Investors who seek passive income want businesses that quietly generate cash flow in the background even when markets are volatile or growth stocks are out of favor. Dividend stocks with high yields are built for providing consistent income and allow you to earn money while you sleep. Here are three such reliable dividend stocks to grab this month.

Dividend Stock #1: Realty Income (O)

Dividend Yield: 4.9%

Realty Income (O) is a real estate investment trust and is often called the “Monthly Dividend Company.” Unlike most companies that pay dividends quarterly or yearly, Realty pays dividends monthly. Its forward dividend yield sits at 4.9%, slightly higher than the real estate sector average. In fact, since its founding, the company has distributed 667 consecutive monthly dividends. It has also raised its dividends for the past 30 years in a row and is now a Dividend Aristocrat.

Realty Income owns thousands of commercial properties leased under long-term agreements to tenants across various sectors. It earns rental income as revenue. This diversification reduces reliance on a single sector and protects its rental income, which supports steady dividend payments.

As a REIT, Realty Income’s AFFO (or adjusted funds from operations) measures the recurring cash flow available to support distributions. Management expects AFFO per share of $4.25 to $4.27 for the full year 2025. While its AFFO dividend payout ratio of 75.2% is high, the company can maintain it as long as it can grow its AFFO. Another significant advantage for income investors is that, as a REIT, Realty Income is legally required to pay 90% of its taxable income in dividends. Aside from its high yield, the consistent payments make it particularly appealing to investors looking for steady cash flow or passive income.

