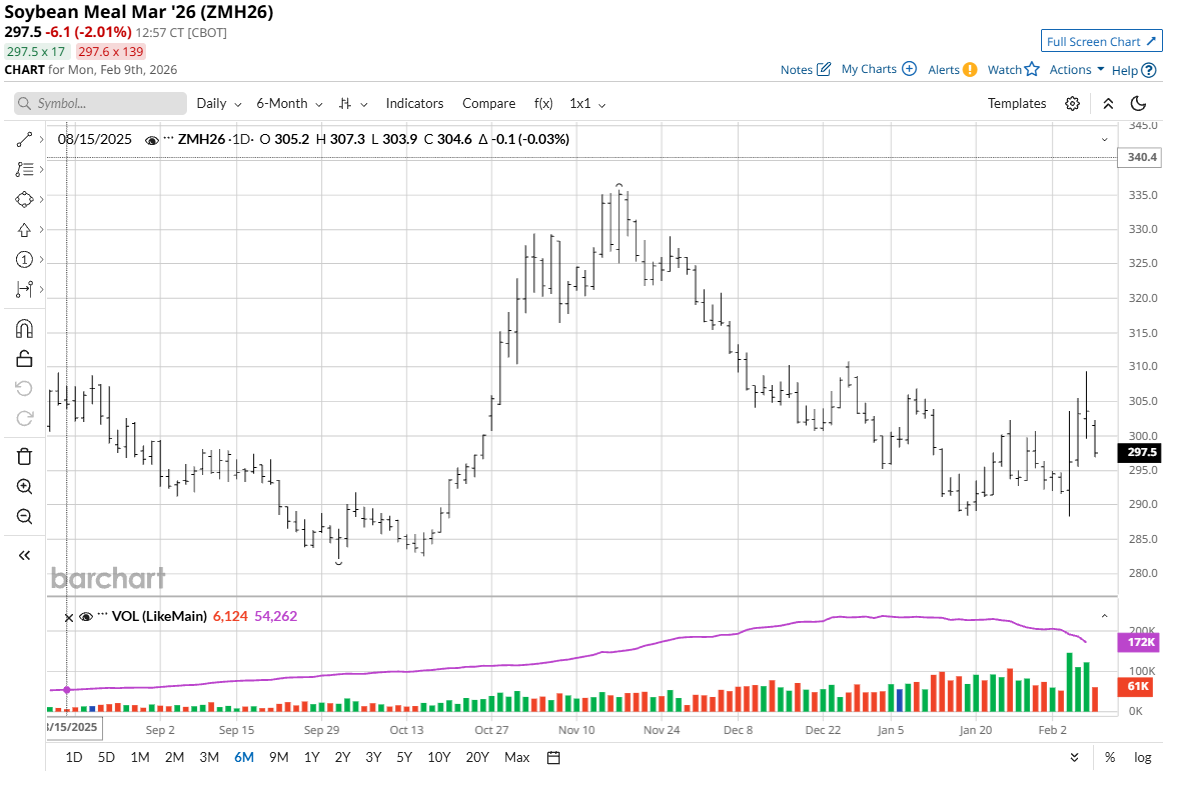

March soybean (ZSH26) futures last week gained 51 cents a bushel from the week prior, boosted by upbeat remarks from President Donald Trump that China will be buying more U.S. soybeans this year. March soybean meal (ZMH26) last Friday hit a six-week high and on the week was up $10.00 a ton. March bean oil (ZLH26) was up 1.82 cents a pound last week.

Grain Traders Now Looking to the Soybean Market for Direction

The soybean complex futures saw some profit-taking pressure from the shorter-term futures traders Friday but the bulls, overall, had a good week. Soybeans have now become the leader for daily price again in the grain futures complex.

Tuesday brings the monthly USDA supply and demand report for February, with analysts surveyed expecting very little changes in U.S. soybean stocks from the January report.

Soybean traders are closely watching weather conditions in South American soybean-growing regions. Weather forecasters are saying that recent dry weather is raising some concern for soybeans, corn, and other crops, because some of those areas are already too dry.

With Trump saying China is looking to buy more U.S. soybeans this year, daily and weekly U.S. export sales reports will be monitored even more closely the next few months — looking for stepped-up China bean buys.

