At a policy speech at the Jackson Hole Economic Symposium on Friday, Federal Reserve Chair Jerome Powell once again declared his commitment to fighting inflation through interest rate hikes. “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Powell said.

Investors had hoped for dovish comments from Powell, due to some signs inflation had peaked, but were sorely disappointed. As a result, the Dow Jones Industrials Index ($DOWI) (DIA) plummeted more than 1,000 points, the S&P 500 Index ($SPX) (SPY) fell 3.37%, and the Nasdaq 100 Index ($IUXX) (QQQ) closed down 3.9%.

With the Fed warning of continued rate hikes, market volatility is likely to remain for the foreseeable future. Therefore, it might be prudent for investors to consider adding low-beta dividend stocks to their portfolios. Beta is a way of measuring a stock's volatility relative to the stock market. The stock market has a beta of 1, so a stock with a beta of more than 1 is more volatile than the market, and a stock with a beta of less than 1 is less volatile.

Today I am going to highlight 3 low-beta dividend stocks that yield 3% or more: Kellogg (K), Consolidated Edison (ED), and American Electric Power (AEP). Not only have each of these stocks significantly outperformed the market year-to-date (YTD) but they’re also rated Strong Buy by Barchart Technical Opinion, which adds market-timing information by calculating and interpreting signal strength and direction.

Kellogg

Headquartered in Battle Creek, Michigan, Kellogg (K) is a multinational food manufacturing company with a market cap of $25.2 billion. It was founded in 1906 and today its products are marketed in over 180 countries.

In June Kellogg announced that it will separate into three independent public companies, focusing on snacking, cereal, and plant-based business. The spinoffs are expected to be completed by the end of 2023.

K yields 3.2% and has a low-beta of only 0.43. And its stock performance has been impressive in 2022, up 14.6% YTD, especially when you compare it to the S&P 500, which is down 14.8%.

On Friday, Kellogg's stock only fell 2.62%, compared to the S&P 500’s 3.37% drop. For the Barchart Technical Opinion, 11 of 13 technical indicators rate the stock BUY.

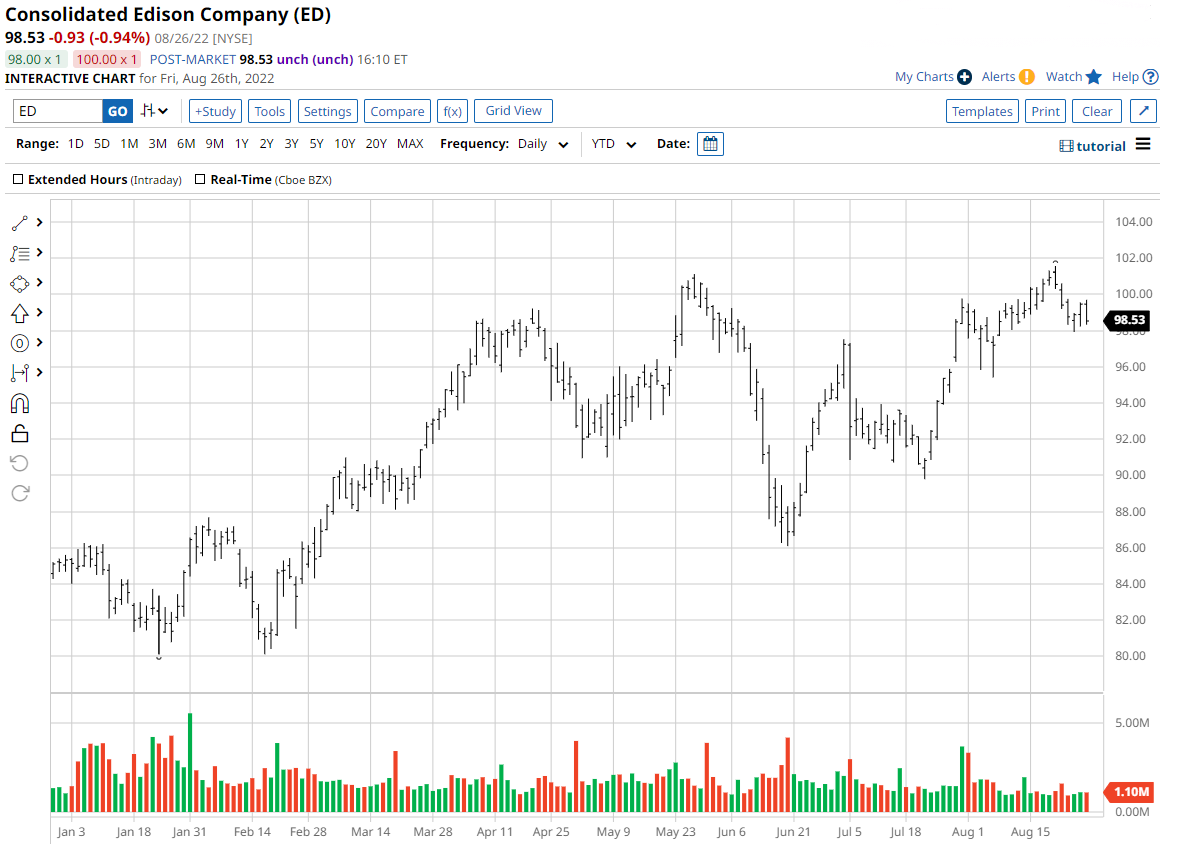

Consolidated Edison

Consolidated Edison (ED), also known as ConEd, is an energy company with a market cap of $34.9 billion. Founded in 1823, the company is headquartered in New York, NY and operates through four segments: Consolidated Edison Company of New York, Inc., Orange and Rockland Utilities, Inc., Con Edison Clean Energy Businesses, Inc. and Con Edison Transmission, Inc.

