/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

The Magnificent 7 trade has been a successful one for investors in recent years. Buoyed by the AI revolution, the cohort comprising the tech titans of Nvidia (NVDA), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), Meta (META), Tesla (TSLA), Apple (AAPL), and Amazon (AMZN) has seen their share prices shoot up. However, not all of them have displayed exponential growth in their share prices, with some not even being able to beat the S&P 500 ($SPX) last year.

Amazon takes the cake here. The worst-performing Mag 7 stock in 2025 had nothing negative going on for it last year. It is just that the investing community developed a perception that the e-commerce giant was not being proactive enough in terms of AI, and perhaps some complacency was seeping in due to its market-leading position in online retail and cloud.

Yet, 2026 has been earmarked by analysts as the year when the Seattle-based tech giant will have a revival. Are there good reasons for it? It seems so.

Amazon's Financials Are Amazing

Amazon has built itself to be a $2.4 trillion market cap giant, not only based on its ubiquitous services across retail, cloud, and streaming, among others. It has managed its finances with astute care, growing its revenues and profitability while keeping its margins under check across various market cycles. Over the last 10 years, Amazon's revenue and earnings have displayed CAGRs of 21.26% and 72.49%, respectively, accompanied by a market cap growth of more than 15 times in the same period, rewarding long-term shareholders.

Lately, the company's quarterly results have consistently surpassed estimates on both the top line and bottom line. Q3 2025 was similar as well.

The most recent quarter saw the company reporting net sales of $180.2 billion, up 13% from the previous year. The same in the much-talked-about AWS segment grew by 20% from the previous year to $33 billion, continuing to hold the apex position in the global cloud market with a 30% share. Overall, the company has guided for net sales to be between $206 billion and $213 billion in Q4 2025, the midpoint of which would denote an annual growth of 11.5%.

Earnings went up by 36.4% on a year-over-year (YoY) basis to $1.95 per share, outpacing the consensus estimate of $1.57. Notably, for more than two years now, Amazon's earnings have surpassed Street expectations consecutively. Meanwhile, although no guidance was provided for the bottom line, Amazon expects operating income to be in the range of $21 billion and $26 billion in Q4 2025.

Cash flow from operations also remained solid. Net cash from operating activities increased by 36.8% from the prior year to $35.53 billion as the company closed the quarter with a cash balance of $66.9 billion, with no short-term debt on its books.

Amazon Is Playing Stealthily

As I had touched upon earlier, the notion is that Amazon is not doing much in terms of AI. Or, at least not on the surface, as its Mag 7 peers. The truth is that Amazon is heavily leaning into AI and with vigor. It's just that they are not as loud as the others. Anthropic, developer of the Claude AI model, has emerged as a pivotal element in Amazon's AI portfolio since the initial investment in 2023. The $8 billion commitment now appears modest relative to Anthropic's valuation, which exceeds $350 billion.

Moreover, Amazon continues to allocate substantial resources to dedicated AI facilities supporting Anthropic and other partners. The recently commissioned $11 billion Project Rainier complex hosts Claude instances running on hundreds of thousands of Trainium 2 accelerators. Additionally, AWS introduced general availability for EC2 Trn3 UltraServers on Dec. 2, 2025, equipped with the Trainium3 processor, described as AWS's first 3 nm AI chip and optimized for token-level efficiency. Compared with the previous iteration, Trainium3 provides a 4.4-fold increase in computational throughput and a 40% decrease in power consumption.

Thus, by relying on in-house accelerators such as Trainium3 and deriving 60% of revenue from services, Amazon is establishing a cost-effective compute foundation while layering higher-value offerings atop its e-commerce base. The key consideration centers on preserving operating margins and pricing discipline as inference workloads predominate. Vertical integration confers a durable benefit in this regard by routing mature inference tasks to proprietary silicon, diminishing vulnerability to external vendor pricing dynamics across refresh cycles. As AI-related revenue constitutes a larger portion of AWS totals, this structure could sustain margins near 30% even during inference expansion.

Overall, Amazon's investment rationale does not require outright dominance in the AI competition. Rather, it emphasizes improving unit-level profitability across diversified streams, thereby buffering against specific execution risks. The combination of multiple cash-generating avenues and rising capital efficiency supports the long-term appeal, notwithstanding temporary free cash flow constraints.

