/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)

Domino's Pizza (DPZ) stock is at a one-year low ahead of full-year earnings due out next week. One play is to sell short out-of-the-money (OTM) put options with a one-month expiry. It has a 2% yield for a 5% lower strike price.

DPZ is trading at $374.48 in midday trading on Tuesday, Feb. 17, well below its recent peak of $438.32 on Dec. 17, 2025. It seems the market is forecasting devastating news before the market opens on Feb. 23. But, is that realistic?

Analysts Forecast Higher Earnings

Analysts' forecasts are for $1.52 billion in revenue for the fiscal Q4 ending Dec. 7, 2025, according to Seeking Alpha, and $4.92 billion for the full year, according to Barchart.

That would be +5.3% higher than last year's $1.444 billion Q4 sales, and +4.6% over the $4.706 billion in 2024 revenue.

So, why is the market so concerned? Are earnings expected to falter?

No, they are not expecting this. Analysts forecast $5.36 in earnings per share (EPS) for Q4, which would be +9.8% higher than last year's Q4 $4.88 diluted EPS. In fact, some surveys show an average estimate of $5.38 in EPS.

Moreover, for 2026, analysts are forecasting $19.54 EPS, which could be 11% higher than the $17.60 EPS projected for the full year 2025 (i.e., +5.45% over $16.69 EPS in 2024).

So, that leaves concern over the DPZ stock's valuation.

DPZ Stock Not Overvalued

One way to see if a stock is overvalued is to look at its average price/earnings (P/E) ratio and compare that to today's P/E.

For example, historically over the last 5 years, DPZ stock has had an average forward P/E ratio of 28.6x, according to Seeking Alpha. Morningstar says it's been 26.90x.

But right now, the forward P/E is lower:

$376.14 price / $19.54 2026 EPS = 19.3x

That is well below its historical average. In fact, Morningstar calculates that the forward P/E metric averaged 20.15x during 2025 and 21.34x in 2024.

So, based on forward earnings, DPZ is not overvalued.

DPZ Price Targets are Higher

Moreover, in my prior Barchart articles, including this one on Dec. 15, based on its free cash flow (FCF) margins and average FCF yield metrics, I estimated DPZ was worth $493.92 per share.

That is over 31% higher than today's price. Moreover, other analysts agree.

For example, Yahoo! Finance reports that 34 analysts have an average price target (PT) of $483.94. Barchart's survey shows a mean PT of $489.00, and AnaChart.com shows that 24 analysts have an average PT of $439.82. The latter is still 16.9% over today's price.

So, the bottom line is that DPZ stock looks too cheap here, anywhere from 16% to 31%.

Shorting OTM Puts and Buying ITM Calls

One way to play this is to sell short out-of-the-money (OTM) put options with one-month expiry. Moreover, to participate in DPZ's upside, less risk-averse investors can use that income to buy in-the-money (ITM) calls further out - say 7 to 10 months later in expiry.

