Valued at a market cap of around $352.7 billion, The Procter & Gamble Company (PG) is a global consumer staples leader that produces and markets everyday household, personal care, and health products. Founded in 1837 and headquartered in Cincinnati, it operates in more than 180 countries and owns iconic brands such as Tide, Pampers, Gillette, and Olay.

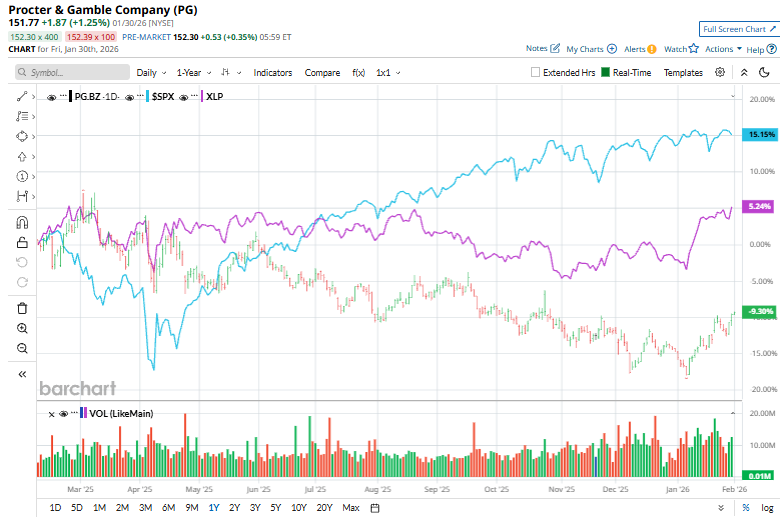

Shares of PG have underperformed the broader market over the past 52 weeks. PG has declined 9.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. However, in 2026, PG is up 5.9%, compared to SPX’s 1.4% rise.

Narrowing the focus, the leading consumer products maker has also lagged behind the State Street Consumer Staples Select Sector SPDR Fund’s (XLP) 4.7% rise over the past 52 weeks and 7.5% gains on a YTD basis.

On Jan. 22, PG shares rose 2.7% after the company released its Q2 earnings. The company reported net sales of $22.2 billion, a 1% year-over-year increase, while organic sales were flat, as higher prices largely offset weaker volumes. Its EPS declined 5% to $1.78, mainly due to restructuring charges, but core earnings per share held steady at $1.88. Despite margin pressures and mixed segment performance, P&G maintained its full-year guidance for sales and earnings growth.

For the current fiscal year ending in June 2026, analysts expect PG’s EPS to grow 2.2% year-over-year to $6.98. The company’s earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

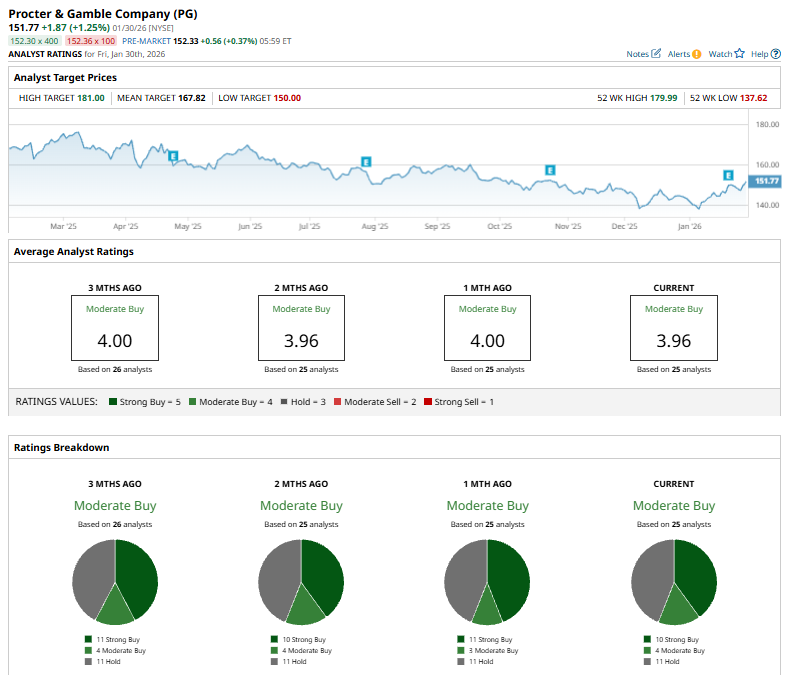

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, four “Moderate Buys,” and 11 “Holds.”

This configuration is bearish than a month ago when the stock had 11 “Strong Buy” suggestions.

On Jan. 27, TD Cowen analyst Robert Moskow downgraded Procter & Gamble from “Buy” to “Hold,” while raising the price target to $156 from $150, reflecting a 4% increase despite a more cautious rating.

Its mean price target of $167.82 suggests an upside of 10.6% from the prevailing price level. The Street-high price target of $181 implies a potential upside of 19.3% from the current price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)