Hedge fund manager Philippe Laffont is known for making outsized and successful bets on disruptive technology companies. Through his fund Coatue Management, the 58-year-old not only made lucrative bets on public companies like Tesla (TSLA) and AMD (AMD), but he was also one of the early investors in TikTok-parent ByteDance, Spotify (SPOT), and Instacart (CART).

A recent 13F filing shedding light on his latest set of transactions revealed some interesting moves by Laffont, wherein he substantially increased his holdings of streaming and e-commerce giants Netflix (NFLX) and Amazon (AMZN), respectively, while trimming his stake in Alphabet (GOOG) (GOOGL) and Meta (META). However, one company, far removed from the tech space, grabbed attention. Curiously, Laffont initiated a position in Sprouts Farmers Market (SFM).

About Sprouts Farmers Market

Founded in 2002, Sprouts Farmers Market is one of the largest specialty health-food retailers in the U.S. Sprouts operates as a "healthy grocery store" with an open-air farmers market layout. Unlike traditional grocers, fresh produce is located at the center of the store rather than the perimeter. They focus on natural, organic, and "attribute-driven" products.

As of early 2026, the company operates over 450 stores across roughly 24 states and continues to expand its footprint across the U.S. with new store openings in markets such as Houston’s Kingwood suburb and the Bay Area in California, reflecting geographic expansion and strategic market penetration.

Valued at a market cap of $6.6 billion, the SFM stock is down 14% on a year-to-date (YTD) basis. Notably, Laffont bought about 601,886 shares of the company, whose stock reached an all-time high in 2025.

What led to this rise, and how come it was able to convince a tech native like Laffont to buy its shares? Let's find out.

Solid Financials Served Fresh

Sprouts has displayed steady growth rates. Over the past 10 years, its revenues and earnings have clocked CAGRs of 9.80% and 15.79%, respectively. It may not be spectacular, but the company has grown sustainably, as evidenced by the manageable amount of debt on its books.

Moreover, the latest quarter saw the company reporting a beat on earnings, the ninth straight instance of doing so. While net sales climbed by 13% from the previous year to $2.2 billion, accompanied by a comparable sales growth rate of 5.9%, earnings went up by 34.1% in the same period to $1.22 per share. Notably, the EPS of $1.22 came in ahead of the consensus estimate of $1.18.

The company opened nine new stores in Q3 2025 while increasing its net cash from operating activities to $577.5 million for the nine months ended Sept. 28, 2025, from $520.4 million in the year-ago period. Overall, the company closed the quarter with a cash balance of $322.42 million, higher than its short-term debt levels of $172.21 million.

For the fourth quarter, the company expects its EPS to be in the range of $0.86 to $0.90, the midpoint of which would denote a year-over-year (YoY) growth rate of 11.4%. The company is set to report its Q4 results today post-market.

Currently, SFM stock is also trading at undervalued levels, with its forward P/E, P/S, and P/CF of 12.82, 0.75, and 8.40, lower than the sector medians of 16.68, 1.08, and 11.93, respectively.

Cultivating Growth With Strong Operations

The financials may look attractive for SFM; however, what may have made the deal for Laffont is the company's way of functioning and its fresh offerings, which make it easy for consumers to trust the brand and drive sales.

At the core of Sprouts' proposition lies its "Attribute-Driven" merchandising. Unlike conventional stores that stock a broad array of mass-market goods, Sprouts curates approximately 70% of its inventory around specific consumer trends such as keto, plant-based, and non-GMO products. This creates a "treasure hunt" experience that drives high customer engagement. Also, the company’s "Sprouts Brand" private label has grown to represent over 25% of total sales, providing a dual benefit of higher profit margins and increased brand loyalty. In 2024 alone, the company introduced over 7,100 new products, utilizing its "Innovation Centers" to test and scale emerging brands faster than its competitors.

The next aspect is right up Laffont's alley and must have certainly played its part in him buying Sprouts shares. To maintain its edge, Sprouts has aggressively integrated AI into its backend operations. The company utilizes machine learning algorithms to optimize inventory management, particularly for its high-turnover perishable items, which account for nearly 60% of its revenue. By predicting demand with higher precision, Sprouts has successfully reduced product waste, contributing to a 60 bps increase in gross margins in late 2025. Additionally, the full rollout of the Sprouts Rewards loyalty program in 2025 has allowed the company to deploy AI-driven personalized marketing, tailoring promotions to individual shopping habits and increasing the average "basket size" per visit.

The company is currently executing a disciplined "smaller-format" expansion plan. Moving away from massive 30,000+ square foot footprints, Sprouts is now opening stores at approximately 23,000 square feet. This model requires less capital to build, allows for faster site selection in dense urban markets, and reaches profitability more quickly. As of early 2026, the company has a pipeline of over 140 approved locations and intends to grow its store count by 10% annually through 2027.

