/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

When a company tells you it's not what you think it is anymore, you should probably listen.

That's the message Tesla (TSLA) delivered to investors during its fourth-quarter earnings call last month. The Austin-based electric vehicle (EV) maker is making a sharp pivot away from cars and toward artificial intelligence, robotics, and autonomous vehicles.

The timing seems odd. Tesla just reported its first-ever annual revenue decline, and vehicle deliveries dropped 8.6% in 2025. Yet CEO Elon Musk is doubling down on a vision that has some analysts calling it a "burn the ships" moment and others warning of serious risks ahead.

For investors trying to decide whether to buy Tesla stock, the question isn't really about EVs anymore. It's about whether you believe Musk can pull off one of the most ambitious business transformations in corporate history.

Tesla's Market Share Remains Under Pressure

Here's the paradox: Tesla's U.S. sales fell 17% in January, according to state registration data. But the EV giant may have gained market share.

Total EV sales in the U.S. dropped over 20% during the same period, according to estimates. When the entire market shrinks faster than your sales, you can lose volume but gain share.

Looking at the bigger picture, Tesla delivered about 1.64 million vehicles in 2025. That's down from 1.79 million in 2024, which was already down from the 2023 total of 1.81 million.

The company's years of rapid expansion seem to be over. After growing 38% year-over-year (YOY) in 2023, deliveries essentially flatlined in 2024 before contracting in 2025. Softer global demand, increased competition (especially from China's BYD), and internal model changes all contributed to the decline.

Tesla Is Pivoting to AI and Robotics

During the earnings call, Musk announced that Tesla will stop producing the Model S sedan and Model X SUV next quarter. These vehicles helped make electric cars mainstream when they launched in 2012 and 2015, but they now represent less than 3% of Tesla's delivery volume.

The production lines at the Fremont, California, factory will be converted to manufacture Optimus humanoid robots instead. Musk's goal is ambitious: one million Optimus units per year from that facility alone.

- Capital expenditures will more than double this year to over $20 billion, up from $8.6 billion in 2025.

- Tesla CFO Vaibhav Taneja said the money will fund six new factories, including facilities for battery storage, the driverless Cybercab, semi-electric trucks, and the Optimus robot factory.

- Additional spending will go toward AI computing infrastructure and expanding existing factories.

Musk acknowledged that Optimus is still in research and development mode. "We're still very much at the early stages," he said on the call. Notably, Tesla doesn't expect significant production volume until the end of 2026.

In 2024, Musk suggested that Optimus could eventually make Tesla a $25 trillion company. The current market cap sits at $1.57 trillion. He's also claimed that 80% of Tesla's value will eventually come from robots.

Tesla’s Autonomous Driving Bet

Further, Tesla is expanding its Robotaxi ride-hailing fleet across the U.S. The company launched a pilot service in Austin, Texas, in 2025 and recently began testing driverless passenger rides without human safety supervisors. According to the company's investor presentation, Tesla plans to expand coverage to seven additional markets in the first half of 2026: Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas.

Additionally, Tesla is building the Cybercab, a two-seat driverless vehicle with no steering wheel or pedals. Production is scheduled to start in April, though Musk has a history of missing self-imposed deadlines.

Competition in autonomous vehicles is intense. Alphabet's (GOOG) (GOOGL) Waymo is rapidly expanding in the U.S., while Baidu's (BIDU) Apollo Go is growing in China.

Tesla’s Top Line Growth Decelerates

Tesla's fourth-quarter results beat analyst expectations, with adjusted earnings per share of $0.40 versus estimates of $0.45. Revenue came in at $24.90 billion compared to estimates of $24.79 billion. But for the full year, revenue fell 3% to $94.8 billion from $97.7 billion in 2024. This marked the first annual revenue decline in company history.

Automotive revenue, which still accounts for about 70% of Tesla's business, dropped 10% in 2025. The company faced stiff competition from BYD (BYDDF) in China and from Volkswagen (VWAGY) and BMW (BMWKY) in Europe.

Net income in the fourth quarter plunged 61% to $840 million as operating expenses jumped 39%. Tesla said the cost increase was driven by AI and other research and development projects.

Also, Tesla announced it would invest about $2 billion in Musk's AI startup xAI. The company said the investment is "intended to enhance Tesla's ability to develop and deploy AI products and services into the physical world at scale."

