/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Electric Vehicle (EV) giant Tesla (TSLA) continues to struggle this year as demand weakens in major markets like Europe and China, where competition is only getting tougher, and the core EV business simply doesn’t carry the same excitement it once did. In fact, much of the market hype around Tesla today has shifted toward artificial intelligence (AI), autonomous vehicles, and robotics - exactly the way CEO Elon Musk wants the story to be told. Still, the performance of the core EV business matters, and that’s where the latest warning now comes into play.

Morgan Stanley just downgraded Tesla, adopting a more cautious stance on the broader U.S. auto sector heading into 2026. The bank warned of a potential “EV winter” that could weigh on demand and profitability across the industry. The leading investment bank now expects U.S. light-vehicle sales to decline to 15.9 million units next year, with EV volumes dropping around 20% and battery-electric penetration slipping to 6.5%.

Morgan Stanley believes internal combustion and hybrid models could see a modest lift, but notes that affordability challenges, tighter credit, and tariff-related price pressures could still hold back consumer demand. Further, analyst Andrew Percoco cut Tesla to “Equal Weight” from “Overweight”, arguing that while Tesla is still a leader in EVs, manufacturing and AI, its valuation already prices in much of the excitement around robotaxis and humanoid robotics.

He sees a “challenging catalyst path” over the next 12 months as the EV business faces softer margins and slowing deliveries, while potential upside from autonomy appears largely priced in at today’s levels. So, with Morgan Stanley turning more cautious on Tesla, is it time to rethink your position?

About Tesla Stock

Few companies push boundaries quite like Tesla. Once known simply for electric cars, Tesla has rapidly transformed into a technology company pursuing breakthroughs in AI, autonomous driving, robotics, and clean energy. Whether it’s self-driving robotaxis or factory-ready humanoid robots, Tesla’s ambitions stretch far beyond the road. Yet despite all the futuristic promise, the company’s core EV business still plays a crucial role in shaping its path forward.

With a market capitalization hovering around $1.48 trillion, Tesla holds a coveted spot inside the “Magnificent Seven” group. Regardless, 2025 hasn’t been all smooth driving. Political controversies surrounding Elon Musk earlier this year, rising EV competition, and slowing demand in key markets have all weighed on sentiment. Still, Tesla’s stock has held up remarkably well, and the reason goes far beyond cars.

Investors are increasingly betting on AI, autonomy, and robotics, treating them as potential mega-products that could someday eclipse Tesla’s entire automotive business. Despite the bumps earlier this year, TSLA shares are up 12.85% in 2025, and the recent momentum has been even stronger.

