/White%20tesla%20with%20outdoor%20background%20by%20capitalstreet_fx06%20via%20Pixabay.jpg)

Tesla (TSLA) has officially lost its crown in Europe. The U.S. electric vehicle (EV) maker is no longer the region’s top seller of fully electric vehicles, with Volkswagen (VWAGY) overtaking it and cementing a decisive shift in the European EV landscape. The change marks more than just a symbolic loss of market leadership — it underscores a year in which Tesla’s momentum in one of the world’s most important EV markets slowed sharply, even as overall EV adoption across Europe continued to grow.

Still, losing the European crown does not mean Tesla is out of the race. The key question for investors in 2026 is not whether Tesla can reclaim its lost share overnight, but whether it can stabilize performance, reset sentiment, and lay the groundwork for renewed growth.

Let's take a look at what went wrong for Tesla in Europe and, more importantly, what needs to change for TSLA stock to turn the narrative back in its favor in 2026.

About Tesla Stock

Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. Led by CEO Elon Musk, the powerhouse designs, develops, manufactures, leases, and sells high-performance fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, Tesla is increasingly focusing on products and services centered around artificial intelligence (AI), robotics, and automation. Tesla has a market capitalization of $1.56 trillion.

Shares of TSLA stock have fallen more than 5% on a year-to-date (YTD) basis. Optimism around the company’s robotaxi service fueled gains in TSLA stock at the start of the year, but those advances were later erased by broader market selloffs. Last week, the stock became caught up in the tech selloff, but it staged a partial rebound on Friday, Feb. 6.

Volkswagen Overtakes Tesla to Become Europe’s Top EV Seller

Europe’s EV market saw a clear turning point in 2025, as Volkswagen overtook Tesla for the first time in regional sales of fully electric cars. Tesla had dominated the continent’s EV segment for four years, but that run came to an end in 2025. That marks another blow for the U.S. automaker after China’s BYD (BYDDY) overtook Tesla as the world’s leading EV maker.

Last week, data from automotive analytics group JATO Dynamics showed that Volkswagen’s brand battery electric vehicles (BEVs) in Europe climbed 56% last year compared with 2024. The launch of the ID.7 sedan played a key role in driving Volkswagen’s success. Notably, VW’s lead goes beyond its core brand, as the group’s wider portfolio — including Audi, Skoda, Cupra, and Porsche — strengthens its EV presence. At the same time, JATO data showed that Tesla vehicle registrations fell 27% over the same period. As a result, VW sold 274,278 BEVs in Europe last year, compared with 236,357 for Tesla.

Tesla’s struggles stand out, given that Europe’s EV market continued to expand at a solid pace last year. JATO Dynamics said EVs took a “significant step forward” in Europe in 2025, with fully electric car registrations rising 29% year-over-year (YOY). Notably, overall car sales rose only 2.3% in 2025 across 28 European countries, including some non-European Union members like Norway and Switzerland.

The U.S. EV maker’s slide across the continent showed no signs of easing in the first month of the new year. Tesla’s registrations in the U.K., its biggest European market, tumbled more than 57% YOY to only 647 vehicles in January. Meanwhile, Chinese rival BYD almost doubled Tesla’s volume, selling 1,326 BEVs in the country last month, up 21% YOY. Moreover, the company saw a sharp drop in registrations in Norway, the Netherlands, France, and Belgium.

How Tesla Can Turn Around Its Fortunes in Europe and Reclaim the EV Crown

Before discussing how Tesla might reverse these declines — or at least find a bottom in Europe — it’s important to determine the key reasons for its struggles. In fact, there aren’t all that many.

The first reason is the company’s limited model lineup, as it mainly sells the Model Y and the Model 3 in Europe, which are starting to feel dated compared with offerings from rivals. Still, the Model Y remained Europe’s most-registered single vehicle at roughly 150,000 units, though that figure was down 28% YOY. The second reason behind Tesla’s struggles in the region is a damaged brand image tied to CEO Elon Musk’s controversial political activities this past year.

So, what can the company do to turn things around in Europe? The most obvious step is to replace or substantially refresh the aging Model Y and Model 3 to better compete with newer designs from European and Chinese rivals. This is critical to combat the perception that Tesla's lineup is stale. Of course, the company recently introduced a more affordable “Standard” version of the Model Y and Model 3, but sales have been weak, as consumers viewed them as offering a poor value proposition.

Another problem with the company’s current lineup is that its vehicles are somewhat large for many narrow European streets. With that, the launch of a smaller, more affordable vehicle — often referred to in reports as the Model 2 or Model Q — would likely make a significant difference, enabling Tesla to tap into the lower end of the EV market while offering European consumers an EV better suited to their needs and preferences. Europeans love compact cars, as evidenced by the Dacia Sandero — a budget-friendly subcompact hatchback — being the best-selling vehicle in Europe in 2025. Tesla could potentially leverage the Cybercab platform for this lower-cost vehicle, allowing it to kill two birds with one stone.

Turning to the second issue, Tesla's damaged brand is not something that can be fixed easily, at least not in the near term. For context, Tesla faced consumer backlash in Europe last year, with the effects still evident today following Musk’s support for far-right parties on the continent. As outlined previously, many analysts have warned that Tesla faces a long road to brand recovery, with some suggesting the damage to TSLA stock could be lasting. What could help here is a more localized, neutral, and professional PR and marketing strategy tailored to Europe.

