/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

Ad-tech leader AppLovin (APP) has been on a remarkable run this year as the industry leans further into high-growth, artificial intelligence (AI)-driven advertising. Plus, the company’s strong earnings momentum and widening margins are keeping it in the spotlight. AppLovin’s breakout moment began with the rollout of its AI-powered Axon 2 platform in 2023, which quickly lifted performance across its ad network.

And while gaming apps remain its home base, the company has broadened its reach into non-gaming mobile apps, connected TV, streaming video, and even the open web. AppLovin says Axon 2’s more predictive, automated design is a natural fit for new categories such as e-commerce, and the company even rebranded the Axon platform recently to reflect this shift toward a broader advertiser base.

It’s not just investors taking notice of this evolution. On Dec. 11, Benchmark raised its price target, citing rising e-commerce adoption, a clearer roadmap for scaling Axon Ads’ self-serve tools, expanding GenAI creative features, and solid margin strength. With that backdrop, let's take a deeper look at AppLovin stock and what’s driving the buzz.

About AppLovin Stock

For those unfamiliar with the business, AppLovin helps apps and brands grow smarter and faster. Founded in 2012, the California-based company started with a simple goal: to make it easier for app developers to market, monetize, and scale their products. Over the years, that mission has evolved into a global platform that powers advertising across mobile apps, connected TV, streaming environments, and the web. Today, AppLovin is best known for creating tools that help businesses acquire users, serve ads efficiently, and measure performance with precision.

Most of AppLovin’s revenue comes from its advertising technology, which sits at the center of its business. The company operates a marketplace where advertisers pay to reach targeted audiences, while publishers earn money by showing those ads. AppLovin’s products, like MAX, AppDiscovery, and Adjust, give developers a full ecosystem to attract users and maximize in-app revenue.

By managing both the demand and supply sides of digital ads, AppLovin has built a highly scalable model that benefits from rising ad spending and improved campaign efficiency. And now AI has become the engine behind AppLovin’s growth, particularly with the rise of its Axon platform. Axon uses machine learning to predict which ads will perform best, automate optimization, and deliver higher returns for advertisers across gaming, e-commerce, and other verticals.

The company recently rebranded its ad platform under the Axon name and rolled out Axon Ads Manager, a self-serve interface designed to make AI-powered advertising easier for businesses of all sizes. With AI now woven into everything it builds, from creative tools to campaign delivery, AppLovin is positioning itself as a leading GenAI player in the next wave of digital advertising.

