/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

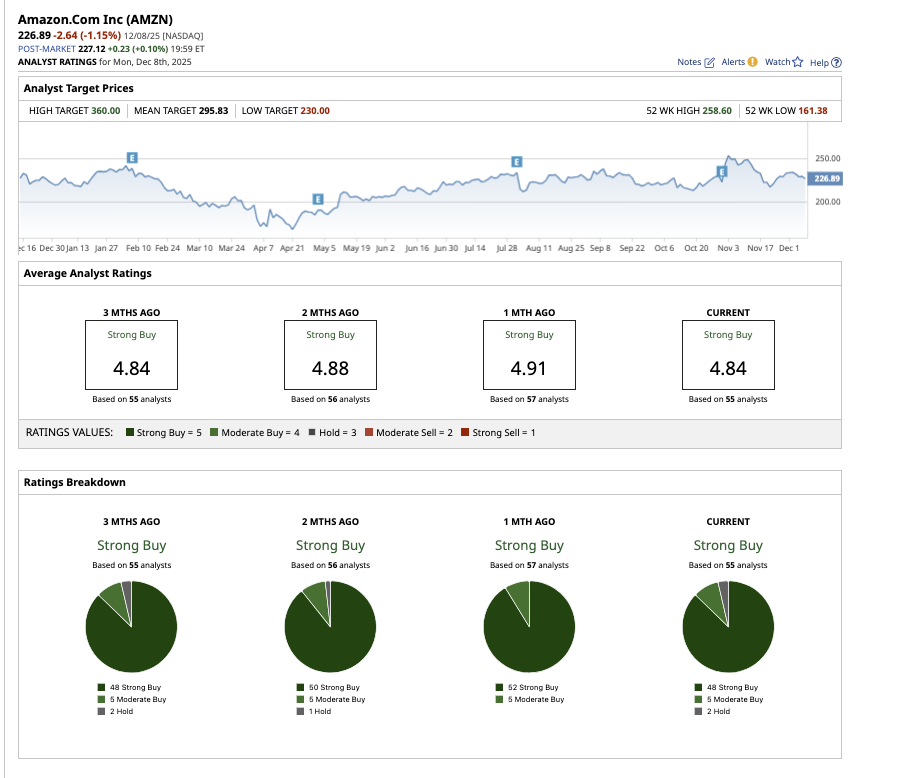

Amazon’s (AMZN) stock has been on a remarkable tear over the past few years, powered by unrelenting cloud momentum, increased retail efficiency, and a renewed push into artificial intelligence (AI). While Wall Street’s high-end target is $360, I believe the tech titan’s rally has enough firepower to break past even the most bullish expectations.

Let’s find out what could push Amazon to touch $400 in 2026?

A Strong Quarter Sets the Stage

Amazon’s revenue, profits, and innovation are surging across all its businesses, from cloud and AI to retail and logistics. Its third-quarter earnings showed that the momentum behind the stock's potential surge to $400 is difficult to ignore. Amazon reported $180.2 billion in revenue, up 12% year-over-year (YoY). North America revenue increased 11% to $106.3 billion, with International revenue up 10% to $40.9 billion. Net income per share increased 36.4% to $1.95.

Advertising revenue increased to $17.7 billion, marking the third straight quarter of rapid growth. Brands are responding to Amazon's full-funnel advertising model, which seamlessly blends shopping data, media reach, video inventory, and AI-powered creative capabilities. This segment remains one of Amazon's highest-margin businesses and a possible long-term earnings driver.

Rufus, the AI shopping assistant, served 250 million customers, with interactions up 210% YoY and users 60% more likely to complete transactions. Rufus alone is projected to generate more than $10 billion in incremental annualized sales.

AWS delivered one of its strongest quarters in years, reporting $33 billion in revenue, growing 20.2% YoY, its highest rate in 11 quarters. Importantly, this increase is taking place at a gigantic $132 billion annualized run rate, making AWS's momentum far more significant than smaller competitors with greater percentages. Backlog has hit $200 billion, driven by both core cloud services and growing demand for generative AI capability. AWS also has a 29% market share, versus Microsoft (MSFT) Azure's 20%. According to the management, AWS's competitive advantage stems from its unrivaled variety of services, extensive functionality, and 15 years as Gartner's (IT) strategic cloud services leader. This strength is currently driving Amazon's rapid expansion into AI. Amazon is developing its own AI agents for coding, migration, and business workflows.

AWS Continues to Expand

To meet the surging demand for AI compute, Amazon has rapidly expanded AWS capacity, adding more than 3.8 gigawatts of power in 12 months. AWS now has double the power capacity it had in 2022, and it could grow at the same pace by 2027. The company launched Project Rainier, a massive U.S. AI cluster with nearly 500,000 Trainium2 chips. Trainium2 is becoming a multibillion-dollar business, growing 150% quarter-over-quarter (QoQ) and fully subscribed. Amazon expects supporting partners like Anthropic to train Claude models on over 1 million Trainium2 chips by year-end. This level of infrastructure expansion signals long-term confidence and offers an enormous monetization opportunity still in its early innings.

Amazon has already spent $89.9 billion on capital expenditures this year, with full-year spending forecast to hit $125 billion in 2025 and rise further in 2026. This includes building new AWS data centers, expanding AI compute infrastructure, scaling Trainium and other custom silicon, and improving logistics in North America and internationally.

