The US Department of Agriculture released its latest World Agricultural Supply and Demand Estimates Report on July 12, 2022. The full text of the July WASDE is available via this link. Market participants consider the monthly report the gold standard for grain and agricultural product fundamentals. However, 2022 is a unique time as geopolitical events have trumped the typical factors influencing prices.

I reached out to Sal Gilberte, the founder of the Teucrium family of grain and oilseed ETF products, including the SOYB, CORN, and WEAT ETFs. Sal’s take on the July WASDE was:

Given the overall macro weakness in outside markets, especially in crude oil, this month’s WASDE needed to provide some headline data to feed the bulls, but that didn’t happen. On the contrary, inventory builds in the grains were greater than traders expected, which reinforced selling pressure already in place from recent seasonal and technical price breakdowns across the grain complex. Digging a bit deeper into the report, bulls are pointing to continued tightening of grain balance sheets (the world is using more grains than it is producing) and the fact that the global wheat balance sheet isn’t what it seems to be, i.e., the wheat inside Ukraine is likely going to stay inside Ukraine, which means wheat supplies for the rest of the world are not as loose as the USDA global data would suggest. Hot, dry weather across the US Midwest will be watched closely to see if corn and soybean yields will be adjusted lower later in the summer. The grain markets are in a bear trend for now, but the risk of prices overreaching on the downside remains given the current projected tightening of global grain supplies and uncertainties surrounding weather and grain availability out of the Black Sea region. Expect price volatility to remain high for quite some time.

Despite the current trends, Sal is not all that bearish on the grain and oilseed futures markets, and I agree.

Soybeans decline

The July WASDE report told the soybean futures market US oilseed production is projected at 4.5 billion bushels, down 135 million from the June report on lower harvested area. The global forecast includes falling production, lower exports, higher crush, and lower ending stocks than the previous month. The USDA reduced 2022/2023 global soybean ending stockpiles to 99.6 million tons on falling inventories for the US, Brazil, and China. Meanwhile, the USDA lowered price forecasts for soybeans, soybean meal, and soybean oil from their June levels.

The report was not all that bearish for soybean prices, but the price action has been as soybean futures became a falling knife on the continuous contract.

The long-term chart shows that nearby soybean futures rose to only 10.75 cents below the all-time 2012 high in June 2022, when they reached $17.84 per bushel. The nearby futures price dropped 17.2% to the $14.7650 level on July 19. The new-crop November futures are in backwardation, with deferred prices lower than nearby prices, and were trading at the $13.5600 per bushel level on July 19.

