You know that classic Wall Street expression “buy the dip.” But have you ever thought about how to actually profit from that dip?

Let’s face it, if you own a stock or equity ETF and it drops in price, you can buy that dip. But by definition, you have already lost.

And, as I’ve written here many times, markets are cyclical. Dip-buying has been the law of the land for about 15 years. Every S&P 500 Index ($SPX) dip has resulted in a higher price in the not-too-distant future. But will it always be that way?

Case in point: That same S&P 500 Index has spent more than 40% of this current century not making a profit, other than a modest dividend yield. Specifically, the index closed at $1,469 on Dec. 31, 1999. Where was it as of Jan. 4, 2013, more than 13 years later? $1,466.

With markets not always being a one-way path to profits, and with the likelihood of a more mixed bag of positive and negative returns going forward, this is a great time for investors to learn about a particular genre of ETFs.

That genre would be none other than “inverse” or “bear” ETFs, which rise in price when their target index falls.

Michael Burry, the hedge fund manager played brilliantly by Christian Bale in the movie The Big Short, recently made news by disclosing that he has another big short position, entered in the third quarter. Technically, by way of put options, he is betting against Palantir (PLTR) and Nvidia (NVDA).

Investors have been so conditioned to “buy stuff and watch it go up in value” that the idea of trying to profit from price drops is somewhere between uncomfortable and unpatriotic. But let’s keep our eye on the prize here. The goal of any investor or trader is to keep the pile of wealth moving forward.

If that means occasionally committing some portion of assets to “defense” alongside the customary “offense” we play, that’s what it takes. Here are two of many levels of inverse ETFs that can be considered once one has done some research. Understand that these move opposite the underlying asset, which means when that asset rises in price, the inverse ETF will need to make more than it lost in percentage terms just to get back to break-even.

These ETFs tend to be adjusted daily in order to closely track their -1x, -2x or -3x target daily return. Yes, some are both inverse and leveraged. In the case where an ETF is both, we have to be extremely careful not to let it go the wrong way for too long. The losses can pile up.

My Mount Rushmore of Inverse ETFs

These have all been around for decades, and were very useful to me throughout my former career as a fund manager. On a few different occasions, I ran mutual funds that were “long-short” in nature. That is, they could try to profit from either a good or bad market, or segments thereof.