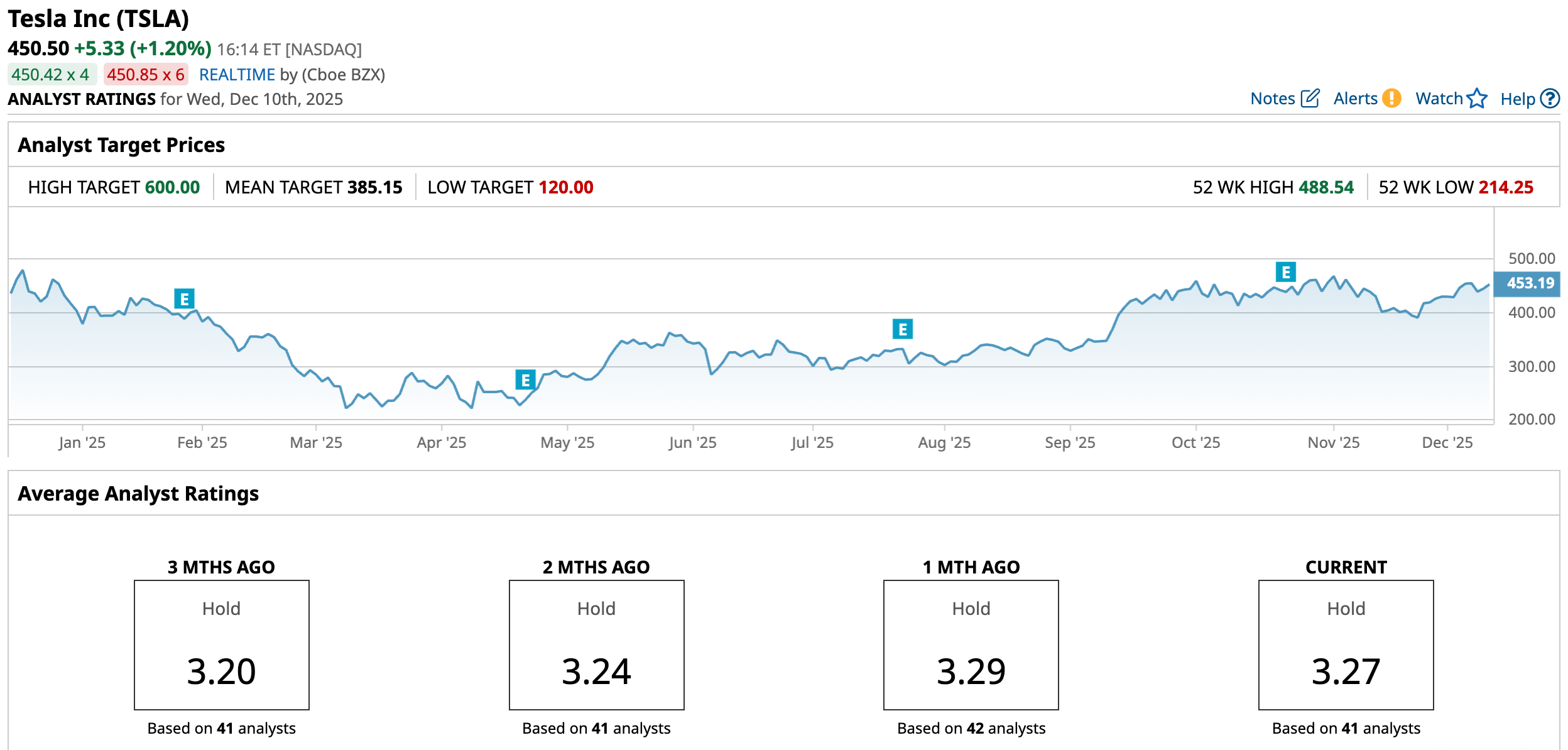

The stock is up an impressive 31.04% over the last three months alone, far outperforming the broader S&P 500 Index's ($SPX) 5.5% gain during the same stretch. In fact, TSLA stock is down only 7.52% from its 52-week high of $488.54, reached in December 2024.

When you look at Tesla through traditional valuation lenses, the numbers jump out instantly. The stock trades at an eye-popping 303.16 times pricer-to-earnings trailing and 14.99 times price-to-sales trailing, compared to industry norms of just 19.7x and 0.95x, respectively.

Usually, investors only pay those kinds of premium prices for companies that are growing like crazy and pumping out big profits. And at least for now, Tesla’s EV business isn’t showing that. So, it’s not surprising that Morgan Stanley thinks a lot of the excitement, especially around AI and robotics, is already baked into the stock price.

Tesla Delivers Mixed Q3 Results

Tesla’s fiscal 2025 third-quarter report, released in late October, served up a mixed, but undeniably intriguing update for investors. Revenue was the standout headline, rising 12% year-over-year (YOY) to $28.1 billion, handily beating Wall Street expectations of $26.6 billion. Importantly, this marked Tesla’s first quarter of the year, showing growth versus 2024. A late-quarter rush by U.S. buyers trying to secure the now-expired $7,500 EV tax credit helped drive a meaningful spike in demand.

That last-minute push helped Tesla’s core automotive business turn the corner, with segment revenue climbing 6% YOY to $21.2 billion. However, the real star of the quarter was once again Tesla’s energy arm. The company’s energy-storage division posted a massive 44% revenue jump to $3.4 billion, powered by accelerating adoption of its advanced battery solutions.

This segment has now delivered repeated double-digit growth, cementing its position as one of Tesla’s most resilient and fastest-expanding businesses. Still, underneath those upbeat revenue numbers, margins told a far more cautious story. Ongoing price cuts aimed at keeping pace with intense global EV competition continued to chip away at profitability. Gross margin slid to 18%, down from 19.8% a year ago, while operating margin dropped 501 basis points to 5.8%.

Adjusted EPS fell 31% YOY to $0.50, landing roughly 10.5% below analyst forecasts and highlighting the cost of protecting market share. Looking forward, Tesla appears laser-focused on executing its most ambitious ideas. The company is eyeing 2026 for “volume production” of some of its biggest upcoming launches, including the long-anticipated Cybercab robotaxi, its heavy-duty Semi truck, and the next-gen Megapack 3 energy-storage platform.

Meanwhile, Tesla is also pushing ahead on one of its most futuristic bets - the Optimus humanoid robot. The company has begun ramping up its first manufacturing lines, signaling that Tesla’s long-talked-about shift from EV maker to robotics and AI powerhouse may finally be moving from concept to commercial reality.

