I asked if platinum is going to catch gold in a September 4, 2025, Barchart article, where I concluded with the following:

Time will tell if platinum catches and surpasses gold on the upside, but there is plenty of room for platinum to narrow the price gap. Platinum remains in a bullish trend in early September 2025, with lots of upside potential at the $1,460 per ounce level.

Nearby NYMEX platinum futures traded at $1,456.30 per ounce on September 3, and have rallied by nearly $900 per ounce in late December 2025.

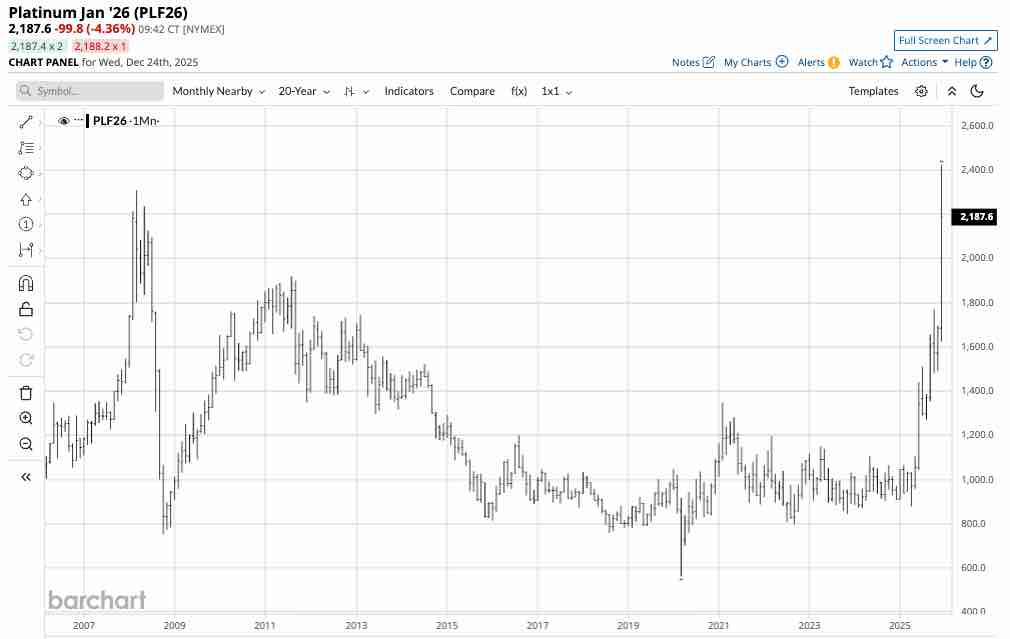

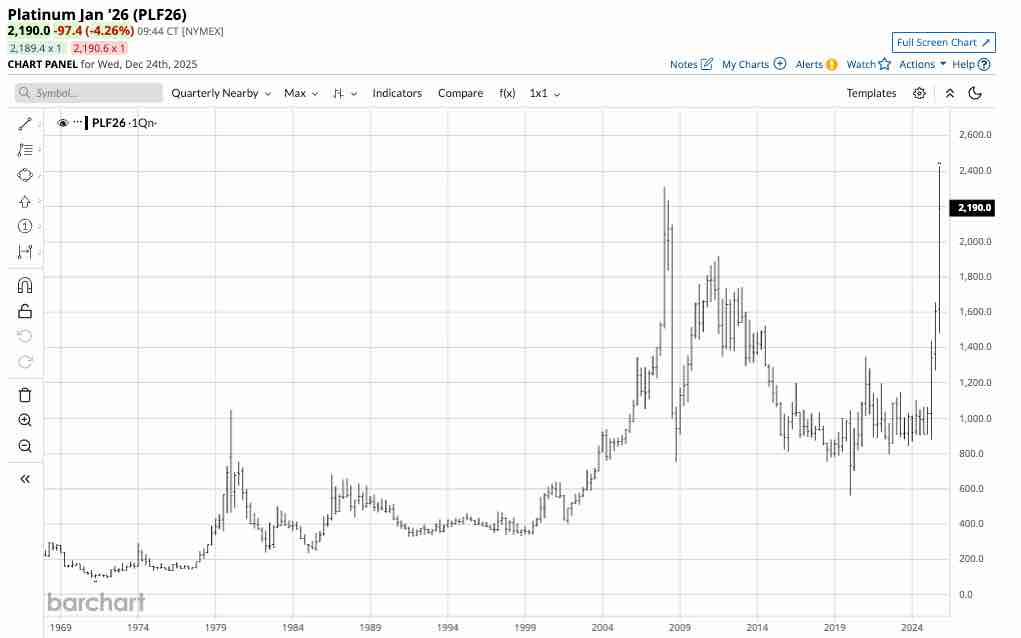

A long-term consolidation gives way to an explosive bullish run in 2025

Platinum reached its previous all-time high at $2,308.80 per ounce in 2008.

