When you’re looking for investing strategies for 2026, it’s important not to overlook exchange-traded funds (ETFs). While ETFs may lack the dramatic growth stories of high-flying stocks like Alphabet (GOOG) (GOOGL) or Nvidia (NVDA), these types of investments are the best ways to add instant diversification to your portfolio—and often at a low price.

Currently, there are more than 14,000 ETFs from which to choose, meaning you can buy an index fund that tracks the total market, or you can find thematic ETFs that focus on a specific industry, theme, or market segment. Essentially, there’s a fund out there for anyone—you just need to know where to look.

Three of the top-performing ETFs in the last year fit the latter category. The SPDR Gold Shares ETF (GLD), the Physical Platinum ETF (PPLT), and the Vaneck Semiconductor ETF (SMH) are each up more than 50% in the past 12 months. And interestingly, two of them don’t even hold a stock. But they are all great choices to give your portfolio some diversity right now.

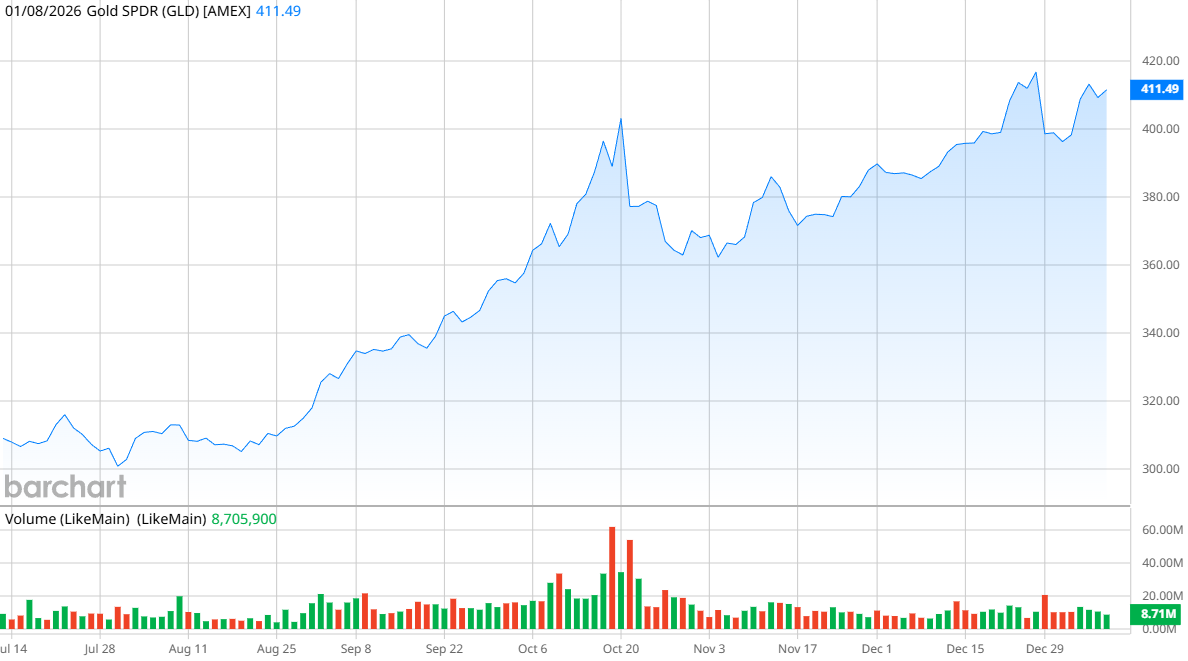

Best-Performing ETFs in 2025: SPDR Gold Shares ETF (GLD)

The SPDR Gold Shares ETF is managed by State Street Global Advisors, a top asset manager and operator of various ETFs. The fund has $148.2 billion in assets under management and carries an expense ratio of 0.4%, or $40 annually for each $10,000 invested.