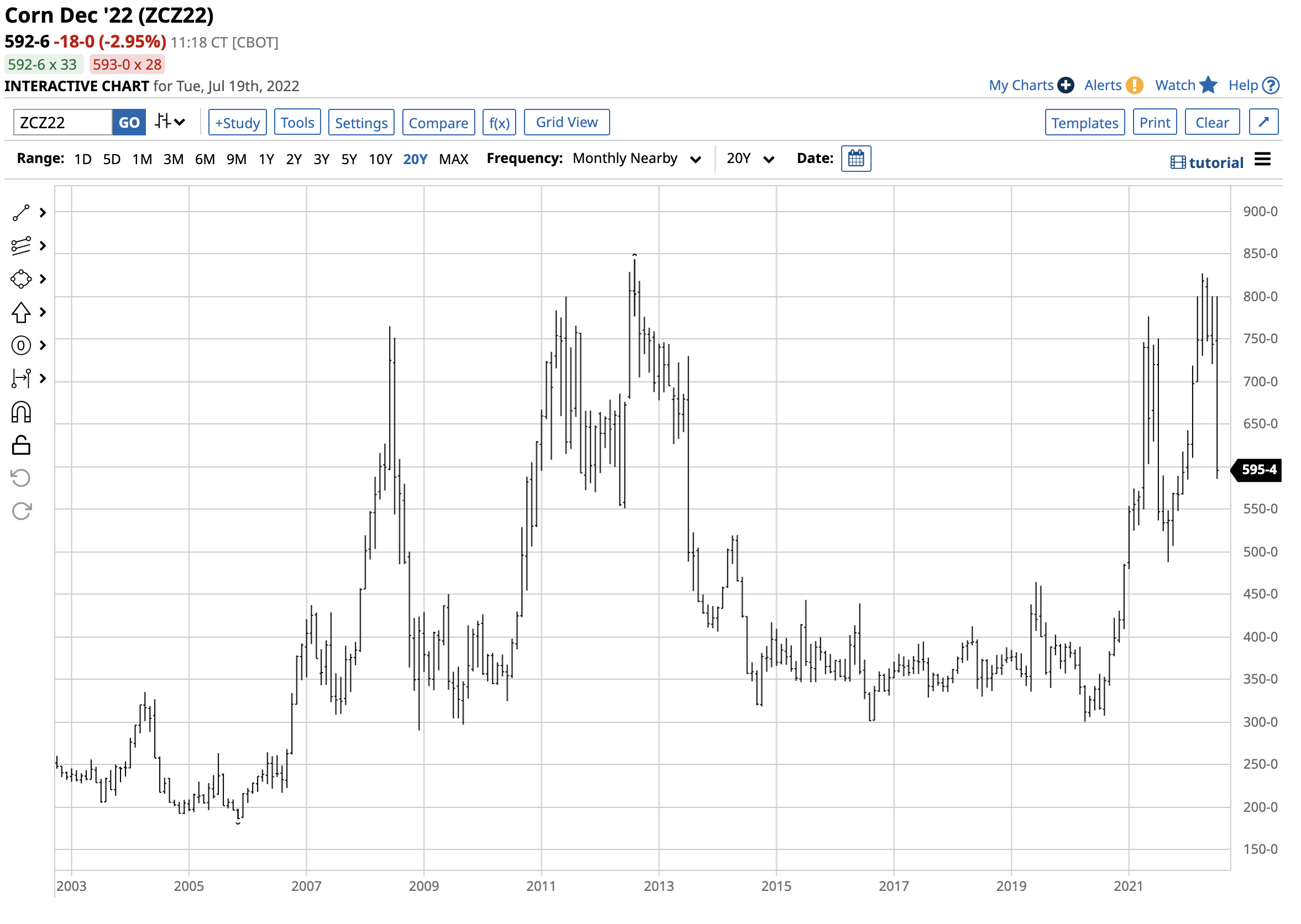

Corn falls

The July WASDE report increased beginning and ending the US and global corn stockpiles and lowered its price forecast.

After rising to a high of $8.27 per bushel in April, 16.75 cents below the 2012 record high, corn prices corrected and imploded in July, falling to below the $6 level on the new-crop December contract on July 19. The

December contract fell to $5.6650 on July 6 before recovering.

Wheat becomes a falling knife

The July WASDE increased the US and worldwide wheat inventories and lowered the season-average price forecast for the grain that is the primary ingredient in bread and many other food products.

After reaching an all-time $14.2525 high in March 2022, CBOT soft red winter wheat futures plunged to a low of $7.6575 in July, almost half the price at the high. At $8.0825 per bushel on July 19, the new crop, September wheat, was sitting near the recent low.

The three factors supporting prices

Soybean, corn, and wheat prices imploded from the 2022 highs, but at least three factors continue to support the prices at the current levels:

- The war in Ukraine is in Europe’s breadbasket, threatening global corn and wheat supplies. As Sal Gilberte points out, “the wheat in Ukraine is likely going to stay in Ukraine,” and there are “uncertainties surrounding weather and grain availability out of the Black Sea region.”

- High energy prices support corn and soybeans as corn is the primary ingredient in US gasoline blends, and soybeans are critical for biodiesel production. While oil and gasoline prices fell from the recent highs, they remain elevated and Russian exports could send them higher over the coming months.

- Sky-high fertilizer prices and inflation are causing soaring worldwide production costs. The higher cost of production supports a rebound in grains and oilseed futures markets.

The bottom line is the potential for rebounds from the current price levels remains high in mid-July 2022.

Expect lots of two-way volatility- It is impossible to pick bottoms; leave room on the downside when buying

We should expect wide price swings in the grain and oilseed futures arena over the coming weeks, months, and even years. Bearish trends can take prices to illogical, unreasonable, and irrational levels, so it is virtually impossible to call a bottom when prices are falling. Meanwhile, the current geopolitical landscape supports higher prices, which could lead to significant bottoms sooner rather than later in the agricultural futures markets.

Buying in the current environment requires leaving plenty of room to add to long risk positions on further declines for value investors and traders. Those following trends remain short after the implosive price action from the 2022 highs and should remain short until the trend bends and prices cross key technical levels.

Trading and investing in corn, soybeans, and wheat futures markets is not for the faint of heart in the current environment. Meanwhile, volatility increases risk, but it also creates profitable opportunities. Those brave enough to dip a toe in the grain and oilseed markets must adjust their risk profiles to reflect the current market dynamics that have established wide price variance.

While the trends remain lower on July 19, I am avoiding getting too bearish on this volatile sector of the commodities market as food is a supply-side economic issue far beyond monetary policy’s reach. The war in Ukraine remains the most significant factor for the path of least resistance of prices.

More Grain News from Barchart

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)