/J_B_%20Hunt%20Transport%20Services%2C%20Inc_%20trucking-by%20Sundry%20Photography%20via%20iStock.jpg)

With a market cap of $21.3 billion, J.B. Hunt Transport Services, Inc. (JBHT) is a transportation and logistics provider offering surface transportation, delivery, and supply chain solutions across the country. It operates through five segments: Intermodal; Dedicated Contract Services; Integrated Capacity Solutions; Final Mile Services; and Truckload, supported by a large, diverse fleet and logistics network serving a wide range of industries.

Shares of the Lowell, Arkansas-based company have exceeded the broader market over the past 52 weeks. JBHT stock has increased 31.5% over this time frame, while the broader S&P 500 Index ($SPX) has returned 11.9%. Moreover, shares of the company are up 15% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, shares of the trucking and logistics company have also outperformed the State Street Industrial Select Sector SPDR ETF’s (XLI) 27.3% gain over the past 52 weeks.

Despite reporting better-than-expected Q4 2025 EPS of $1.90 on Jan. 15, shares of JBHT fell over 1% the next day as the company reported revenue of $3.10 billion down 2% year-over-year and below Street forecasts. Investor sentiment was further pressured by demand softness across core segments, including a 3% revenue decline in Intermodal, a 7% drop in ICS load volume, and a sharp 10% revenue fall in Final Mile Services.

For the fiscal year ending in December 2026, analysts expect J.B. Hunt Transport Services’ EPS to grow 16.8% year-over-year to $7.15. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

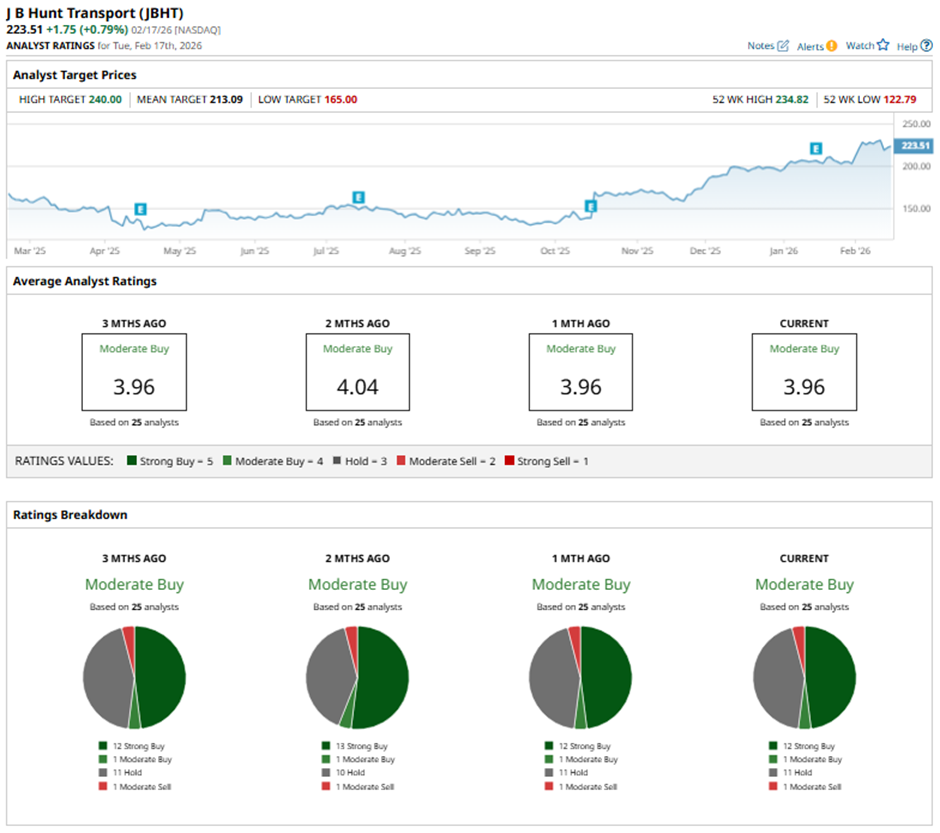

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and one “Moderate Sell.”

On Jan. 17, UBS analyst Thomas Wadewitz maintained a “Hold” rating on J.B. Hunt Transport Services with a price target of $196.

As of writing, the stock is trading above the mean price target of $213.09. The Street-high price target of $240 implies a potential upside of 7.4% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)