When whispers of a 'Sell America' trade resurface, markets don’t wait for confirmation – they react first and ask questions later. That is exactly what happened after news broke recently that the U.S. Department of Justice had subpoenaed the Federal Reserve, reigniting fears around political pressure on America’s most important economic institution.

For global investors, ‘Sell America’ is shorthand for a sudden loss of faith in U.S. exceptionalism, a moment when capital starts drifting away from U.S. stocks, bonds, and the dollar toward safer or more stable shores abroad.

Fed Chair Jerome Powell’s bold response, calling the probe an intimidation tactic tied to the administration’s push for ultra-low interest rates, only sharpened those concerns. Bond yields spiked, the dollar slid to near multi-month lows, gold (GCG26) and silver (SIH26) surged, and volatility quietly crept higher. Yet equities told a more conflicted story, shaking off early losses and ending the day stronger, suggesting hesitation rather than panic.

The tension between political noise and resilient markets is precisely where international diversification starts to matter. As non-U.S. equities quietly outperformed, one ETF, iShares MSCI ACWI ex U.S. ETF (ACWX), could be a wise buy now to step outside the U.S. storm without abandoning global growth altogether.

About iShares MSCI ACWI ex U.S. ETF

The iShares MSCI ACWI ex U.S. ETF gives investors a direct window into global equities beyond the U.S. It tracks large- and mid-cap companies across developed and emerging markets, investing at least 80% of assets in index-linked securities. ACWX delivers diversified international exposure, capturing worldwide market performance without U.S. bias.

ACWX, part of BlackRock’s (BLK) iShares lineup, has been in the market since March 26, 2008, quietly growing into a global heavyweight. As of Jan. 12, the ETF manages roughly $8.48 billion in assets, underscoring its scale and investor confidence. Its net asset value (NAV) stands at $69.72 now, while a 0.32% expense ratio keeps costs relatively efficient for broad international exposure.

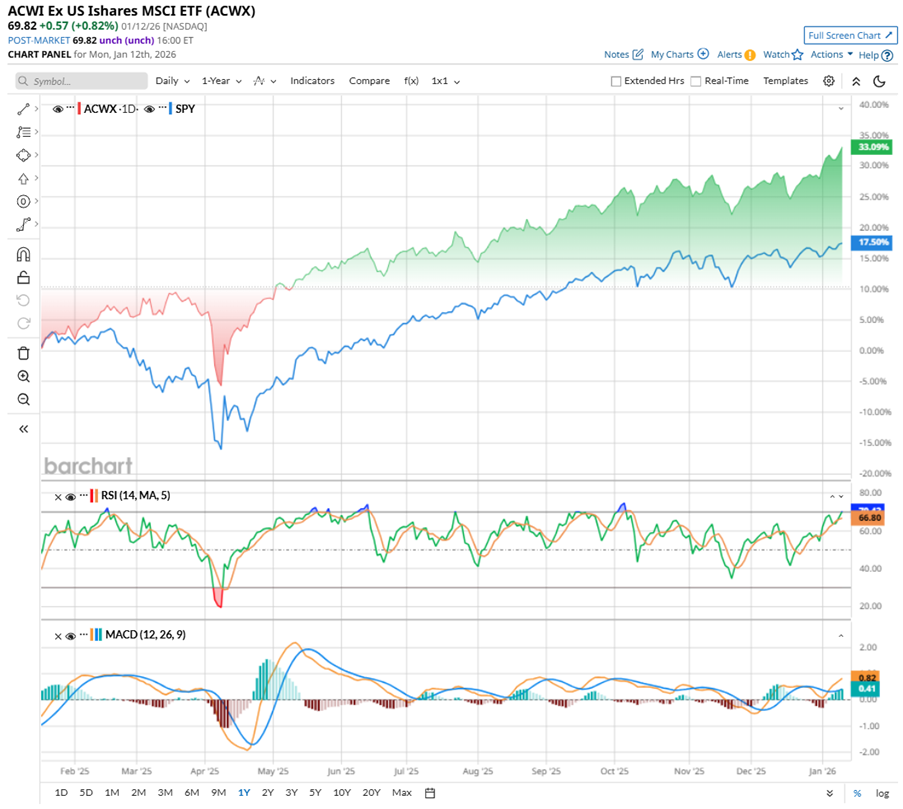

Over the past decade, ACWX has climbed nearly 87%, steadily compounding as international markets regained their footing. Momentum has sharpened in the near term. The ETF is up about 35.16% over the past 52 weeks and nearly 14.28% over the last six months, comfortably outpacing the S&P 500 Index SPDR’s (SPY) rallies during the same stretch. The strength has carried into 2026, with the fund already up 1.4% and printing a fresh all-time high of $69.86 on Jan. 12.