The late-March USDA planting intentions report will be one of the most important USDA data points of the year for the grain markets.

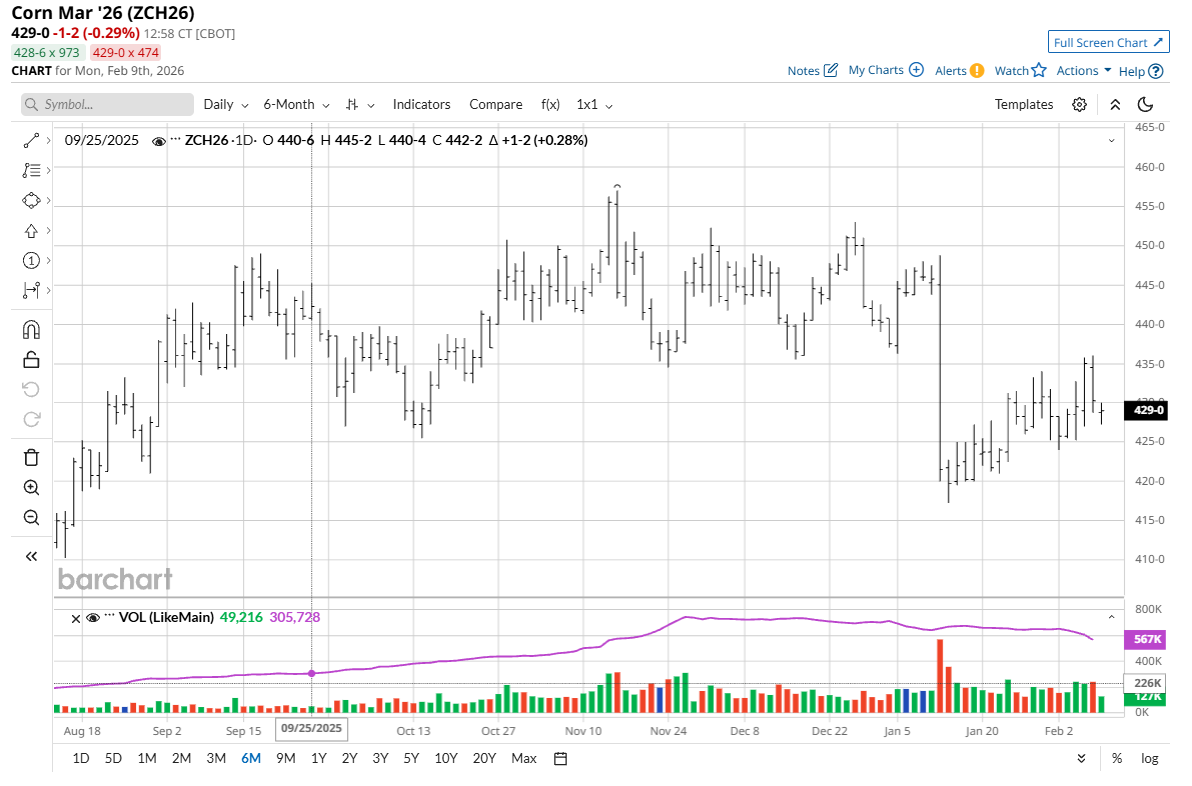

Corn Bulls Are Also Showing Signs of Life

March corn (ZCH26) futures last week gained 2 cents a bushel from the week prior. Price action last Friday also saw profit-taking pressure in corn from the shorter-term futures traders, after prices last Thursday hit a three-week high. The data point of the week next week for corn will be Tuesday’s monthly USDA supply and demand report. The February S&D report is considered by traders to be one of the more uneventful monthly WASDE releases, with surveys of analysts showing they expect very minor changes in U.S. corn stockpiles from the January report.

Corn traders will also continue to closely monitor growing conditions for South American crops.

Winter Wheat Markets Are the Weak Sister

Winter wheat futures headed south last week, with March soft red winter wheat (ZWH26) for the week down 8 1/4 cents. March hard red winter wheat (KEH26) on the week was down 13 1/2 cents from the week prior.