This fund couldn’t be simpler. It holds entirely gold and seeks to reflect the performance of the price of gold bullion. In short, as the price of gold increases, so does the value of the ETF.

So, it’s important for investors to understand that this fund is physically backed by gold, rather than gold futures. If you want to invest in gold, this is a more convenient way to do it because you don’t need to worry about keeping coins or bars yourself and risk that they get lost or stolen. It’s also much easier to trade in and out of the GLD ETF than to try to buy or sell gold bars on your own.

On the downside, this fund will always slightly underperform the price of gold because of the expense ratio charged by fund managers. That’s the tradeoff.

Shares are up 67% in the past 12 months.

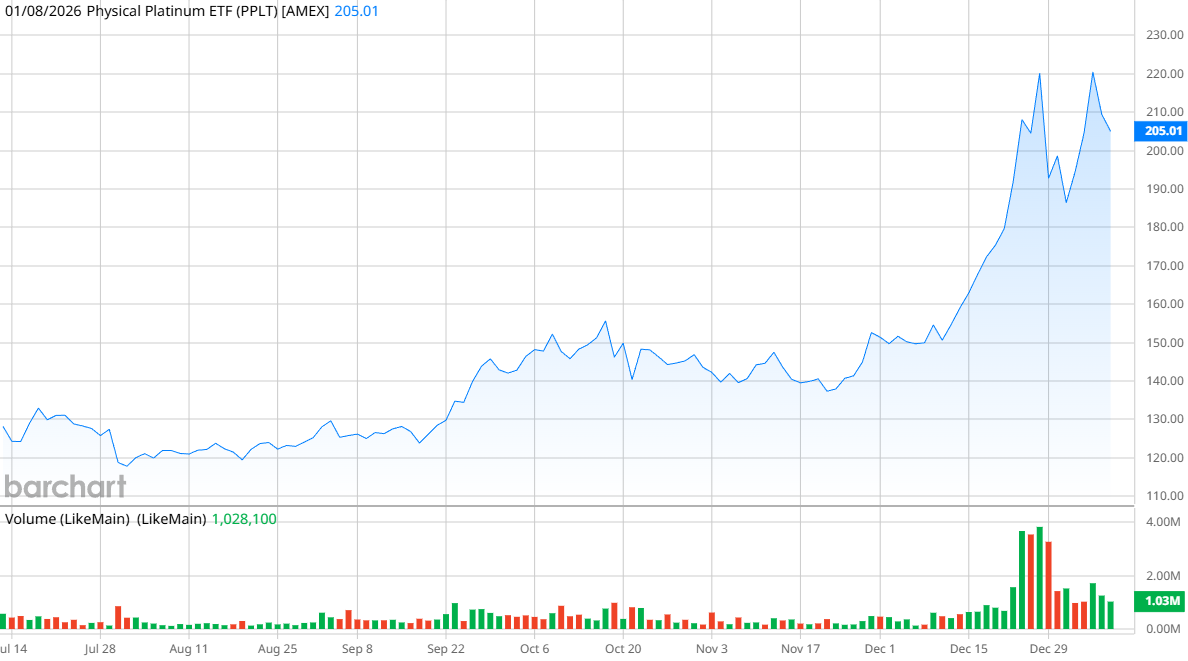

Best-Performing ETFs in 2025: Abrdn Physical Platinum Shares ETF (PPLT)

This is very similar to the GLD ETF. The Abrdn Physical Platinum Shares ETF is managed by the U.K. asset manager Aberdeen, which reverted from Abrdn to its original name in March 2025 because its ill-fated “disemvoweling” rebrand became too much of a distraction.

This fund, which has $3.1 billion in assets under management, holds physical platinum bullion and is designed for investors who want to invest in platinum without having the physical risk of keeping the precious metal for themselves.

The PPLT ETF has a larger expense ratio than the GLD ETF, at 0.6%. However, shares in the past 12 months have increased by 138%—so you more than make up for that expense ratio with the fund’s recent performance.

