Precious metals have long been seen as a safe haven during any market uncertainty. And as the stock market flashes the occasional warning sign of stress, these commodities have been big winners over the last year. Gold prices are up 77% over the last 12 months, and the price of silver has done even better, rising 153%.

But it’s also noteworthy that both gold and silver stumbled lately. Gold dropped nearly 13% from its late January high before making a mild recovery; silver tumbled 31% from its high of $114 and is now drifting at $80.

That’s why a warning from Hank Smith, the CIO of Haverford Trust, is getting attention these days. He warns that investors should be cautious about putting money into gold, silver, or any commodity. He says the run higher in 2025 and early this year is more fueled by momentum instead of substance, and investors should instead consider stocks that offer yield, such as dividend stocks.

"Those (commodities) are speculations. They're not investments," he told Business Insider. “Because physical commodities do not have earnings, they don't have an income statement, a balance sheet, they don't pay dividends or interest—you’re buying that with the expectation that someone's going to come along and buy at a higher price. That's the only way you're going to make money.”

Smith has a point—investors should never, ever consider putting all their investments into a single class such as commodities. And while I believe that gold, silver, and even cryptocurrency have a place in a well-diversified portfolio, I agree that investors should have the bulk of their investments in the stock market, looking for yield.

Here are two ways to capitalize on that strategy through exchange-traded funds. Each has a different strategy but is geared toward providing yield through proven strategies.

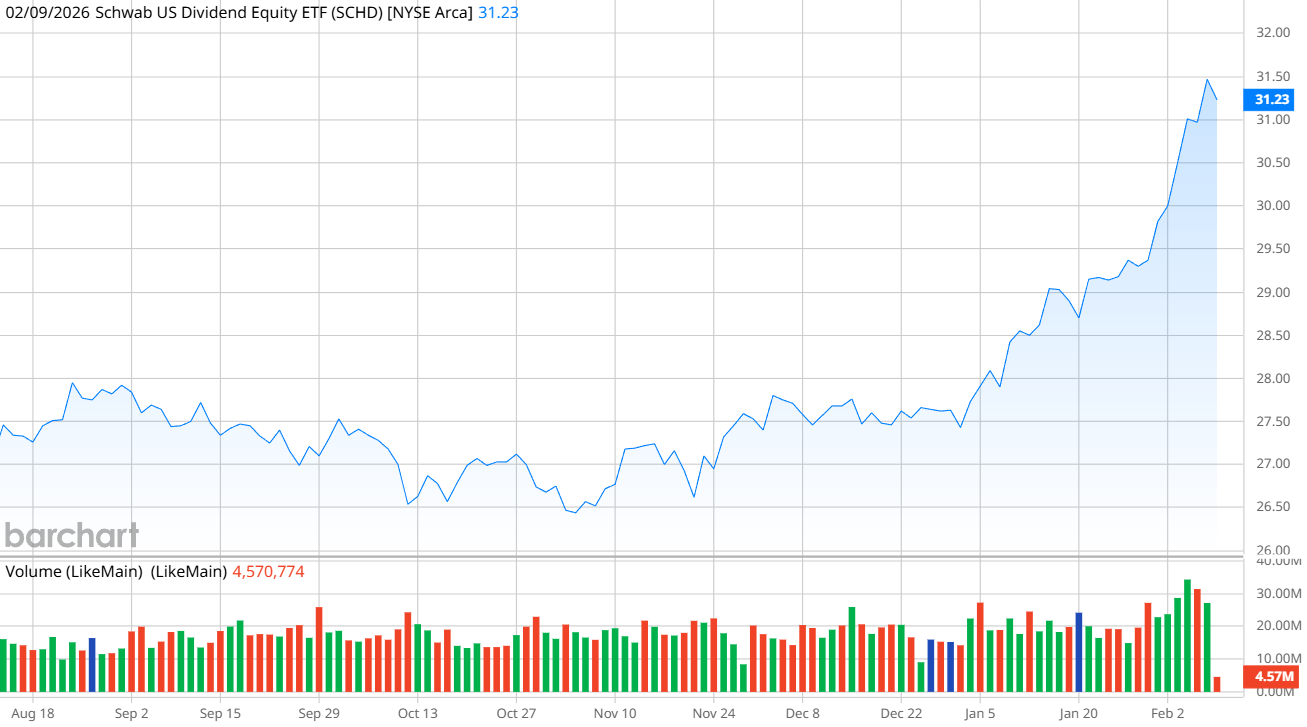

Quality Dividend Growth Through SCHD

The Schwab U.S. Dividend Equity ETF (SCHD) is one of the most popular dividend ETFs on the market, with $78.5 billion in net assets and trading volume of nearly 20 million shares per day.

The fund tracks the total return of the Dow Jones U.S. Dividend 100 Index, which includes U.S.-based dividend-paying stocks. The fund focuses on large-cap value stocks that provide stable returns and dividend growth—ideal for any investor seeking consistent yield.

The top holdings in the fund include Verizon Communications (VZ), Coca-Cola (KO), Altria Group (MO), ConocoPhillips (COP), and Lockheed Martin (LMT). No stock in the ETF has more than a 4.5% weighting, giving the fund significant diversification without overexposure to any single name.

