Gold reached a bottom at $252.80 per ounce in 1999 and has made higher lows and higher highs for over two and one-half decades. After eclipsing the $875 high from 1980 in 2008, the bull market continued. At its recent high, gold was over 18 times its 1999 low.

Gold is in uncharted territory in early 2026, and the trend remains higher.

A very bullish 2025

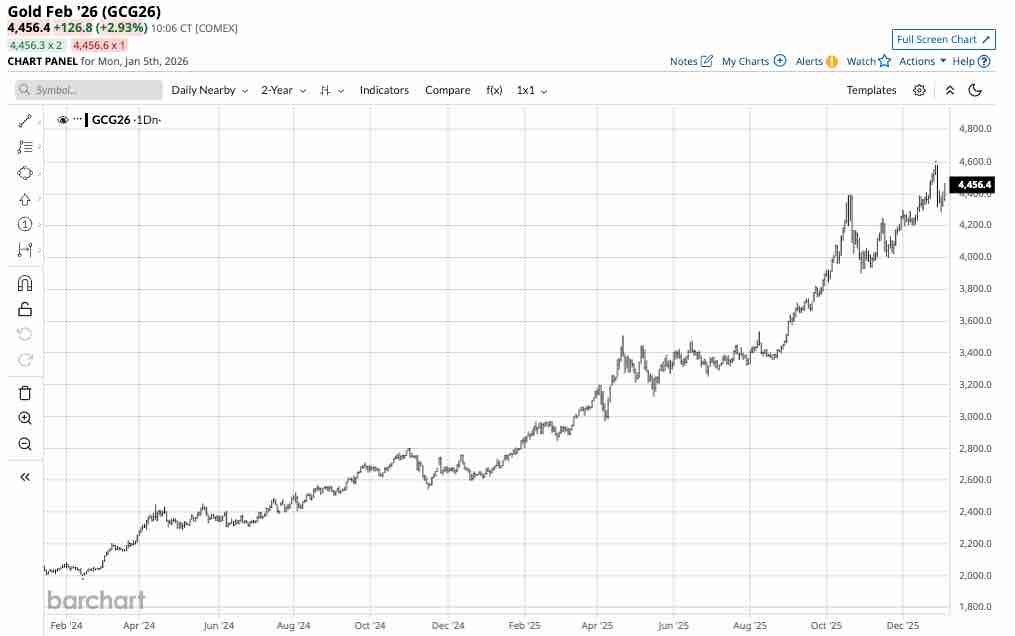

Gold experienced a parabolic 2025, rising from below $2,700 to over $4,580 per ounce.

The daily two-year continuous COMEX gold futures chart highlights the precious metals’ 73.6% rise from $2,641 at the end of 2024 to the 2025 high of $4,584 per ounce.

Gold is money and tells us that fiat currency continues to depreciate

Gold is the world’s oldest means of exchange and store of value. For thousands of years, gold has been a unique asset, serving as a currency with many ornamental and industrial applications.

Central banks, governments, monetary authorities, and supranational institutions hold gold as an integral part of their reserve assets, treating it as a currency reserve. Over the past years, central banks have continued to add to their gold reserves, despite rising prices.

Meanwhile, China and Russia are the world’s leading gold-producing countries. Strategic reserves are national security matters in China and Russia, and it is likely these governments have vacuumed in domestic production to increase reserves, leaving statistics understated regarding government holdings.

Moreover, gold’s ascent has increased retail and institutional investment, accelerating its rally. As a means of exchange, gold has increased in value relative to the U.S. dollar, the world’s reserve fiat currency, and all other currencies. Since fiat money derives its value from the full faith and credit in governments that issue legal tender, gold’s rally tells us that fiat money’s purchasing power has precipitously declined in 2025, and since the turn of this century.

Will commodity cyclicality impact gold?

Even the most aggressive commodity bull markets rarely move in straight lines, and corrections are commonplace. However, over the past 9 consecutive quarters, gold has reached new record highs.

Commodity cyclicality in bull markets causes prices to rise to levels where production and inventories increase, demand declines, and price tops trigger corrections. However, given its financial, ornamental, and industrial applications, gold is a unique asset that has thus far, been largely unaffected by the cyclicality concept over the past few years. Time will tell if cyclicality impacts the current trend in 2026. One of the core factors will be whether central banks and governments continue their unending appetite for the precious metal. If 2025 is a guide, the buying and stockpiling will continue.

The bullish factors for 2026

The following factors support higher gold prices in 2026:

- The trend is always a trader’s or investor’s best friend, and it remains very bullish going into 2026.

- Falling U.S. short-term interest rates and a weaker U.S. dollar support higher gold prices. Moreover, the decline in fiat currency values is bullish.

- Elevated inflation above the Fed’s 2% target remains a bullish factor.

- The rising U.S. deficit, now over $38.5 trillion, weighs on the U.S. dollar’s value and purchasing power.

Picking price tops in any market is dangerous, as rallies often defy logical, reasonable, and rational technical and fundamental analysis. Gold’s bull market is entering its 27th year, with no sign that selling will overwhelm buying.

The reasons for caution

The factors that could cause a sudden and perhaps violent downside correction are:

- Commodity cyclicality could cause an eventual downdraft.

- A substantial sale of central bank or government gold could trigger a correction.

- An economic crisis that impacts markets across all asset classes could cause gold dishoarding. Gold prices fell during the 2008 global financial crisis and the 2020 worldwide pandemic.

- The cure for high commodity prices is often those high prices; therefore, gold could decline if the demand declines and profit-taking and technical selling overwhelm the market.

The bottom line is that the higher gold prices rise, the greater the odds that they will eventually run out of upside steam.

Many analysts who did not see gold’s 65.9% 2025 rally are now calling for prices to rise to $5,000 in 2026. Meanwhile, continued uncertainty in the economic and geopolitical landscapes could push prices much higher. I remain bullish on gold’s prospects for the coming year, but buying on pullbacks rather than on rallies has been optimal for over two and a half decades. I expect that trend to continue in 2026.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)