The monthly chart highlights the 75.7% decline that took the continuous platinum futures price to a low of $562.00 per ounce in March 2020 when the global pandemic weighed on markets across all asset classes.

After recovering to nearly $1,350 in February 2021, platinum futures traded sideways around the $1,000 per ounce level from 2021 through May 2025. The NYMEX platinum futures broke out to the upside in June 2025, surpassing the critical technical resistance level at the high from February 2021 and rising to a new record high in late December 2025.

The quarterly chart shows that platinum futures formed a bullish key reversal pattern in Q2 2025 when the price traded below the Q1 2025 low and closed Q2 above the Q1 2025 high. Platinum futures have made higher highs in Q3 and Q4, and blew through all technical resistance levels at the Q3 2011 high of $1,918.50 in late 20235, and eclipsed the 2008 $2,308.80 record high price, rising to $2,425 per ounce on December 24.

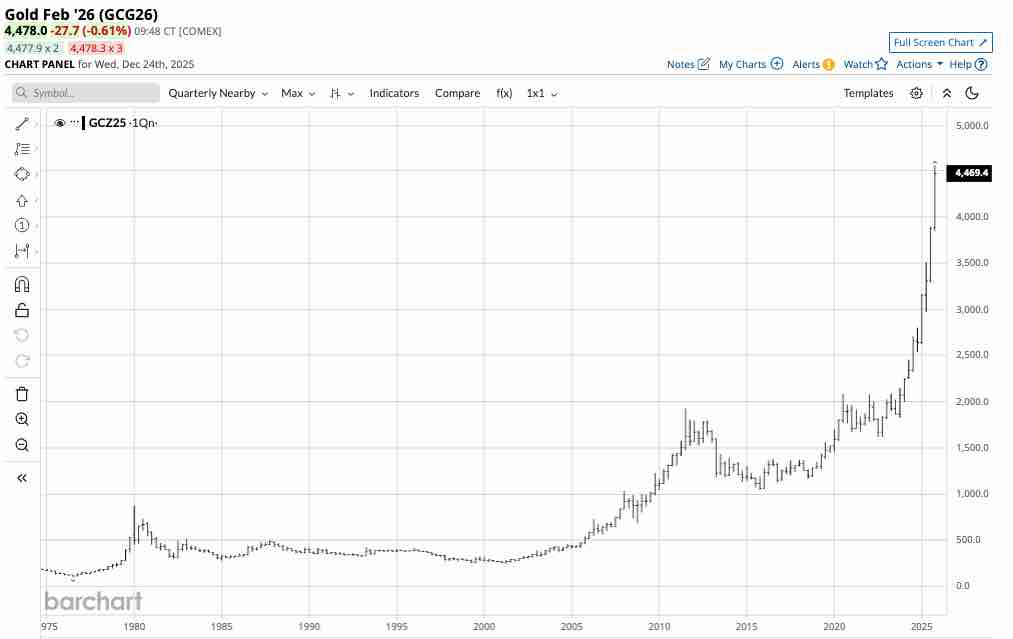

Platinum remains inexpensive compared to gold

Platinum was once considered “rich person’s gold” due to its rarity and because it often traded at a higher price than gold. However, gold’s ascent over the past years has left platinum in the dust.

The quarterly chart illustrates gold’s parabolic move that has taken the price to over $4,550 per ounce in Q4 2025. In late December, platinum was trading at a discount of near $2,290 per ounce to gold.

