Dividend investing is one of the best strategies for generating passive income. However, there are thousands of dividend-paying companies in the market, and only a few dozen offer the stability and consistency that long-term investors want.

Now, I’ve written extensively about dividend stocks and have ranked them across many different metrics and criteria, so I know finding the right candidate for your long-term income portfolio can be a pain.

Thankfully, there are other options, like exchange-traded funds (ETFs) that focus on dividends. One of the most popular is the Schwab U.S. Dividend Equity ETF (NYSE Arca: SCHD). Today, I'll cover its pros and cons, and whether the ETF is right for you.

What Is The Schwab U.S. Dividend Equity ETF?

The Schwab U.S. Dividend Equity ETF was launched in 2011 and tracks the Dow Jones U.S. Dividend 100™ Index. The index comprises 100 companies that pay dividends and have the business and financial strength to pay them consistently. To be included in the index, a company must have paid dividends for at least 10 consecutive years, among other stringent criteria. The ETF is managed by Charles Schwab Asset Management, one of the most prominent asset managers here in the United States.

Relevant ETF Details for Investors to Know

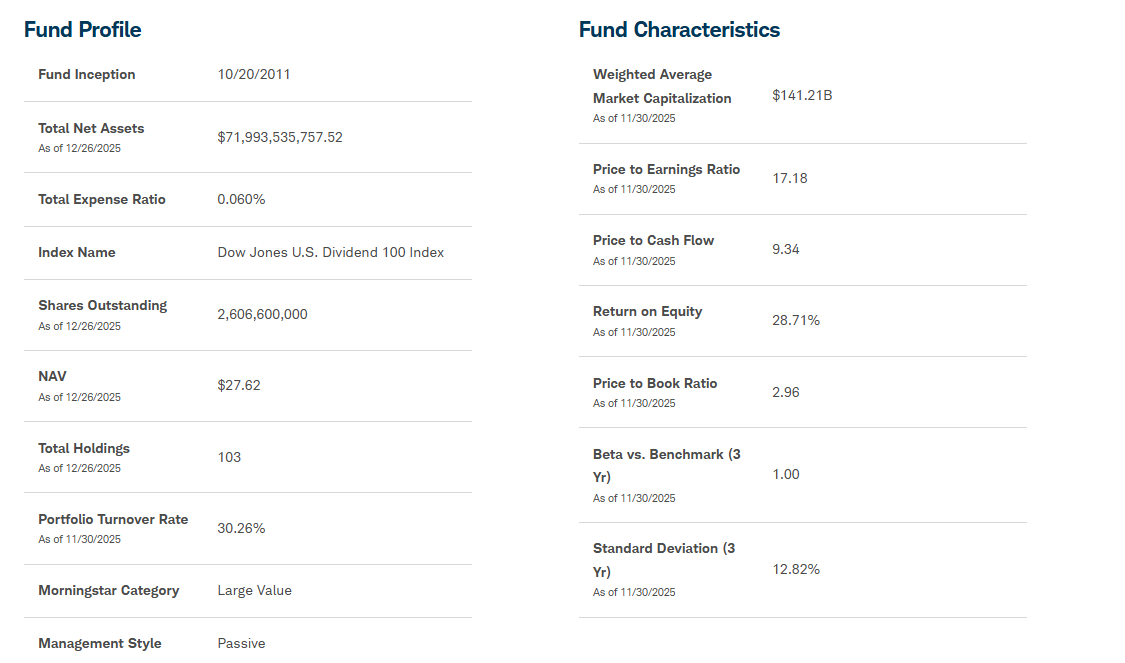

Before we proceed to the pros and cons, let’s dissect the ETF’s key metrics.

The fund holds just shy of $72 billion in assets as of December 26, 2025. It has about 2.6 billion shares outstanding, and has a net asset value (NAV) of $27.62 (per share). The NAV is calculated by taking a fund's total assets, subtracting its total liabilities, and dividing the result by the number of outstanding shares. The metric is the ETF's “fair value” and is a key guiding metric for investors. If the ETF is trading above its NAV, it’s trading at a premium and might be expensive. If it’s below, then it’s a discount and might be cheap.

Notice that I say “might” in these statements. That’s because NAV and trading price don’t tell the whole story. Market demand, liquidity, and investor sentiment still play a key part in valuation, just like with regular stocks.