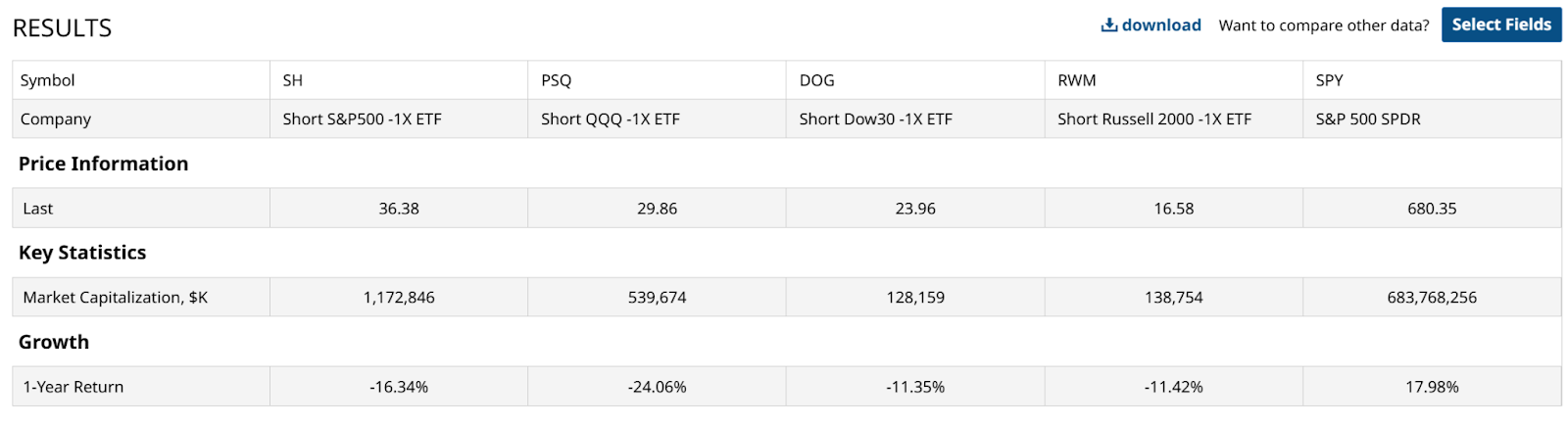

It was typical for me to own ETFs and stocks as “long” positions, but anchor the risk management in the portfolio by owning one or more of these, shown below. They move in the opposite direction of the S&P 500, Nasdaq-100 Index ($IUXX), Dow Jones Industrial Average ($DOWI), and Russell 2000 Index (IWM), respectively. I show them versus the S&P 500 ETF (SPY) so you get an idea of how that opposite nature plays out over an extended period of time, 12 months.

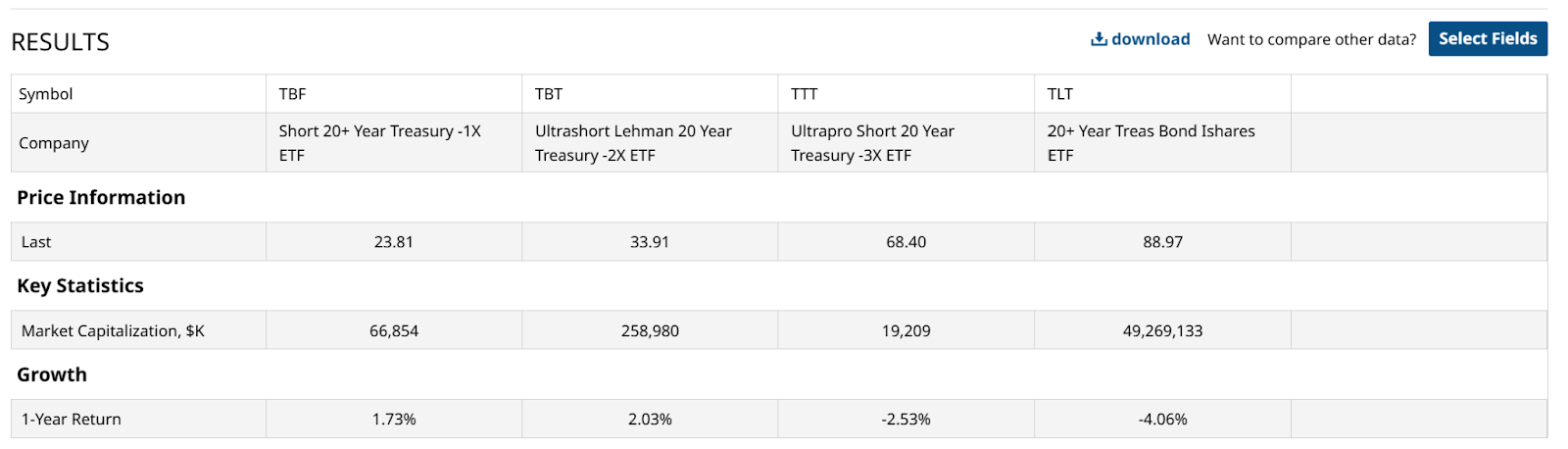

Inverse ETFs Are Not Just for Stocks

Actually, we’ve been able to use some of these for many years. They represent just a few of several inverse ETFs that move opposite bond prices. As a reminder, when bond yields rise, bond prices fall. So how does a trader protect against a sudden, steep drop in TLT (TLT) or a similar rate-sensitive position? Here are three ways, essentially the same idea but in -1x, -2x and -3x varieties.