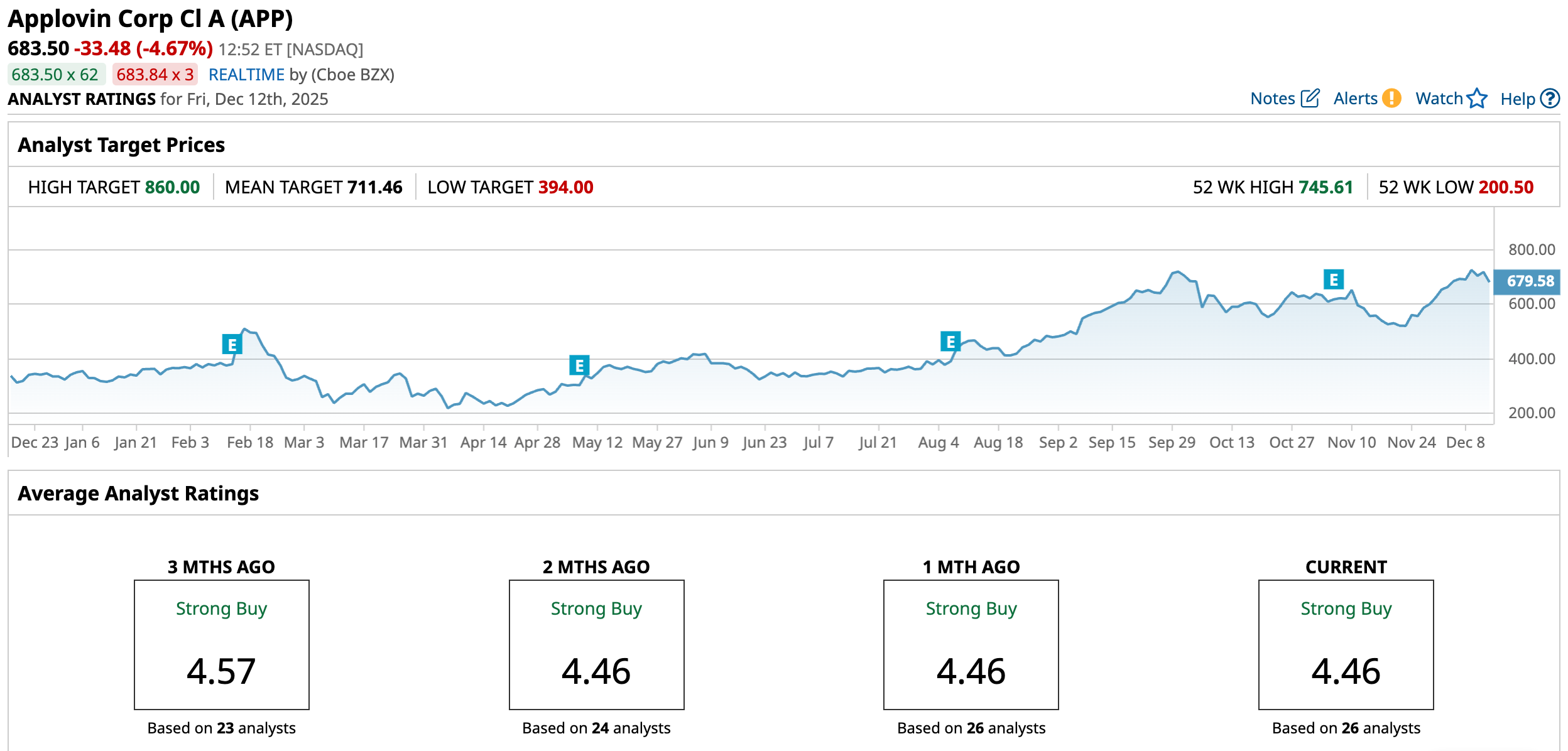

AppLovin’s momentum has been nothing short of explosive. After posting tremendous growth throughout 2023 and beyond, the company earned a spot in the S&P 500 Index ($SPX) in September. The company now boasts a massive $242.3 billion market capitalization, and its stock soared a stunning 110.3% in 2025, easily eclipsing the broader index’s 16% gain. In fact, after touching an all-time high of $745.61 in September, the stock remains just 9.4% off that peak.

Inside AppLovin’s Q3 Earnings Report

AppLovin delivered a standout fiscal 2025 third-quarter earnings report on Nov. 5, smashing Wall Street’s expectations across the board. Strength across its gaming advertising ecosystem and technology platforms continued to drive exceptional performance. For the quarter, revenue jumped a stunning 68% year-over-year (YOY) to $1.41 billion, surpassing the consensus estimate of $1.34 billion. The Software Platform segment once again led the charge, fueled by the advanced capabilities of AXON 2.0.

Thanks to the platform’s improved ad optimization, AppLovin saw a 75% jump in net revenue per installation, all while maintaining user volume, a sign of both strong efficiency and competitive reach. Profitability also impressed, with adjusted EBITDA rising 79% YOY to $1.16 billion and margins expanding to 82%, up from 77% in the year-ago quarter. EPS came in at $2.45, soaring 96% YOY and topping expectations of $2.39.

Additionally, the company demonstrated exceptional cash generation, producing $1.05 billion in net cash from operating activities and an equal $1.05 billion in free cash flow, nearly double the $551 million and $545 million, respectively, generated in Q3 2024. Looking forward, AppLovin expects its momentum to continue into the fourth quarter of 2025.

Management projects revenue between $1.57 billion and $1.60 billion, with adjusted EBITDA guided at $1.29 billion to $1.32 billion. The company also expects to maintain its exceptional 82%–83% margins, underscoring the ongoing strength of its scalable, AI-driven business model.

What Do Analysts Think About AppLovin Stock?

AppLovin drew fresh attention this week after Benchmark lifted its price target, reflecting rising confidence in the ad-tech company’s AI-fueled momentum. Analyst Mike Hickey reaffirmed the stock as one of the firm’s “Best Ideas,” pointing to strengthening e-commerce traction, a clear roadmap for scaling AXON Ads’ self-serve platform, expanding GenAI creative capabilities, and consistently durable margins.