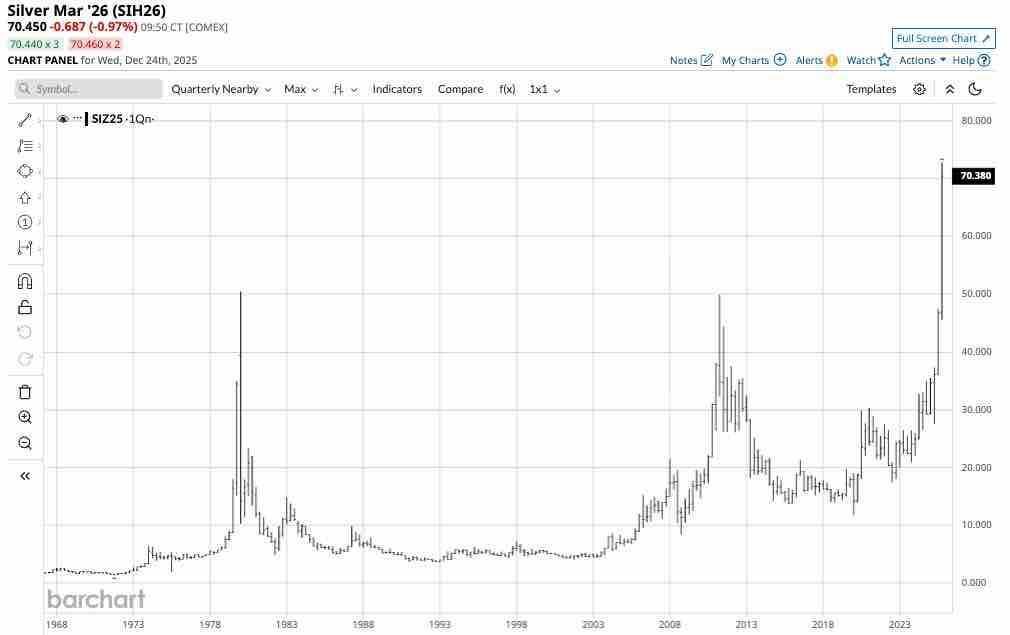

Silver has soared- Platinum is a precious alternative

While gold rose to a new record high, surpassing its 1980 peak in 2008, silver did not eclipse its 1980 all-time high until 2025.

The quarterly chart shows that COMEX silver futures reached a new record high in Q4 2025, topping $72 per ounce in December.

Gold and silver are industrial and financial metals, with long histories as stores of value. Platinum is also an industrial precious metal that shares the same characteristics. Gold and silver’s ascent and reduced liquidity in the platinum futures market could send platinum prices substantially higher, as the precious metal has successfully challenged the 2008 record high.

Levels to watch in the platinum futures market in 2026- Liquidity can exacerbate the price action

While the critical upside target was the 2008 record high, technical support now stands at the $2,425 level, and platinum futures are in uncharted territory.

Meanwhile, platinum is less actively traded than gold and silver, which could contribute to future price volatility. Each platinum futures contract is for 50 ounces. As of December 23, the total number of open long and short positions in the NYMEX platinum futures market was 90,512 contracts, or 4,525,600 ounces. Gold’s open interest at 500,555 contracts at 100 ounces per contract is 50,055,500 ounces. Therefore, platinum futures are more than ten times less liquid than gold futures. Low liquidity can cause substantial price volatility as bids to purchase often disappear during bearish periods and offers to sell can evaporate when the price rises. Given platinum’s significant discount to gold and the substantial price discount relative to gold, a continuation of the current rally could push prices far above the already eclipsed 2008 record high.

Platinum ETFs that track the metal’s price

Two popular ETF products that hold physical platinum are the Physical Platinum ETF (PPLT) and the GraniteShares Platinum Shares ETF (PLTM).

At $198.14 per share, PPLT had over $2.829 billion in assets under management. PPLT trades an average of more than 780,000 shares daily and charges a 0.60% management fee.

At $20.96 per share, PLMT had nearly $196 million in assets under management. PLMT trades an average of more than 1.28 million shares daily and charges a 0.50% management fee.

In 2025, nearby NYMEX platinum futures rose 141% from $910.50 at the end of 2024 to $2,195 on December 24, 2025. Over the same period, PPLT rose 139.3%, while PLTM appreciated by 139.8%. PPLT, PLTM, and other platinum ETFs that hold physical metal provide an alternative to direct ownership of platinum bars and coins or platinum futures.

I remain bullish on platinum as the market moves into 2026, and expect the metal to reach new all-time highs, with the potential for a parabolic rally if the rare precious metal follows gold and silver’s path. However, the higher the price of platinum rises, the greater the odds of a significant correction. As gold and silver have taught us in 2025, picking tops is a very dangerous game.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)