On the retail front, meanwhile, Amazon projects that automation could eventually encompass up to 75% of warehouse processes. Morgan Stanley anticipates deployment of 40 next-generation automated centers by 2027, yielding potential annual cost reductions of $2 billion to $4 billion through 20% to 40% lower per-order fulfillment expenses.

Analyst Opinion of AMZN Stock

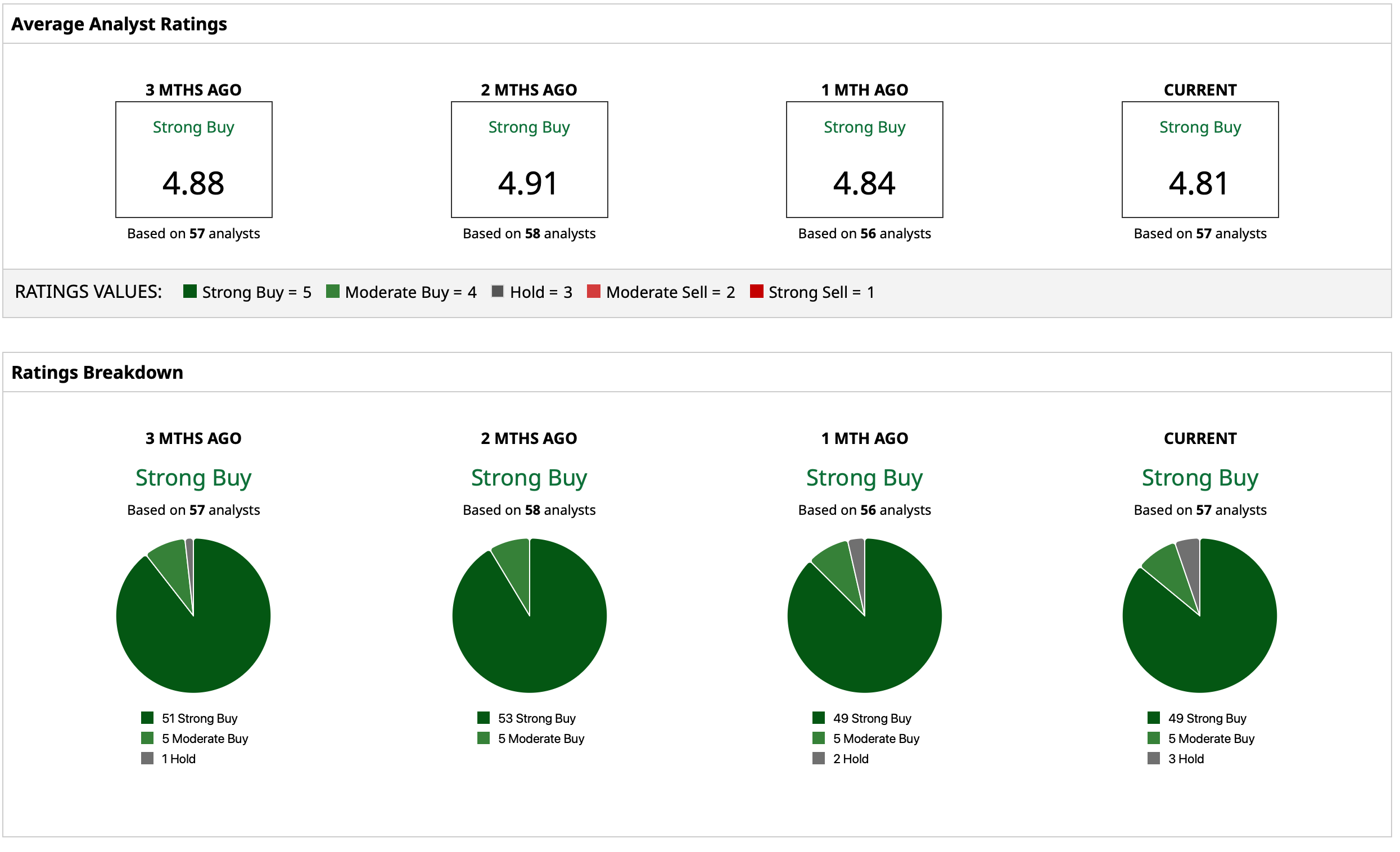

Taking all of this into account, analysts have attributed a consensus rating of “Strong Buy” for the stock with a mean target price of $295.05. This indicates an upside potential of about 26.6% from current levels. Out of 57 analysts covering the stock, 49 have a “Strong Buy” rating, five have a “Moderate Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)