Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) is a leading global food and beverage company, formed in 2015 through the merger of Kraft Foods and H.J. Heinz. With a market cap of $30.2 billion, it produces iconic brands like Kraft, Heinz, Oscar Mayer, and Philadelphia, offering products across condiments, cheese, snacks, and packaged meals.

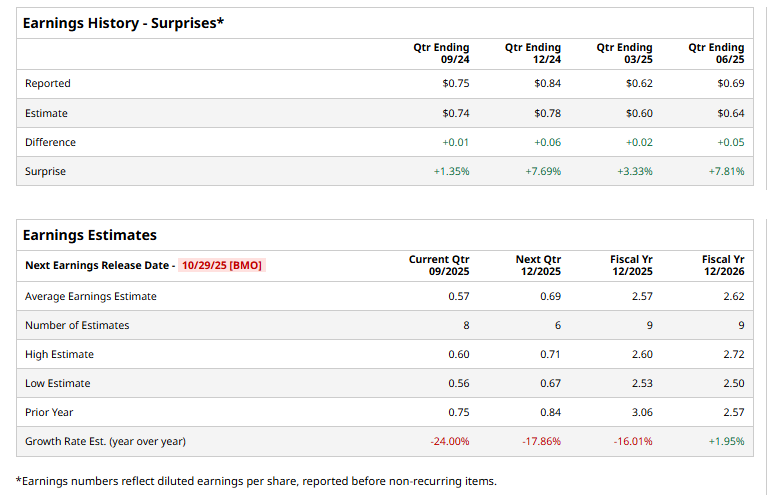

The food titan is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 29. Ahead of the event, analysts expect KHC to report a profit of $0.57 per share on a diluted basis, down 24% from $0.75 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect KHC to report EPS of $2.57, down 16% from $3.06 in fiscal 2024. However, its EPS is expected to rise 2% year over year to $2.62 in fiscal 2026.

Over the past year, Kraft Heinz has struggled, with shares down 29%, sharply lagging the S&P 500 Index’s ($SPX) 14.1% gain and underperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) fund, which fell 2.8%.

Kraft Heinz has struggled in recent years, with its stock losing over 70% of its value since February 2017. Once a Wall Street favorite for steady growth and high dividends, the company has been weighed down by cost-cutting focus, slow adaptation to healthier consumer trends, rising competition, and tighter household budgets.

Kraft Heinz’s stock saw a marginal dip after its Q2 earnings release on July 30, as the company grappled with a 2% drop in organic sales and a 1.9% decline in revenue to $6.35 billion. Margins slipped 140 basis points to 34.1%, and adjusted operating income fell 7.5% to $1.3 billion. However, adjusted EPS of $0.69 beat expectations by 7.8%, showing that the company still managed to outperform analyst forecasts despite the pressure on top-line growth.

Analysts’ consensus opinion on KHC stock is cautious, with a “Hold” rating overall. Out of 22 analysts covering the stock, 2 advise a “Strong Buy” rating, 19 give a “Hold,” and the remaining analyst suggests a “Moderate Sell.” KHC’s average analyst price target is $28.24, indicating a potential upside of 10.7% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)