Tesla's brand value declined by $15.4 billion in 2025, a 36% drop, according to Brand Finance. The firm cited a lack of innovative new EV models, relatively high prices compared to competitors, and Musk's controversial political activities.

Consumer recommendation scores in the U.S. fell to 4.0 out of 10, down from 8.2 in 2023, which basically means people aren't willing to recommend a Tesla to friends and family.

The Bottom Line for TSLA Stock Investors

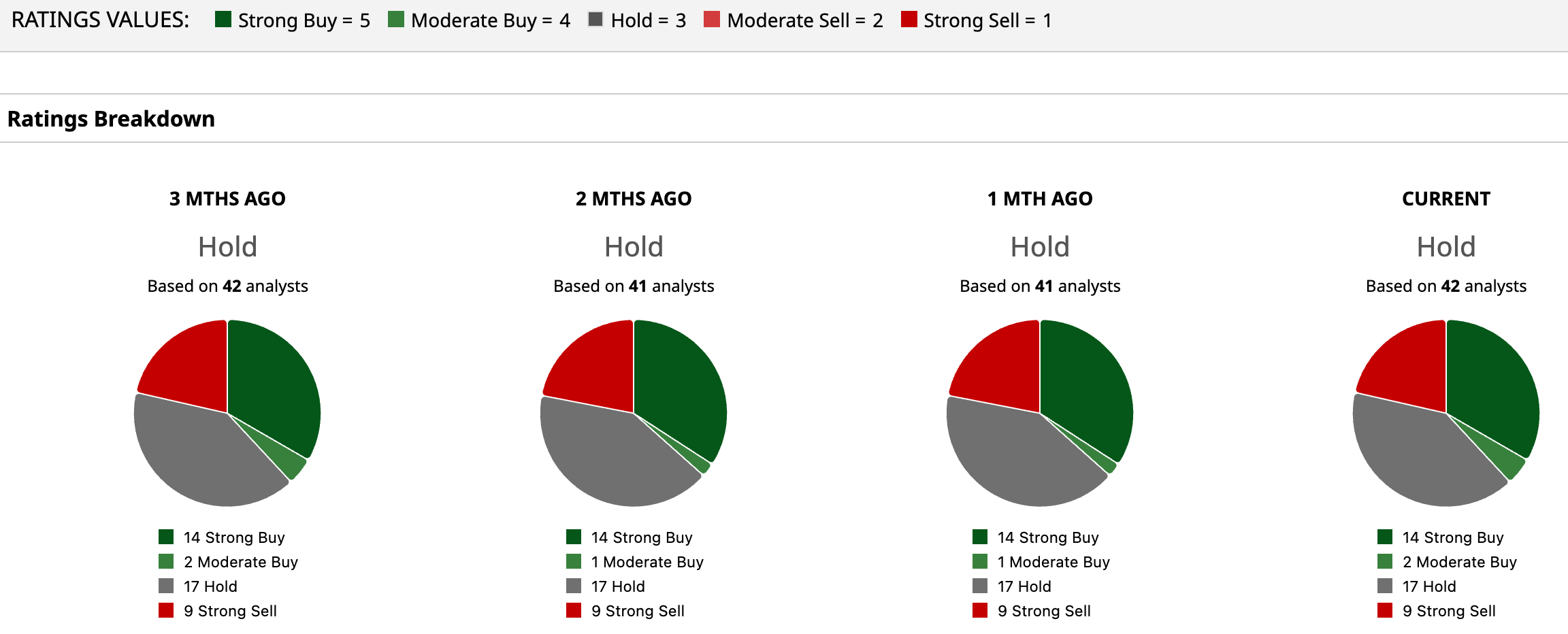

Out of the 42 analysts covering Tesla stock, 14 recommend “Strong Buy”, two recommend “Moderate Buy”, 17 recommend “Hold”, and nine recommend “Strong Sell”. The average TSLA stock price target is $406.94, below the current price of $410.85.

If you believe Tesla can successfully scale autonomous vehicles, humanoid robots, and AI chips while managing the enormous capital requirements and technical challenges, then the current TSLA stock price might look attractive.

However, if you think the EV heavyweight is abandoning a profitable car business for unproven technologies with intense competition and uncertain timelines, you'll want to stay away.

One thing is clear: Tesla is no longer primarily an EV company. For better or worse, it's betting its future on AI and robotics. Investors need to be comfortable with that reality before buying the stock.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)