The company also generated $14.8 billion in trailing 12-month free cash flow, highlighting a business both expanding rapidly and improving profitability. This financial strength gives Amazon the firepower to keep investing aggressively in areas driving its next wave of growth, especially AI and cloud infrastructure.

Analysts expect that Amazon's earnings will climb by 27.4% and 11.2% over the next two years. Based on the long-term prospects in cloud and AI, AMZN stock still looks like a reasonable buy trading at 28 times forward earnings.

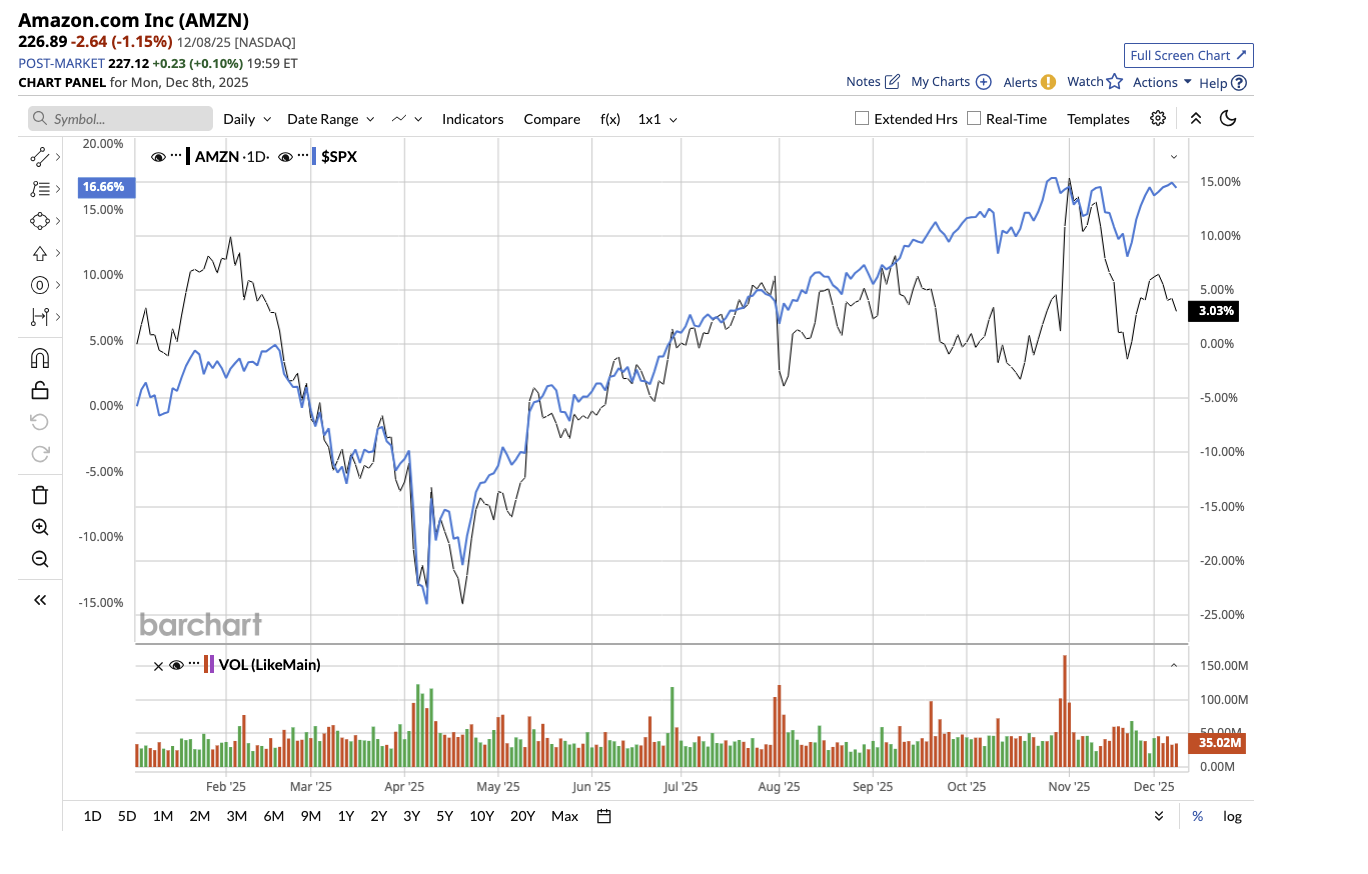

Is AMZN Stock a Buy, Hold, or Sell on Wall Street?

Overall, Amazon stock is rated a “Strong Buy” on Wall Street. Of the 58 analysts covering the stock, 52 have given it a “Strong Buy” rating, and six recommend a “Moderate Buy.”

The average target price is $269.14, indicating a potential upside of 30.4% from its current price. Additionally, the highest target price of $360 suggests the stock could rise by as much as 58.6% over the next 12 months.

Can Amazon Hit $400 in 2026?

Amazon's performance and momentum in cloud, AI, and e-commerce indicate a company entering a new era of scale and profitability. AWS is accelerating. AI demand is exploding. Retail is becoming faster, smarter, and more efficient. And Amazon is aggressively investing in the infrastructure that is driving the worldwide AI boom.

With increased revenue, improving margins, deepening customer interaction, and multibillion-dollar AI prospects still in the early stages of development, the runway ahead is substantial. Amazon appears to be on track to surpass its current Street-high estimate and hit $400 by 2026.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)