Distributions

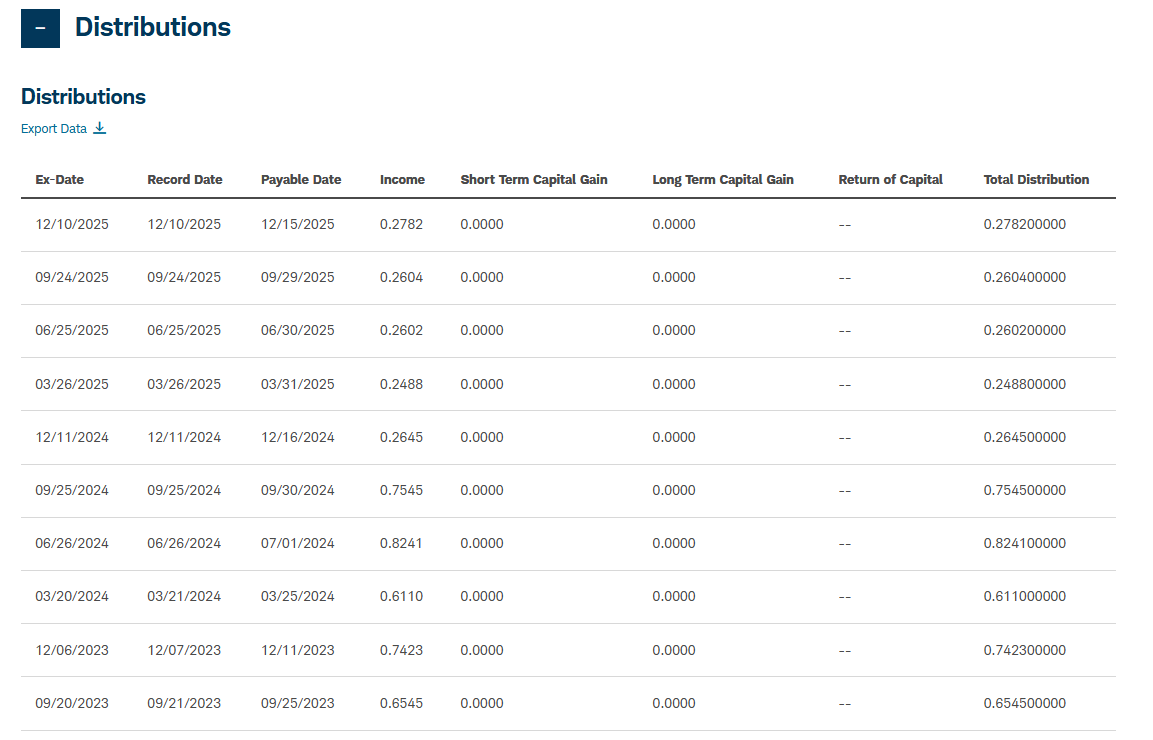

Now, let’s talk distributions- this is the income you get for holding the ETF.

SCHD pays distributions four times a year. Its last payout was 27.82 cents, which translates to a roughly $1.11 forward annual dividend rate and a yield of around 4%. However, its distributions fluctuate based on the fund’s actual income for the quarter, so expect this number to change. SCHD has a return on equity (ROE) of 28.71%, meaning it earns roughly 29 cents for every dollar invested. This is a strong indicator of financial efficiency.

Plus, unlike high-income ETFs I’ve covered in the past, SCHD’s distributions do not include any return of capital (ROC). ROC is essentially the fund giving you back some of your money, which erodes its overall NAV.

Lastly, SCHD has a total expense ratio (TER) of 0.06%- or just $6 for every $10,000 invested. TER is the annual cost of owning the fund, expressed as a percentage of its assets. These include administrative and management fees, as well as other operational costs. The lower the TER, the more cost-efficient the ETF, which is the case here.

Why Consider SCHD For Your Income Portfolio?

What makes the Schwab U.S. Dividend Equity ETF a good choice for long-term investors is its focus on high-quality dividend stocks. As mentioned earlier, the Dow Jones U.S. Dividend 100™ Index comprises companies with strong financials and an emphasis on shareholder value, as evidenced by their consistent dividend payments.

It also offers the same benefit as other ETFs: built-in diversification. When buying SCHD, you get exposure to several sectors all at once. Right now, the ETF has holdings diversified in 10 industries, with the largest being Energy (19.34%) and Consumer Staples (18.50%). I’ve featured many Energy and Consumer Staple stocks that belong to the Dividend 100™ Index in my articles; with SCHD, you get access to most, if not all, of them.

Lastly, distributions from investing in SCHD are qualified dividends, which are taxed as long-term capital gains. Long-term capital gains enjoy lower rates (0% to 20%, depending on your income bracket) than ordinary income tax, which can reach up to $206,583.50 plus 37% of any amount exceeding $768,700 for married individuals filing joint returns.

The Disadvantages of SCHD

But it’s not all positive. SCHD has several disadvantages you should know about.

First is concentration risk. SCHD is diversified, but not evenly diversified. 38% of the ETF’s holdings are concentrated in the Energy and Consumer Staples sectors. Any negative movement in these sectors- price drops, dividend cuts, etc - may have outsized effects on the ETF’s performance and distribution.

Speaking of which, SCHD’s distribution is growing, but at different rates from quarter to quarter and year to year. Again, these fluctuations are caused by changes in the dividends paid by the underlying companies, shifts in the fund’s holdings, and timing differences in dividend payments. Economic conditions, company earnings, and sector performance also play a key role.

Next, dividend ETFs are sensitive to interest rate changes. Rising interest rates make bonds and fixed-income securities a better choice than dividend-paying stocks- they’ll likely pay higher, after all. Additionally, higher rates mean increased borrowing costs, which can potentially squeeze profits.

