Michael Saylor's Strategy (MSTR), formerly MicroStrategy, is a business software company turned Bitcoin treasury powerhouse. Yesterday, Strategy reported an unrealized loss of $17.44 billion in Q4 of 2025, as Bitcoin (BTCUSD) prices declined by 25% in the December quarter. The loss marks a sharp reversal from the $3.9 billion unrealized gain Strategy reported in Q3. It highlights the extreme volatility inherent in the company's Bitcoin-centric strategy.

Under new accounting standards adopted in Q1 of 2025, Strategy must mark its Bitcoin holdings to fair value each quarter. This creates massive swings in reported earnings that track the cryptocurrency's price movements.

MSTR stock fell 53% in Q4 and is down 66% from all-time highs, as investors grapple with mounting concerns about its ability to service debt and pay dividends without generating meaningful cash flow. Strategy scrambled to address liquidity fears, establishing a $2.19 billion cash reserve funded through stock sales. Yet even as Strategy braces for its massive paper loss, it doubled down on its Bitcoin bet, purchasing $116.3 million worth of the cryptocurrency in early January.

While Strategy holds around $60 billion in BTC, the stock trades at a market cap of $47 billion. Let’s see if you should own MSTR stock right now.

MSTR Stock Is Expected to Remain Volatile

Investors are concerned about Michael Saylor’s fragile and high-risk Bitcoin treasury strategy. Last month, it established a $1.44 billion cash reserve to cover dividend payments and interest obligations. The defensive move indicates Saylor is worried about the entity’s ability to meet financial commitments without selling its prized Bitcoin holdings. At the end of 2025, the cash cushion covered 21 months of payments.

Strategy holds more than 3% of the total BTC supply that will ever exist, making it the largest institutional holder of the digital asset. When Strategy issued guidance in October, analysts assumed Bitcoin would hit $150,000 by year-end. Reality proved far harsher. Bitcoin plunged from $111,612 in late October to as low as $80,660 by late November, prompting the company to slash its year-end price assumptions to a range of $85,000 to $110,000.

The revised forecast would mean the potential losses for Bitcoin could range between $5.5 billion and $6.3 billion in 2025. The average BTC acquisition cost for Strategy is around $75,000, which is below the current price of $93,770.

In October 2025, S&P Global Ratings assigned Strategy a B-minus credit rating with a stable outlook. The rating agency explained that Strategy holds Bitcoin but owes dollars. While debt payments, interest obligations, and preferred stock dividends are paid in cash, the company's assets are held in a volatile cryptocurrency that generates no income.

Strategy’s legacy software business is expected to report an EBT margin of just 1.2% in 2025 and is struggling to generate meaningful cash flow. For the first half of 2025, the company reported $8.1 billion in pre-tax earnings, with most of it coming from Bitcoin appreciation rather than operations.

S&P analysts are most concerned about the $5 billion in convertible debt maturing in 2028 that is currently out of the money. If those bonds come due during a Bitcoin crash, Strategy could face a brutal choice between liquidating Bitcoin at depressed prices or restructuring its debt, which might trigger a default.

Strategy continues to buy Bitcoin aggressively despite mounting risks, betting that access to capital markets will remain open even as traditional metrics suggest the strategy is growing increasingly precarious.

What Is the MSTR Stock Price Target?

The performance of MSTR stock will depend on BTC prices. During the last crypto bull run, MSTR stock rose from $14 in January 2023 to $450 in July 2025. However, it also underperforms significantly during pullbacks.

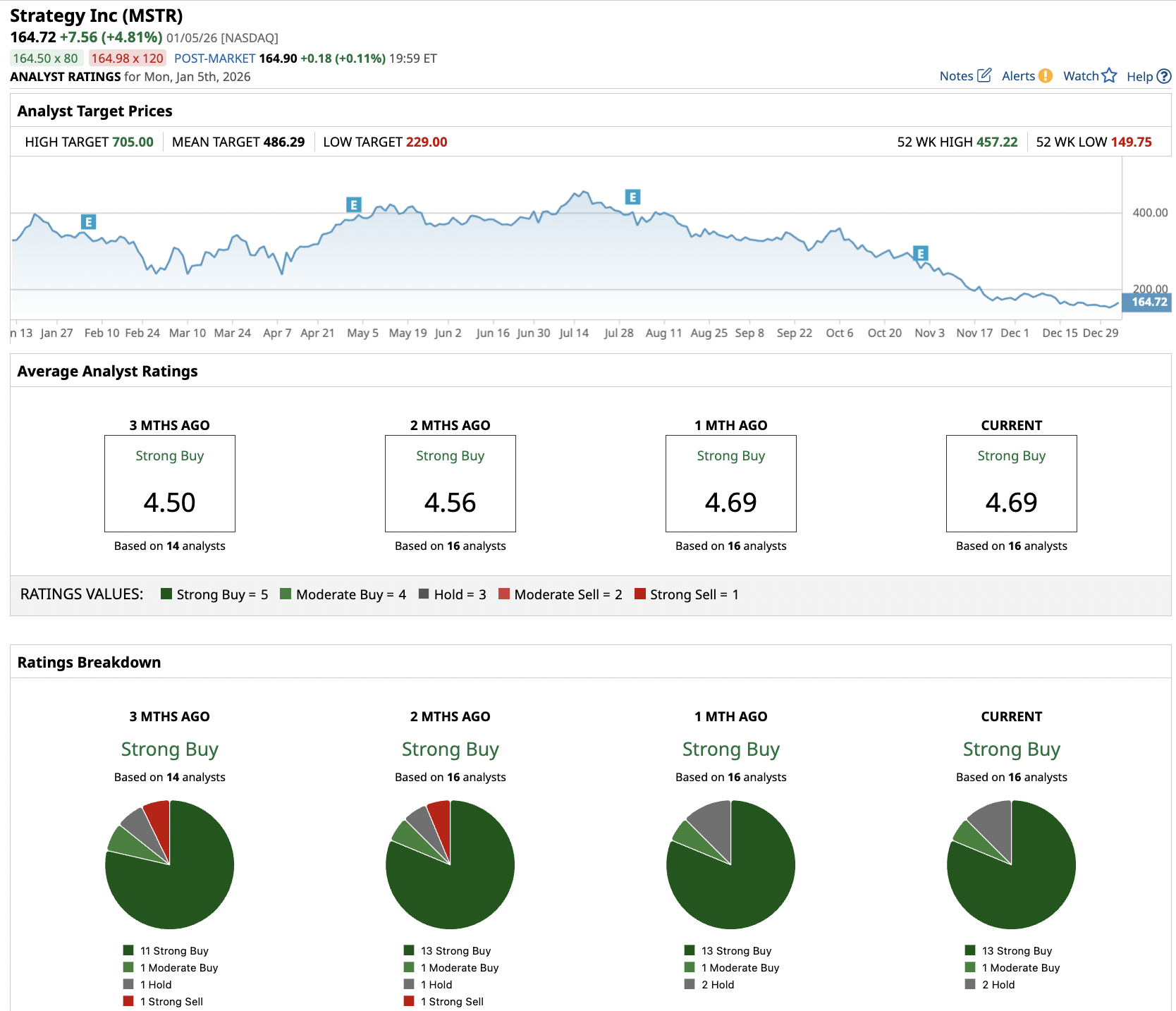

Out of the 16 analysts covering MSTR stock, 13 recommend “Strong Buy,” one recommends “Moderate Buy,” and two recommend “Hold.” The average MSTR stock price target is $486.29, indicating an upside potential of almost 200% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)