ConocoPhillips (COP) reported strong cash flow yesterday and said it would pay shareholders 45% of its operating cash flow. That makes COP stock looks cheap. One way to play it is to sell short one-month puts with a yield of at least 2%.

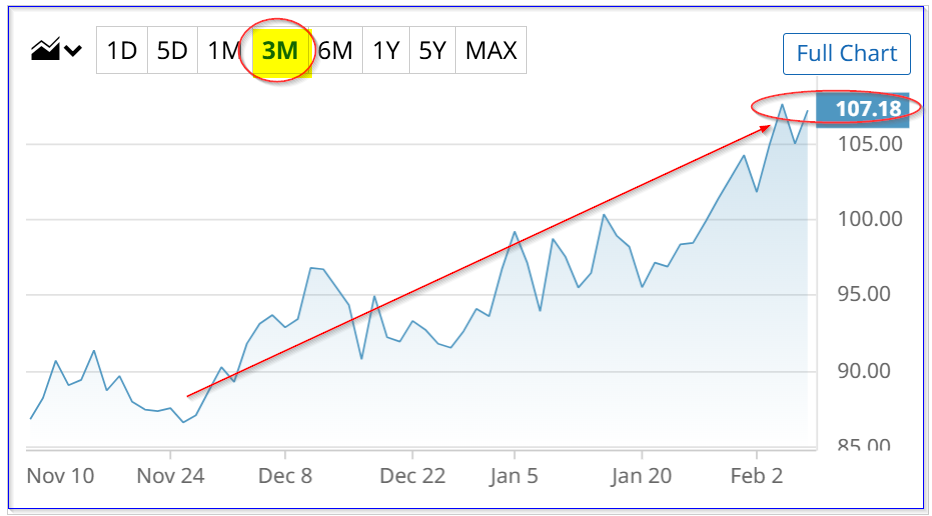

COP is at $107.23 in midday trading, up over 2% today. But it could still have more to go, based on its price targets. I discussed this in a Jan. 18 Barchart article ("ConocoPhillips Has a 3.42% Annual Yield, but Short-Put Investors Can Make 1.5% Monthly").

Strong Cash Flow Results

ConocoPhillips reported stronger-than-expected quarterly revenue, according to Seeking Alpha, with full-year revenue up 6.78% to $60.279 billion, according to Stock Analysis.