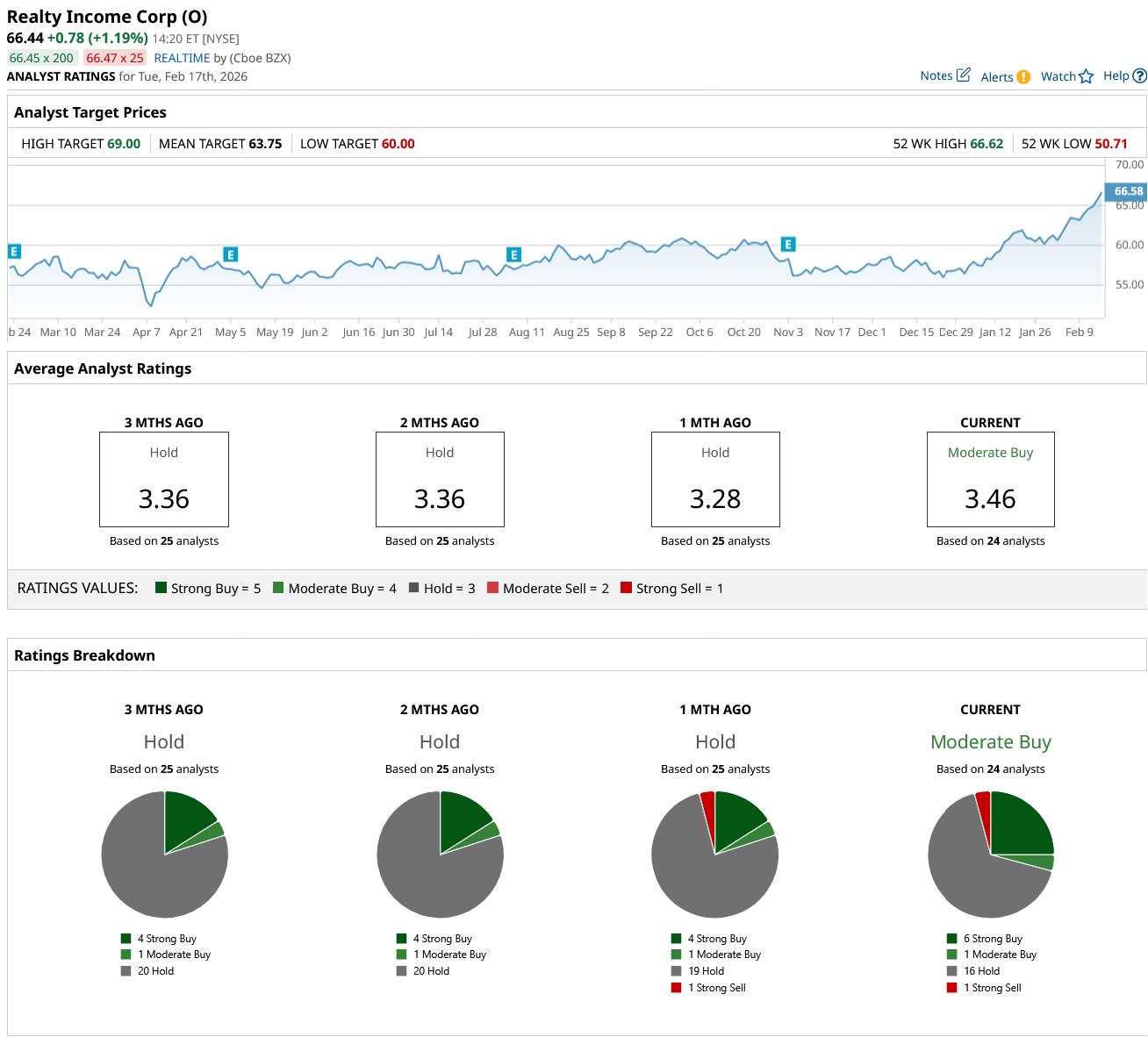

Overall, on Wall Street, O stock is a “Moderate Buy.” Of the 24 analysts covering the stock, six rate it a “Strong Buy,” one says it is a “Moderate Buy,” 16 rate it a “Hold,” and one says it is a “Strong Sell.” Realty Income stock is trading above its average target price of $63.75. However, its high price target of $69 is 4% higher than current levels.

Dividend Stock #2: Enterprise Product Partners (EPD)

Dividend Yield: 5.8%

Enterprise Products Partners (EPD), a midstream energy company, has earned its name among passive income investors. EPD moves, stores, and processes oil, natural gas, and natural gas liquids through pipelines, storage terminals, and processing facilities. Its business model is meant to deliver consistent distributions over multiple economic cycles, thereby protecting its dividend. Its forward dividend yield hovers around 6%, higher than the energy sector average of 4.2%.

In 2025, EPD generated $7.9 billion in operational distributable cash flow (DCF). This level of cash flow comfortably supported distributions. After paying dividends, Enterprise kept $3.2 billion in distributable cash flow, allowing it to reinvest in growth initiatives while maintaining balance sheet strength.

The company increased its annual distribution by 3.6% to $2.175 per common unit in 2025, marking 27 consecutive years of dividend increase. EPD is also a Dividend Aristocrat. This long history of increases reflects both business stability and disciplined financial management, qualities that dividend investors appreciate.