The winter wheat futures markets sold off Friday as the corn market posted losses, and the soybean market lost its good early gains. Tuesday’s USDA supply and demand report for February is expected to show only very minor changes in U.S. wheat stockpiles from the January report.

The U.S. central and southern Plains have received limited to no precipitation during the past week. Another week of drier weather is slated for U.S. hard red winter wheat country this week, with temperatures climbing to well above normal. That means soil-drying rates will be much higher compared to the past week and drought is expected to expand and intensify.

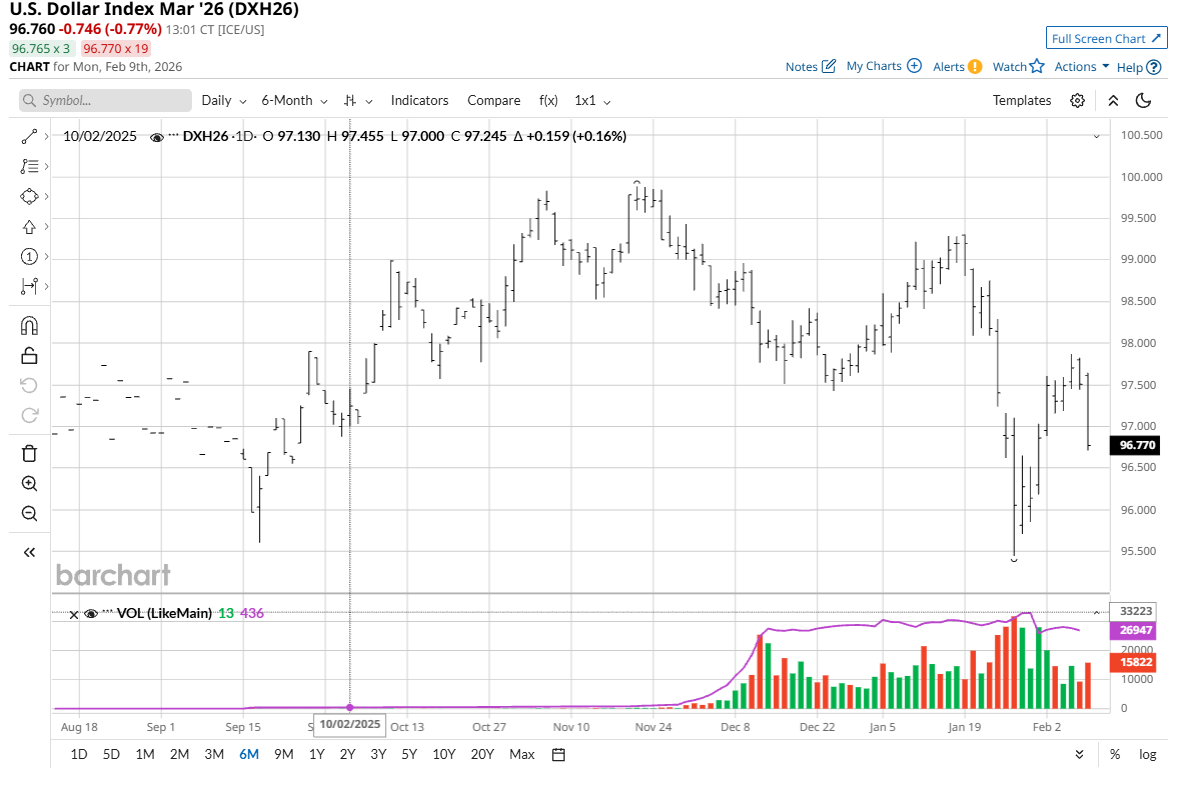

Crude Oil and U.S. Dollar Index Will Also Help Drive Daily Price Action

Key outside markets including crude oil (CLH26) and the USDX ($DXY) will also impact daily price action in corn, soybeans, and wheat.

Price action in crude oil has been driven by headlines around the ongoing discussions between Iran and the U.S. The U.S. dollar index has made a strong recovery after hitting a four-year low in late January. If the greenback continues to appreciate in the coming months, such would be a bearish element for the U.S. grain markets, including wheat, which is already struggling on the world trade markets from a competitive price perspective.

I enjoy hearing from my Barchart readers all over the world. I try to respond to all your emails to me. My email address is jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.