The energy composite, which includes WTI and Brent crude oil, gasoline, heating oil, U.S. natural gas, and Chicago ethanol swaps, fell 7.06% in Q4 and was 10.99% lower in 2025.

I concluded my Q3 energy report on Barchart with the following:

Expect lots of volatility in energy commodities over the coming days and weeks. In late October, I remain bearish on crude oil and bullish on natural gas for the coming weeks and until the end of 2025.

Crude oil prices declined, while natural gas prices rose in Q4.

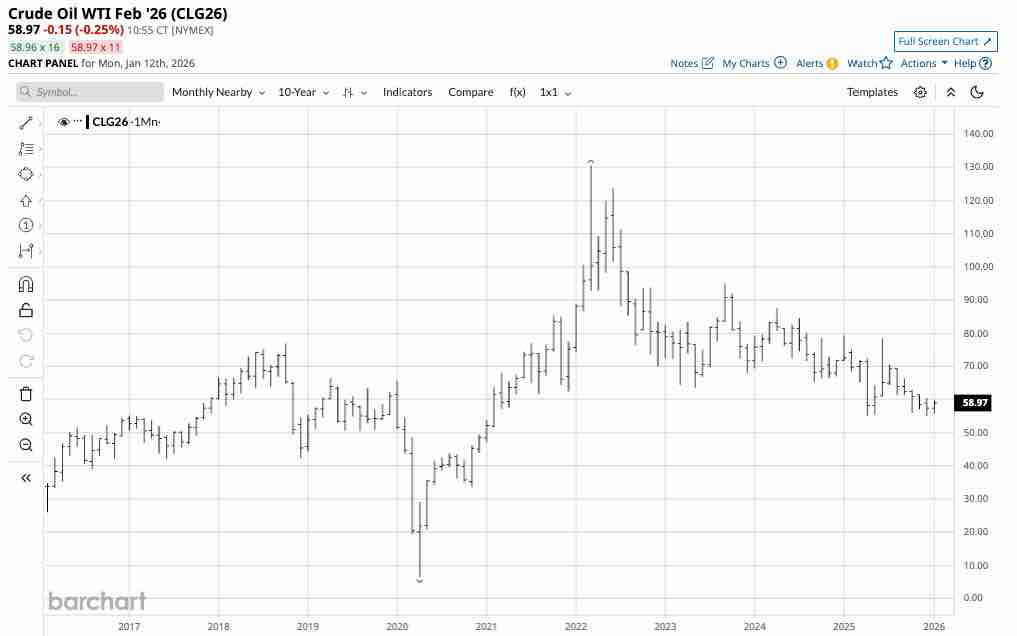

Crude oil prices declined in Q4 and 2025

Seasonality and increasing production weighed on crude oil prices in Q4. Nearby NYMEX crude oil futures declined 7.94% over the final three months of 2025.

The monthly chart shows that NYMEX WTI crude oil prices fell 19.34% in 2025, and remain in a bearish trend in early 2026. WTI futures settled 2025 at $57.42 per barrel and were higher near the $59 per barrel level on January 12, 2026.

