ULSD NY Harbor Mini Feb '23 (QHG23)

Seasonal Chart

Price Performance

See More| Period | Period Low | Period High | Performance | |

|---|---|---|---|---|

| 1-Month | 2.9719 +4.67% on 01/04/23 | | 3.5509 -12.39% on 01/23/23 | -0.1842 (-5.59%) since 12/30/22 |

| 3-Month | 2.7665 +12.45% on 12/07/22 | | 3.5724 -12.92% on 11/04/22 | -0.3570 (-10.29%) since 10/28/22 |

| 52-Week | 2.4574 +26.59% on 01/31/22 | | 3.8345 -18.87% on 06/16/22 | +0.6594 (+26.90%) since 01/28/22 |

Most Recent Stories

More News

February WTI crude oil (CLG26 ) on Friday closed up +0.25 (+0.42%), and February RBOB gasoline (RBG26 ) closed up +0.0014 (+0.08%). Crude oil and gasoline prices settled higher on Friday, recovering some...

February Nymex natural gas (NGG26 ) on Friday closed down by -0.025 (-0.80%), Feb nat-gas prices settled lower on Friday but remained above Thursday's 3-month nearest-futures low. Abundant US supplies...

February WTI crude oil (CLG26 ) today is up +0.71 (+1.20%), and February RBOB gasoline (RBG26 ) is up +0.0136 (+0.76%). Crude oil and gasoline prices are moving higher today as they recover some of Thursday's...

As Microsoft unveils a new community-friendly face on its data center land grab, our top technical strategist explains the ‘Mad Max’-style investing thesis bubbling up under the surface.

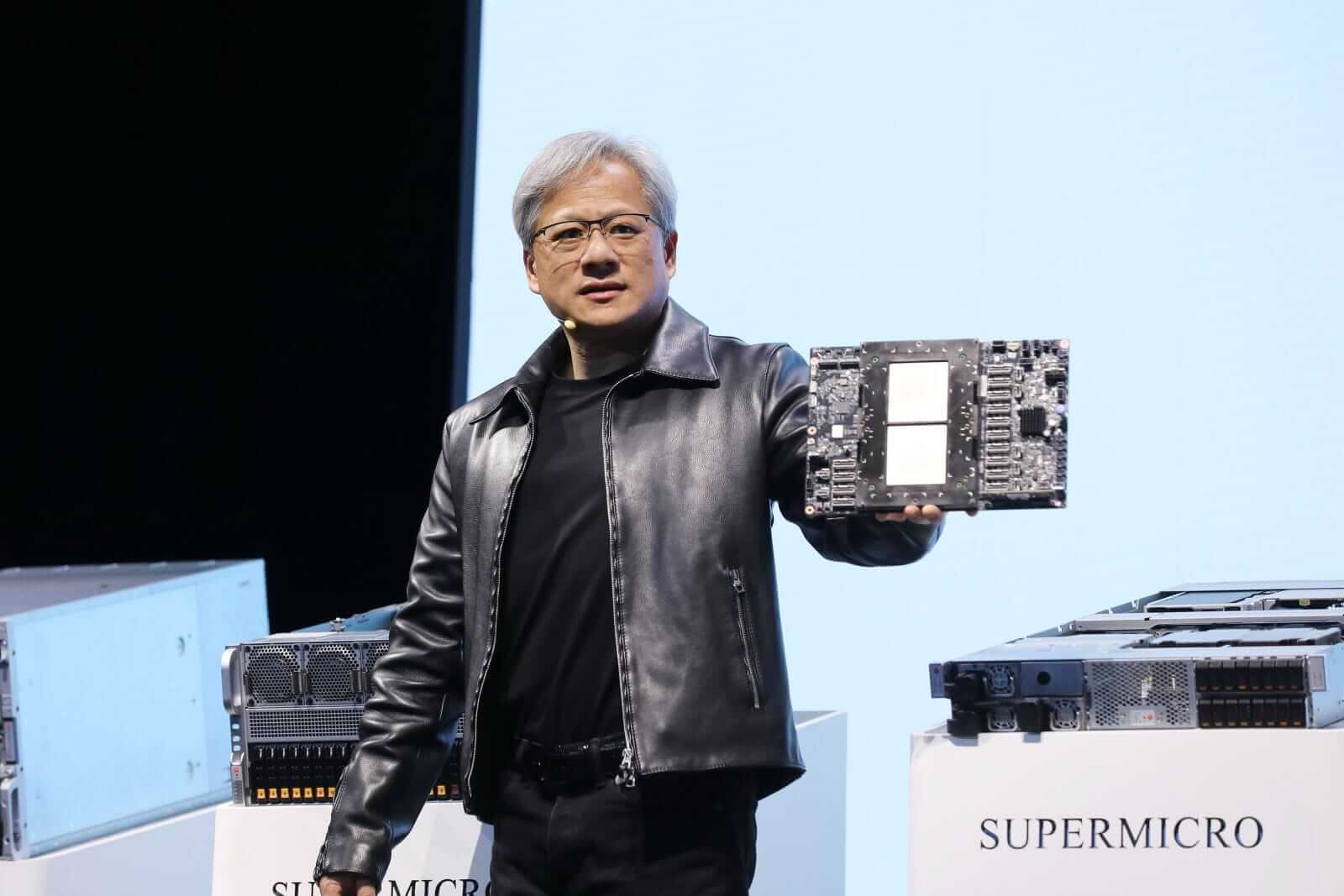

Jensen Huang outlines how energy capacity underpins AI leadership, reframing U.S.–China competition as an infrastructure and industrial challenge.

February WTI crude oil (CLG26 ) on Thursday closed down -2.83 (-4.56%), and February RBOB gasoline (RBG26 ) closed down -0.0466 (-2.55%). Crude oil and gasoline prices sold off sharply on Thursday as geopolitical...

February Nymex natural gas (NGG26 ) on Thursday closed up by +0.008 (+0.26%), Feb nat-gas prices recovered from a 3-month nearest-futures low on Thursday and settled slightly higher as forecasts for below-normal...

The composite of energy commodities moved lower in Q4 2025 and in the year that ended on December 31, 2025. While crude oil, oil products, crack spreads, and Chicago ethanol swaps declined, Rotterdam coal...

Instead of names like Exxon and ConocoPhillips, check out downstream refiners and shipping stocks, says our top chart expert.

February WTI crude oil (CLG26 ) today is down -2.82 (-4.56%), and February RBOB gasoline (RBG26 ) is down -0.0506 (-2.76%). Crude oil and gasoline prices are falling sharply today as geopolitical risks...