Yesterday was not a good day for the markets. The S&P 500 lost 1.23% on Thursday, and the Dow lost 1.20%. Meanwhile, tech and Bitcoin-related stocks also had a bad day, with Qualcomm (QCOM) and Strategy (MSTR) down 8% and 17%, respectively.

The good news for investors is that the index is up nearly 0.9% as I write this, an hour into Friday trading. The bad news is that the labor market is looking weaker by the day. The U.S. Labor Department’s latest data showed that the number of people filing for initial jobless claims increased by 22,000 in the past week to 231,000, the highest level in the past eight weeks, and 19,000 higher than expected.

I don’t know whether this latest bout of volatility has legs. I guess we’ll see if today turns negative and the losses carry into next week.

Among the 2,000 unusually active options that had Vol/OI (volume-to-open-interest) ratios of 2.71 or higher yesterday, volume of 500 contracts or higher, and expiring in seven days or more, 278 had Vol/OI ratios of 15 or higher.

In today’s commentary, I’ll look at 3 stocks whose calls or puts were among the 278 and whose strike prices were within $1 of their share price, essentially, ATM (at-the-money), and what options strategies options investors might use for big profits.

As for the big game on Sunday, I’m 100% behind the Seahawks and Sam Darnold.

Have an excellent weekend and enjoy the Super Bowl!

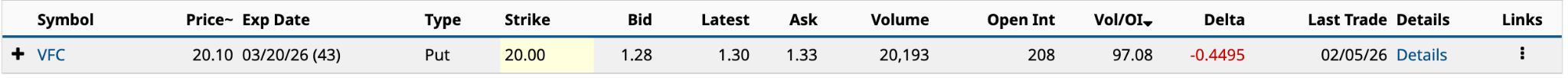

VF Corp (VFC)

VF Corp (VFC) had the fifth-highest Vol/OI ratio at 97.08. Its shares are up 13.3% year to date. However, they’re down 75% over the past five years.

The apparel and footwear manufacturer, whose three leading brands are The North Face, Vans, and Timberland, is in the midst of a turnaround that’s seen divestitures, job cuts, and other drastic measures to rightsize the business and prepare it for renewed growth. CEO Bracken Darrell was hired away from Logitech (LOGI) in June 2023 to oversee the turnaround.

Analysts are on the fence about VFC stock. Of the 22 analysts that cover it, only three rate it a Buy (3.00 out of 5), with an $18.58 target price. However, the Barchart Technical Opinion is a Strong Buy, indicating a much more positive near-term outlook.

I was bullish about VF’s future in November 2023; I’m even more so today.

Given the $20 put and a bullish view, the most straightforward strategy would be a cash-secured put. Based on the $1.28 bid price, the annualized return would be 47.7% [$1.05 bid price / $20 strike - $1.05 bid price * 365 / 43 DTE (days to expiration)].

There’s not much volatility in its stock, but if that concerns you, I’d do a Married Put: you buy 100 VFC shares at $20.10 and one long put for $1.33. Your maximum loss is $1.43 [$20.10 share price + $1.33 ask price - $20 strike price]. While your maximum profit is unlimited, you make money at expiration if the share price is higher than the $21.43 breakeven.

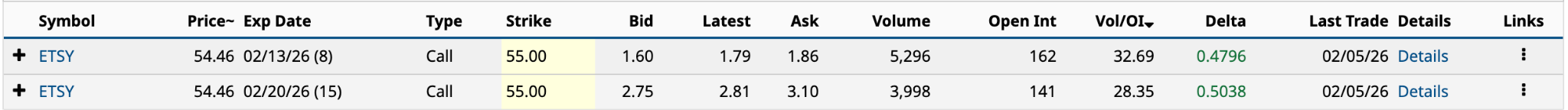

Etsy (ETSY)

Etsy (ETSY) had the 28th-highest Vol/OI ratio at 32.69. I’ve also included the $55 call, which expires a week later. It had the 41st-highest at 28.35. Its shares are up 4.1% year to date. However, they’re also down 75% over the past five years.

The crafts-focused two-way online marketplace that brings buyers and sellers together doesn’t have the revenue growth it once did -- in 2020, in the height of COVID, it had year-over-year growth of 111% -- but its margins remain healthy. Its gross margin in the latest 12 months ended Sept. 30, 2025, was 72.0%, according to S&P Global Market Intelligence, only 110 basis points below its 2020 record. Meanwhile, its EBIT (earnings before interest and taxes) margin was 13.8%, the highest it’s been since 2022.

Analysts are lukewarm about its stock. Of the 32 analysts covering it, seven rate it a Buy (3.25 out of 5), with a $66.96 target price, considerably higher than its current share price.

Two things caught my attention as I got up to speed on where it’s at: First, in December, it announced a new $750 million share repurchase plan, in addition to the $200 million remaining from the previous plan. With 2025 free cash flow likely to be close to $800 million, it will have plenty to buy back its cheap stock. Secondly, at the same time it announced the buyback, it appointed venture capitalist Fred Wilson as the company’s lead independent director. On the board since 2007, his presence will provide stability as it looks for renewed growth.

