/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

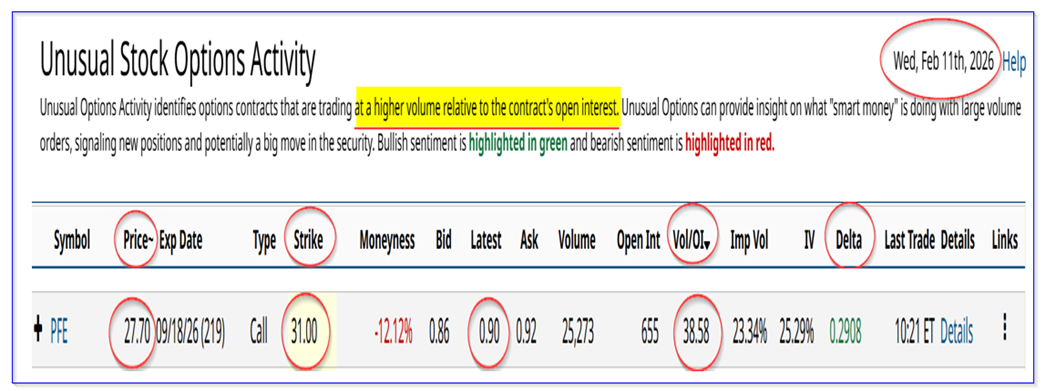

Pfizer, Inc. (PFE) reported strong earnings and earnings guidance on Feb. 3. Large, unusual call option activity today, as seen in a Barchart report, shows that investors are bullish.

PFE is at $27.72 in midday trading on Feb. 11, higher than its pre-earnings release price of $26.66 on Feb. 2. Today's call option activity may indicate that investors expect PFE stock to keep rising.

The heavy, unusual call options volume is seen in Barchart's Unusual Stock Options Activity Report. It shows that over 25,000 call option contracts have traded for the Sept. 18 expiry period. That is 218 days from today.

Moreover, the call options are at the $31.00 strike price, which is 11.8% higher than today's price (i.e., "out-of-the-money"). The midpoint premium is 90 cents, which implies that buyers of these calls believe PFE could rise to at least $31.90 over the next 7 months.

That is a bullish sign for existing PFE stock investors. Moreover, it could also mean that covered call sellers of this options contract are happy to potentially sell their shares at $31.00.

In return, they receive 86 cents on the bid side, or a yield of 3.1% (i.e., $0.86/$27.72). And the total potential return is almost 15%:

$31.86/27.72 = 1.1493-1=14.93% upside

The point is that buyers and sellers of these calls expiring in 7 months might have a bullish outlook on PFE stock. Let's look at why.

Strong Outlook

Pfizer reported that, although its full-year 2025 revenue fell 2%, on an adjusted basis, it was up 6% to $. Seeking Alpha reports that its Q4 revenue of $17.56 billion was $729.44 higher than analysts' forecasts.

In addition, its $0.66 adjusted diluted earnings per share (EPS) was $0.09 higher than analysts' estimates. For the full-year, EPS was $3.22, up 3.5% over last year's $3.11 adj. diluted EPS.

More importantly, Pfizer reaffirmed its revenue guidance of between $59.5 billion and $62.5 billion. And, Pfizer's adj. EPS is projected to fall between $2.80 and $3.00.

That's slightly lower than in 2025, but this is already incorporated into the stock price.

As a result, PFE stock could be seen as too cheap. Here's why.

PFE Stock Valuation and Target Prices (TPs)

For example, over the last 5 years, PFE stock has had an average 5-year price/earnings (P/E) multiple, on a forward basis, of almost 10x, according to Morningstar (9.77x).

Similarly, Seeking Alpha reports that the average 5-year forward P/E multiple has been 10.26x.

So, using an average 10x multiple and management's forward EPS guidance, PFE could be worth $29.00:

$2.90 x 10 = $29.00 target price (TP)

Moreover, 25 analysts surveyed by Seeking Alpha have an average $2.98 EPS for 2026. So, that puts the TP at $29.80 per share using a 10x multiple.

Yahoo! Finance says that 26 analysts have an average TP of $28.63 per share, and Barchart's analyst mean survey TP is $28.35. However, AnaChart.com, which tracks recent analyst TP write-ups, reports that 7 analysts have an average $34.79 target price.

The bottom line here is that PFE stock could still be worth anywhere from 4.5% to 25.5% undervalued.

That could be why investors are piling into these long-dated call options that have a $31.00 exercise price.

Summary and Conclusion

Although PFE may be cheap here, investors should be careful, if they repeat this call option trade. It could result in capital loss, especially if PFE does not move higher.

After all, the call option exercise price is still out-of-the-money. The breakeven point is at least $31.90, or 15% higher than today's price.

That means, on an intrinsic value basis, not including any extrinsic value portion of the option price, PFE stock has to rise 15% from today before there is any potential profit.

The bottom line: Be careful when buying call options like this. Thankfully, there is plenty of time in the expiration period for this trade to work out.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)