/Avery%20Dennison%20Corp_%20logo%20on%20builsing%20by-%20Mark%20Roget%20Bailey%20via%20Shutterstock.jpg)

Valued at a market cap of $13.4 billion, Avery Dennison Corporation (AVY) is a materials science and digital identification solutions company based in Mentor, Ohio. It is known for producing pressure-sensitive labeling materials, packaging solutions, branding and information tags for apparel and retail, and industry-leading Radio-Frequency Identification (RFID) inlays that enable product tracking and supply-chain visibility.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and AVY fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the packaging & containers industry. The company is recognized for its expertise in advanced adhesives, sustainable packaging innovations, and technologies that connect physical products with digital data, supporting industries such as retail, logistics, food, healthcare, automotive, and consumer goods.

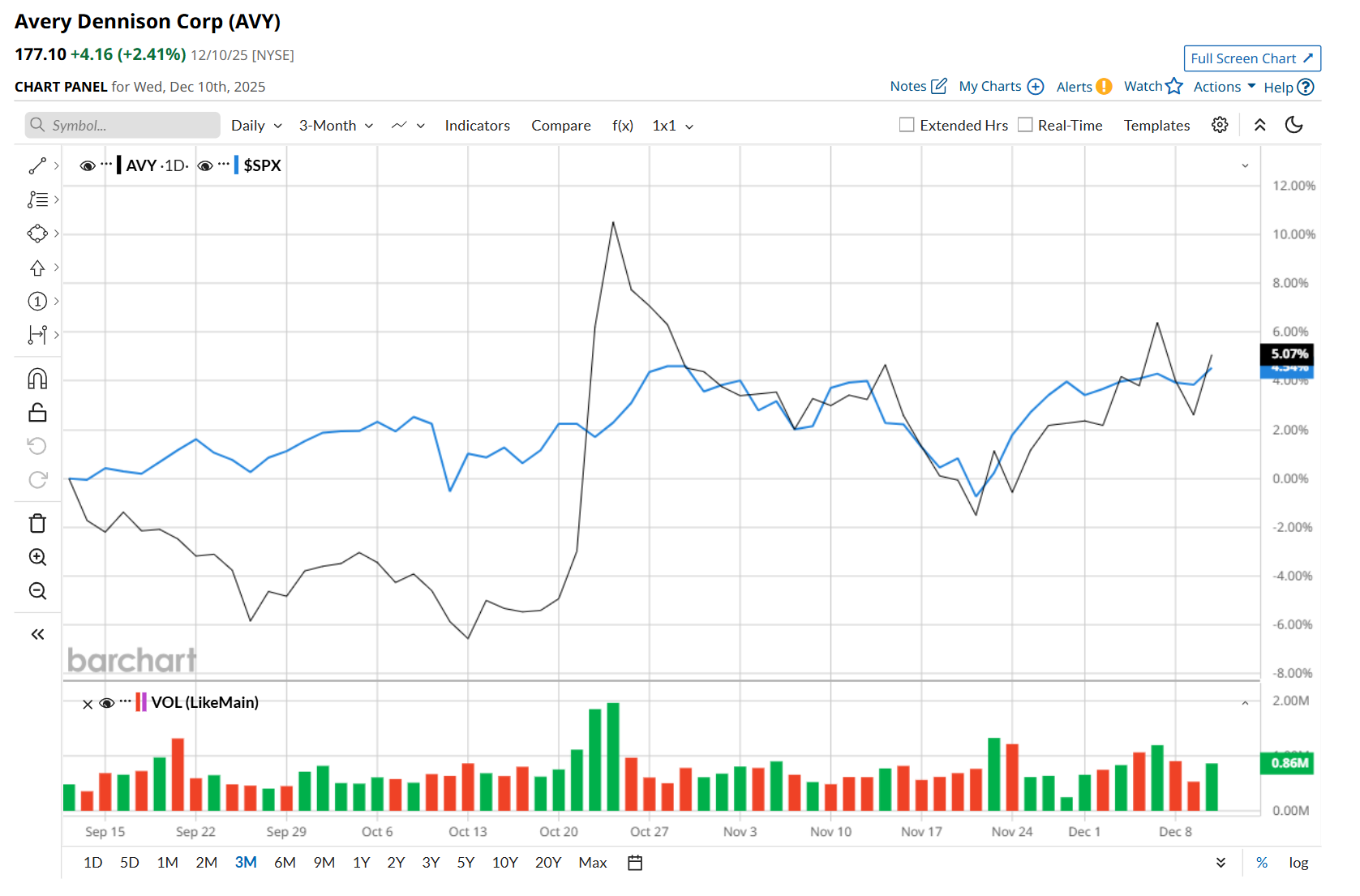

This materials science and digital identification solutions company is currently trading 12.8% below its 52-week high of $203.06, reached on Dec. 11, 2024. Shares of AVY have gained 7.5% over the past three months, outperforming the S&P 500 Index’s ($SPX) 5.4% rise during the same time frame.

However, on a YTD basis, shares of AVY are down 5.4%, compared to SPX’s 17.1% return. Moreover, in the longer term, AVY has fallen 12.1% over the past 52 weeks, lagging behind SPX’s 14.1% uptick over the same time frame.

To confirm its recent bullish trend, AVY has been trading above its 200-day moving average since early December, with minor fluctuations, and has remained above its 50-day moving average since late October, with slight fluctuations.

On Oct. 22, shares of AVY surged 9.5% after delivering better-than-expected Q3 earnings results. Due to modest growth across both its reportable segments, the company’s overall revenue improved 1.5% year-over-year to $2.2 billion, surpassing analyst expectations by a slight margin. Moreover, its adjusted EPS increased 1.7% from the year-ago quarter to $2.37, beating consensus estimates by 2.2%.

AVY has outpaced its rival, Ball Corporation (BALL), which declined 16.3% over the past 52 weeks and 13.4% on a YTD basis.

Given AVY’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 13 analysts covering it, and the mean price target of $202.17 suggests a 14.2% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)