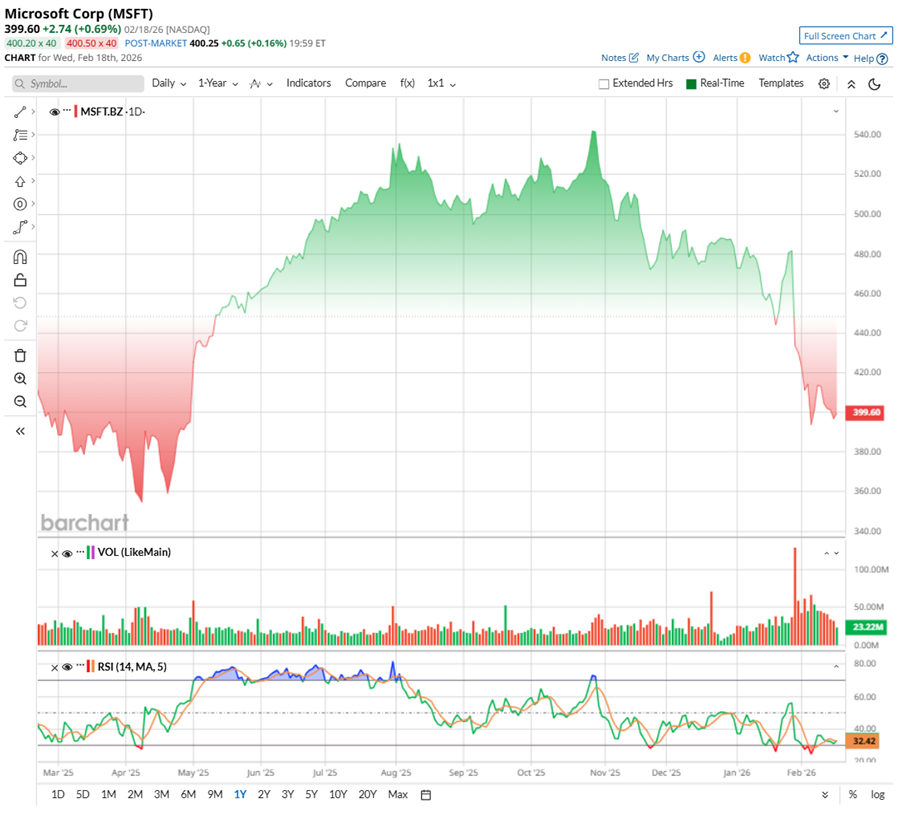

But zoom into the past year, and the tone shifts. Over the past 52 weeks, MSFT has been down about 4.3%. The six-month stretch has been tougher, with shares sliding 22.14%. And just weeks into 2026, the stock is already down 17.9% year-to-date (YTD). Concerns around heavy AI-related capital expenditures, competitive pressures, and a tempered outlook have weighed on sentiment. After the Q2 report, shares dropped 10% in a single session – the steepest one-day decline since March 2020. The stock is hovering near a 10-month low after four consecutive monthly declines, revisiting levels last seen in April.

Technically, trading volumes have picked up, signaling repositioning. Meanwhile, the 14-day RSI dipped into oversold territory earlier this month and now sits near 32, suggesting downside momentum may be stabilizing.

Valuation-wise, Microsoft is not cheap. MSFT is priced at around 23.9x forward adjusted earnings and 9x forward sales, sitting above the broader tech sector averages. But it is actually below its own historical multiples. So, while the sticker price looks premium, it is more about quality. This is the gold standard in cloud, enterprise software, and AI infrastructure. When revenue, margins, and cash flow are all climbing, a higher multiple feels earned, not stretched.

Despite its premium valuation, Microsoft has remained consistently loyal to shareholders, steadily rewarding them through disciplined capital returns. Since initiating dividends in 2003, payouts have climbed year after year. In March 2026, it is set to pay a $ 0.91-per-share dividend, bringing the annual payout to $3.64 per share. The forward annualized yield is 0.91%, and with a conservative 22.6% payout ratio, there is plenty of room to keep growing. Two decades of increases later, it’s knocking on “Dividend Aristocrat” territory.

