Bitmine Immersion Technologies (BMNR) shareholders face a critical vote on Jan. 15 that could determine whether the company can execute its aggressive Ethereum (ETHUSD) accumulation strategy.

The digital asset treasury company is asking investors to approve an increase in authorized shares from 500 million to 50 billion, and Chairman Tom Lee is making an unusually direct appeal for shareholder support.

Lee, the well-known Fundstrat analyst who chairs Bitmine's board, released a video message explaining the rationale behind the proposal. He emphasized the capital raise will help create financial flexibility for three strategic initiatives, which include:

- Conducting capital markets activities, including at-the-market offerings and convertibles,

- Pursuing opportunistic acquisitions

- Enabling future stock splits as the share price appreciates.

Bitmine Is Bullish on Ethereum

The stock split rationale reflects Bitmine's bullish conviction about Ethereum's future price trajectory. The company currently holds 4.1 million ETH valued at roughly $12.1 billion, which accounts for 3.41% of the total ETH supply.

Bitmine has observed that its share price tracks Ethereum movements, with a coefficient of 0.015 times the ETH price, plus the accretion of ETH per share. Using this framework, Lee outlined scenarios where Ethereum reaches $22,000, $62,500, or even $250,000, which would imply Bitmine share prices of $500, $1,500, or $5,000, respectively. At those levels, the company would need stock splits ranging from 20-to-1 up to 100-to-1 to keep shares accessible to retail investors.

Bitmine has become one of the most actively traded stocks in America, with an average daily dollar volume of $980 million, ranking 47th among all U.S.-listed companies. Valued at a market cap of over $13 billion, Bitmine is a blockchain technology company primarily based in the United States. Let’s see if the crypto stock should be a part of your equity portfolio right now.

Is Bitmine Stock a Good Buy Right Now?

The digital asset landscape is shifting, and Bitmine is a company that has taken a page from the MicroStrategy (MSTR) playbook. Traditionally known for its Bitcoin (BTCUSD) mining operations, Bitmine has transformed into a premier Ethereum treasury platform. Led by Wall Street veteran Tom Lee, the company is executing a strategy it calls the “Alchemy of 5%,” an ambitious goal to own 5% of the total Ethereum supply eventually.

By treating ETH as a primary treasury asset, the company aims to increase the amount of “ETH held per share,” offering investors a unique way to gain exposure to the token through a traditional stock.

Bitmine’s fiscal 2025 results show the impact of this “all-in” crypto strategy. The company reported a massive net income of $328.2 million, translating to a diluted earnings per share (EPS) of $13.39.

However, investors should look closely at the balance sheet. Most of this profit came from an $805 million unrealized gain on its digital asset holdings. While its cash position jumped to $512 million, total assets are now dominated by its $8.28 billion in digital holdings.

In a move almost unheard of among high-growth crypto stocks, Bitmine recently declared an annual dividend of $0.01 per share. While the yield is small, the message is clear: the company wants to act like a mature “large cap” financial entity.

To put this in perspective, Bitmine notes that it is currently the only large-cap crypto stock to pay a dividend.