On August 4th, ED released its second-quarter 2022 adjusted earnings. The company reported EPS of $0.64, which was $0.06 better than analyst estimates. Revenue for the quarter also beat expectations, coming in at $3.42 billion compared to the estimate of $3.12 billion. ED guided FY2022 EPS to $4.40 - $4.60, compared to the consensus of $4.50.

YTD, ED has rallied 15.4% and when the market plunged on Friday, the stock was only down 0.94%. This dividend stock yields 3.2% and has a low-beta of just 0.25. 11 of the 13 indicators for ED’s Barchart Technical Opinion rate it a Buy.

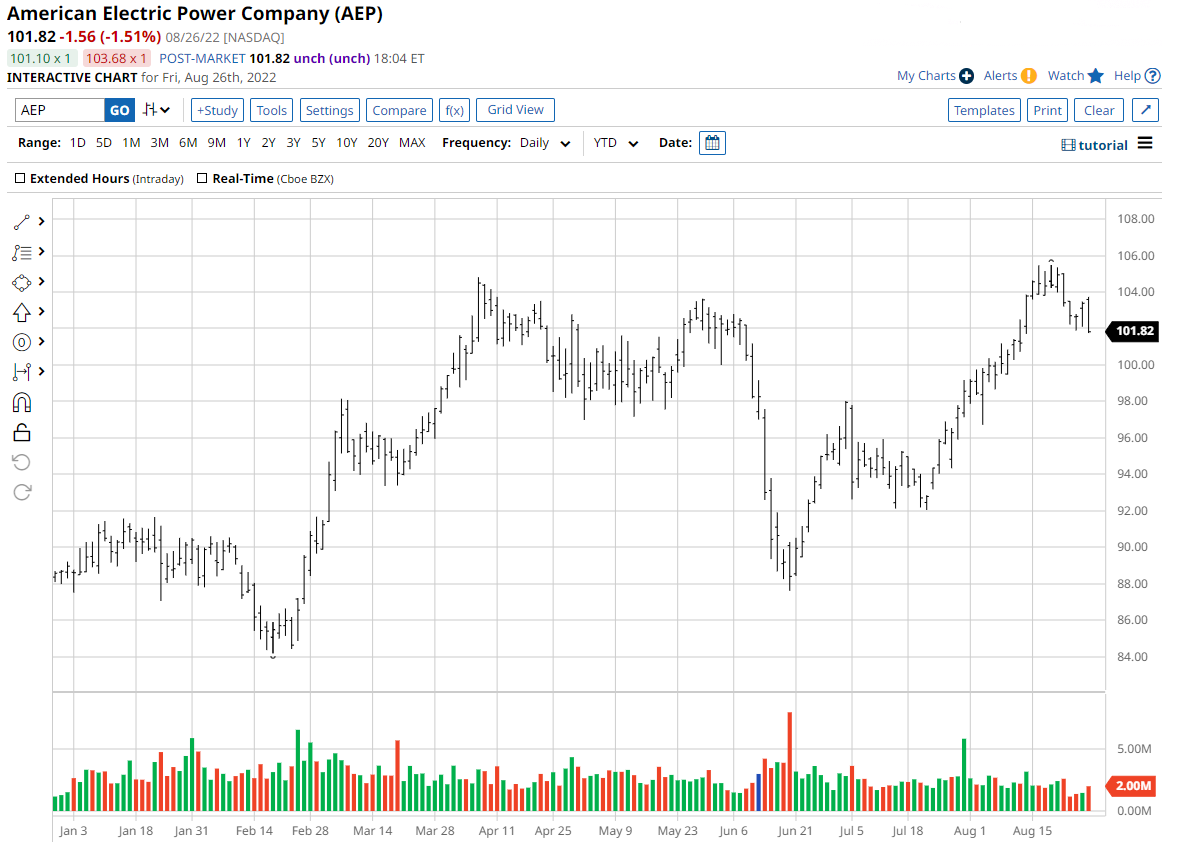

American Electric Power

American Electric Power (AEP) is an electric utility company, headquartered in Columbus, OH, with a market cap of $52.3 billion. It was founded in 1906 and operates through 4 segments: Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco, and Generation and Marketing.

On August 10th, AEP announced that Julie Sloat, the company's current executive vice president and chief financial officer, was promoted to President and on January 1, 2023, she will become the new CEO of the company.

AEP is trading up 14.4% in 2022, and only dropped 1.51% during Friday’s Fed induced sell-off. The stock yields 3% and its beta is just 0.36. Out of the 13 indicators that comprise the Barchart Technical Opinion, 11 of them rate AEP a Buy.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)