How Are Analysts Viewing Tesla Stock?

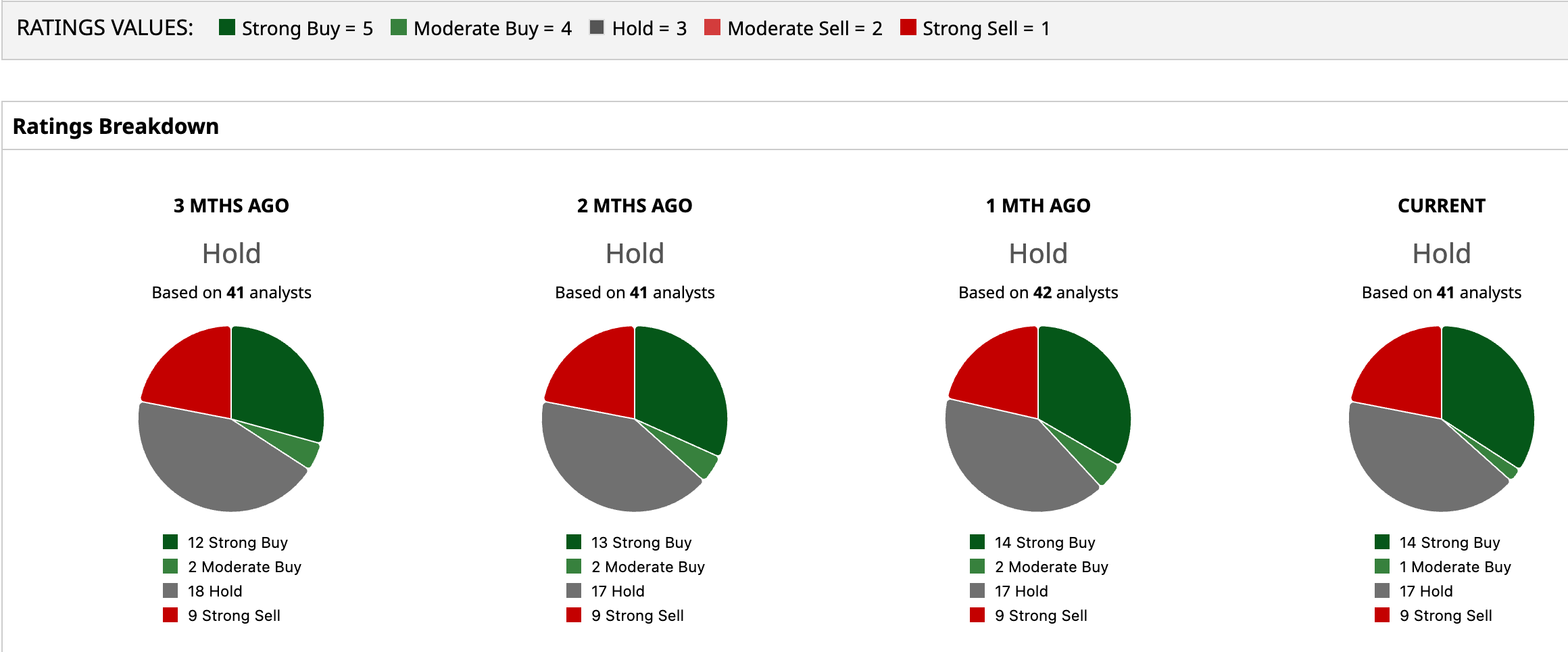

Right now, Wall Street isn’t exactly aligned on Tesla’s next chapter. The stock carries a consensus “Hold” rating, underscoring just how divided analysts are. Among the 41 analysts covering TSLA, 14 rate it a “Strong Buy,” one calls it a “Moderate Buy,” 17 are sitting on the sidelines with a “Hold,” and nine have gone all the way to a “Strong Sell.”

Tesla is already trading above its average price target of $385.15, but that doesn’t mean the upside story is over. The most bullish voices on the Street still think shares could reach $600, implying about 33.2% upside if the company can execute on its ambitious vision.

Bottom Line

While Morgan Stanley might be cautious, its recent downgrade doesn’t dismiss Tesla’s long-term vision. It simply underscores the increasingly challenging landscape the company must navigate to get there. Slowing EV demand, tighter margins, and rising competition are creating real pressure today, while much of tomorrow’s promise in AI and robotics is already priced into the stock. Tesla may still have the potential to reshape multiple industries, but investors now have to decide whether that future is compelling enough to justify the risks unfolding in the present.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)