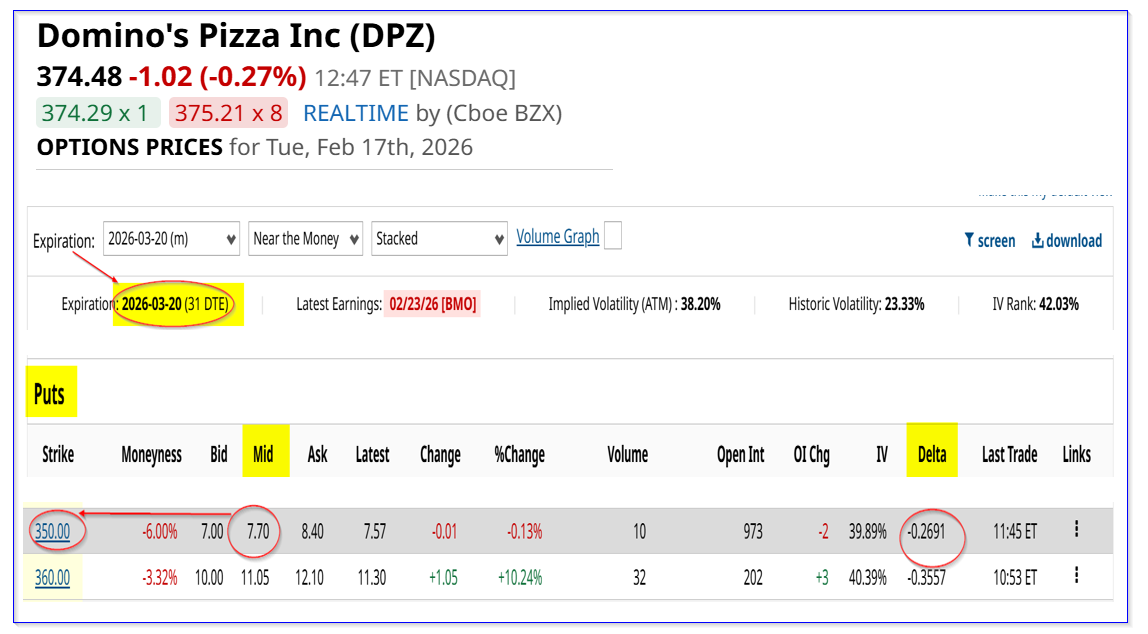

OTM Short-Put. For example, the March 20, 2026, expiry period, 31 days to expiry (DTE), has a 2.2% yield for a 5% lower strike price put option contract.

The $350 exercise price put contract, which is 6.5% lower than today's price, has a midpoint premium of $7.70. That provides a short-seller a 2.20% yield (i.e., $7.70/$350.00 = 0.022).

In other words, once the investor secures $35,000 with their brokerage firm, the account will immediately receive $770.00 after entering an order to “Sell to Open” this contract that gets filled at the midpoint.

As long as DPZ stays over the $342.30 breakeven point (i.e., $350-$7.70), which is 8.59% lower than today's price, by March 20, the investor makes this full 2.20% monthly yield.

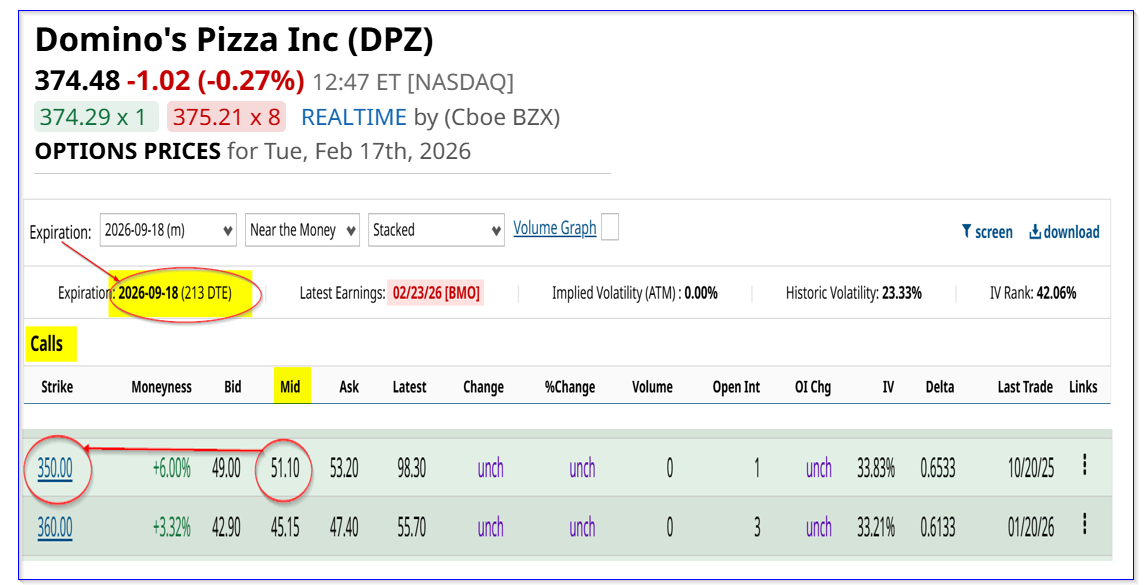

ITM Call Play. Moreover, this trade can be repeated each month and help pay for a purchase of an in-the-money (ITM) call option at the same $350.00 strike price for a later date.

For example, look at the Sept. 18, 2026, expiry period, which is 7 months further out. It shows that the $350.00 call option has a midpoint premium of $51.10.

That means that if the investor can keep making $7.70 over 7 months (no guarantee this will be possible), the total accumulated of $53.90 could more than pay for a purchase today of a $350 call at $51.10.

So, as long as DPZ stays over $350.00, the investor could make a huge leveraged return.

For example, if DPZ rises to $400.00, the call would be worth $50 (i.e., $400-$350.00). So, if the investor can reduce the net cost to at least $25.00 through short-put plays, the expected return is:

$50/$25 = 2.0x, i.e., a 100% return on investment

That is 3 times better than the expected 31% ROI just holding DPZ stock if it were to reach the much higher TPs projected above.

The bottom line is that shorting one-month DPZ puts and buying longer-dated ITM calls is a great way to play the undervalued Domino's stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)