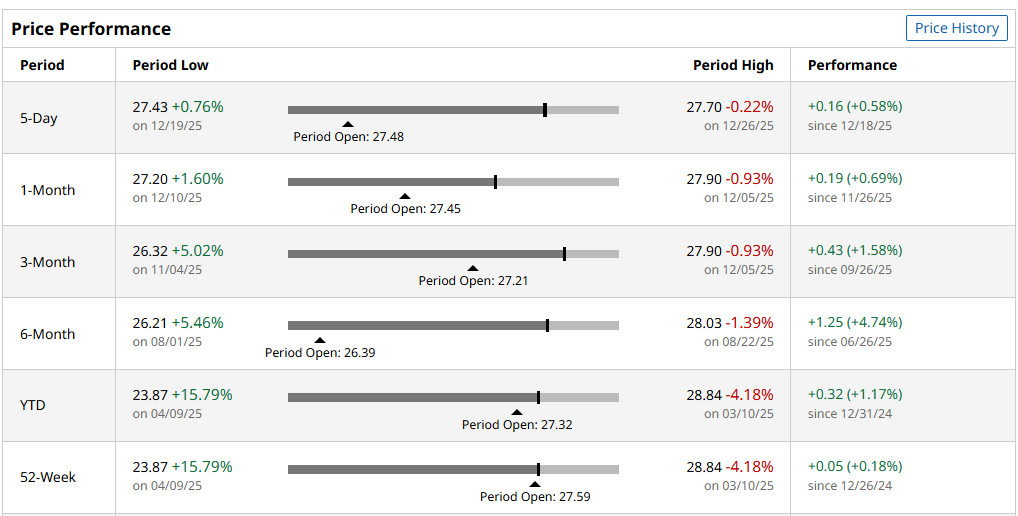

Lastly, there’s the fact that dividend ETFS, much like dividend stocks- aren’t exactly geared towards high growth. Yes, you get reliable distributions, but that comes with slow price performance. And when I mean slow, it can sometimes be glacial.

For reference, here is SCHD’s performance from the last five days to the last 52 weeks (not including dividend distributions):

As you can see, it barely broke over 5% in all short-term monitoring periods. If we take the 52-week performance (0.18%) and add the total distribution percentage from 2025 ($1.05, or 3.80% as of the last closing price), we get a total return of less than 4%.

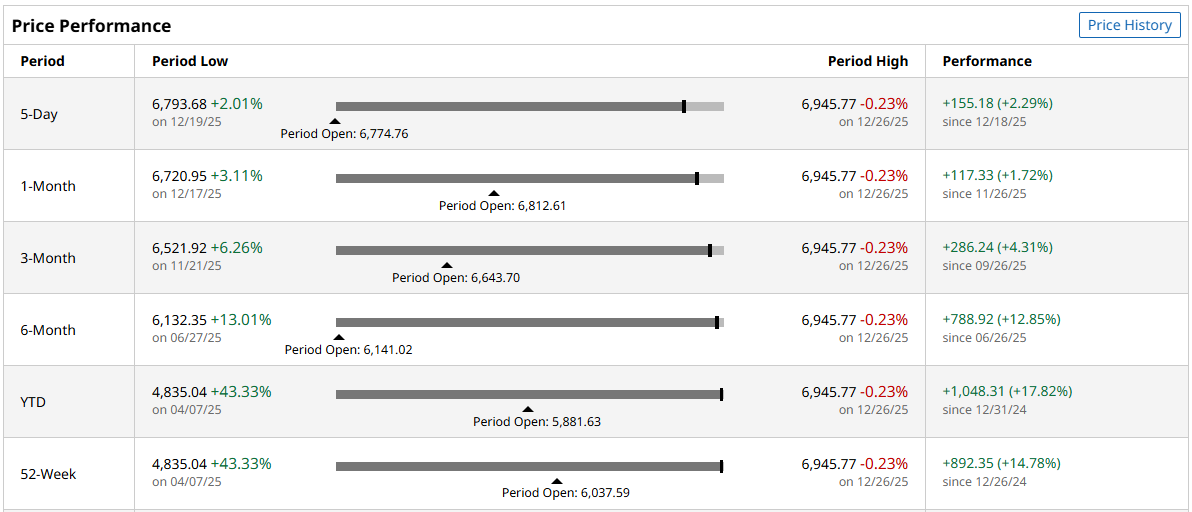

Here’s the S&P 500’s performance during the same period.

So, when you invest in SCHD and other dividend-focused ETFs, know that you’re buying income stability, not necessarily growth.

Final Thoughts

The Schwab U.S. Dividend Equity ETF is a low-cost, diversified alternative to picking individual dividend stocks for your long-term portfolio. It has a history of strong and consistent payouts, high-quality picks, and offers a tax-efficient structure that long-term investors would love. However, it does come with some caveats, the biggest of which is its slow growth, variable distributions, and interest rate sensitivity.

At the end of the day, SCHD is just another choice. You can pick it up or not, depending on your trading goals, risk tolerance, and income needs.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)