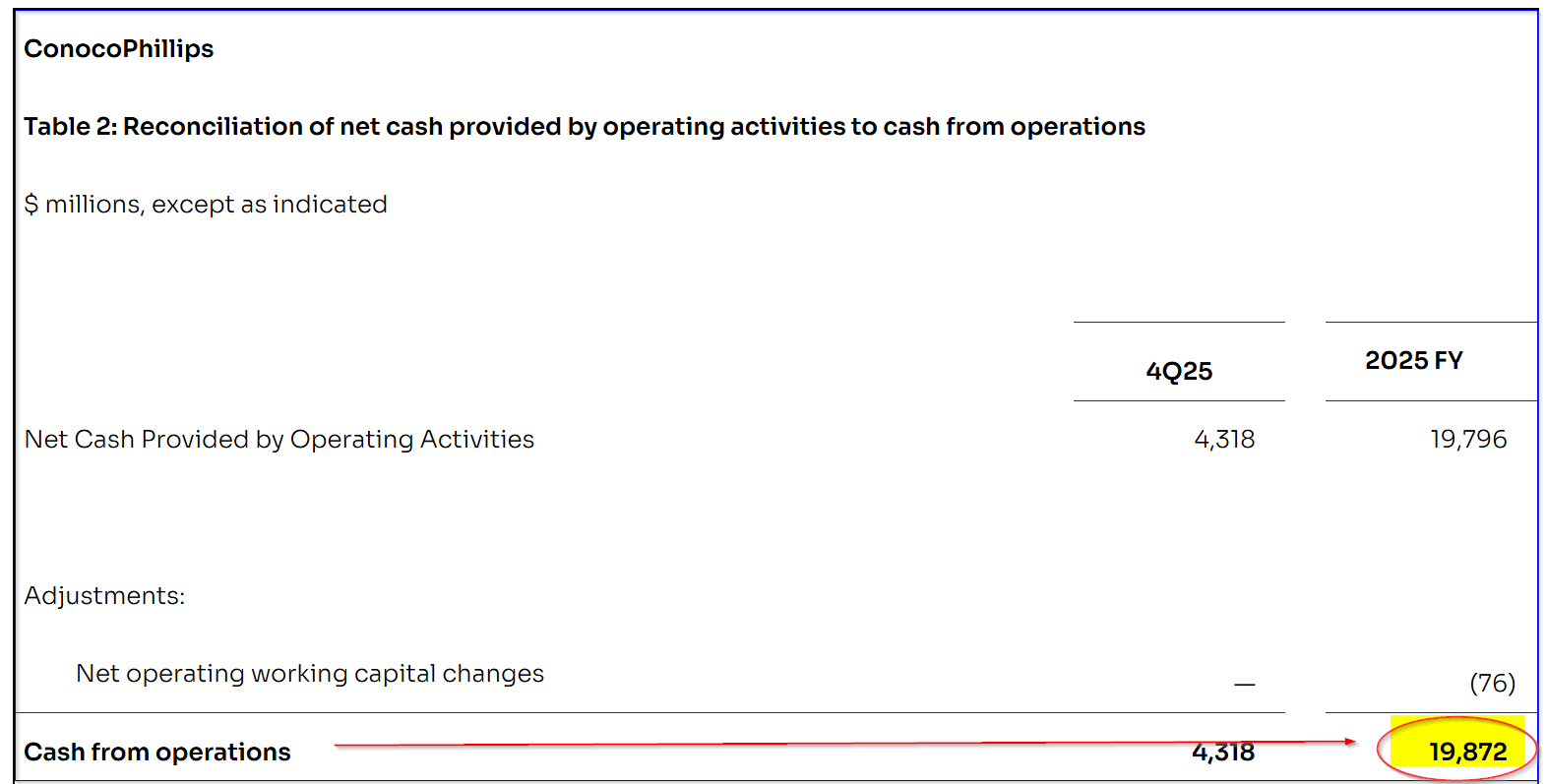

Moreover, Concoco's full-year cash flow from operations (CFO) was $19.872 billion. Although lower than last year ($20.14 billion), it still represented about 1/3 revenue.

More importantly, management said it would pay out 45% of its expected 2026 CFO to shareholders in buybacks and dividends.

That implies that its dividend looks very secure, especially after it raised it 8% last quarter.

Dividends Look Secure

For example, analysts now project revenue could be $52.52 billion in 2026 and $59.85 billion in 2027. That implies $56.2 billion in average revenue for the next 12 months (NTM). That is lower than in 2025, but the numbers still work for shareholders.

For example, assuming ConocoPhillips makes ⅓ of its revenue in CFO, it could generate $18.7 billion in cash flow. That was lower than the $19.872 billion in 2025. However, buybacks and dividends still look affordable:

45% x $18.7 billion = $6.23 billion shareholder payments

In Q4, Conoco paid out $1.038 billion in dividends and about $4 billion through 2025. Buybacks were $1.022 billion in Q4 and $5 billion in 2025.

So, assuming it keeps this pace, total dividends and buybacks (if kept at the same level) would be $9 billion. That is more than the $6.23 billion in expected CFO. But its dividend payments are still affordable.

Moreover, if CFO margins rise just slightly to 35% as in 2025, its NTM CFO would rise to $19.67 billion (i.e., 35% x $56.2 billion). So, 45% of that amount would be $8.85 billion, enough to cover the same level of dividends and buybacks as in 2025.

Price Targets

In my last article, I showed that COP stock could be worth between $112 and $126 per share, based on its historical dividend yield metrics. That still provides good upside for investors of between 4.4% and 17.5%, or +10.95% on average.

Moreover, analysts' surveys show that average price targets range between $113.43 (Yahoo! Finance) and $128.88 (AnaChart.com). That provides a potential average upside of +13%.

So, buying COP here could potentially provide a good return of 11% to 13% over the next 12 months (NTM). Including COP's 3.13% annual yield (i.e., $3.36 annual dividend/$107.23 price), the total return could be 14% to 16% over the next year.

