/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

Earnings season began last month, and several chip makers have already delivered solid revenue gains. Investors are now looking for a similar lift in December, with AI-related demand expected to keep pricing firm and orders steady across the sector.

Micron Technology (MU) is set to release its fiscal first-quarter 2026 results after the market close on Wednesday, Dec. 17. Wall Street is abuzz, with analysts forecasting roughly $3.38 earnings per share on about $12.6 billion in revenue, roughly double last year’s EPS and a 45% revenue jump.

Investors note that Micron’s booming data-center business, especially high-bandwidth memory for AI, should drive these gains. Recent strategic shifts, including exiting its Crucial consumer memory line to free up capacity for AI chips, have fueled optimism.

In short, Micron’s upcoming earnings call is highly anticipated as a test of whether this tech stock can keep meeting sky-high expectations.

About Micron Stock

Micron Technology is a leading semiconductor company and one of the world’s largest makers of memory and storage solutions. The firm designs and manufactures high-performance DRAM and NAND memory chips used in servers, personal computers, mobile devices, and rapidly expanding AI and data center applications. Micron’s products, sold under the Micron and soon-to-be-defunct Crucial brands, form the backbone of computing and storage in everything from cloud data centers to automobiles and smartphones.

Valued at $285 billion by market cap, Micron’s stock has outperformed in 2025. Since the start of the year, MU shares have roughly tripled year to date (YTD), far outpacing the broader tech market. This surge came on the heels of surging demand for memory chips driven by the AI boom.

Despite its torrid run, Micron still looks relatively cheap by many metrics. The stock trades around 14x forward earnings, which is well below the roughly mid-20s multiple typical for the semiconductor industry. Moreover, its price/earnings-to-growth (PEG) ratio, roughly 0.5 currently, is also far beneath the sector median. In practical terms, Micron is delivering explosive growth both in revenue and profits and yet commands a lower multiple than many peers. This suggests analysts view MU as undervalued on a forward basis.

Upcoming Earnings Preview

Analysts expect Micron’s Q1 earnings release to be quite strong, albeit with very tough year-ago comparisons. Consensus forecasts call for roughly $3.38 EPS and about $12.6 to 12.7 billion in revenue for fiscal Q1 2026. If realized, that would be more than double last year’s $1.79 EPS and roughly a 45% bump in sales. Micron itself has given slightly more conservative guidance. In recent commentary, it projected about $3.75 EPS on $12.50 billion in sales for the quarter.

In other words, management’s outlook is very close to Wall Street’s consensus. Thus, results should mark new revenue and profit records for Micron, thanks to accelerating AI demand.

Key items to watch in the report include memory average selling prices and inventory levels. Analysts will scrutinize how Micron’s high-bandwidth memory (HBM) and high-capacity DIMM products performed versus expectations, since these drove much of the last quarter’s gains. Gross margin trends will be closely watched, given UBS’s note that DDR chip margins may surpass HBM margins if supply constraints ease. Investors will also listen for any updated guidance. Micron said it sees industry DRAM supply remaining tight through 2026.

In short, traders will be looking for confirmation that data center demand remains strong, that the exit from consumer memory is proceeding smoothly, and that capital spending plans hinted at rising into FY2026 remain on track.

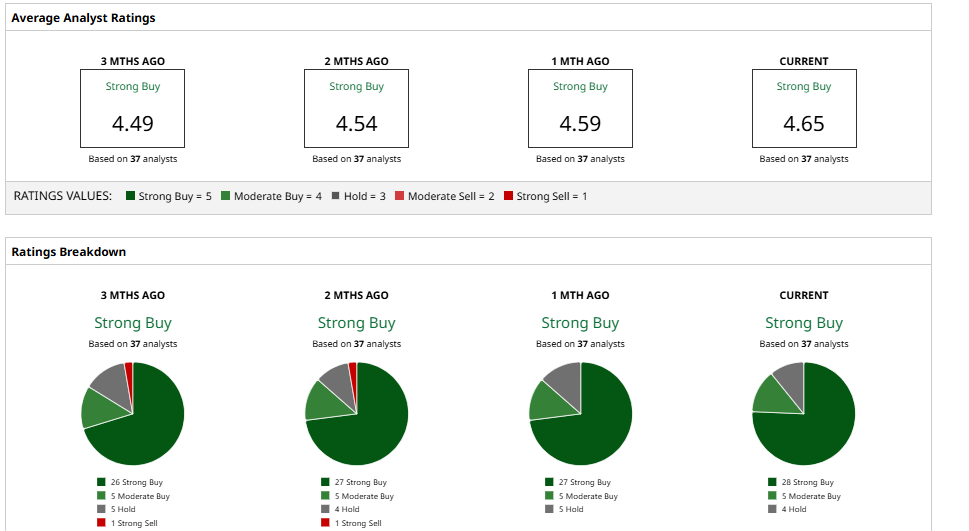

What Do Analysts Say About MU Stock?

Several analysts have been raising their price targets and initiating new coverage ahead of earnings, which indicates that they are optimistic about demand for AI-driven memory.

Morgan Stanley continues to declare Micron “Overweight” and increased its 12-month target to the high $338. Micron was declared the best AI stock by the firm.

On the other side, UBS maintained its “Buy” rating and increased its target to $275 due to the tightness of the memory supply. Also, strong DRAM and HBM prices led Deutsche Bank to raise its target to $280 from $200, adding FY26 earnings and revenues.

Similarly, Wolfe Research and Bank of America set goals of $250 to $300, based on the high demand for the servers.

More bullish, HSBC initiated its coverage with a “Buy” rating and a target of $330.

Micron is specializing in data center memory and has abandoned selling consumer products under its Crucial brand. This has led investors to gain confidence. The stock is currently performing much better, trading much above its average price target of approximately $230, and the majority of analysts remain convinced it is a “Strong Buy.” This, however, is equal to increased stakes. If earnings fail or expectations sour, the stock may plummet. It is all eyes on Dec. 17 to see whether Micron can continue the bullish story.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)