/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

What does 2026 hold for Palantir Technologies (PLTR)? The software and data-mining company is wrapping up another tremendous year, up 146% in 2025, which is a great follow-up to its 340% run higher in 2024. But Palantir has its skeptics as well, including famed investor Michael Burry.

Burry seems to be enjoying a more public profile after closing down his Scion Asset Management hedge fund and launching a Substack called “Cassandra Unchained.” He recently made some interesting remarks about Palantir, comparing it to the former consulting firm DiamondCluster that was a high-flyer as well.

DiamondCluster was a business-to-business that sold expensive consulting services, while Palantir both consults and sells a powerful software system powered by artificial intelligence. DiamondCluster’s valuation jumped by more than 300% during the dot-com bubble, similar to Palantir’s rise. When that bubble burst, DiamondCluster’s stock fell from $98 to $7.50 in less than a year, and it was eventually purchased by PwC in 2010 for $12.50 per share.

Could Palantir face the same fate?

About Palantir Stock

Palantir, which is based in Denver, is a data analytics company that first came to prominence as a government contractor. The company’s sophisticated software system pulls in data sources from thousands of points, including satellite images, to provide real-time intelligence to military units and intelligence agencies. Palantir was credited with providing information that led to the locating and killing of 9/11 mastermind Osama bin Laden.

However, Palantir does a lot more than just military work. It also has a fast-growing commercial product, powered by its unique Artificial Intelligence Platform (AIP), that helps commercial clients manage inventory and supply chains and analyze the competitive landscape.

Palantir uses five-day bootcamps to introduce its platform to prospective clients to show them how it can improve their businesses. As the product uses generative AI and runs on Palantir’s powerful software, the response has been overwhelmingly positive.

“The shorthand is if you’re doing anything that involves operational intelligence, whether it’s analytics or AI, you’re going to have to find something like our products,” CEO Alex Karp.

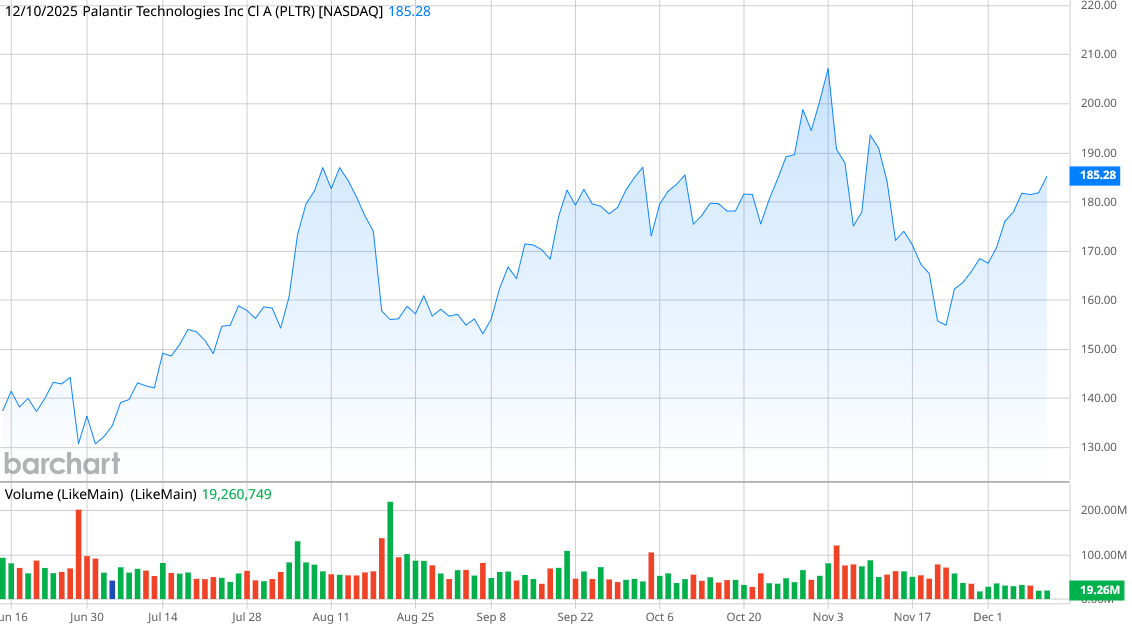

While Palantir’s stock had a strong 2025, outdistancing the S&P 500 ($SPX), the growth has slowed in recent months. The stock is up only 12% in the last three months—good for many companies, but not the growth that Palantir shareholders have come to expect.

The biggest issue that Palantir bears point to is the stock’s eye-watering valuation. The price-to-earnings ratio of 425 and the forward price-to-earnings ratio of 251 indicate that there is already massive growth built into Palantir stock. By way of comparison, Nvidia (NVDA) is the most successful company in the world with a rapid growth curve as well, and its P/E ratio is only 45. Palantir has to have everything go perfectly for its valuation to hold water moving forward.