However, despite its strengths, shareholders must remain mindful of significant headwinds. The most immediate concern is the securities litigation filed in late 2025, which alleges the company provided misleading growth projections during a period of consumer softening. Furthermore, as traditional retailers like Amazon (AMZN)-owned Whole Foods and Walmart (WMT) expand their organic offerings, price competition in the "natural" space is intensifying. There is also the risk of "cannibalization" as the company densifies its store count in existing markets like Florida and California.

Analyst Opinion of SFM Stock

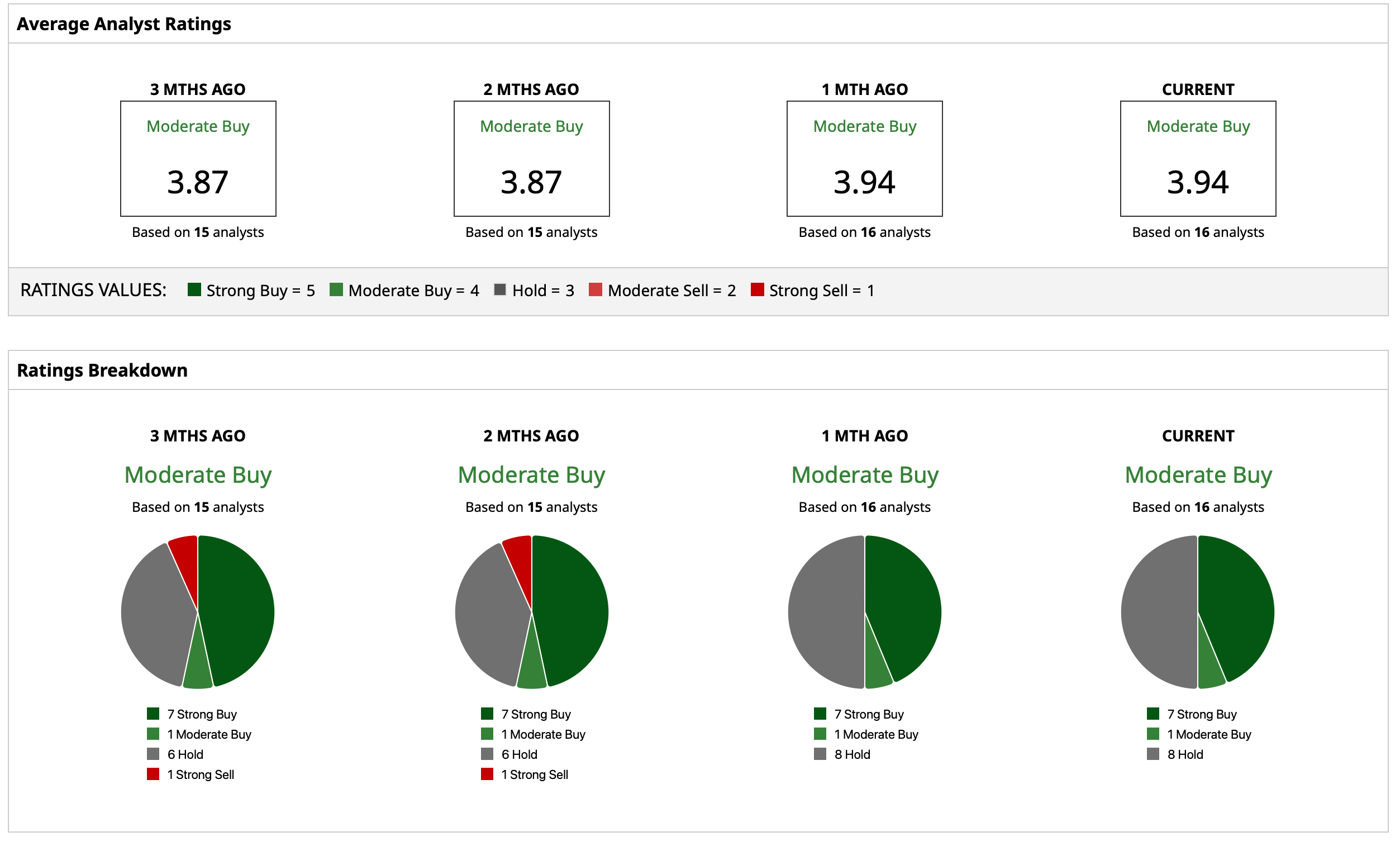

Thus, analysts remain cautiously optimistic about the SFM stock, attributing to it a rating of “Moderate Buy,” with a mean target price of $105.92. This indicates an upside potential of about 56% from current levels. Out of 16 analysts covering the stock, seven have a “Strong Buy” rating, one has a “Moderate Buy” rating, and eight have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)