/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is reshaping the tech landscape at breakneck speed, and investors are scrambling to lock in the biggest winners. Yet even in a crowded AI trade, few names have delivered like Micron Technology (MU). The memory-chip giant has ridden the AI wave to record highs, with MU stock delivering massive returns over the past year. Surging demand for memory chips from AI hyperscalers racing to build out massive data center capacity has been the primary engine behind Micron’s remarkable ascent.

But every rally eventually meets a reality check. Micron’s momentum recently hit a speed bump earlier this week after reports suggested that Samsung Electronics is nearing certification from Nvidia (NVDA) for its next-generation HBM4 chips. High-bandwidth memory (HBM), a specialized chip designed to move enormous volumes of data at ultra-fast speeds, is a critical component inside AI accelerators.

Nvidia relies heavily on HBM for its AI processors, making supplier approvals a closely watched development on Wall Street. Now, with Samsung reportedly preparing to begin mass production of its next-generation HBM chips earlier than expected, competitive dynamics in the AI memory space could shift quickly.

The South Korean tech giant’s progress threatens to add meaningful pressure on Micron, which is a key supplier of advanced memory products used across data centers and AI infrastructure. Given this latest development, should you buy, sell, or hold MU stock? Let's take a closer look.

About Micron Stock

Based in Boise, Idaho, Micron Technology stands at the center of the global memory market, supplying the chips that quietly power today’s data-driven world. The company designs and manufactures a broad portfolio of DRAM, NAND, and NOR memory products that sit inside everything from cloud data centers to smartphones and connected devices.

With a strong emphasis on engineering expertise and manufacturing scale, Micron plays a critical role in enabling AI workloads and other compute-intensive applications. From large-scale data centers to edge devices and mobile platforms, its memory and storage solutions form the backbone of systems that process, store, and move vast amounts of information every day. With a market capitalization of roughly $465 billion, Micron has grown into a semiconductor heavyweight.

Shares dipped about 2.8% on Feb. 9 following news surrounding Samsung, but that pullback barely dents what has been an extraordinary run. Over the past year, the stock has skyrocketed an eye-popping 336%, leaving the broader S&P 500 Index ($SPX) — up just 12% over the same stretch — far in the dust. After touching a record high of $455.50 last month, Micron now sits only about 9% below that peak, underscoring just how powerful its AI-fueled rally has been.

While Micron has delivered a breathtaking rally, its valuation remains far from excessive. MU stock trades at roughly 12.6 times forward earnings, a sharp discount to the sector median of 23.6 times. For a company powering the AI memory boom, that gap suggests investors are still paying a relatively modest price for its growth trajectory, even after an extraordinary run.

Micron’s Q1 Earnings Snapshot

Micron kicked off fiscal 2026 with a strong quarter. In its Dec. 17 earnings report, the company crushed both top- and bottom-line expectations, posting revenue of $13.6 billion, up 57% year-over-year (YOY) and comfortably ahead of the $12.7 billion consensus estimate. The results marked Micron’s third-straight quarter of record revenue, powered by a 69% surge in DRAM sales and a 22% increase in NAND revenue.

DRAM alone generated $10.8 billion, accounting for 79% of total sales, while NAND contributed $2.7 billion, or 20%. Notably, total company revenue, DRAM and NAND revenue, HBM and data center revenue, and revenue across each business unit all reached new records. Cloud memory sales climbed to $5.28 billion, doubling YOY, while core data center revenue rose 4% annually to $2.38 billion.

The company said performance across both major segments was driven by higher pricing. Profitability also followed a similar growth trajectory. Adjusted gross margin came in at 56.8%, up from 39.5% in the year-ago quarter. On the bottom line, adjusted EPS soared a stunning 167% YOY to $4.78, crushing the Street’s $3.78 estimate.

Looking ahead, Micron struck an optimistic tone for Q2 fiscal 2026, projecting revenue of around $18.7 billion and adjusted EPS of $8.42. Management expects strong AI-driven demand across data centers and edge computing to continue, even as supply constraints are likely to persist through 2026, a backdrop that could further reinforce pricing strength.

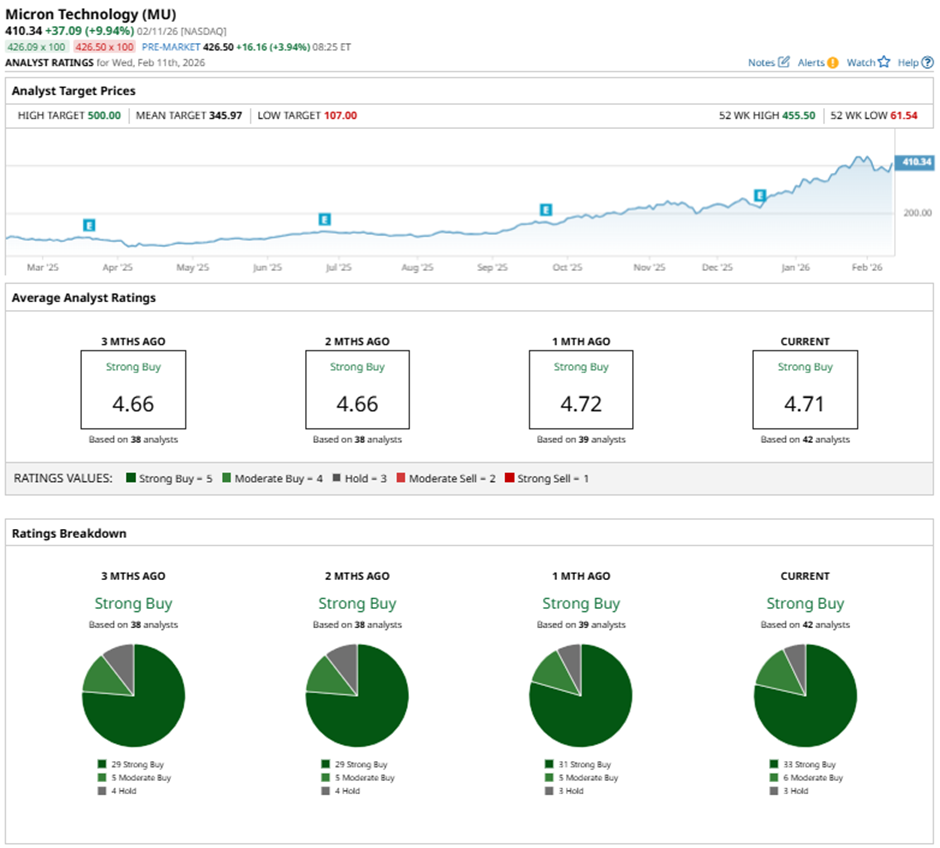

How Are Analysts Viewing Micron Stock?

Despite intensifying competition, Wall Street’s conviction in Micron remains firmly intact. MU stock carries a consensus “Strong Buy” rating, with 33 out of 42 analysts calling it a “Strong Buy,” six assigning a “Moderate Buy” rating, and just three recommending a “Hold.”

Even after its powerful run, optimism hasn’t faded. While MU has already surged beyond its average price target of $345.97, the Street-high target of $500 implies that there could still be roughly 21% upside ahead. That's a sign that many analysts believe the AI-driven momentum is far from over.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)