For many investors, dividend stocks are the foundation of a reliable income strategy — but not all dividend payers are created equal.

In his latest video, Rick Orford breaks down the major types of dividend stocks and how each plays a different role in your portfolio. From the long-term consistency of Dividend Kings to the high-yield potential of Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs), understanding these distinctions can help you balance income and growth.

#1. Dividend Aristocrats (25+ Years of Growth)

Dividend Aristocrats are companies in the S&P 500 Index ($SPX) that have increased their dividend payouts for at least 25 consecutive years.

Income credentials:

- They demonstrate strong financial discipline and resilience.

- They raise dividends even during recessions or inflationary cycles.

- They often attract long-term investors focused on consistency.

Examples include:

- Abbott Laboratories (ABT)

- Archer Daniels Midland (ADM)

- McDonald’s (MCD)

- PepsiCo (PEP)

- Caterpillar (CAT)

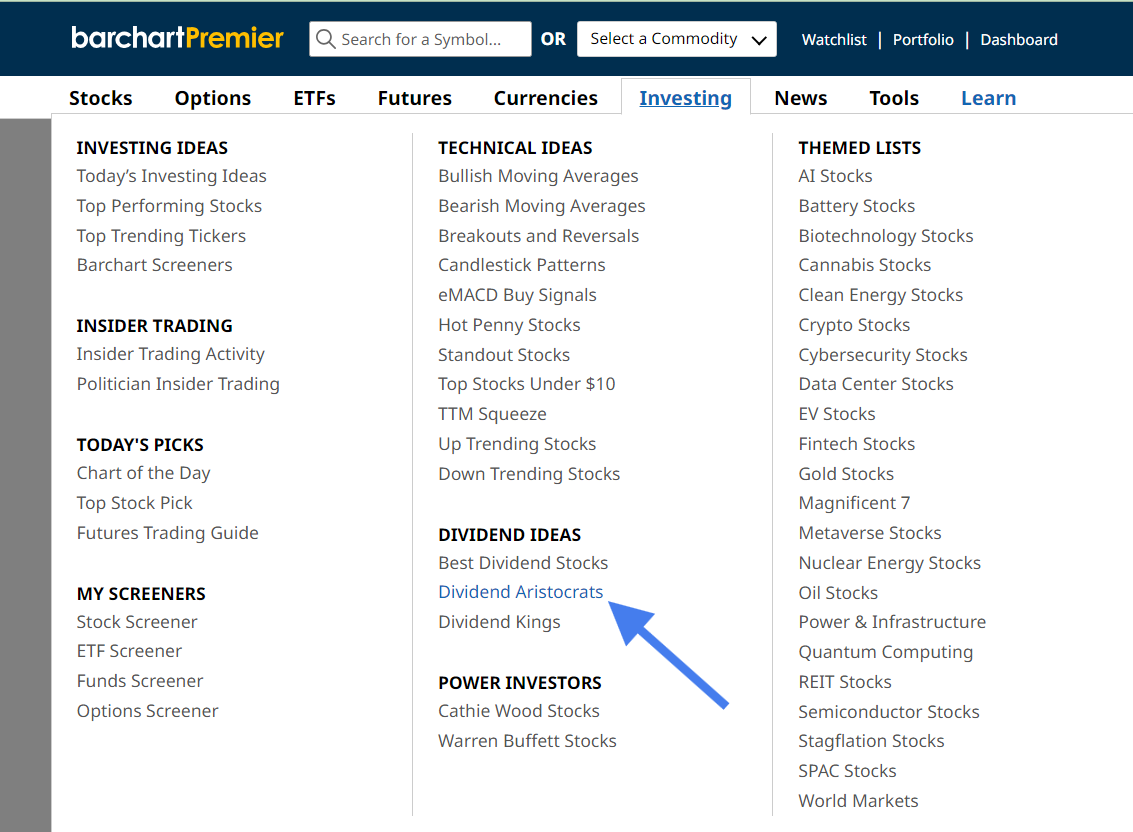

Explore the full Dividend Aristocrats Watchlist →

#2. Dividend Kings (50+ Years of Increases)

Dividend Kings take reliability to another level. While not necessarily S&P members, these companies have increased their dividends for 50 or more straight years.

Income credentials:

- They’ve survived multiple market crashes and inflation cycles.

- They represent the gold standard of dividend consistency.

- Their steady payouts appeal to conservative, income-focused investors.

Examples include:

See the full Dividend Kings Watchlist →

#3. Dividend “Zombies” (100+ Years of Payments)

Dividend “zombies” have paid dividends for over a century without interruption. They haven’t necessarily raised their payouts each year, but they’ve consistently delivered income for generations.

Income credentials:

- They include companies with unmatched longevity.

- They provide steady, predictable cash flow.

- They’re often household names that have stood the test of time.

Examples include:

- General Mills (GIS)

#4. REITs and BDCs (High Yield, Slower Growth)

If you’re after higher income, Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs) offer above-average yields — often 5–10% or more.

Income credentials:

- By law, they must pay out at least 90% of their profits to shareholders.

- They can provide strong cash flow during low-rate or volatile markets.

- However, they have limited reinvestment ability, which can slow long-term price growth.

Find top-paying REIT stocks for investors seeking passive income →

Which Type Fits Your Strategy?

- Long-term investors: Focus on Dividend Aristocrats or Kings for reliability and compounding income.

- Income seekers: Look at REITs and BDCs for higher immediate yield.

- Balanced investors: Blend a few Aristocrats with select high-yield plays for growth and income.

Find and Track Dividend Leaders on Barchart

Use these resources to research dividend opportunities:

The Takeaway

“If you’re after long-term reliability, look to Dividend Aristocrats and Kings,” Rick says. “If you’re chasing yield, REITs and BDCs can give you more income — but they often trade growth for payouts.”

No matter your approach, dividend investing rewards patience — and Barchart’s tools can help you find the right balance for your portfolio.

Watch Rick’s Clip on Dividend Stocks →

- Stream the Full Video: 7 Ways to Make Money from Your Investments

- Screen Options Strategies for Income: Covered Call // Cash-Secured Put

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)