However, another way to play this is to sell short out-of-the-money (OTM) put options for monthly yields. That way, an investor can set a lower potential buy-in point as well as get paid income while waiting.

Shorting OTM COP Puts

For example, 2 weeks ago I suggested shorting the $92.50 COP put option (i.e., 5.79% below the trading price) expiring on Feb. 20.

At the time, the premium received was $1.63, providing a one-month yield of 1.762% (i.e., $1.63/$92.50). That premium has now dropped to just 38 cents, and there is little chance it will be exercised (i.e., it will likely expire worthless).

So, this play been very successful and it makes sense to go out another month and short another put, perhaps less out-of-the-money (OTM).

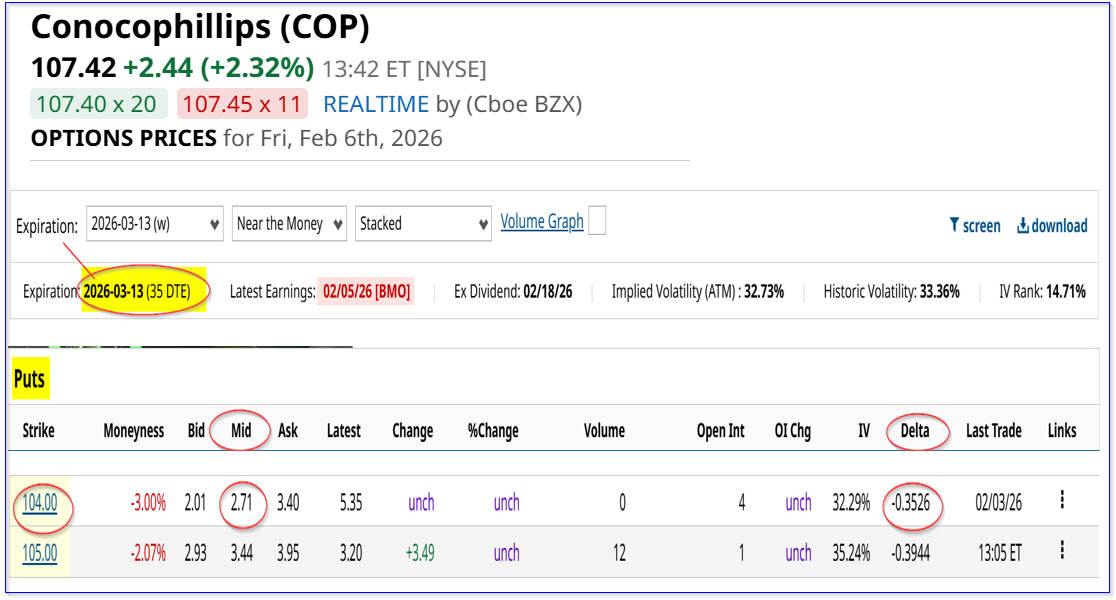

For example, look at the March 13 expiry period. It shows that the $104.00 strike price put option, 3% lower than today's price, has a midpoint premium of $2.71.

That provides a one-month yield income of 2.60% (i.e., $2.71/$104.00). Even after deducting the cost of rolling over the 38 cents cost of closing the prior short-put play, the net yield is still over 2.0%

($2.71-$0.38)/$104.00 = $2.33/$104.00 = 2.24%

That allows the investor to have made a net credit of $2.33 and $1.25 two weeks ago (i.e., $1.63-$0.38), or $3.58 in the 6 weeks from Jan. 18 to March 13.

The average investment cost will have been $98.25 ($92.50 +104), so the net yield over the period will be 3.643% (i.e., $3.58/$98.25. That works out to an average of 2.43% per month.

That's why it makes sense to keep doing these close out-of-the-money (OTM) put option plays each month. For example, let's say the investor can average 2.2% per month:

0.022 x 12 = 26.4% annualized expected return (ER)

That is a much better ER than holding COP stock over the next year (see above): 14-16% vs. 26% shorting OTM puts. Moreover, investors get to set a lower potential buy-in point using this play.

The bottom line is that COP stock looks undervalued, but a safe way to play it is to short out-of-the-money put options.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)