All things considered, I see Etsy as a decent value play at this moment. While I wouldn’t say I’m overly bullish about its sales growth, I do think you can make money on its stock over the next 12-24 months.

I would do a Cash-Secured Call on either DTE. Etsy’s share price is up 6.5% as I write this. The Feb. 13 $55 call ask price is $3.90, up $2.30 from yesterday, while the Feb. 20 ask price is $5.85, up $2.75. You’d already be making money.

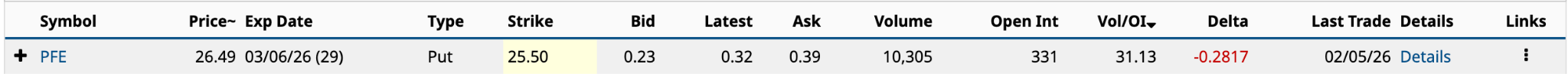

Pfizer (PFE)

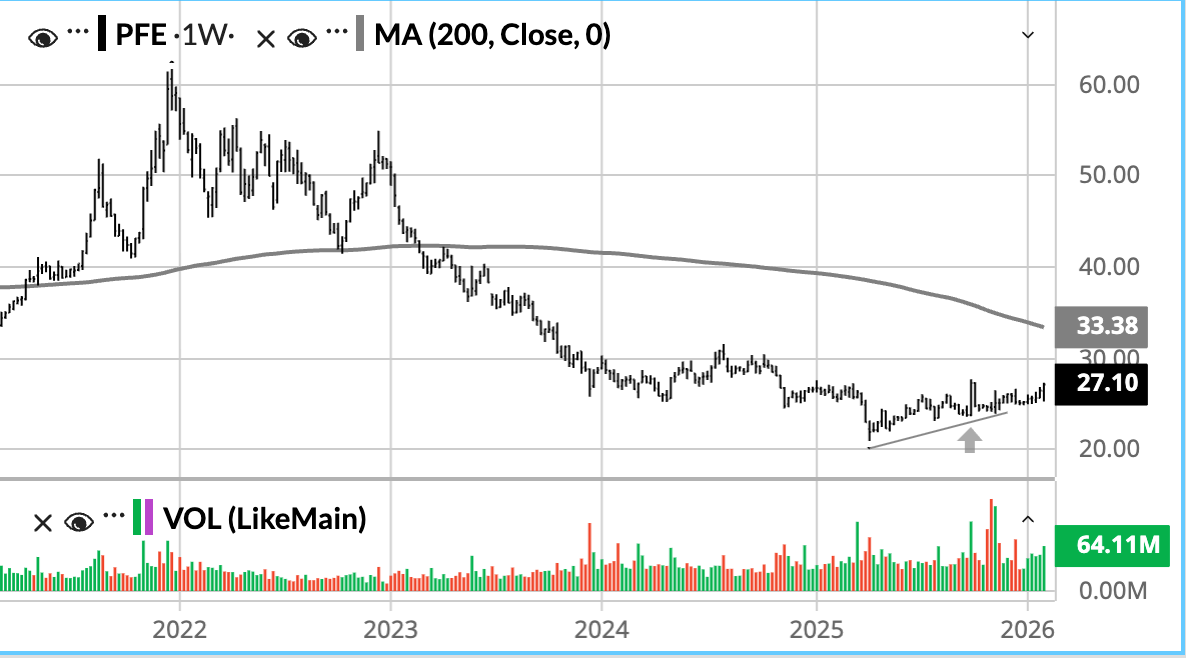

Pfizer (PFE) had the 35th-highest Vol/OI ratio at 31.13. Its shares are up 9.1% year to date. They’re down 22% over the past five years.

The drug manufacturer has had trouble matching its vaccine success during the height of the COVID-19 pandemic. That’s kept its share price in a deep freeze. On Jan. 9, I discussed two options strategies for Pfizer’s unusual options activity: a Long Straddle and a Bull Put Spread.

Pfizer was scheduled to report its Q4 2025 results on Feb. 3. They were generally positive, with revenues of $17.56 billion, $61 million higher than Wall Street’s estimate, and earnings per share of $0.66, nine cents higher than the consensus.

While analysts are lukewarm about its stock -- 8 of 25 analysts who cover it rate it a Buy (3.44 out of 5), with a $28.43 target price -- one look at its chart suggests it has bottomed and is slowly recovering from losses over the past three years.

Yesterday, Pfizer announced that its PF-08653944 experimental weight-loss drug, currently in clinical trials, is delivering promising results for participants. The drug, which involves a single shot each month, could be an effective competitor to those already sold by Novo Nordisk (NVO) and Eli Lilly (LLY).

It’s still early, but it’s another reason to bet on Pfizer eventually coming out of its funk.