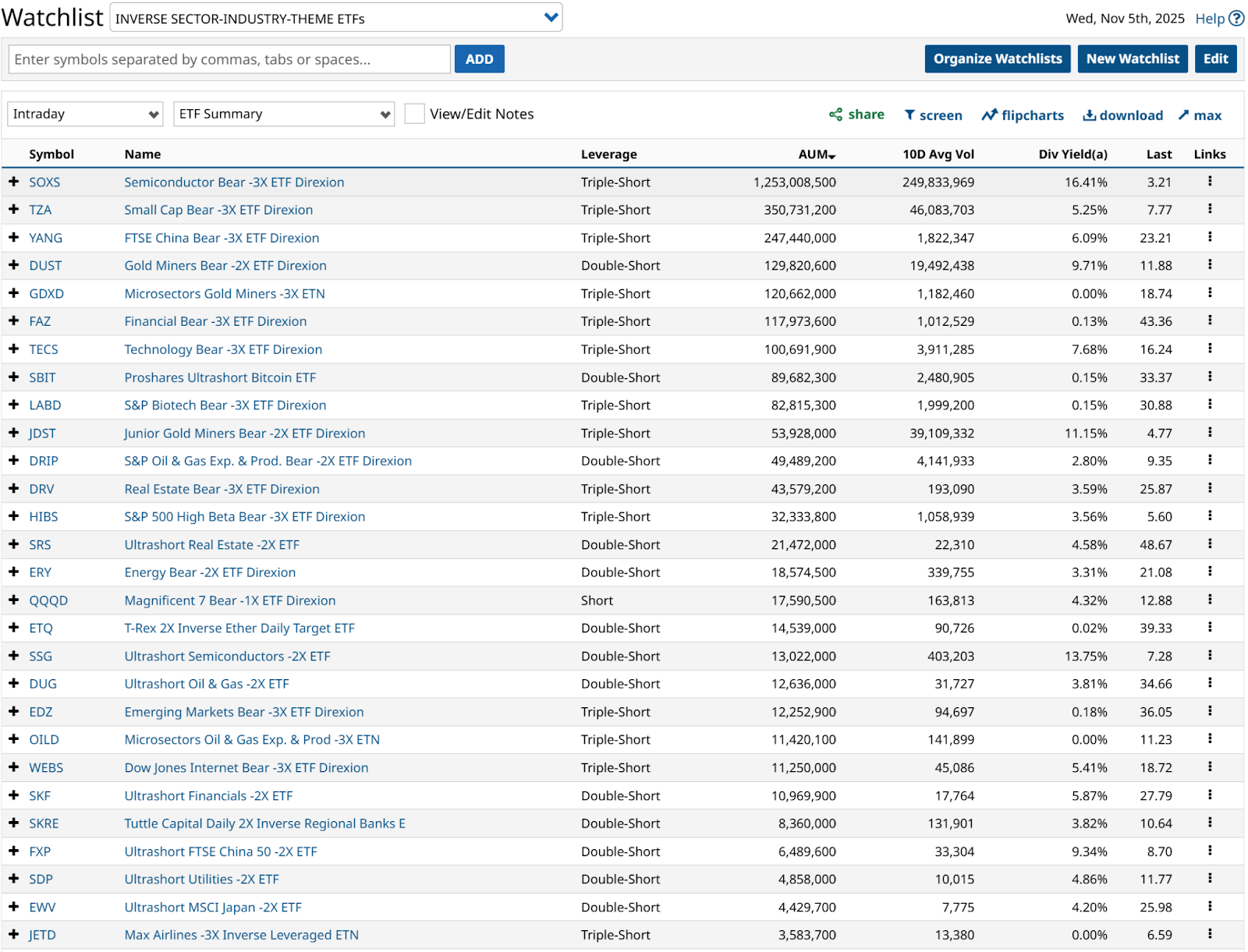

Are There Inverse ETFs for Individual Sectors?

Yes, and here are just a small batch of them, from a watchlist I created and track closely. I’m a risk manager, and that means whenever I think something is likely to go down in price sharply, my first question is “can I profit from that using an inverse ETF?” Increasingly, the answer is yes.

Are There Inverse ETFs for Single Stocks?

Yes, and that segment of the inverse ETF world is growing rapidly. Many inverse ETFs do not have high asset levels, and some do not trade every day. So be careful that the bid-offer spread is tight enough to avoid being right about your trade, but losing due to a wide spread you did not expect.

My suspicion is that there will come a time in the foreseeable future where the interest in these inverse ETFs could spike, just as it did for AI stocks a few years ago.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)