Hickey raised his price target to $775 from $700 and maintained a “Buy” rating. He explained that the updated target is based on a 40x FY2026 AEBITDA multiple, which he views as appropriate for a company delivering accelerating top-line growth, margins above 80%, and an expanding total addressable market (TAM) across gaming, e-commerce, and international channels.

The analyst also emphasized AppLovin’s industry-leading profitability, steady free cash flow generation, and strengthening AI-driven competitive moat as key reasons supporting a premium valuation.

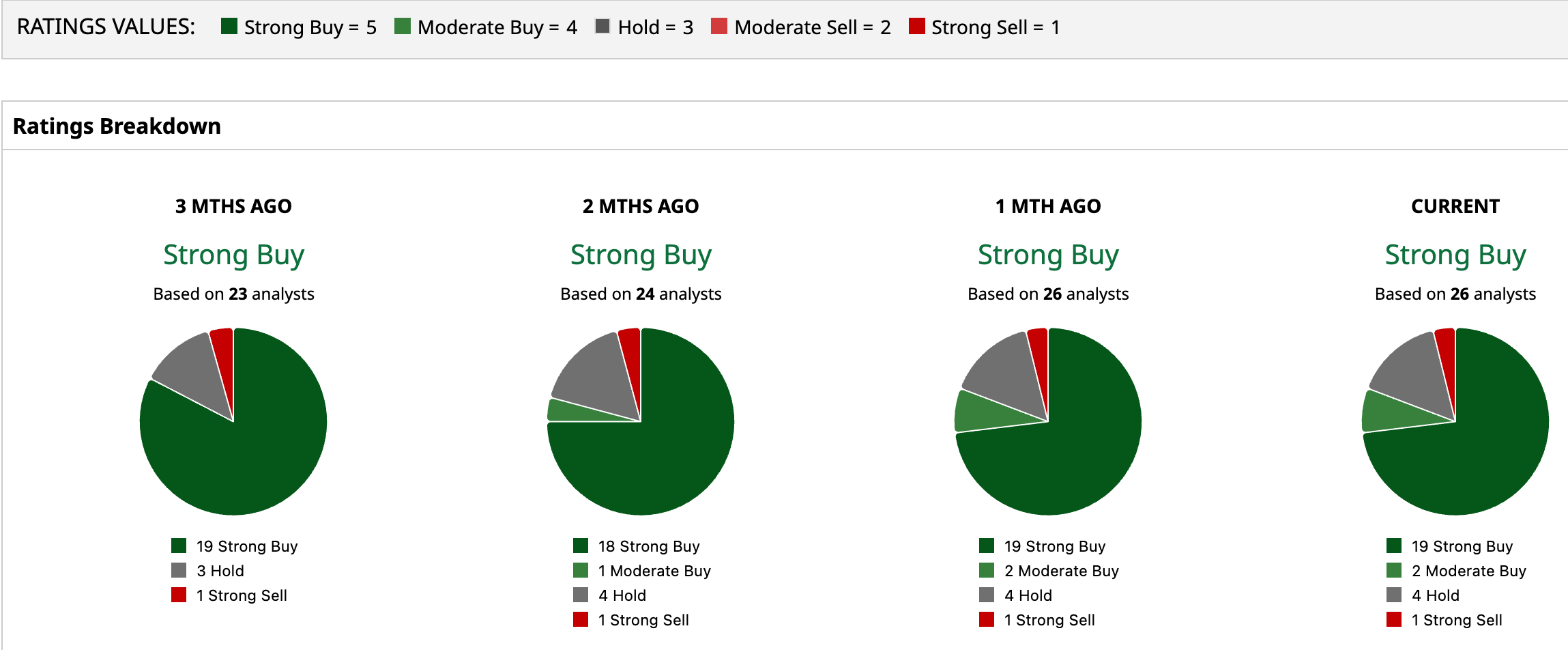

Overall, Wall Street’s outlook on AppLovin is overwhelmingly positive, reflected in its consensus “Strong Buy” rating. Among the 26 analysts covering the stock, 19 rate it a “Strong Buy,” two call it a “Moderate Buy,” four recommend “Hold,” and only one has issued a “Strong Sell.”

AppLovin’s strong momentum has already pushed shares beyond the average price target of $711.46, yet analysts still see room for further gains. The Street-high target of $860 implies the stock could rally another 25.87% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)