(ZWH26) (ZWN26) (KEN26) (WEAT) (CORN) (SOYB) (DBA) (TAGS)

"USDA grain market shocker: Any chance for a bull market based on weather?"

by Jim Roemer

Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Scott Mathews Editor-in-Chief

January 16, 2026

Feel free to download this latest free issue of WeatherWealth:

https://www.bestweatherinc.com/weather-wealth-sample/

Here are excerpts from one of our recent issues:

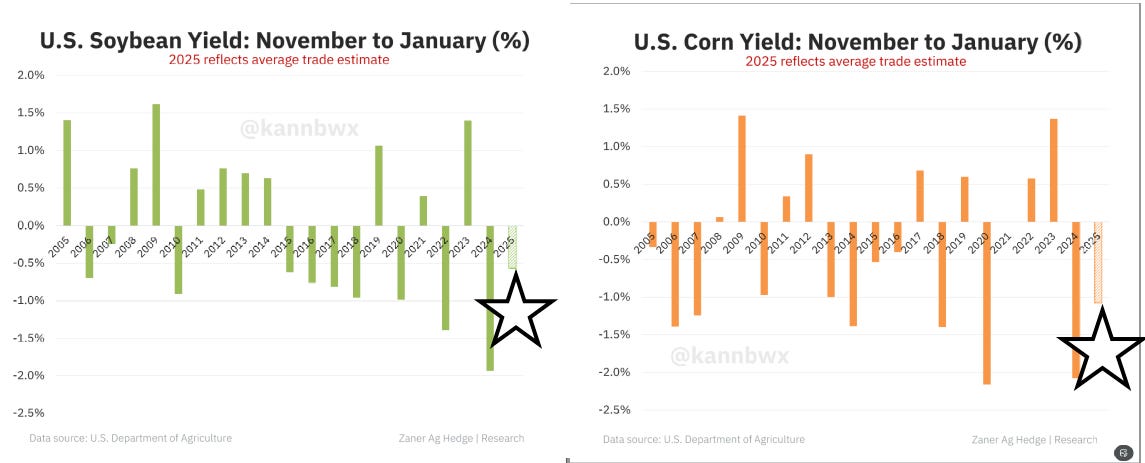

“… Even though corn and soybean yields dropped slightly due to the dryness in late summer, I preached (last April and May) for another big US crop and a generally bearish attitude. Is it possible that all of this could change?

Eventually, there will be a bull market in grains. It all depends on the weather and if La Niña will hold on a bit longer into spring or early summer. For the most part, during three consecutive years, I have not been getting caught up in all the hype about Midwest droughts, hot weather, what China may do (or may not do), trade tariffs, etc.

I have stuck to the weather, which, on a global basis, has been bearish for corn, soybeans, and wheat …”

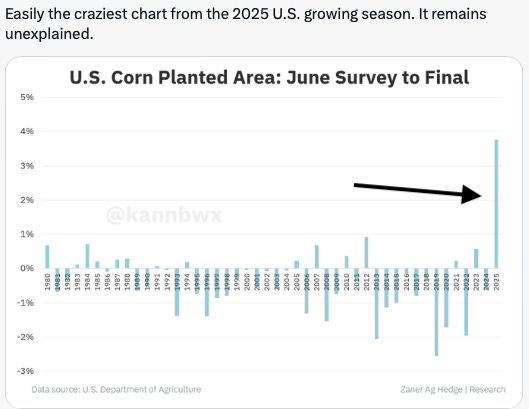

“… Unbelievable shocker in corn acreage: This goes to show you that trading USDA crop reports is futile and a waste of your money …”

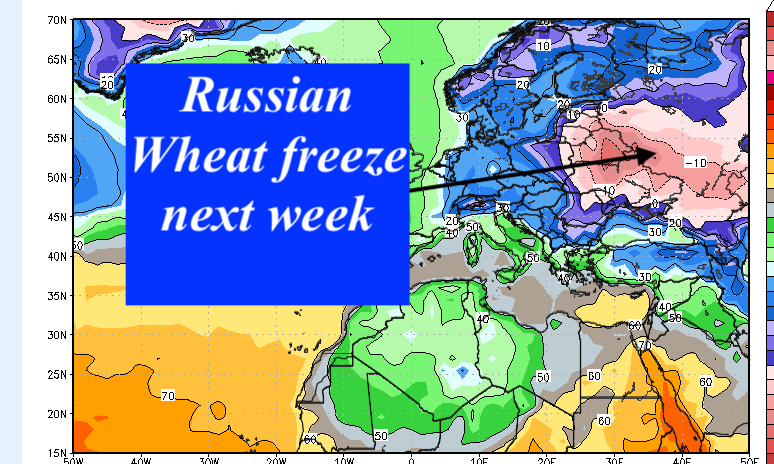

"… The first potential weather problems I’m seeing for grains are a possible Russian freeze next week with sub-zero temperatures and a lack of snow cover. This, and the lack of moisture in the southern Plains wheat-growing regions, will be closely watched by the trade, once the crop comes out of dormancy later in March.

In addition, I am concerned about a dry, hot end-of-season for Argentina’s corn crop. Although, of course, South American production is huge again, and we may need wider crop problems to boost the market prices…"

Image Sources: StormVistaWxModels and WeatherWealth newsletter

"…This latest free issue of WeatherWealth (top of page) discusses the grain situation and offers some recent trade ideas. Most recently, catching the massive 40-70% move up in silver prices in the last 6 months was one of our highest-confidence trades. Being short coffee longer term from $4.00, was another.

One trade alone (past performance is not indicative of future results) could pay for our newsletter for years. You get what you pay for: i.e., some advisory services out there called for crop problems and bull markets for three straight Midwest summers…"

Remember, when trading commodities, always apply risk management, such as stop-loss orders and position sizing, and consider using spreads to isolate the seasonal component of a particular market move.

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)