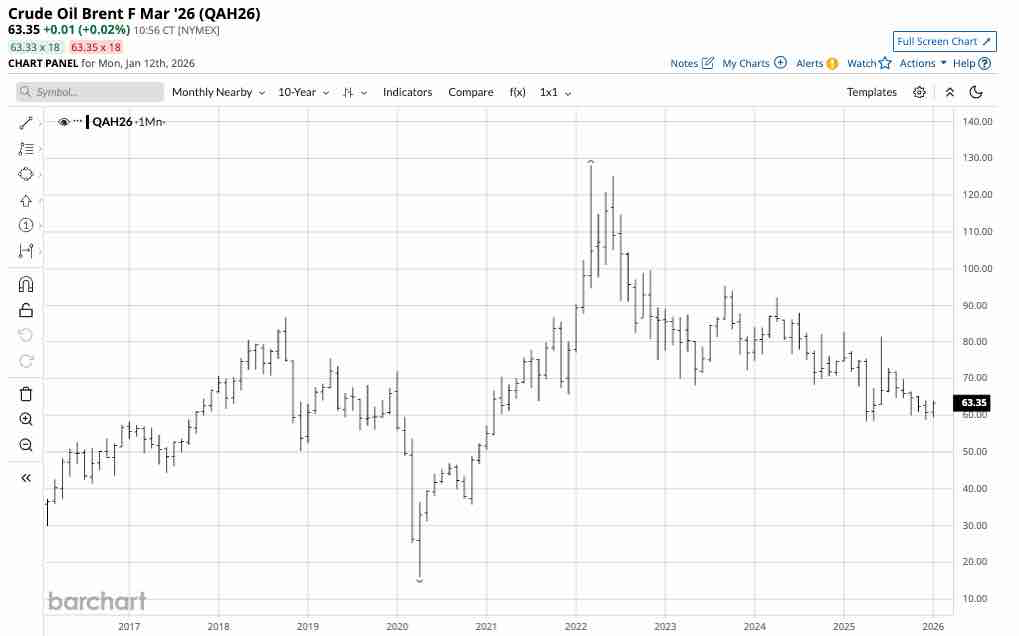

Nearby ICE Brent oil futures declined 9.41% over the final three months of 2025.

The monthly chart shows that ICE Brent crude oil prices declined by 18.49% in 2025 and remain in a bearish trend in early 2026. Brent futures settled 2025 at $60.84 per barrel and were higher at over $63 per barrel on January 12, 2026.

Oil products and crack spreads fell in Q4 and 2025

Seasonality caused gasoline prices to fall more than heating oil prices over the final three months of 2025. NYMEX gasoline futures fell 13.07% in Q4 and were 14.64% lower in 2025. Meanwhile, NYMEX heating oil futures, a proxy for distillates including diesel and jet fuel, dropped 9.05% in Q4 and 8.41% in 2025. The oil products were slightly higher on January 12, 2026.

Crack spreads reflect the margin for processing a barrel of crude oil into oil products. The gasoline crack spread fell 21.06% in Q4 but rose 13.98% in 2025. The distillate refining spread moved 9.32% lower in Q4 and was 24.78% higher in 2025. The overall gains in crack spreads increased refineries’ earnings, putting upward pressure on crude oil refining equities in 2025. The gasoline crack was slightly higher, and the distillate refining spreads were slightly lower than the 2025 closing prices on January 12, 2026.

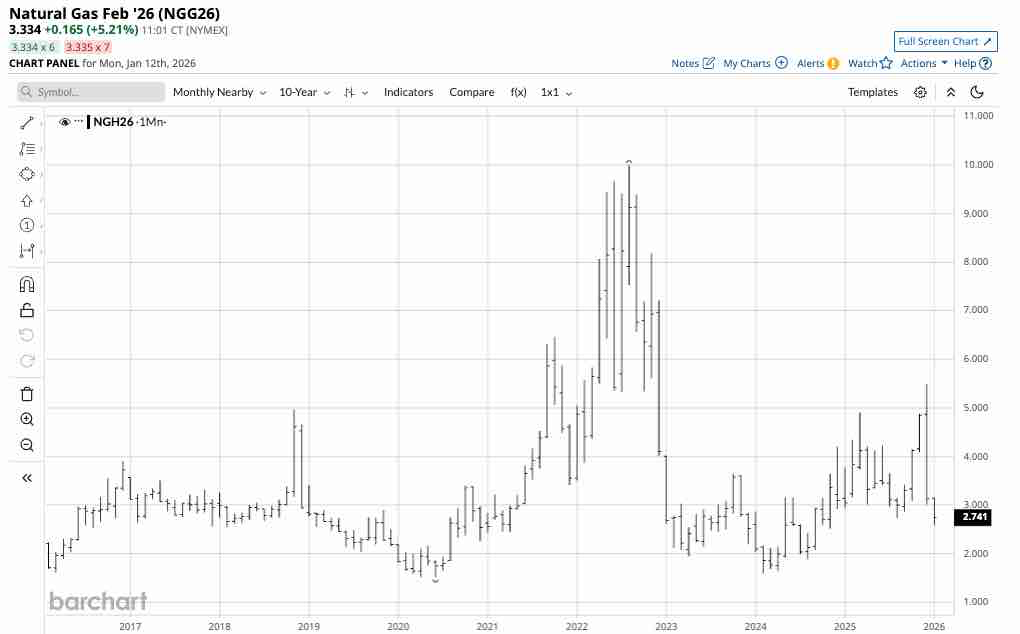

U.S. natural gas futures posted gains in Q4 and 2025

U.S. NYMEX natural gas futures are seasonal and tend to rally as the annual heating season approaches. The natural gas futures rallied 11.60% in Q4, settling at $3.686 per MMBtu on December 31, 2025.