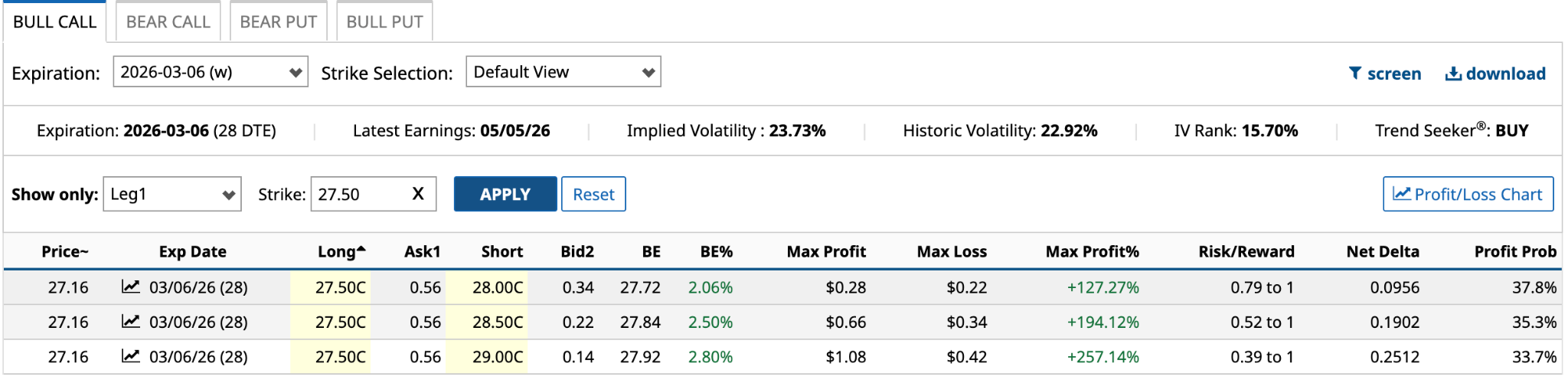

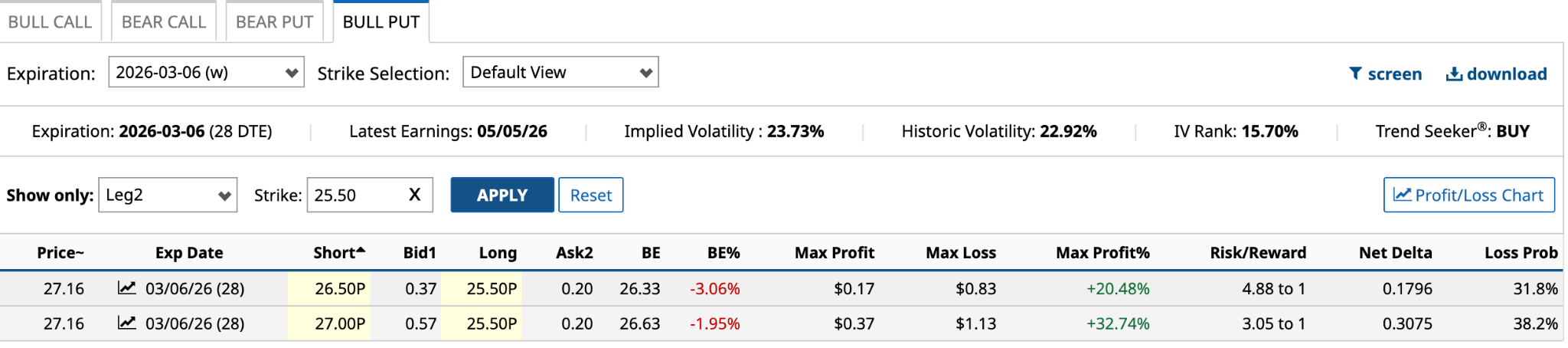

Based on the March 6 $25.50 put, I’m going to go out on a limb and suggest a Double Bull Spread, which is the combination of a bull call spread and a bull put spread. The call strike prices should be above $25.50, while the put strike prices should be below it.

Here’s how they look in Friday trading.

The maximum loss from this strategy depends on which of the puts you go with short. That’s because the difference between the two call strikes should be the same as the difference between the two puts.

So, using the $26.50 short put, a difference of two strikes, you’d go with the long $27.50 call and short $28.50 call. The combination of those four options would be a net debit of $0.17 [ask prices of $0.56 + $0.20 - bid prices of $0.22 + $0.37].

The maximum loss would be $0.83 [$26.50 put strike - $25.50 put strike - $0.17 net debit], while the maximum profit would also be $0.83 [$28.50 call strike - $27.50 call strike - $0.17 net debit].

You would achieve the maximum gain if Pfizer’s share price on March 6 is above $28.50, while the maximum loss would occur if the share price is below $25.50. You breakeven if the share price at expiration is between $28.50 and $25.50.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)