From a technical perspective, the trend remains constructive. The 14-day RSI is rising and approaching overbought levels, signaling persistent buying interest rather than immediate fatigue. The MACD oscillator confirms that strength, with the MACD line trending upward above the signal line, a classic bullish setup. Meanwhile, the histogram has turned positive, suggesting momentum is expanding, not stalling, as ACWX continues to press higher.

ACWX also brings a steady income angle to its global appeal. The ETF has paid dividends consistently for 17 straight years and has grown those payouts over three consecutive years.

Most recently, it delivered a semiannual dividend of $1.049 per share in December, translating to roughly $1.90 annually and a yield of about 2.72%. That comfortably exceeds the S&P 500 Index SPDR’s 1.05% yield, making income generation a steady and reliable feature of ACWX’s long-term story.

When it comes to holdings, ACWX strikes a thoughtful balance between broad diversification and meaningful focus. The ETF owns a wide basket of 1,751 stocks, giving investors exposure across regions and industries, yet it avoids being overly scattered. The top 10 holdings make up roughly 13% of the portfolio, providing stability without concentration risk dominating the story. Taiwan Semiconductor Manufacturing (TSM) leads the lineup at about 3.8% by weight, followed by global heavyweights such as Tencent Holdings Limited (TCEHY) (1.46%), ASML Holding NV (ASML) (1.42%), Samsung Electronics Co Ltd (1.32%), and Alibaba Group Holding (BABA) (0.94%). The list rounds out with familiar names in healthcare, finance, and technology, including Roche Holding AG (RHHBY) (0.88%), AstraZeneca (AZN) (0.85%), SK Hynix (0.81%), HSBC Holdings (HSBC) (0.80), and Novartis AG (NVS) (0.79).

Liquidity is another quiet strength. Over the past year, ACWX has posted average monthly trading volumes of more than 2.132 million shares, reflecting steady investor participation and ease of entry and exit. On costs, the ETF remains competitive, charging a 0.31% management fee. That pricing places ACWX in a solid middle ground among international equity funds, especially for investors seeking diversified exposure across developed and emerging markets without paying a premium.

Volatility Sparks a Shift Beyond U.S. Markets

Over the past year, ACWX has attracted net inflows of $1.82 billion, with $1.07 billion in the last six months and another $619.24 million flowing in over the past month alone. That steady buildup suggests investors are not reacting impulsively, but repositioning deliberately as the market backdrop grows more complex.

The latest market tremors did not emerge in isolation. They were set in motion by a rapid series of policy surprises from President Donald Trump that caught Wall Street off guard and injected uncertainty across multiple sectors.

Over just a few days, investors were forced to digest proposed bans on institutional investors buying single-family homes, restrictions on defense contractors’ dividends and buybacks, calls for massive mortgage bond purchases, threats of a one-year cap on credit card interest rates, and even public pressure on oil companies to invest in Venezuela. Markets whipsawed accordingly. Housing-linked stocks slid, defense names plunged and rebounded within hours, banks sold off sharply, and oil prices lurched as corporate America struggled to price in policy by social media.

Against that backdrop, the ‘Sell America’ narrative found fertile ground. The DOJ's subpoena of the Fed amplified existing concerns that political intervention was bleeding into monetary policy, undermining one of the market’s most trusted institutions.

The reaction was swift but uneven. Treasury yields surged to their highest levels since September 2025, signaling anxiety around inflation control. The U.S. dollar weakened broadly, pushing the ICE Dollar Index ($DXY) near December lows. Precious metals rose, and the CBOE Volatility Index climbed, though it stayed within its recent range, suggesting unease rather than outright fear.

U.S. equities reflected that conflict. Stocks sold off early, stabilized by midday, and finished stronger, with the S&P 500 Index reclaiming fresh highs as investors hesitated to fully embrace a prolonged exit.

That hesitation is precisely why ACWX is quietly gaining ground. As policy noise clouds U.S. assets, international markets – less exposed to Washington-driven volatility – are attracting steady inflows. With diversified exposure to non-U.S. large- and mid-cap equities, ACWX offers investors a way to rebalance globally, capturing relative stability and currency tailwinds without abandoning growth altogether.

Conclusion

As ‘Sell America’ fears ripple through markets, ACWX stands out as a practical way to stay invested without being boxed in. It offers broad exposure to global equities beyond U.S. borders, spreading risk across countries and sectors while keeping costs in check. With dividends adding income and international stocks outperforming during periods of U.S. policy noise, ACWX fits neatly into portfolios seeking balance, resilience, steady pay, and participation in global growth when confidence in U.S.-centric trades starts to wobble.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)