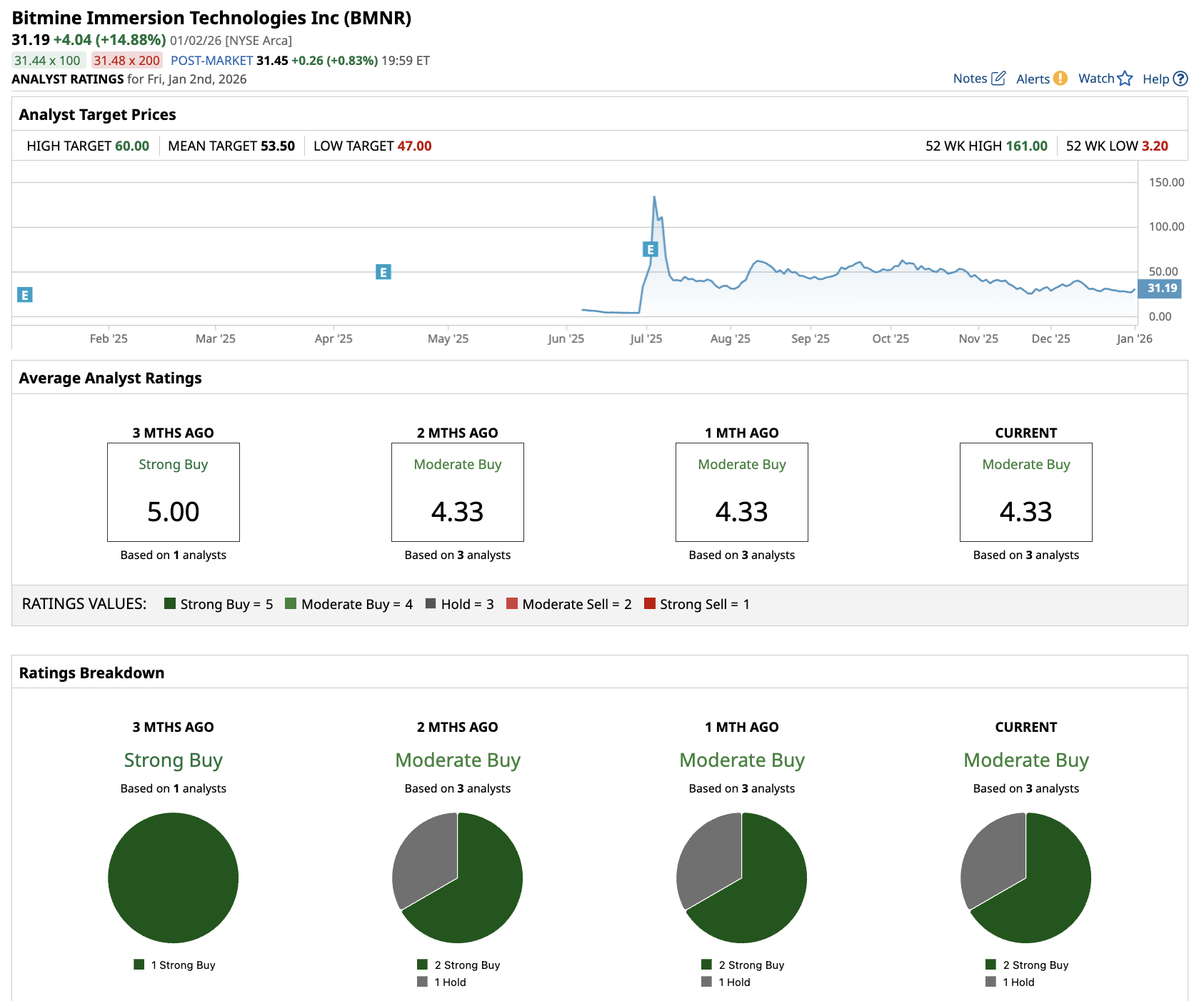

What Is the BMNR Stock Price Target?

Out of the three analysts covering BMNR stock, two recommend “Strong Buy,” and one recommends “Hold.” The average BMNR price target is $53.50, indicating an upside potential of over 70% from current levels.

Bitmine is no longer just a “miner.” It is a massive bet on the Ethereum ecosystem. With the upcoming launch of its “Made in America Validator Network” (MAVAN) in early 2026, the company plans to stake its ETH to generate native protocol rewards, further boosting its yield.

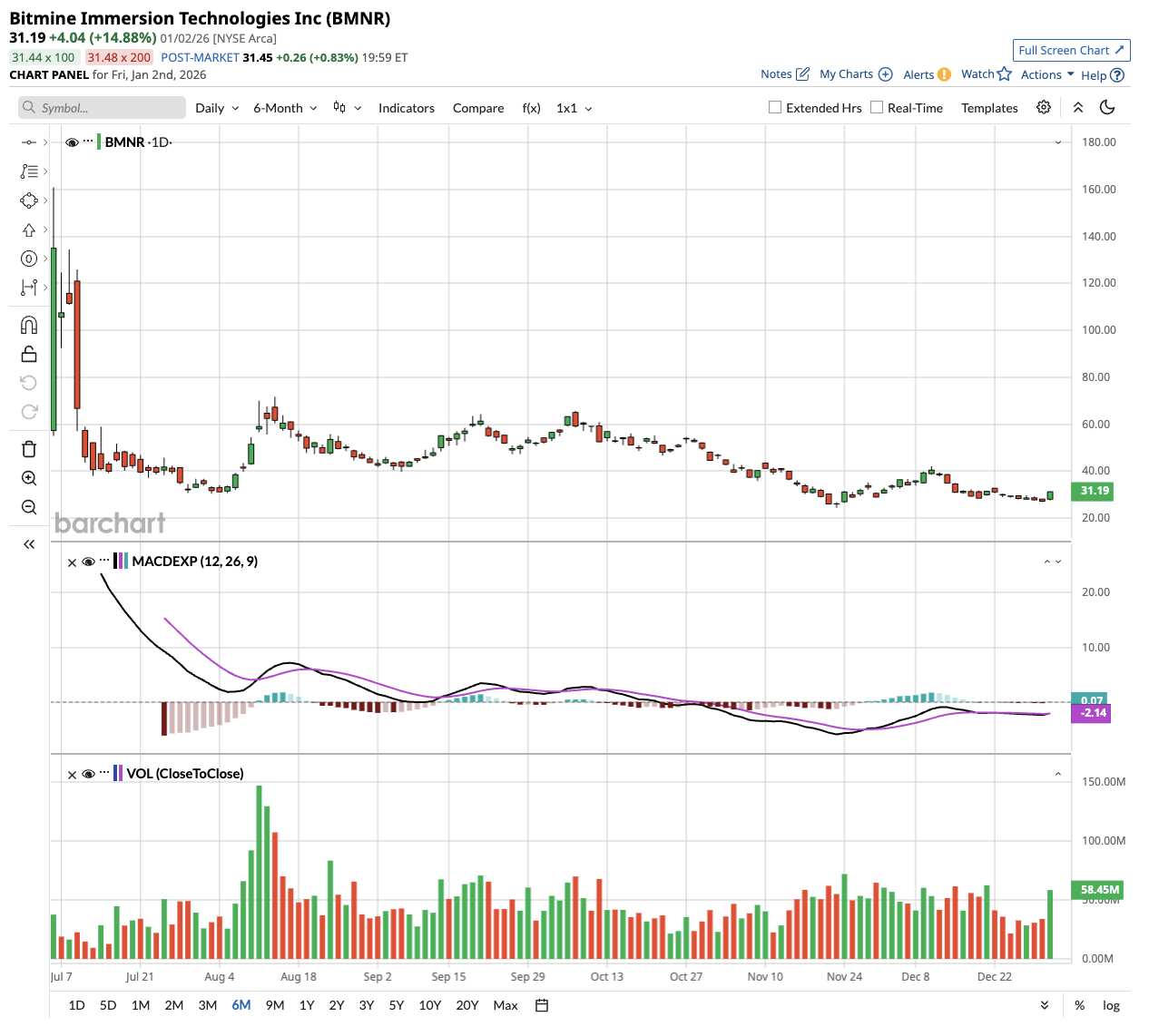

For investors who believe Ethereum will be the backbone of future finance, Bitmine offers a regulated, dividend-paying vehicle to play that trend. Just keep in mind that with nearly all its value tied to ETH prices, this stock will remain highly volatile.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)