/Waste%20Management%2C%20Inc_%20logo%20and%20chart%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Based in Houston, Texas, Waste Management, Inc. (WM) operates one of North America’s most expansive environmental services platforms. With a $91.4 billion market cap, the company manages waste collection, recycling, disposal, and material recovery while also converting landfill gas into energy and delivering regulated healthcare waste and secure information destruction services.

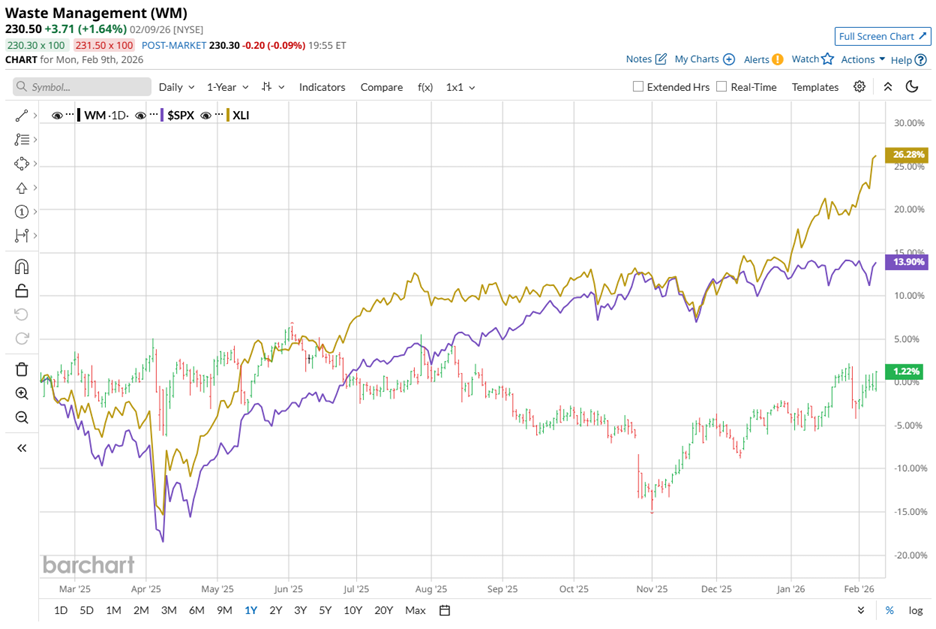

Over the past 52 weeks, WM stock gained 2.5%, significantly lagging the S&P 500 Index ($SPX) 15.6% gain. Year-to-date (YTD) performance, however, has been stronger, with WM rising 4.9% and surpassing the broader market’s modest 1.7% increase.

Sector comparisons further highlight the gap. The State Street Industrial Select Sector SPDR ETF (XLI) has surged 26.5% over the past year and climbed 12% YTD.

On Jan. 28, Waste Management released its Q4 2025 earnings results and prompted an immediate market reaction. Shares declined nearly 3.7% in the following session after revenue totaled $6.31 billion, falling short of Street expectations of $6.39 billion, despite still increasing 7.1% year over year.

Adjusted EPS followed a similar pattern, coming in at $1.93 versus consensus estimates of $1.95, yet again improving 13.5% year over year. Margin performance offset those headline misses, as operating adjusted EBITDA in the Legacy Business rose 10.1% in 2025 and margins expanded 150 basis points to 31.5%. Healthcare Solutions strengthened its results further, with adjusted EBITDA margins improving 180 basis points to 16.9%.

Management’s forward outlook reinforced confidence in the operating model. For 2026, they have guided operating EBITDA of $8.15–$8.25 billion and projected free cash flow of $3.7–$3.8 billion.

These targets reflect the strength of WM’s unreplaceable solid waste network and disciplined investments in recycling, renewable energy projects, fleet modernization, and a premier medical waste platform.

Meanwhile, analysts expect diluted EPS of $8.14 for fiscal year 2026, ending in December, implying 8.5% year-over-year growth. Waste Management has beaten EPS expectations in two of the past four quarters while missing in the remaining two.

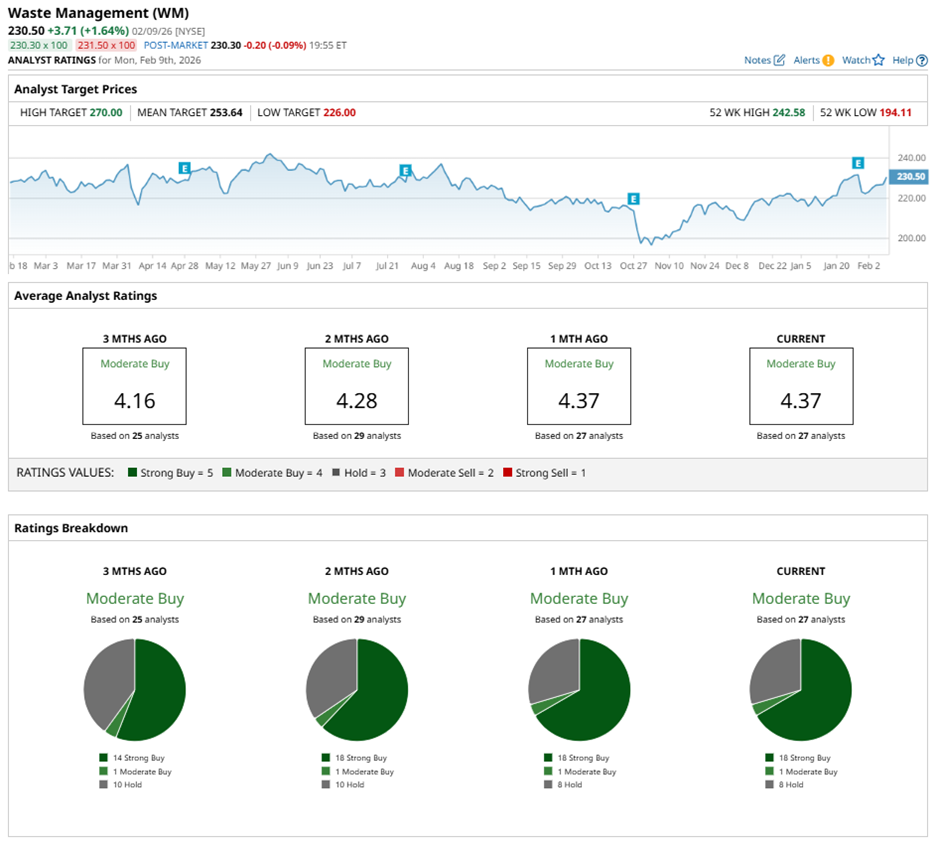

Wall Street continues to support WM stock, assigning it a “Moderate Buy” consensus rating. Among 27 analysts, 18 have issued a “Strong Buy” recommendation, one assigns a “Moderate Buy,” and eight maintain “Hold” ratings.

The confidence has strengthened over time. Three months ago, only 14 analysts rated the stock a “Strong Buy,” signaling improving conviction as margin expansion and capital discipline continue to validate management’s long-term strategy.

Price targets tell the same story in quieter tones. On Jan. 30, Oppenheimer raised its target from $263 to $264 while reiterating an “Outperform” rating. That same day, TD Cowen analyst James Schumm increased his target from $265 to $270 and maintained a “Buy” rating.

WM’s average price target of $253.64 implies potential upside of 10%. Meanwhile, TD Cowen’s Street-high $270 target suggests even greater potential of 17.1% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.