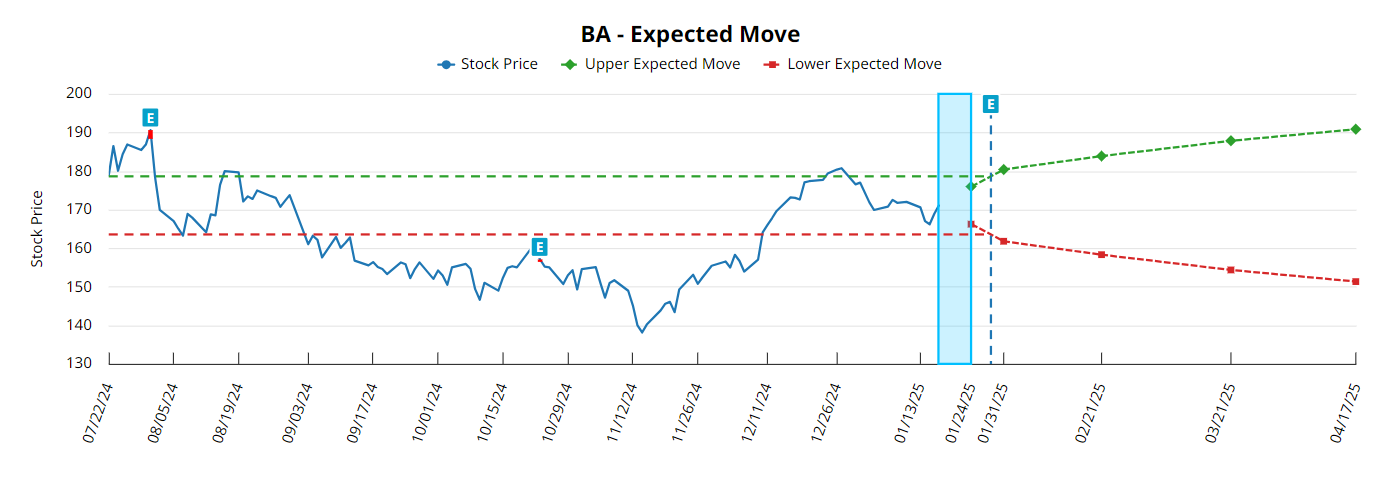

Beaten-down aerospace giant Boeing Company (BA) is set to report quarterly earnings before the market opens on Tuesday, Jan. 28, and options traders are expecting a bigger-than-usual post-event move in the stock. Currently, BA options are pricing in a 5.44% move after earnings, compared to the average realized move of 4.09% over the past four quarters.

However, a move of that size is hardly out of the question for Boeing, which fell 6.45% after its July 2024 earnings announcement.

Boeing stock is currently priced at $171.09, marking a decline of 15.7% over the past year - a significant underperformance compared to broader market indices like the S&P 500 Index ($SPX) and Nasdaq-100 Index ($IUXX). This underperformance is also evident when compared to its industry peer Airbus (EADSY), which is marginally higher over the last 52 weeks.

Boeing's market capitalization stands at approximately $104.43 billion, but a long streak of unprofitability highlights its operational difficulties in recent years. Likewise, revenue trends show a struggle to return to pre-pandemic levels, with ongoing issues - such as safety concerns with the 737 series and a costly labor strike - continuing to affect BA stock’s performance.

Despite these serious challenges, analyst ratings show a “Moderate Buy” consensus, and an average price target of $194.39. That suggests potential upside of about 13.6% to Friday’s close. The company’s short-term growth prospects weigh heavily on strategic moves like the acquisition of Spirit AeroSystems (SPR) to address quality issues and support production targets.

Overall, Boeing's valuation metrics and market signals suggest that the stock may be fairly valued at current levels, with potential for upside if the company successfully addresses its current challenges. However, with the stock’s turnaround still a work in progress, risk-averse investors might prefer to look elsewhere in the industrial sector for growth and stability.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.