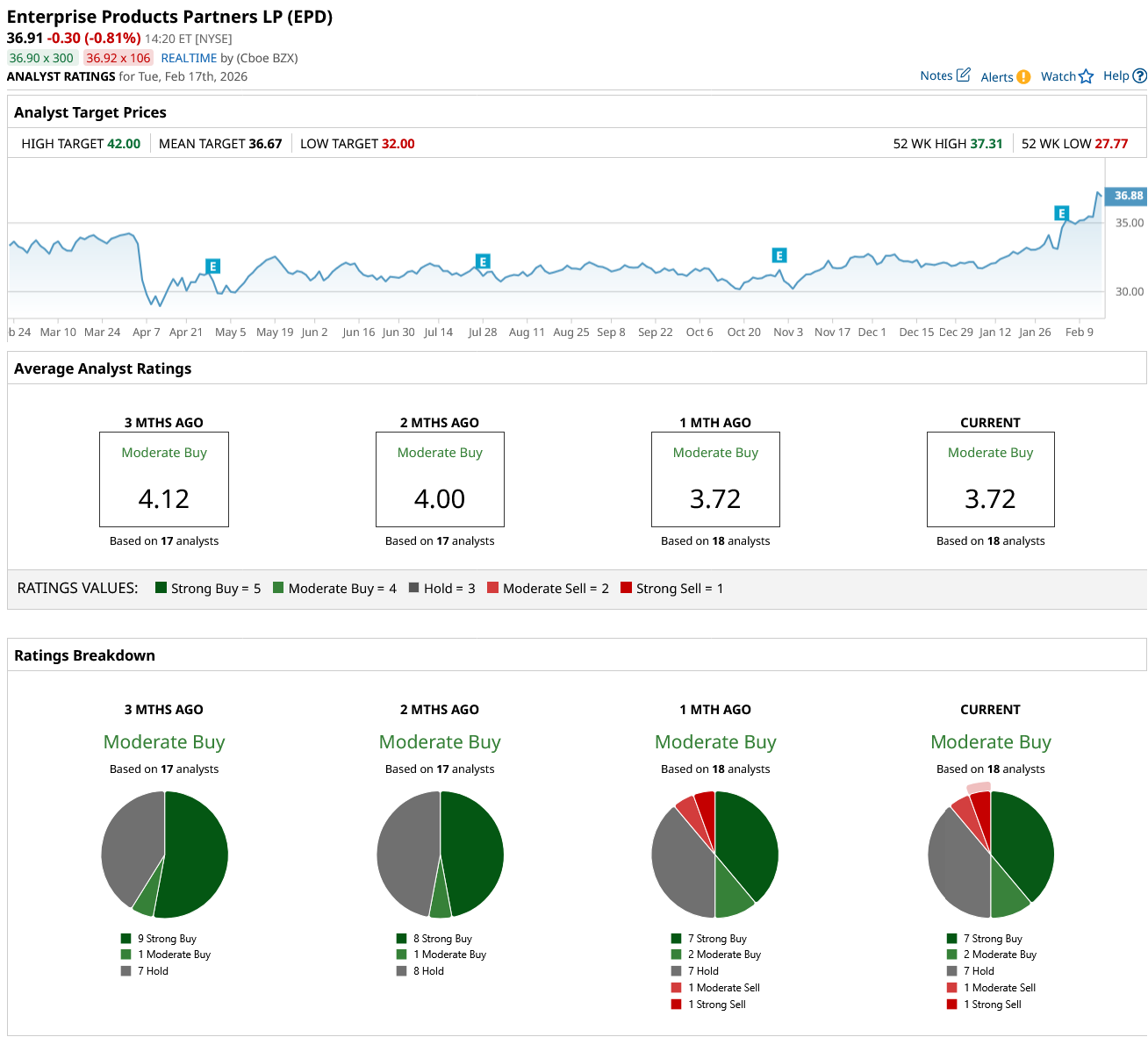

Overall, on Wall Street, EPD stock is a “Moderate Buy.” Of the 18 analysts covering the stock, seven rate it a “Strong Buy,” two rate it a “Moderate Buy,” seven say it is a “Hold,” one rates it a “Moderate Sell,” and one says it is a “Strong Sell.” EPS stock has also surpassed its average target price of $36.67. However, its high price target of $42 implies the stock can climb 13% over the next 12 months.

Dividend Stock #3: United Parcel Service (UPS)

Dividend Yield: 5.5%

United Parcel Service (UPS) is a global logistics and delivery company that picks up, transports, and delivers packages and freight for businesses and individuals worldwide. While logistics companies are cyclical, UPS has earned a name as a shareholder-friendly company capable of delivering steady income. UPS pays an attractive dividend yield of 5.5%, much higher than the industrial average of 2.4%. UPS’s forward payout ratio of 82%, while it seems high, is normal for mature companies with stable cash flows.

In 2025 alone, UPS generated $5.5 billion in adjusted free cash flow and returned $6.4 billion to shareholders through dividends and share repurchases. The company also expects to distribute approximately $5.4 billion in dividends in 2026, signaling continued commitment to income investors. While it may not be a Dividend Aristocrat yet, it has consistently increased its dividends for the past 16 years.