While natural gas was higher in Q4 and rose 1.46% in 2025, the energy commodity formed a bearish key reversal in Q4, rising above the Q3 high and closing below the Q3 low. Nearby natural gas futures were significantly lower on January 12, 2026.

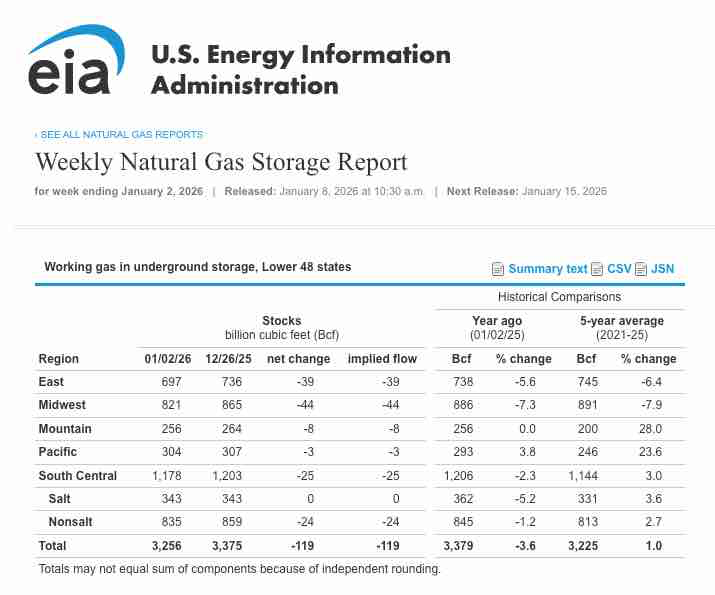

Source: EIA

The latest EIA natural gas inventory data, as of the week ending January 2, shows that stockpiles were 3.6% lower than the previous year and 1% above the five-year average.

The path of least resistance of U.S. natural gas futures prices during Q1 2026 depends on the weather conditions across the United States.

Ethanol was lower in Q4 and 2025. Rotterdam coal edged higher in Q4 but fell in 2025

Chicago ethanol swaps fell 14.52% in Q4 and was 5.92% lower in 2025, settling around $1.59 per gallon on December 31, 2026.

Coal futures for delivery in Rotterdam, the Netherlands, moved 1.47% higher in Q4 and settled around $96.90 per ton. The Rotterdam coal futures fell 14.36% in 2025.

Ethanol and coal futures were slightly higher than the 2025 closing prices on January 12, 2026.

The prospects for energy commodities Q1 2026 and beyond

Crude oil remains the energy commodity that powers the world. In early 2026, a U.S. military operation in Venezuela arrested Nicolas Maduro and transported him to the U.S. for prosecution on narcotrafficking charges. U.S. President Trump stated that the U.S. will be running Venezuela until free and fair elections replace the deposed leader. Venezuela has the world’s leading crude oil reserves and is a founding member of the international oil cartel, OPEC. The operation in Venezuela and the future of its petroleum industry could cause significant volatility in oil and oil product markets. Venezuelan crude oil is heavy and sour, meaning it has a high sulfur content and impurities such as vanadium and nickel, which require specialized, intensive refining and processing.

Natural gas and coal prices should remain volatile through the winter as demand will depend on weather conditions. Meanwhile, ethanol prices tend to follow gasoline futures, which experience seasonal strength in spring and winter when drivers put more miles on their cars.

When it comes to crude oil, prices remain near the lows, and I expect lower lows over the coming weeks and months as increased U.S. and OPEC production, and the potential for U.S. control of Venezuelan crude oil, could put significant pressure on prices.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)