The fund is up 13.4% in the last year, which is just under the return of the S&P 500 ($SPX). But when you calculate the total return, including dividends, the SCHD ETF comes out on top with a one-year return of 18.6% versus the total one-year return of 16.5% for the broader index.

The SCHD ETF has a small expense ratio of 0.06%, or $6 annually per $10,000 invested, and provides a 3.5% yield.

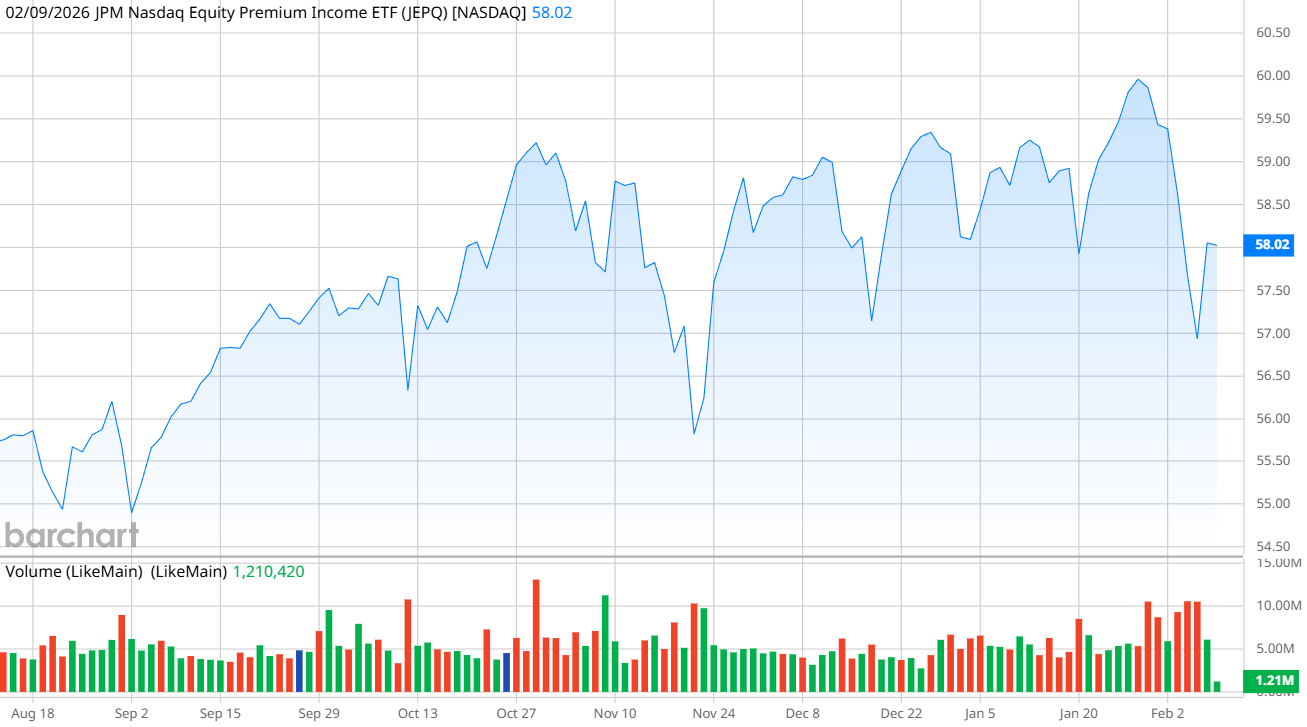

A Covered Call Strategy With the JEPQ ETF

My favorite ETF for yield right now is the J.P. Morgan Nasdaq Equity Premium Income ETF (JEPQ). This is an actively managed fund that uses a covered call strategy to invest in Nasdaq-100 stocks through equity-linked notes. Fund managers for J.P. Morgan Asset Management sell out-of-the-money call options on stocks, and then pay the proceeds to shareholders through a monthly dividend.

While options aren’t for every investor, this is a relatively safe way to invest. The covered call strategy limits downside risk (and upside potential), and because you’re investing in the ETF rather than holding the options, you never have to worry about being assigned shares or losing money on a bad options bet.

This strategy also means that you’re investing in some of the biggest stocks in the market. Nvidia (NVDA) isn’t considered a true dividend stock because it offers only a paltry 1-cent dividend per quarter. But because JEPQ functions on a covered call strategy. Nvidia is the biggest holding in the fund with a weighting of 7.1%. Other top holdings in the fund, which include 92 stocks, are Apple (AAPL), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Amazon (AMZN).

The JEPQ is up only 2% in the last year, badly underperforming the S&P 500. But with a whopping dividend yield of 10.3%, thanks to the covered call strategy, it has a total return of 13.5%, which nearly matches the broader index. This fund has an expense ratio of 0.35%.

If you are looking for aggressive dividend yield and exposure to the biggest stocks in the market, the JEPQ ETF is hard to beat.

On the date of publication, Patrick Sanders had a position in: JEPQ , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)