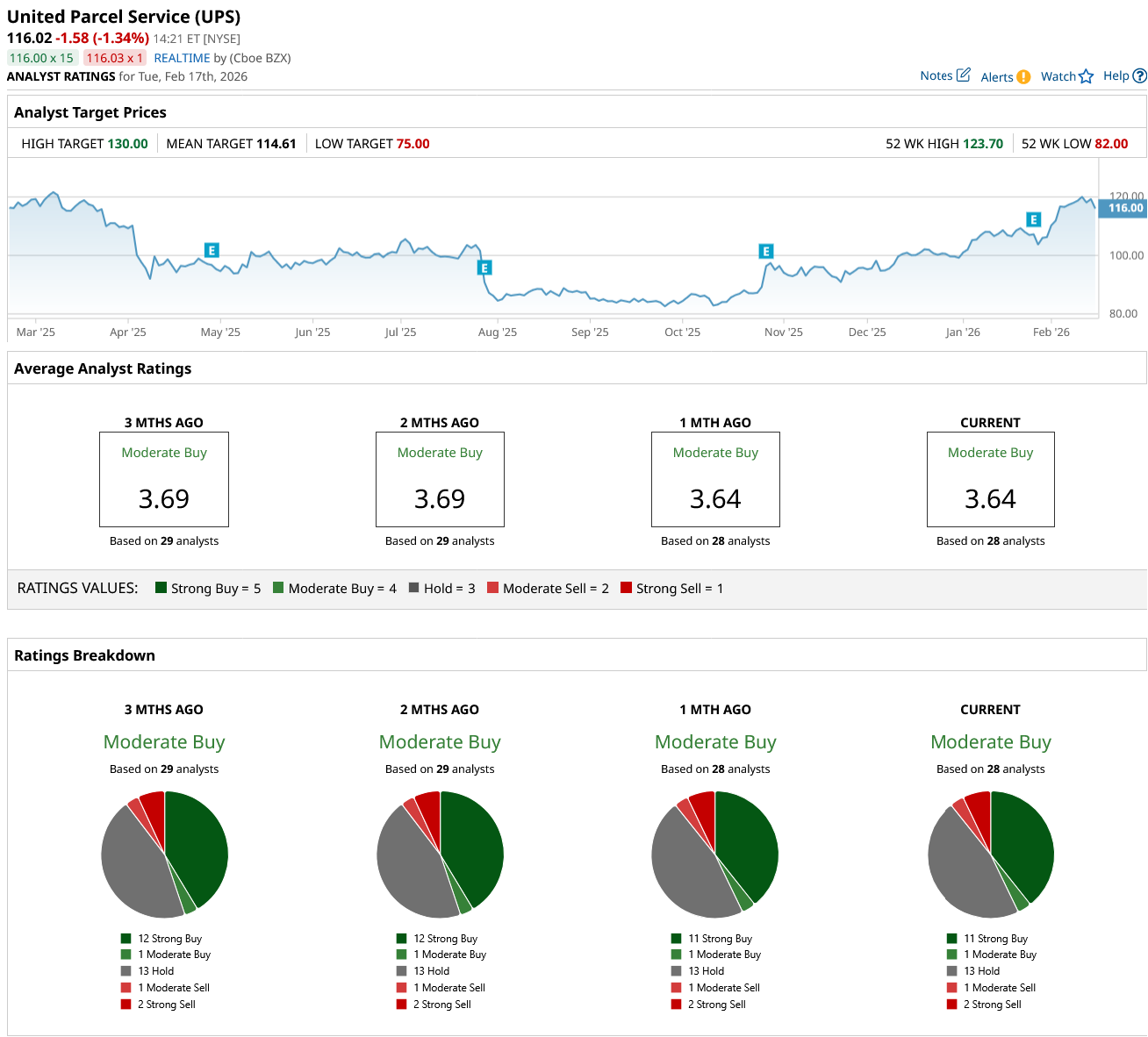

Overall, on Wall Street, UPS stock is a “Moderate Buy.” Of the 28 analysts covering the stock, 11 rate it a “Strong Buy,” one rates it a “Moderate Buy,” 13 rate it a “Hold,” one says it is a “Moderate Sell,” and two rate it a “Strong Sell.” UPS is trading higher than its average target price of $114.61. However, its high price target of $130 implies the stock can climb 9% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)