Meanwhile, Musk said during his appearance at the World Economic Forum in Davos last month that Tesla is likely to win regulatory approval in Europe for its driver-supervised Full Self-Driving (FSD) system as early as February. The Dutch vehicle authority, RDW, is also expected to make a decision on FSD in February. Tesla has said that once approval is granted in the Netherlands, other EU countries could recognize the exemption and permit a rollout ahead of formal EU-wide approval. That could help boost Tesla's “tech-forward” brand image.

What Do Analysts Expect for TSLA Stock?

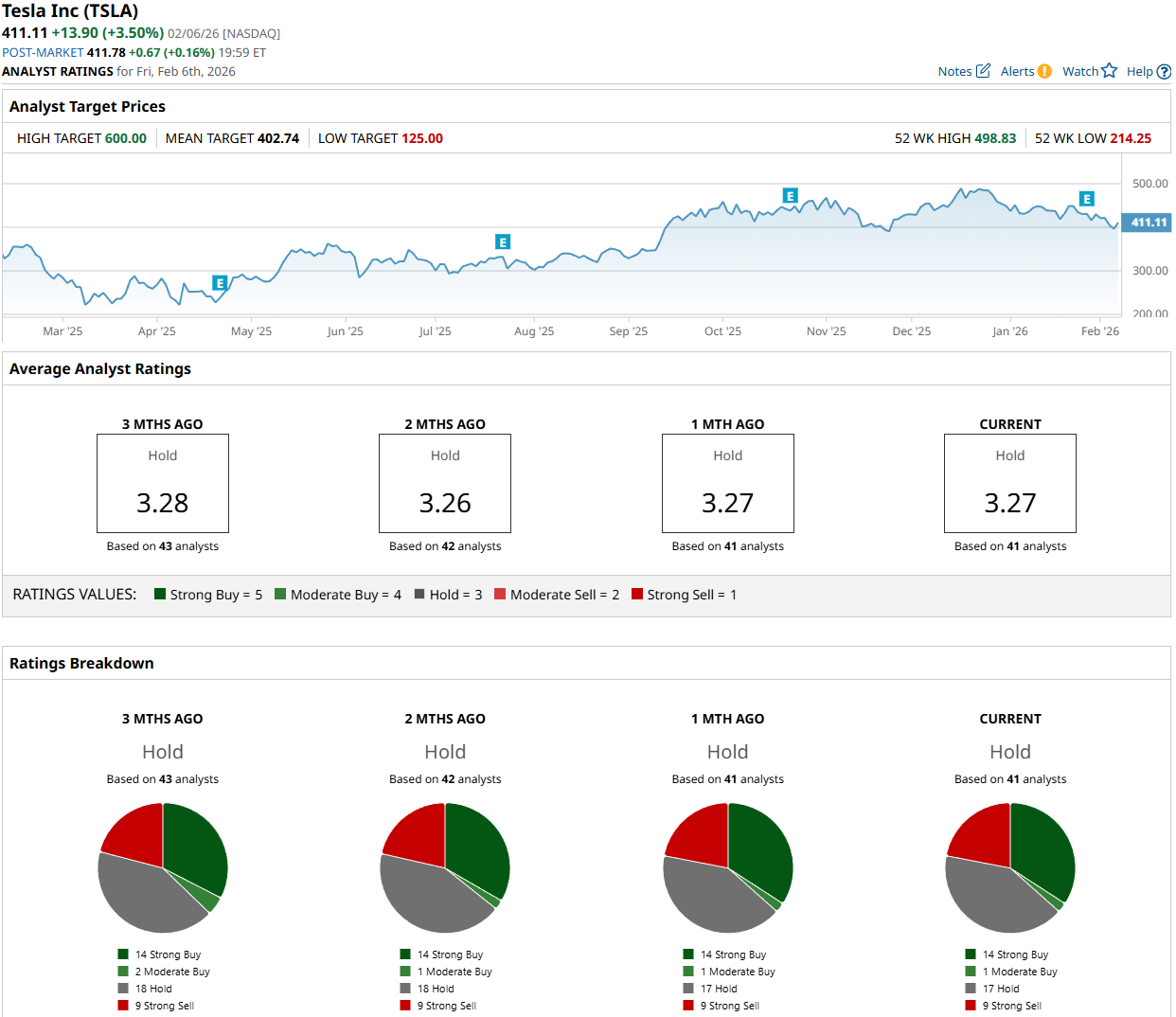

Tesla’s future continues to spark debate among Wall Street analysts. While 14 analysts rate the stock as a “Strong Buy” and one assigns a “Moderate Buy” rating, 17 recommend a “Hold” rating while nine call TSLA stock a “Strong Sell.” Tesla bulls remain optimistic about Elon Musk’s ambitious vision for AI, robotics, and self-driving technology. At the same time, bears argue that Tesla’s core EV business will remain under pressure and that Musk’s bold promises will not materialize quickly enough — if at all — to justify TSLA stock’s stretched valuation.

Shares of Tesla currently trade slightly above the mean price target of $402.74. However, the Street-high target of $600 still implies meaningful potential upside of 41%.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)