Palantir Beats on Earnings

Palantir’s recent earnings reports show the company’s extraordinarily fast growth cycle. Revenue in the third quarter was $1.18 billion, up 63% from a year ago. The company posted income of $600 million with a 51% profit margin and earnings per share of $0.18, which beat the $0.12 that analysts expected.

Palantir also continued its rapid growth in both the government and commercial segments. Palantir’s U.S. commercial revenue grew 121% on a year-over-year (YoY) basis to $387 million, and its U.S. government revenue increased 52% from a year ago to $486 million. The company reported closing 204 deals in the quarter that were valued at more than $1 million each. It also closed 91 deals—roughly one per day—valued at more than $5 million each and 53 deals valued at more than $10 million each.

“These results make undeniable the transformational impact of using AIP to compound AI leverage,” Karp said.

What Do Analysts Expect for PLTR Stock?

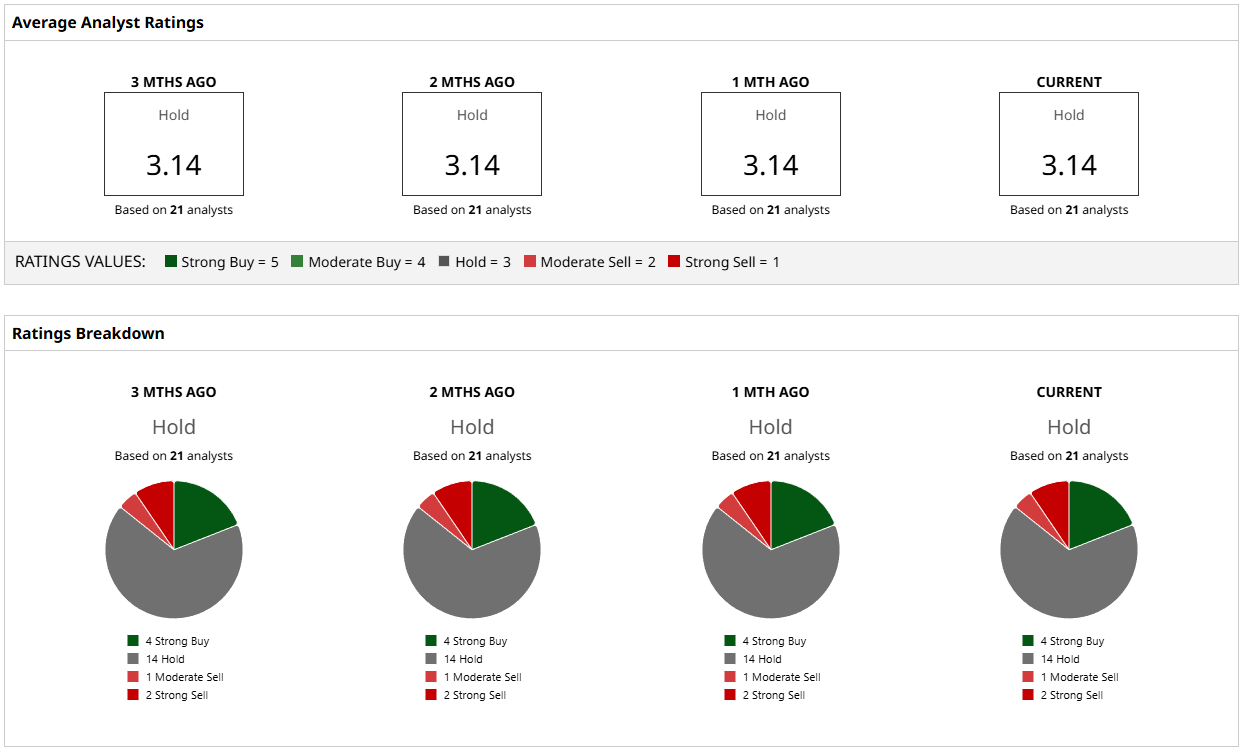

Generally, analysts are taking a wait-and-see approach to Palantir. Of the 21 analysts covering the stock, 14 have a “Hold” rating. Four give it “Buy” ratings, and three have “Sell” ratings.

The mean price target of $192.67 indicates only a 4% potential short-term gain. The most bullish target of $255 suggests a potential 38% increase, while the bearish target of $50 is more in line with Burry’s caution, warning of a 73% decline.

All in all, Palantir is a momentum play. It’s impossible to ignore the company’s rapid growth and the number of lucrative deals that it’s signing, but the valuation is also a huge concern, and the stock price is starting to cool off.

For me, Palantir is still a buy, but I’m more cautious of PLTR stock today than I was at this point a year ago.

On the date of publication, Patrick Sanders had a position in: PLTR , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Space%20Technology%20by%20Rini_%20com%20via%20Shutterstock.jpg)