Microsoft Beats Q2 Estimates, yet Shares Head South

Microsoft released its earnings report for the second quarter of fiscal 2026 on Jan. 28. On the surface, the headline numbers were the kind investors would expect from a tech giant. Revenue rose 17% year-over-year (YOY) to $81.3 billion, while non-GAAP EPS climbed 24% to $4.14. Both exceeded Wall Street expectations, underscoring continued strength in cloud, AI, and productivity solutions.

A notable contributor this quarter was Microsoft’s investment in OpenAI. The company recorded a $7.6 billion net gain tied to that stake, reversing prior-year losses that had weighed on earnings. While these investment-related swings affect GAAP results, management emphasized operational performance by highlighting non-GAAP metrics and providing outlook guidance excluding OpenAI impacts.

Meanwhile, operating margins expanded to 47%, and that’s impressive, considering the aggressive AI infrastructure buildout underway. The cloud segment surpassed $51 billion in quarterly revenue for the first time, growing 26%. Management acknowledged that AI demand continues to outpace supply, particularly across enterprise workloads. Commercial bookings increased 23%, and remaining performance obligations surged to $625 billion, creating a deep pipeline of contracted future revenue. Notably, roughly 45% of that backlog reflects OpenAI-related commitments – a tangible sign of how central AI has become to Microsoft’s growth engine.

Yet the market reaction was swift as shares dropped 10% the next day. The issue was not weakness, but expectations. Investors wanted even faster cloud acceleration and showed concern over the scale of AI-driven capital expenditures, which totaled $29.9 billion in the quarter.

And Microsoft is spending with intent. It added roughly one gigawatt of data center capacity in just three months, introduced custom silicon like Maya 200 and Cobalt 200, and expanded AI-optimized facilities globally. Azure AI Foundry now serves over 80,000 organizations, including 80% of the Fortune 500. AI features reach 900 million monthly active users across Microsoft’s ecosystem, with more than 150 million engaging with Copilots.

Microsoft’s balance sheet remained solid. The company ended Q2 with $89.5 billion in cash, cash equivalents, and short-term investments, while long-term debt, including the current portion, amounted to $40.3 billion. Operating cash flow reached $35.8 billion for the quarter, highlighting strong underlying cash generation. During Q2, Microsoft returned $12.7 billion to shareholders through dividends and share repurchases, up a 32% YOY – reinforcing its commitment to capital returns alongside continued investment.

Looking ahead, the management expects Q3 revenue between $80.65 billion and $81.75 billion, implying an annual growth of roughly 15% to 17%. However, the mid-point of the range indicates a slight sequential decline, which likely contributed to the pressure on MSFT’s stock following the earnings report. Operating margins are projected to dip slightly, reflecting continued AI investments, but management still sees full-year fiscal 2026 margins edging up modestly as revenue mix improves and first-half spending priorities normalize.

Revenue from Productivity and Business Processes is projected between $34.25 billion and $34.55 billion, with Microsoft 365 Commercial cloud growth estimated to land somewhere between 14% and 15%, driven by E5 adoption and Copilot-driven ARPU gains. LinkedIn is expected to grow by low-double digits, while Dynamics 365 should post high-teens growth.

Intelligent Cloud remains the powerhouse. Revenue is forecast at $34.1 billion to $34.4 billion, with Azure growth accelerating to 37% to 38%. Demand continues to exceed available capacity, and Microsoft expects to remain supply-constrained through fiscal year-end – meaning some Azure revenue is effectively deferred due to infrastructure limits.

More Personal Computing revenue is guided to $12.3 billion to $12.8 billion. Windows OEM revenue may decline by low teens due to elevated channel inventory, and Xbox content and services are expected to see similar modest declines.

With millions using its AI tools and Copilot monthly, Microsoft has achieved meaningful AI scale. The focus now is on balancing rapid infrastructure expansion with disciplined, profitable growth. CapEx is expected to decline sequentially in Q3, reflecting typical cloud buildout timing, while asset mix remains steady.

Meanwhile, analysts are calling for Q3 2026 EPS of $4.05, a clean 17% jump from last year's quarter. Revenue is projected to be around $81.4 billion, keeping growth firmly intact. Zooming out, and the confidence gets even louder as full-year EPS is estimated at $16.37, up 20% YOY, before climbing another 14.4% annually to $18.72 in fiscal 2027.