Both the PPLT ETF and the GLD ETF are good purchases to invest in precious metals, which are often a safe landing spot for investors in times of market instability.

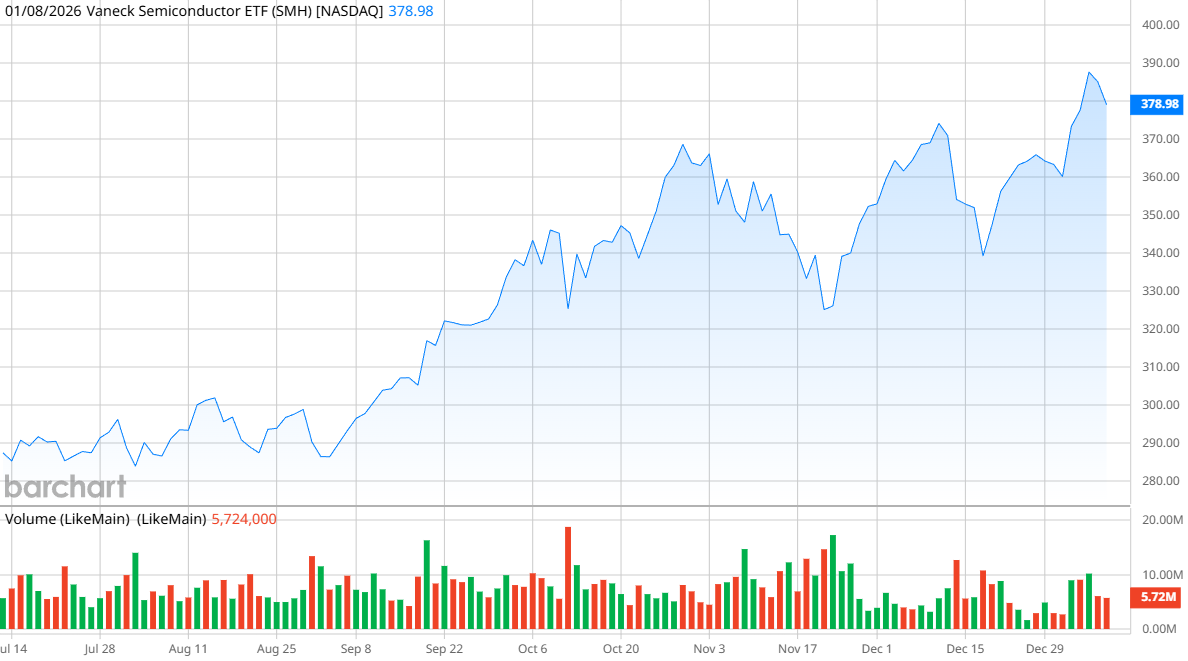

Best-Performing ETFs in 2025: VanEck Semiconductor ETF (SMH)

This is probably more similar to what you would consider a “typical” ETF. The VanEck Semiconductor ETF is operated by a family-owned investment management firm, Van Eck Associates. It seeks to replicate the performance of the MVIS US Listed Semiconductor 25 Index, which includes the 25 largest U.S.-listed companies that get at least half of their revenue from the semiconductor industry.

The fund has $40.2 billion in assets under management and has an expense ratio of 0.35%. Top holdings include Nvidia, Taiwan Semiconductor (TSM), Broadcom (AVGO), Micron Technology (MU), and ASML Holdings (ASML), which collectively make up 49% of the fund. Nvidia alone accounts for a 20% weighting of the SMH ETF.

Semiconductors have been one of the biggest drivers in the stock market for the last two years, and that will likely continue in 2026. The SMH ETF is an ideal investment if you are interested in Nvidia but also want to hedge that bet by getting exposure to other top semiconductor companies.

Shares of SMH are up 52% in the past 12 months.

On the date of publication, Patrick Sanders had a position in: NVDA. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)