What Do Analysts Expect for Microsoft Stock?

Amid all the noise around short-term numbers, Goldman Sachs stays bullish on Microsoft, maintaining a “Buy” rating with a $600 price target. The analysts highlight that MSFT is thinking long-term by prioritizing AI, Copilot, and internal R&D over immediate Azure revenue. And doubling down on first-party compute and building AI across the tech stack, Microsoft is positioning itself for a stronger strategic advantage and bigger returns in the medium term.

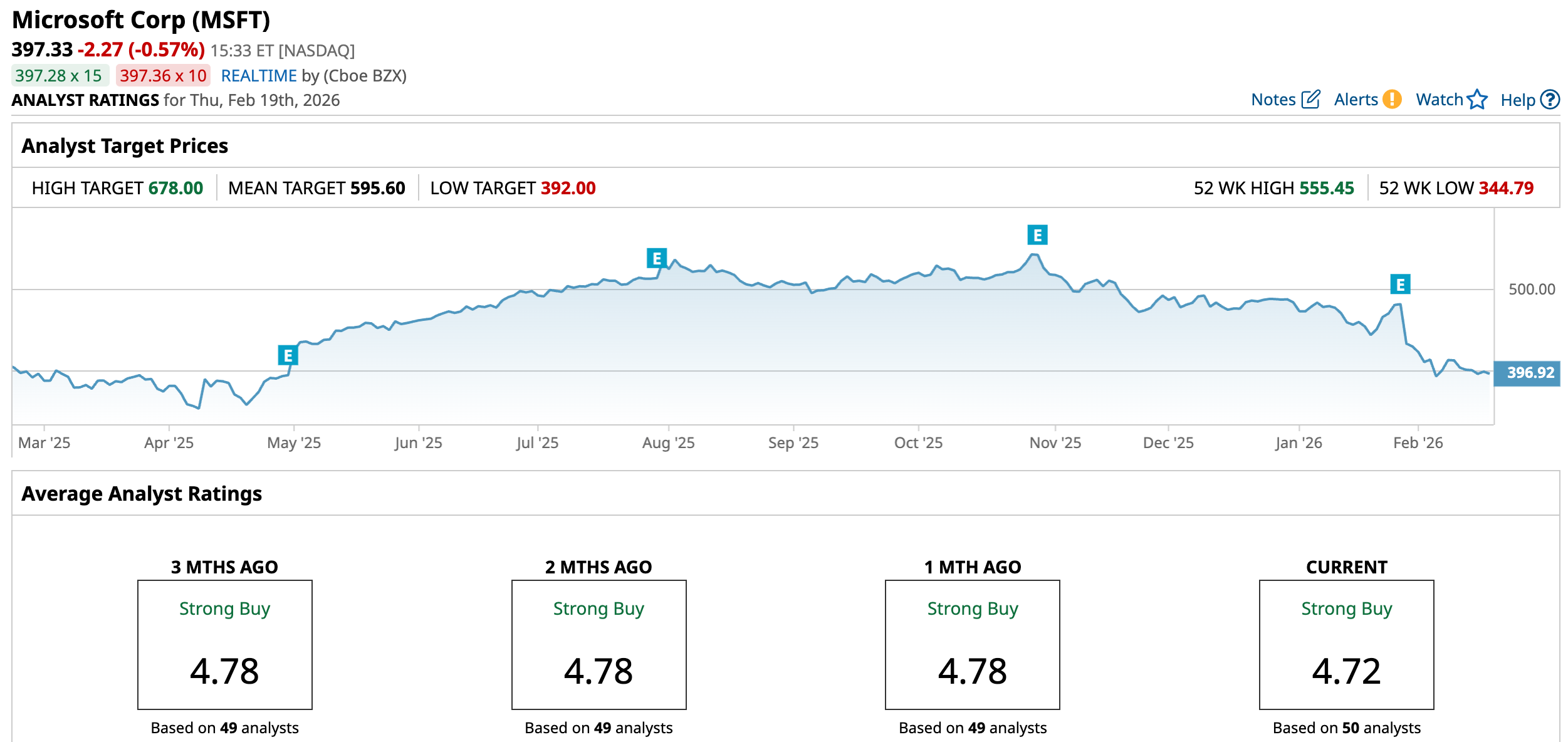

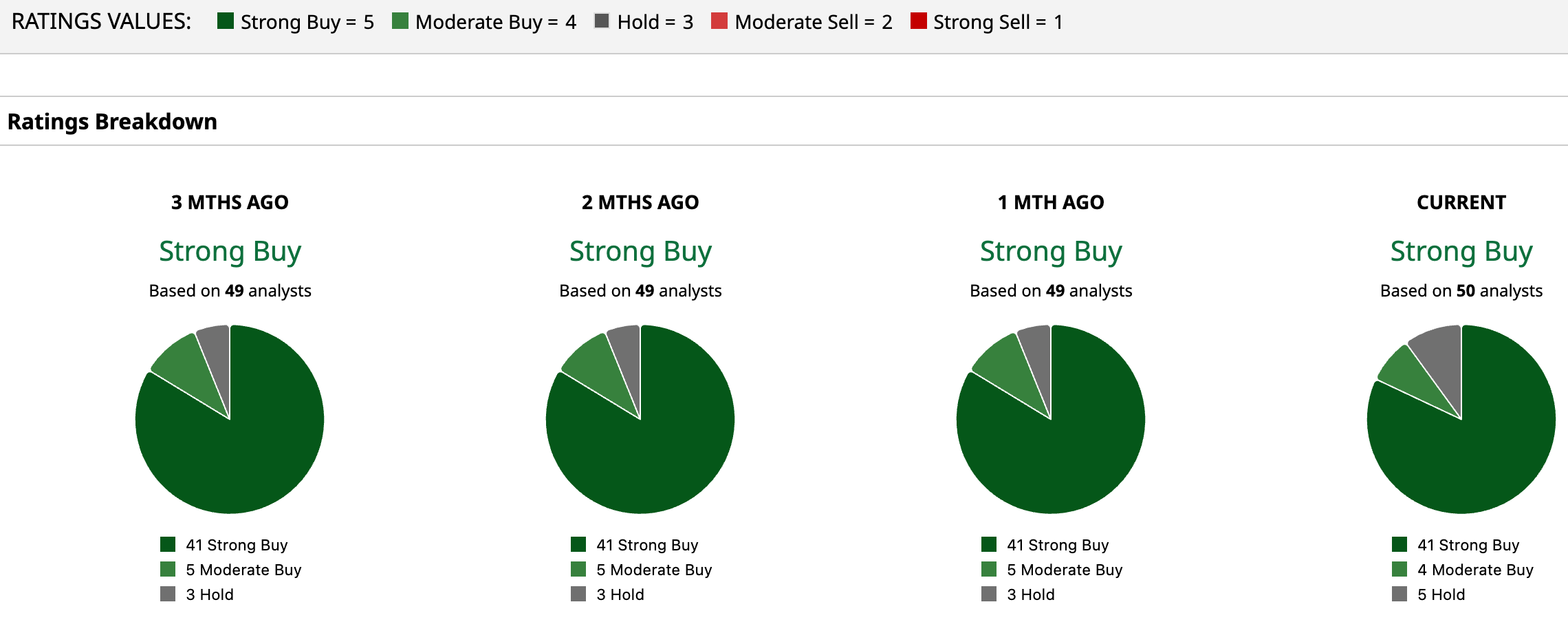

Analysts are upbeat on MSFT, with an overall “Strong Buy” consensus. Of the 50 analysts tracking the stock, 41 rate it a “Strong Buy,” four suggest a “Moderate Buy,” and the remaining five are on the sidelines with a “Hold” rating.

If we listen to Wall Street, Microsoft’s run may not be finished yet. MSFT has an average price target of $595.60, implying roughly 50% upside potential from current levels – a sign analysts believe the momentum still has room to build. On the bullish end, the Street-high target of $678 points to even sharper gains ahead of 70.6%, underscoring strong confidence in Microsoft’s long-term AI and cloud growth trajectory.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)